PM Images

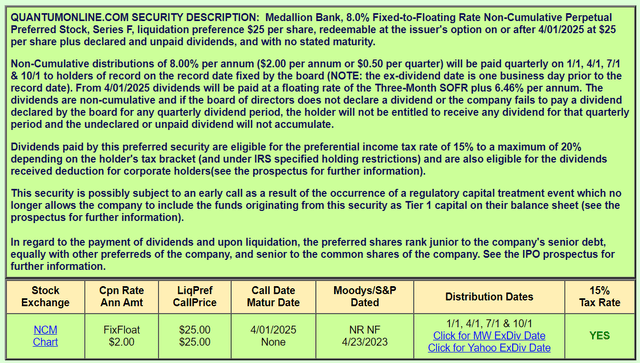

Medallion Financial (NASDAQ:MFIN) is a niche bank that has successfully pivoted away from lending to taxicab drivers. Today, the bank manages deposits and lends them out for recreational and home improvement loans. Recently, I came across the bank’s 8% fix to floating preferred share (NASDAQ:MBNKP). After reviewing the financials, I believe the fixed to floating preferred share presents a great income opportunity for investors with the potential for income growth when the shares float next April.

QuantumOnline

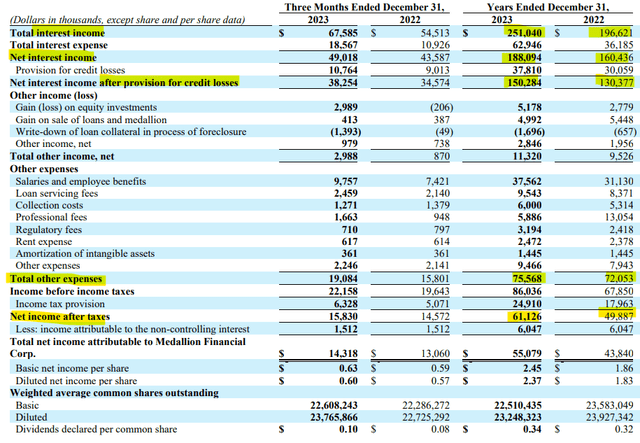

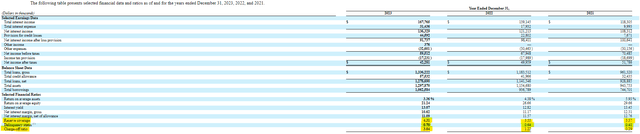

Medallion Financial had a strong 2023. Like all banks, the company saw its interest income and interest expenses rise as interest rates increased. Fortunately, Medallion’s net interest income (interest income less interest expense) was able to rise by nearly 20% to $188 million in the face of a more restrictive financial backdrop. The bank was also able to control expenses, leaving net income after taxes at $61 million, a healthy jump from $50 million in 2022.

SEC 10-Q

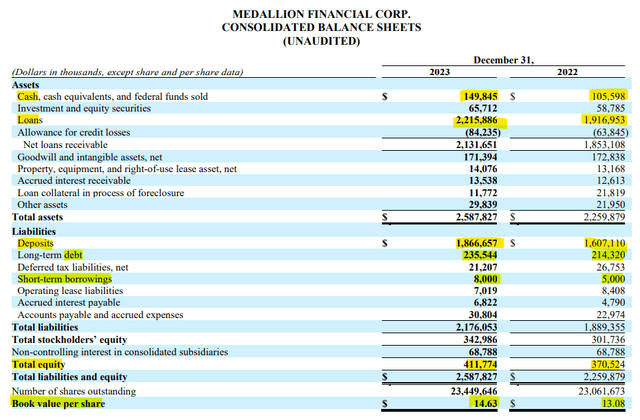

Medallion Financial’s balance sheet shows the impressive growth undertaken by the bank in 2023. Medallion grew lending by $300 million to over $2.2 billion and grew deposits by $260 million. This growth is rather impressive as the industry struggled to maintain deposits and dealt with low single digit loan growth. The bank did engage in some outside borrowing to cover the gap between deposit growth and loan demand, but shareholder equity grew by more than $40 million to $412 million and book value per share rose by more than 10%.

SEC 10-K

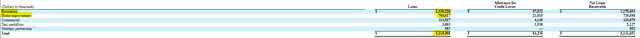

Because of Medallion’s specialized position in the banking industry, investors should dig deeper to understand Medallion’s loan composition and its customers. Medallion’s loans fall into mostly two categories: recreational and home improvement loans. While both areas are sensitive to changes in the customer, Medallion is quick to point out that they lend against assets that are less volatile and their lending growth has come despite the tightening of loan standards.

SEC 10-K Earnings Call Transcript

Medallion Financial customers in the bank’s fast-growing home improvement segment are also helping fuel earnings. Even with the high interest rates that they are generating, Medallion is lending out to an average consumer with a credit rating of over 760. Strong credit scores amongst customers in a fast-growing segment with a 12.87% average interest rate is certainly positive for the bank.

Earnings Call Transcript

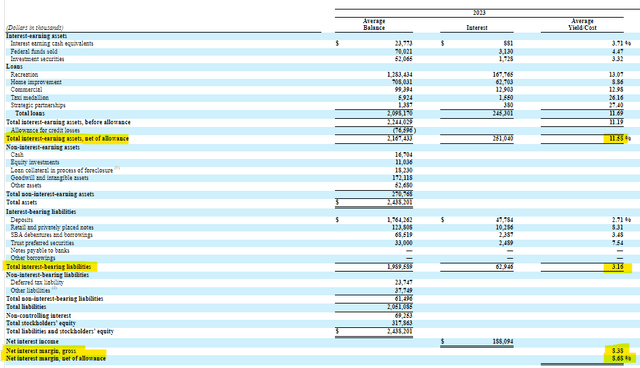

When looking at the overall performance of Medallion Financial’s loans, investors should be optimistic. The bank averages an 11.6% return on its interest-bearing assets, which is much higher than a traditional commercial bank. Medallion also averages a 3.16% interest rate on liabilities, which is slightly lower than some commercial banks due to their ability to grow deposits and not rely on external debt.

SEC 10-K

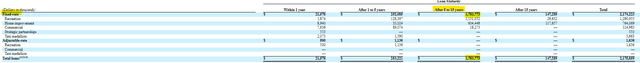

Additionally, Medallion’s rate structure and duration of its loan portfolio is favorable to investors. As of the end of last year, $1.75 billion of the bank’s $2.18 billion loan portfolio sat in loans that had a fixed rate of interest and durations of between five and fifteen years. This is different than other lenders who either specialize in short-term or variable interest line of credit or short-term consumer debt. Medallion’s interest income from its loans should be more stable and predictable in future quarters.

SEC 10-K

As mentioned briefly, investors should be on the lookout for changes to the consumer, such as increases in unemployment or drops in wages. These sources of volatility could bring about increased delinquencies and lower loan demand for Medallion Financial. It is important to note that the bank did see a small jump in delinquencies last year and a larger jump in its charge-off ratio. Despite these changes, Medallion Financial’s earnings remained strong.

SEC 10-K

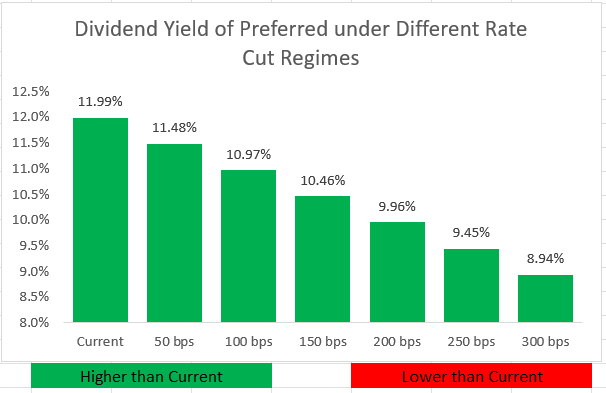

Income investors also face the possibility of dividend growth when investing in Medallion Financial’s preferred shares. The dividend is set to float next April at a rate of 646 basis points plus the three-month SOFR rate. As the rate structure currently stands, it would imply a 12% dividend yield. While it is certainly feasible for Medallion to call these shares, investors do not face call risk due to the shares’ current price being below par. It is highly unlikely that the dividend will drop below the current 8% level, as that would require more than 400 basis points of rate cuts from the Federal Reserve.

QuantumOnline

Medallion’s strong financial performance highlights the low level of risk present with an investment in its preferred shares. The bank is not having issues holding depositors and is successfully growing its loans with its fastest lending segment catering to prime customers. The risks to the consumer are worth watching, but will likely have a greater impact on the common shares. In the meantime, the preferred shares represent a great income investment with an even higher dividend opportunity.