Not to mention, fluctuating home values can significantly impact your financial situation, especially if the market trends lead to a decrease in home values over time, further compounding the financial burden on homeowners.

If you move again within a short period—for example, four years—all those fees will dwarf any equity gains you may have. Imagine driving a car off the lot: We all know that it instantly loses value. The same is true of your house, and it takes time to amortize (or spread) the costs.

Most people stay in their house for less than 8 years, and that number is the highest it’s been in several decades! Before the 2008 financial crisis, the average length of time Americans stayed put was around 4 years.

Don’t give in to peer pressure to buy a house if you might not stay there for the long term. If you know you’ll move in fewer than 10 years, you will likely make more money by renting and investing in S&P index funds.

-

Common mistake: “I’m not moving for a few years. I should buy so I don’t throw money away on rent!”

-

Reality: If you buy for a short period, when you factor in all costs, you will almost certainly lose money.

Is your total monthly housing cost lower than 28% of your gross monthly income?

Your total housing costs should be less than 28% of your gross income, including your monthly mortgage payments. When housing costs exceed 28%, you risk being overwhelmed with expenses if something goes wrong (e.g., an unexpected repair, job loss, etc.) Use the 28/36 Rule to see if you can afford your housing.

Here’s an example:

-

Assume you make $10,000/month (that’s $120,000 per year gross or before taxes).

-

Assume your total housing costs are $2,000 per month, including monthly mortgage payments. Great! Your housing costs you 20% of your gross income. You pass this test, and you can afford your housing.

-

Note that total housing costs include everything: taxes, interest, maintenance, furniture, electricity, water, and even the roof repair 7 years from now (project it).

Evaluating the affordability of monthly payments is crucial in the context of overall financial planning for a house purchase. It helps in assessing whether you can maintain your lifestyle without compromising on other financial goals.

Why gross income? I use gross because it’s easy to calculate. Everyone knows their gross income, and taxes complicate net income (different people choose different deductions). However, if you prefer to use net income, go for it! I love when people create their own points of view on their finances.

Exceptions to the 28/36 rule

- If you live in an HCOL (high cost of living) area like NYC or Los Angeles, many people stretch the 28% number to 35% or even 40%.

- If you have no debt (e.g., no car payment, student loans, or credit card debt), you might stretch the numbers a little. I’d consider going to around 33%, but I’m conservative with my finances.

- If your income is reasonably expected to go up soon, such as with a job promotion, you may stretch the numbers a little. Again, I’d conservatively consider going to 33%… maybe.

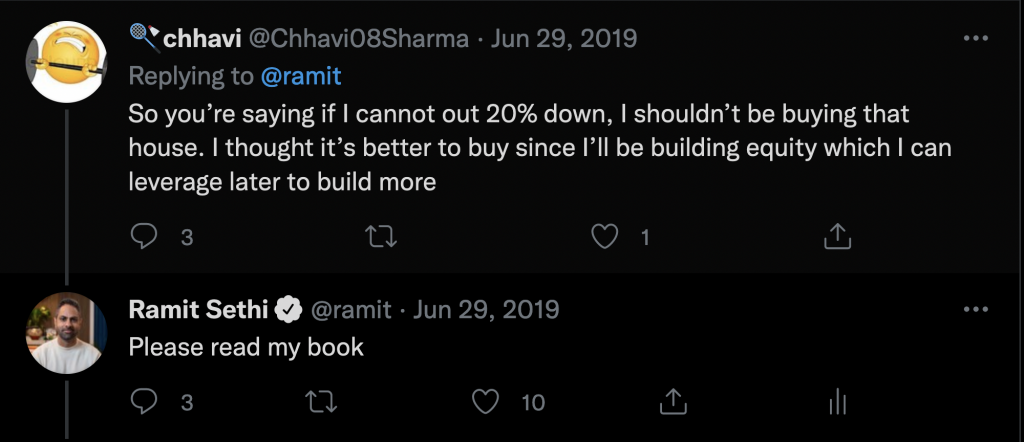

Have you saved a 20% down payment?

If you haven’t saved a 20% down payment, you’re not ready to buy a house.

Why? Not just because of PMI, which is an additional fee you’ll often pay when you get a mortgage without 20% down.

The real reason to save 20% before buying is counterintuitive: building the habit of saving is critical before you buy and have unexpected housing expenses such as a broken water heater, roof, or unexpected taxes.

I frequently get frustrated comments about how “impractical” this rule is. “How am I supposed to save 20%? That will take years!”

Yes, it will—which is exactly why you should save now. Saving is a habit that is better practiced before your mortgage is at risk. Additionally, consulting with various mortgage lenders to find the best mortgage terms and rates can significantly impact your financial planning. The Federal Reserve plays a crucial role in influencing interest rates, which can affect how much you need to save for a down payment, highlighting the importance of understanding the broader economic factors at play.

If you write a comment like this, you are not ready to buy a house.

Note: I don’t mean that you have to put 20% down. In some cases, such as low interest rates, many people intentionally choose to put a small amount down. But you should be able to.

Are you OK if the value of your house goes down?

If you are buying because you believe home prices always go up, reconsider: fluctuations in home prices can significantly impact your investment, indicating that real estate is not always the best investment.

Here are some good reasons to buy a house

- You have kids, and you want to stay in your area or school district and build memories in the same house for at least 10 years 👨👩👦👦

- Your parents are moving in with you 🧓

- You want to design a house together with your spouse 📐

- You love repairing and tinkering with a house and making it your own 🔨

- You just want to! 🫰

Notice what’s not on the list: “You need the price of the house to go up”. Maybe it will—if so, great! Maybe, once you factor in expenses and opportunity costs, you could have gotten a much better return in a simple S&P index fund.

Buy for the right reasons!

Are you excited about buying?

If you’re approaching buying a house with dread—like a heavy feeling of obligation or peer pressure—just stop. You don’t need to buy and you should never feel guilty about renting. I rent by choice. In this video I talk about why.