FG Trade

With Medical Properties Trust, Inc. (NYSE:MPW) presenting encouraging earnings for its last quarter, and with investors barely reacting to the news of one of its most important operators, Steward Health Care System, sliding into bankruptcy, I think that we could see substantial upside price movement for the hospital real estate investment trust in the short term.

While I am generally long-term oriented, I believe that we could be at the brink of seeing a major breakout to the upside on short sellers trying to close out their short position in the REIT.

Medical Properties Trust remains an excessively shorted stock, and with the trust recently reporting solid normalized funds from operation results for 1Q24, I think that the short case for the trust has substantially less strength.

My Rating History

In my April piece, Medical Properties Trust: A Key Level Is Now In Sight (Technical Analysis), I analyzed Medical Properties Trust from a technical angle and concluded that the trust’s stock remained a Buy. Since then, Medical Properties Trust’s largest operator, Steward Health Care System, has filed for bankruptcy.

With that being said, however, the lack of a sustained price reaction to the bankruptcy filing strongly indicates that the market has been prepared for this event.

The strong upside price movement for the trust’s stock on Monday, May 13th, which is when the stock skyrocketed 17%, also indicates that the market has turned from extreme pessimism to optimism, which could drive a further closing of short positions for Medical Properties Trust.

Portfolio Review, Steward Health Care Bankruptcy, And Investor Confidence

Steward Health Care System earlier this month filed for bankruptcy, causing Medical Properties Trust stock to drop initially. However, the stock quickly rebounded and the trust’s first quarter results, which reflected the impact of the bankruptcy filing, were actually quite good, given the circumstances.

Medical Properties Trust owns a large portfolio of hospital assets, mainly in the U.S., but the trust has said that it will try to sell at least $2.0 billion worth of assets to throw more cash at its debt and lower its leverage.

Furthermore, I think Medical Properties Trust has big surprise potential in 2024 if it exceeds its divestment target. As such, investors will have to expect a decline in the trust’s funds from operations, or FFO, which is associated with asset sales.

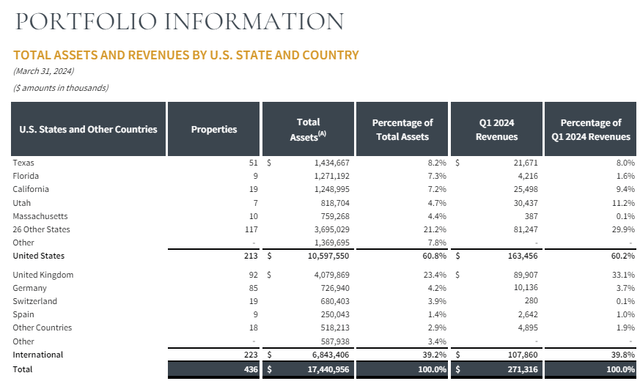

Portfolio Information (Medical Properties Trust)

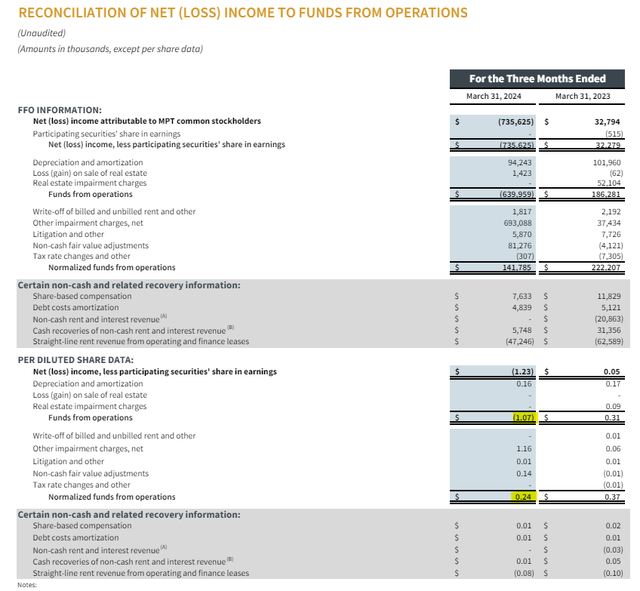

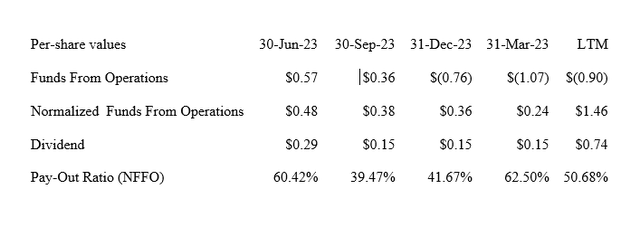

Medical Properties Trust had its second consecutive quarter of a net loss in 1Q24, in the amount of $1.07 per share, driven by Steward-related impairments totaling $1.16 per-share. On a normalized funds from operations basis, which makes adjustments for impairment charges, the trust performed quite well and easily covered its $0.15 per share dividend (more on that later).

The strength of normalized funds from operations (and payout ratio) as well as last month’s asset divestment target of more than $2.0 billion are taking considerable wind out of the short sellers’ case against the trust. And what was once a core weakness for Medical Properties Trust (a high short-interest ratio) may now ironically catalyze a re-rating of the trust’s embattled stock.

Funds From Operations (Medical Properties Trust)

Highly Shorted Stock, Unwinding Of Short Positions Could Lead To Big Short Squeeze

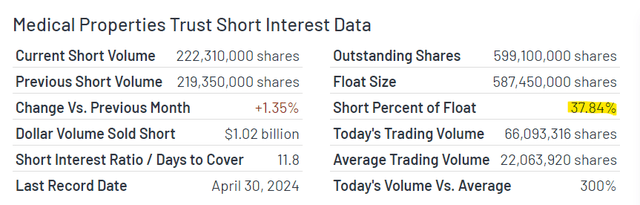

Medical Properties Trust skyrocketed 17% on Monday, which was generally a good day for highly shorted stocks, including GameStop Corp. (GME), which exploded more than 74%. According to CNBC, short sellers lost more than $1.0 billion on the price move, which may have been in part driven by short sellers closing out their positions. GameStop, at last count, had a short interest ratio of 21%.

Medical Properties Trust is an even more aggressively shorted stock, with a short-interest ratio of 38%. It would take approximately 12 days to fully cover the outstanding short interest. With such a high short-interest ratio as well as the trust shrugging of the Steward Health Care system bankruptcy, I think we could see a lot of short covering in the next couple of days, and maybe even weeks.

Short Interest Data (Medical Properties Trust)

63% Payout Ratio Should Render The Dividend Safe In 2024

One of the biggest concerns of short sellers was that one of its anchor tenants, Steward Health Care System, could be forced out of business, which in turn would have a trickle-down effect on Medical Properties Trust’s lease business.

A Steward bankruptcy could potentially threaten the dividend for Medical Properties Trust. To a certain extent, short sellers were right about this, as the hospital real estate investment trust did adjust its dividend payout in the third quarter of 2023.

However, the Steward Health Care System bankruptcy might not have as negative an effect on the trust’s payout metrics as short sellers might have thought.

Despite payment problems that are well-acknowledged, Medical Properties Trust had a 63% payout ratio based on its normalized funds from operations in the first quarter. Though the trust’s payout ratio increased rather drastically QoQ (up from 42% in 4Q23), there is plenty of margin of safety left for dividend investors.

Dividend (Author Created Table Using Trust Information)

Equity Value, About $11.40

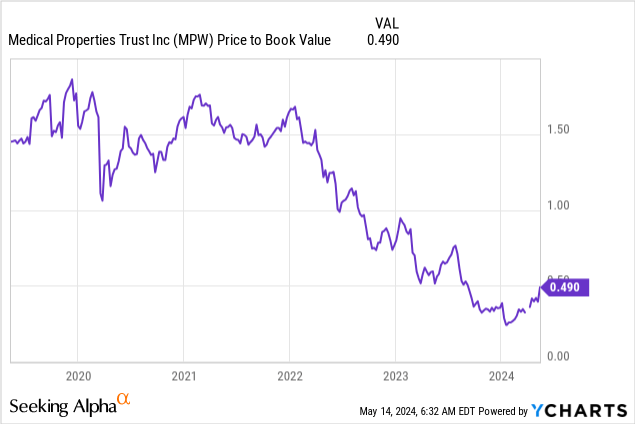

Medical Properties Trust is selling for a more than a 50% discount to book value, indicating substantial undervaluation in my view. In the past, I valued MPW based on funds from operations, but the FFO figure has become a bit volatile due to asset sales and shortfalls in rent, making a proper valuation more difficult.

With that said, though, I think that Medical Properties Trust could be sensibly valued at book value considering that most of its assets are cash-flowing.

Presently, Medical Properties Trust has a book value of $11.40 per share and the stock is selling for just $5.58, so less than half book value. I believe that Medical Properties Trust could re-rate to $11.40 fairly quickly, particularly if the short squeeze theme plays out as I anticipate.

I think book value is a fair valuation benchmark for Medical Properties Trust, considering that Steward Health Care Systems’ hospitals are going to get re-tenanted. Historically, MPW even managed to sell for premiums to book value, so a return to the BV level is not an outrageous assumption.

What Could Hamper The Investment Thesis

Steward Health Care System has been Medical Properties Trust’s largest operator. However, landlords always have to deal with the risk that other operators also run into payment problems and delay making rental payments, which obviously is a risk that the trust cannot fully diversify away.

The most significant change to the investment thesis, in my view, would probably be a change in the payout metrics and a possible rise above 100% if other operators fail to make timely payments. This is presently not the case, so I think that the dividend, at least for now, is well-covered and not at risk of getting axed.

My Conclusion

I think we could be at the brink of seeing the mother of all short squeezes, considering that the Steward Health Care System bankruptcy did not have as negative an impact on the trust’s valuation as short sellers might have hoped.

The reason is that a bankruptcy had been fully priced into the trust’s market valuation ahead of the bankruptcy filing. As a matter of fact, Medical Properties Trust’s payout ratio remained well below the 100% threshold in 1Q24, and Monday’s 17% price increase strongly suggests that short sellers are seeing their fortunes change.

With the trust’s stock essentially fully shrugging off the Steward Health Care System bankruptcy, I think a major pillar of the short thesis has collapsed.

Since Medical Properties Trust, Inc. remains a highly shorted stock with a short-interest ratio of 38%, which would take approximately 12 days to cover, the odds of a major short squeeze have actually drastically increased since the trust’s 1Q24 earnings. Strong Buy.