Milan Markovic

Investment Thesis

I wrote on Lam Research (NASDAQ:LRCX) in early April, ahead of management reporting the third quarter of FY2024 earning results. The investment thesis I proposed then played out this quarter; I had noted, “I expect Lam to continue to outperform as the industry’s wafer fabrication equipment spend, or WFE increases, to keep up with the appetite for advanced tech to keep up with the AI boom.” And this quarter, management revised its 2024 wafer fab equipment market from $85 billion-$89 billion to $91 billion to $95 billion. The company also reported revenue growth of 1% sequentially, lower than I’d hoped for, to $3.79 billion, but nonetheless beat consensus estimates at $3.72 billion. In my opinion, this quarter’s outperformance was supported by memory recovery, which translates into higher better overall Wafer fab equipment or WFE spend and benefits Lam’s NAND and DRAM-related system sales. I continue to be positive about Lam; management continues to be guarded in its outlook for next quarter, leading me to expect another beat next quarter as the WFE spend (outside of China) recovers.

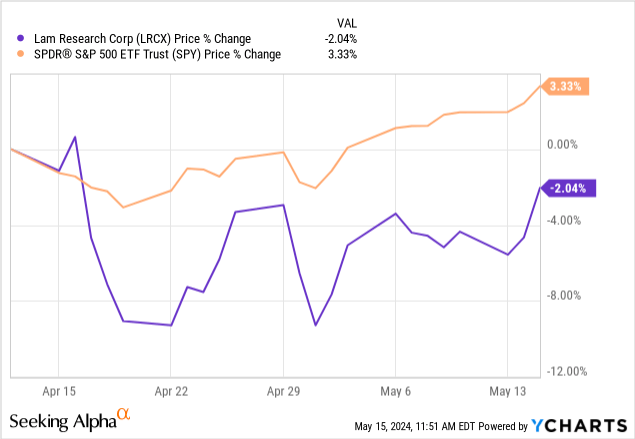

Investors haven’t been too confident in Lam over the past month, with the stock underperforming the S&P 500 by around 5%, as shown below. Lam’s stock performance over the past month tells us it is not immune to the broader industry downturns. Now, I believe Lam has a very favorable risk-reward profile in the mid-to-long term, but I do believe we could see pockets of pullback this year as the semi-peer group is vulnerable to a possible lacking demand environment amid heightened expectations due to AI.

I’m not too worried about this, as I think it’s a window for investors to add on the pullback. Wafer fab equipment sales are anticipated to increase by 3% this year and 18% in 2025, with the following breakdown for growth on the memory front: NAND equipment is expected to grow 21% in 2024 and 51% in 2025, while DRAM is for 3% and 20%, respectively. Keep in mind that Lam is positioned in the etch and deposition market, which makes up ~52% of the total semi-capital equipment industry, which keeps the semi-supply chain running. So, I think Lam will benefit from a chunk of that growth.

YCharts

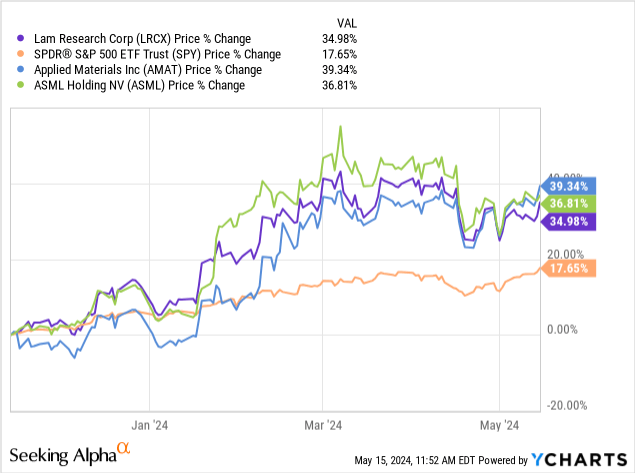

I’ve re-created the same six-month chart of Lam’s stock against the S&P 500, ASML (ASML), and Applied Materials (AMAT); what this chart confirms and will continue to confirm next quarter is that the semi-cap names will continue to outperform the S&P 500 even in an industry downtrend on a six-month to one-year chart.

YCharts

Lam’s Value Proposition

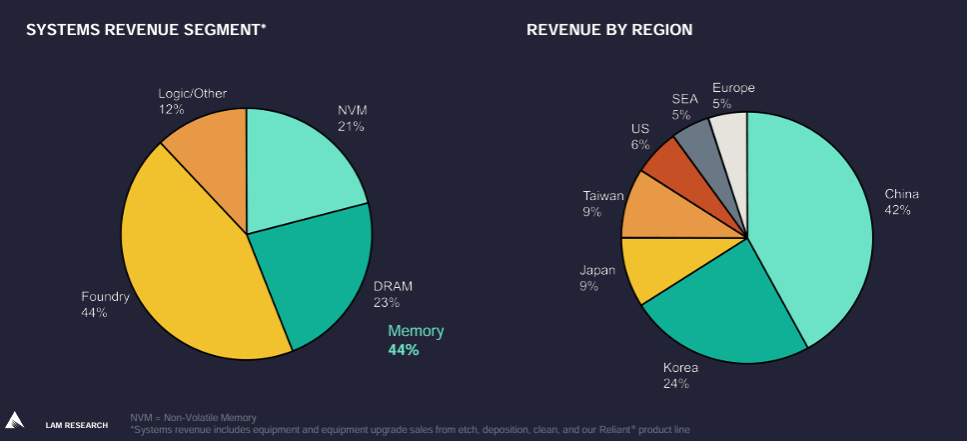

My investment thesis on Lam continues to be relevant; there’s more upside for wafer fab equipment spending because of memory in 2024 and 2025. Lam’s revenue comes from three primary markets: memory, foundry, and logic, representing 44%, 44%, and 12% of total sales. I think in 2HFY24, Lam will continue to find stable footing as it exists the sharp memory downturn that happened last year and slowly loses the high Chinese demand catalyst.

This quarter, Lam reported that its system sales increased 4% quarter-over-quarter to $2,396M as a result of foundry and memory growth. Taking a closer look at the memory side of the business, NAND-related revenue increased 29% quarter-over-quarter, and DRAM dropped 23% quarter-over-quarter. I’m not too worried about the sequential decline on the DRAM front as I think the only reason we saw a quarter-over-quarter decline is because of last quarter’s (2QFY24) high DRAM growth, growing 51% quarter-over-quarter which accounted for around 38% of total system sales. I think there’s more upside in terms of DRAM sales, specifically because of the higher demand for high-bandwidth memory DRAM or HBM DRAM. Micron’s (MU) earnings call this quarter made it clear that HBM is a real catalyst for 2024. I’m more confident in Lam over Micron for longer-term investors as I think the company will see a rebound not only on memory but also on the logic/foundry front that accounts for the rest of total sales, as shown below. NAND-related wafer fab equipment spend is also expected to recover more significantly next year, adding visibility to Lam’s next leg of growth.

Lam Research 3QFY24

The China question continues to be a trigger button for semi investors, and for good reason. The concern is that shipments to China, which represented 42% of total revenue by region this quarter, are not a reliable or sustainable growth driver. This quarter, for example, sales to China grew 6% quarter-over-quarter, while they declined 10% sequentially last quarter and grew 100% the quarter prior. I do think the sustainability of the higher shipments to China is questionable at best, but I don’t think it’ll disappear before the global wafer fab equipment spend rebounds. Also, I think the negative news of shipments to China slowing has already been confirmed and priced in after management’s call this quarter, and their expectations for China sales to be on the lower end of the range in the second half of the year.

What could go wrong?

The risk for Lam is that the wafer fab equipment spend doesn’t rebound materially. Last year, revenue from the top wafer fab equipment manufacturers dropped 1% year-over-year to $93.5 billion due to “weak memory spending, macroeconomic slowdown, inventory adjustments, and low demand in the smartphone and PC end markets.” Lam felt the heat last year, with CY2023 revenue at $14.3 billion compared to CY2022 revenue of $19 billion, while ASML and Applied still achieved year-over-year growth. The reason for Lam’s sharp downturn is the company’s memory market exposure, which was 48% of total sales in the last quarter of FY2023 and 44% this quarter. Smartphone and PC demand have yet to recover, and both are big drivers for NAND and DRAM sales recovery. So, the risk is that a lack of end-demand recovery in these markets will prolong the recovery of wafer fab equipment spending. I think this risk is manageable for Lam because of one thing: AI.

The company should be experiencing AI tailwinds on the memory front because of the industry’s demand for HBM DRAM. This should help boost Lam’s performance until smartphone and PC sales rebound. I think we’ll see this reflected in system sales in FY2025, and I’d recommend investors watch for this.

Valuation makes sense

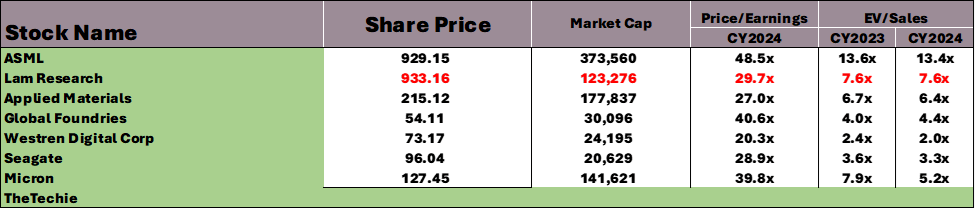

Lam is fairly valued, in my opinion. I value stocks using a relative methodology based on my coverage universe. Lam trades at a Price/Earnings ratio for CY2024 of 29.7, which is lower than the peer group average ratio of 33.5, according to data from Refinitiv shown in the table below. Reviewing the stock’s EV/Sales ratio for CY2024, Lam trades at a ratio of 7.6, slightly higher than the peer group average ratio of 6. I think the stock’s valuation makes sense at current levels. I reaffirm my buy-rating because I think Lam will experience material outperformance in FY2025 and would advise investors to get in ahead of the recovery.

Image created by The Techie with data from Refinitiv

What’s Next?

For the June quarter, Lam is guiding sales to be flat at $3.8B, not too far off consensus expectations at $3.78B. I think there could be more upside surprises to top-line growth next quarter. Next quarter’s results and outlook for FY2025 should provide more visibility on the demand recovery environment, although I expect management to continue being cautious in their outlook. I understand where investors’ panic is coming from, but I don’t think it’s well placed at this point in the cycle. Gartner now expects a reversal of the memory industry downtrend we saw last year, “with NAND revenue increasing 49.6% and DRAM increasing 88% for a combined growth of 66.3% in memory.”

Looking forward, I think the ideal price range to establish or add to a long-term position for Lam is in the $785-$840 range. I see memory recovery supporting outperformance for Lam in FY2025.