lcva2

Investment Thesis

Teleperformance SE (OTCPK:TLPFF) is expected to generate around €10m in annual sales and €1 billion in free cash flow, with a leading EBITDA margin of 20%. Despite this strong financial performance and FCF yield of 15% on the market cap., TLPFF’s shares have dropped significantly due to slower revenue growth post covid, fears of AI replacing contact centers, normalization of market multiples from the peak of 2021, and skepticism over the Majorel acquisition. These factors have led to a conservative valuation of 5x NTM EV/EBITDA and 6.86x NTM P/E multiple.

This drop in share price of 73% from the peaks finally presents a potential investment opportunity in the biggest Customer service provider, as TLPFF maintains a robust Est. ROE of 20%, strong free cash flow, and a healthy balance sheet. Currently, its market cap stands at €6.7 billion, reflecting an undervaluation. TLPFF has also announced a 500m buy back program to capitalize on this undervaluation. Although this seems like a bid to counter the dilution of shares from Majorel’s acquisition, but with the stock prices lower now, it seems like a reasonable thing to do. The company is not ruling out launching new programs in the future should the stock price continue to undervalue the strength of the company’s business model.

Business Introduction

Teleperformance is the largest Business Process Outsourcing (BPO) company globally, with operations in 91 countries and 500,000 employees. TLPFF’s global presence allows it to offer 24/7 support, and it holds a 10% market share in the customer experience industry, especially after acquiring Majorel.

The company provides its customers with consultancy services and integrated solutions to manage and enhance their customer relationship experience. They also offer specialized services with high added value. The services are divided into two main segments:

- Core Services & D.I.B.S. (Digital Integration Business Services): This includes customer relationship operations, technical assistance, customer acquisition, business process management, back-office services, and digital platform services.

- Specialized Services: These are high-value services such as online interpretation and visa application management, and health management services.

With nearly 1,200 clients, including 50% global accounts, Teleperformance has the most diversified client base in its sector. Their loyalty, as demonstrated by a retention rate of over 95% and an average client relationship of 13 years, is the best indicator of their satisfaction.

TLPFF is well positioned to benefit from the trend of outsourcing to lower-cost regions, which is gaining momentum as companies seek cost efficiencies. Offshoring and nearshoring are becoming popular, and TLPFF’s revenue from these services has increased significantly.

Teleperformance has been accused of employee’s mistreatment in the past. In 2021, an article was written on a website about local Colombian news to highlight the issues employees face and the toxic work environment in Teleperformance’s offices. It seems like the company has been working on this aspect as well. In 2023, Teleperformance was recognized as one of the top five World’s Best workplaces by Fortune and Great Place to Work®. This marks the third consecutive year Teleperformance has been among the top 25 global leaders, moving up from 25th place in 2021. The company is certified as a great place to work in 72 countries.

Teleperformance also implemented a global agreement with UNI Global Union signed in December 2022 which now includes Colombia, Romania, Poland, Jamaica, and El Salvador. This agreement aims to strengthen workers rights to form trade unions and engage in collective bargaining, while also improving workplace health and safety.

Development on AI front

AI, while seen as a potential threat, might actually enhance TLPFF’s operations efficiency and service offerings. AI can streamline customer interactions, potentially reducing call times and improving accuracy, through complex tasks will still need human intervention.

We believe Generative AI (GenAI) presents a significant opportunity for Teleperformance to develop more effective hybrid solutions by combining automation with employee’s expertise. Although still in its early stages in customer experience management, this technology requires secure data handling and reliable responses. Teleperformance, already skilled in IVR, OCR, chatbots, and other automation technologies, is now using GenAI to transform its own operations, especially in hiring and training.

The company is collaborating with clients over 250 AI projects, including those involving GenAI at various development stages. In 2023, Teleperformance focused on expanding its high-performance hybrid solutions through partnerships with global AI leaders:

- ServiceNow: By using the ServiceNow cloud platform, Teleperformance is developing AI solutions that stream link knowledge management and automate tasks, enhancing employee experience and productivity.

- Microsoft: Expanding collaboration with Microsoft through the launch of TP GenAI, a generative AI platform, Teleperformance leverages Microsoft’s Azure AI tools to improve customer experiences.

Following the acquisition of Majorel, TLPFF has introduced TP Infinity, a global digital consulting arm aimed at enhancing customer experience and strengthen client brands. TP Infinity comprises over 650 specialists, including data analysts, tech experts, creative minds and operations professionals, spreads across 15 countries in North & South America, Europe, and Asia.

Joao Cardoso joins TLPFF as Chief innovation and digital officer. A, experienced leader with a background in computer science and AI, Cardoso was the architect of “TP Cloud Campus” the remote management platform that helped the company navigate the challenges of the COVID-19 pandemic.

Majorel’s Acquisition

On November 8th, 2023, Teleperformance completed its acquisition of Majorel, a month ahead of the original schedule set on April 26. This acquisition will significantly expand Teleperformance’s presence in Europe, especially in France and Germany, where the company had previously had a smaller footprint. It will also allow Teleperformance to enter high-growth sectors like social media, luxury goods, automotive and travel, as well as areas requiring specialized expertise such as claim management and end to end document processing.

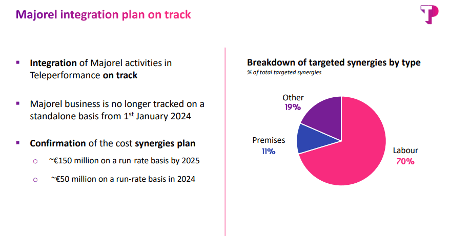

This move strengthens Teleperformance’s reach among European clients, complementing its existing predominantly American client base. This merger is expected to create numerous synergies in both revenue and cost savings. The cost-saving plan announced in April is on track to achieve approximately €150 million in savings.

Additionally, the acquisition is expected to boost earnings per share before synergies start in 2024. This strategic move reinforces Teleperformance’s global leadership, bringing the combined company to nearly 500,000 employees worldwide, with pro forma 2023 figures showing €10.1 billion in revenue and €2.1 billion in EBITDA.

Company Earnings Presentation – Q1

Valuation and Analysis

Teleperformance’s First Quarter 2024 Financial Update

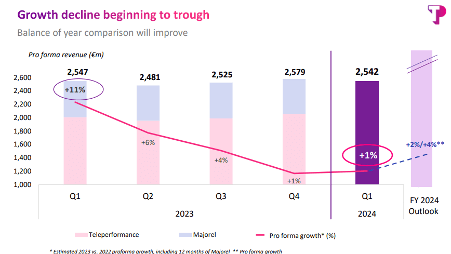

Teleperformance reported consolidated revenue of €2,542 million for the first quarter of 2024, a 26.7% year-on-YAR increase and 0.9% increase on a pro forma basis. As it has big global operations the company is exposed to the currency exchange risk and in Q1 an unfavorable currency impact reduced revenue by €28 million, approximately 1% impact.

Core Services & Digital Integrated Business Services (D.I.B.S) showed robust growth, especially in India, Asia pacific, and some European countries, although the growth in offshore solutions put pressure on overall revenue growth, particularly in the Americas.

Growth varied by Industry, with the financial services and automotive sectors performing strongly, while the retail and technology sectors began to recover. Conversely, the healthcare, telecoms, and social media sectors saw slower growth. The Specialized Service division continued its fast-paced growth, driven by language line solutions in the US and a post covid surge in visa application management at TLScontact.

Regional Highlights:

- Americas: Revenue reached €1,046 million, up 6.1% year-on-year but down 3.1% on a pro forma basis. Strong offshore growth, particularly in India for the US market, was offset by weaker performance in social media and healthcare sectors.

- Europe, MEA & Asia-Pacific: Revenue was €1,138 million, up 62.9% and 1.3% on a pro forma basis. Asia-Pacific led the growth, supported by new contracts in social media and travel verticals. Multilingual activities and business in the UK, particularly in financial services and retail, also performed well.

- Special Services: Revenue was €358 million, up 11.3% and 13.7% on a pro forma basis, driven by strong growth in language line solutions and ongoing demand in visa application management.

Teleperformance gave a positive outlook for 2024 with a pro forma growth of 2% to 4%, increase in EBITDA margin by 10 to 20 bps excluding the non-recurring acquisition costs. The company also expects an increase in net free cash flow and ongoing return to shareholders of up to two thirds of net free cash flow, including share buybacks and dividends paid.

The decrease in growth rates that seemed to be a huge problem for Mr. Market and rightly so, seems to be finally bottoming.

Company Earnings Presentation – Q1

Valuation

When we look at the valuation side of the business company seems to be trading at the historically low multiples, Although it can be argued that these multiples are normalizing as the company moves from a high-growth stage to more of a mature company with low growth and the other very strong argument is the normalization after zero rate environment in 2021 is normal as seen across the industries. Mr. Market is not wrong on these two fronts, but as explained, it seems to be overdoing it in the name of AI fears, employee mistreatment, and skepticism over Majorel’s acquisition.

After fighting with Mr. Market on how the potential issues highlighted are not the reason for punishing the stock so much, we want to look at the numbers as well and analyze how much a stock could be worth under some skeptical assumptions.

I plan to model the scenarios surrounding TLPFF in both EPV and DCF model. Although EPV might not be as useful here but if we assume a very small growth, we can identify exactly how much are we paying for growth under the value investing regime. As TLPFF has such a vast network spun over 90 countries and industry-leading margins, it can be said that it might have a network-based moat like booking has in a hotel industry, But our point of analysis is not revolving around a possible moat. We want to highlight how much we would be paying for growth considering a very small growth capex.

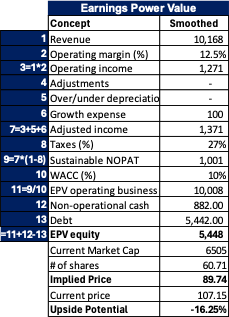

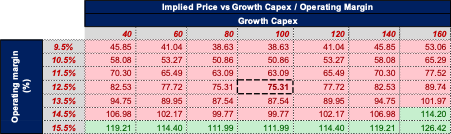

If we assume the est. 2024 revenue as a sustainable earnings figure and keep the margins stable at 12.5% ignoring the positive impact from Majorel acquisition synergies and increase in efficiency from AI. The company has been spending on average €500 million on growth each year in the form of net capex and acquisitions. We can rightly say all of that was not growth capex in contrast to what Mr. Accountant would tell us, as in the value investing regime, we only consider that part of capex growth which was invested to truly grow not just to keep up with the industry. As an example, all the capex being spent on AI is not a growth capex because it’s necessary to retain the current market share. For these reasons, I will be conservative here and only consider €100 million as growth capex, 20% of the original amount spent. With an estimated WACC of 10% we find out that the Earning Power Value for the stock is €89.74, which is also close to the lows that the company reported in the last 52 weeks. This highlights that we are not very far away from the no growth price of the stock that could also act as a floor for the stock which has always grown at absurd rates either organically or inorganically.

Moat Investing

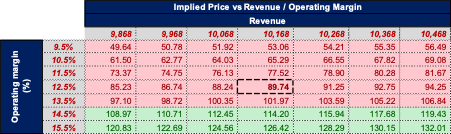

We are aware that everyone might not agree with our assumptions, sensitivity table below highlights how stock performs under different assumptions of revenue, growth capex and operating margins.

Moat Investing

Moat Investing

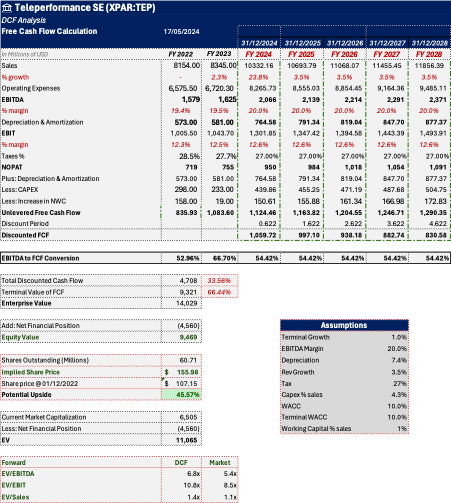

To further analyze the potential upside under some conservative assumptions, we employ a DCF approach. Using a 5-year DCF framework, I am normalizing the growth to only 3.5% for the next 5 years and a terminal growth of 1%. Although if you look at reinvestment and ROIC, it can justify a higher growth, but we want to side with the conservative side of the market’s belief and see if we have enough margin of safety.

I am assuming a small improvement in operating margins of just 10 bps, in contrast to what management expects from increased AI-generated efficiencies and synergies from Majorel’s acquisition. I am relying on the historical averages for net working capital requirements, depreciation/amortization, and tax.

To highlight that the company will have to spend on the AI front, I have increased the capex requirements to 4.3% of the sales vs. the last three years’ average of 3.2%. On the WACC side, looking at the leverage of the company it can be argued that our assumption of WACC is high and on top of it there are no implied assumptions of improved interest rate environment in my model as the terminal WACC is also kept at 10%. I want to highlight here the higher equity risk premium of the company based on the geographical revenue breakdown, which pushes the WACC higher, even this can be argued, but we want to be as conservative as possible and leave the room for errors as well by using 10% WACC for the next five years and in terminal calculation.

We have an implied price of €155.98 which represents 46% upside from the current levels. Under the assumptions used, the upside seems reassuring.

Moat Investing

We have performed a sensitivity analysis on the main value drivers affecting the potential upside.

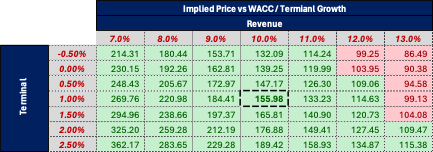

Since we have only used 1% terminal growth, there can be multiple arguments against or in favor of this. In the following table, we have a sensitivity analysis on the implied share price vs. different terminal growth and discount rates.

Moat Investing

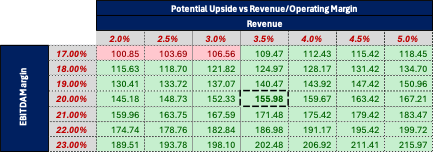

Considering our below guided revenue growth and operating margins, the table below is helpful to understand the impact different margins and growth can have on the valuation.

Moat Investing

Conclusion

Looking at the progress of the company on GenAI front we believe this will be actually beneficial for the company, increasing its efficiency. The company also seemed to have worked on the employees’ reservations as it jumped from 25th best to the top five best places to work. Majorel seems to have given the much-needed edge and introduction to the other sectors that Teleperformance was longing for. This is not exactly a multi bagger as many of us would want but this highlights that it’s safe to have a small to medium percentage position in the stock.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.