Monty Rakusen

Investment summary

My previous investment thought on Marvell Technology (NASDAQ:MRVL) (published in April 2024) was a buy rating because of my belief that the worst was over, and the business should start to see growth recovery in 2H25. I reiterate a buy rating for MRVL, as the path to an upcycle has become more visible after looking at the 1Q25 results. Management guidance and forward-looking comments were also very encouraging. There are also visible catalysts that suggest growth could further accelerate in 2H25.

1Q25 results update

Released at the end of May 2024, MRVL reported 1Q25 revenue of $1.16 billion, down 19% vs. 4Q24 and 12% vs. 1Q24. By segment, Data Center [DC] revenue grew 6.7% sequentially to $816 million, which was better than management guidance for low-single-digits [LSD] percentage growth; Carrier Infrastructure [CI] revenue was down 58% sequentially to $72 million, down 800bps more than management guided; Enterprise Networking [EN] revenue was down 42% sequentially to $153 million, 200bps more than guided; Consumer revenue fell 71% to $42 million, in line with guided decline of 71%; and lastly, Auto/Industrial [ATI] revenue fell 6% sequentially to $78 million, which was worse than management guidance for flat sequential performance. Non-GAAP gross margin fell 150bps sequentially to 62.4%. At the bottom line, non-GAAP EPS came in at $0.24, pretty much in line with consensus.

For guidance, management is now guiding for a sequential growth recovery of 8% to a total revenue of $1.25 billion, driven by DC sequential growth expectation of mid-single-digits [MSD] percentage growth at the midpoint, Consumer up 100% sequentially at the midpoint, and the other segments (CI, EN, ATI) to be flat vs. 1Q25.

Growing sight of recovery momentum

MRVL is tracking well against my expectations that the business will start to see an upcycle in 2H25. Below is supportive evidence of this.

First and foremost, management forward-looking comments are very encouraging. Specifically, they expect sequential growth for 2Q25, which is one big piece of evidence since they probably already saw sequential improvements in the first month of 2Q25 (the month of May). In addition, management expressed confidence in surpassing their $1.5 billion and $2.5 billion AI revenue projections for FY25 and FY26, respectively, even though they only presented a multi-year revenue outlook at the AI event ~7 weeks ago. From these comments, I believe 2Q25 has started off on a very good note.

MRVL

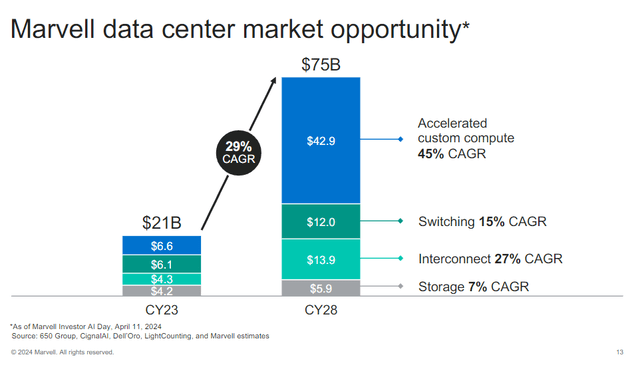

The main strength that is going to drive sequential growth for MRVL’s largest segment (the DC segment) is the increasing demand AI. AI has positive impacts on all parts of the DC segment: Custom compute; Switching; Interconnect; Storage. In particular for: (1) Switching: MRVL is going to start shipments of its 51.2T switch in 2FH25, and I expect to see strong adoption because it is stated to have the lowest latency in the industry; (2) Interconnect: I have talked about this in my previous post, and I reiterate: MRVL has a leading position in the 800G PAM4 solution, which should continue to well-position MRVL in this sub-segment.

As for custom compute, the traction so far has been promising. MRVL already has orders in its books and will be shipping the orders in 1FH25, followed by a substantial ramp in 2FH25 and high-volume production in FY26.

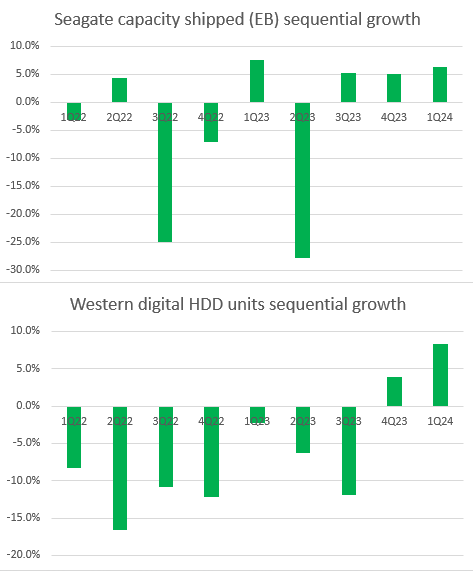

Redfox Capital Ideas

Lastly, for storage, the demand trend has tracked very positively as well. I inferred this strength from the performance of Seagate and Western Digital (big players in the industry), which have shown strong sequential volume growth improvements over the past few quarters. Both Seagate and Western Digital’s’ comments on the industry correction reaching its end and that end-demand is improving also support my view that orders should continue to improve for MRVL. In fact, I think the supply demand dynamics have tipped towards demand outpacing supply as both Seagate and Western Digital are able to raise prices.

We believe the long-running cloud customer inventory correction is mostly complete and their end demand is also improving. Based on our customer interactions, we currently expect healthy nearline demand growth to continue through the rest of calendar 2024. STX 3Q24 earnings call

As we move toward a new supply and demand environment, characterized by higher demand, supply tightness and product shortages, we are leveraging our proven technology we’ve already introduced to the market to meet the demands of our customers with the right portfolio at the right time, while also operating with a lean cost structure for continued profitability improvement in our HDD business. WDC 3Q24 earnings call

On an overall basis, the DC segment, which accounts for 49% of total revenue within the last twelve months, has also shown a fourth consecutive quarter of positive sequential growth of 6.7%, and I think this supports all the positive underlying drivers I have noted above.

Zooming into the second-largest segment, EN, I believe the supply demand situation has also shifted in favor of MRVL. Management noted in the call that comments from their networking customers indicate that order patterns are stabilizing. Comments from large enterprise networking businesses also point to demand normalizing ahead. Also, 1Q25 saw the largest sequential drawdown in the EN segment, pushing revenue back to pre-covid levels, which, I think, is compelling evidence that the downcycle is near or past the trough. My logic is that with AI pushing up demand for products in the EN segment, it doesn’t seem logical that MRVL is seeing a demand (based on revenue) level that is similar to pre-covid levels.

But now, I’d like to turn to our performance in Q3 and what we’re seeing in terms of customer demand. The breadth of our portfolio, together with our many touch points with partners and customers around the world, provides us with differentiated insight into what’s happening in our customer base. Based on activations to the cloud, which we track as well as conversations with our customers and partners, we believe that the products customers have on hand are being steadily deployed in line with the expectations we laid out last quarter, meaning we currently expect customers to complete the installation of the majority of their inventory by the end of our fiscal year in July.

And Matt, on the demand normalization, based on what we see today, I think we would expect starting in Q1 and beyond, we should see that normalize. CSCO 3Q24

The demand environment remains soft and large enterprises have yet to return to the market in force. However, we do see some green shoots that give us confidence that networking will transition to modest sequential growth beyond Q2 as we had expected 2Q24 HPE earnings call

Valuation

Redfox Capital Ideas Redfox Capital Ideas

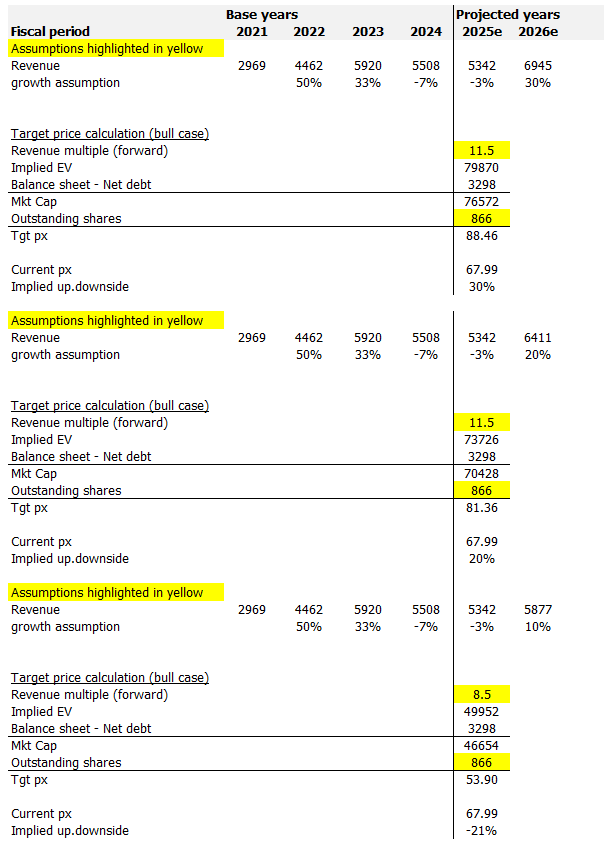

MRVL’s 1Q25 results reinforced my belief that the business is going to see a recovery in the coming quarters, and I stand firm on my assumptions that FY26 is going to be a recovery year. I have listed out three scenarios, as shown above:

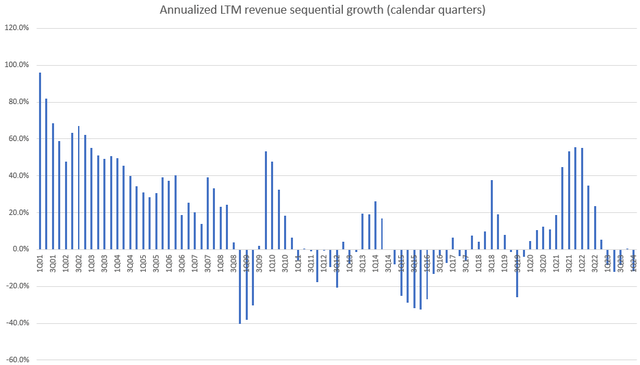

- In the bull case, MRVL should see 30% growth in FY26 (annualized LTM sequential growth went up 30+% after subprime and in 3CQ18) like it did after previous huge downcycles (subprime period; and 3CQ14 to 1CQ18 that saw revenue decline by 41% from peak to trough). I assumed a similar multiple as my base case for my bull case because I don’t want to model aggressive acceleration in multiples. I do note that MRVL traded as high as 14x back in CY2021 when sequential growth reached 30%, so there is a possibility for that.

- In the base case, MRVL is expected to see growth of 20%, using the growth rate seen in 3CQ13–1CQ14 as a gauge. In this case, I don’t think multiples will expand upwards, as the recovery is not as strong as the past major cycles.

- In the bear case, MRVL sees a growth recovery of only 10% due to lower-than-expected demand in the near term, as the high-interest rate environment may have caused a delay or slower recovery. In this case, I expect multiples to get downgraded to an MRVL average of 8.5x as the market gets disappointed with the timing of recovery.

Risk

Although DC segment recovery growth seems to be well underway (already printed 4 consecutive quarters of positive sequential growth), the shape of recovery in EN and CI segment is less visible. Weaknesses could persist beyond my expectations should the macroeconomic environment worsen and/or customers continue to be conservative on their investment purchases as they worry about the uncertain economy.

Conclusion

My view of MRVL remains unchanged at buy. 1Q25 results and management’s guidance paint a clear picture of a business on the path to an upcycle. There are multiple catalysts for growth, including continued strength in the Data Center segment, product launches, and the growing custom compute industry. Given the positive outlook, MRVL’s valuation appears attractive, and I continue to see upside.