blinow61/iStock via Getty Images

Introduction

Index investing is great – especially if you’re betting on the United States of America.

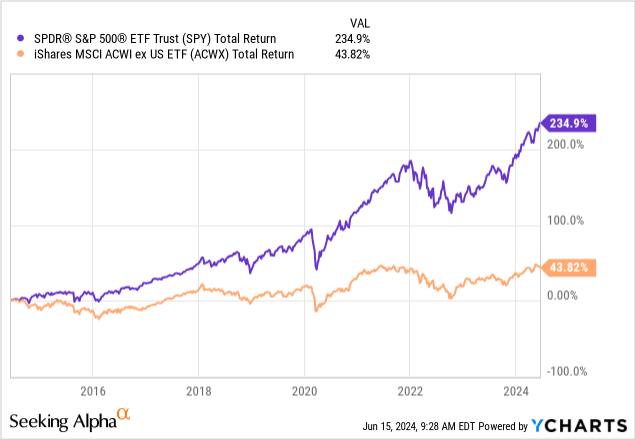

Including dividends, over the past ten years, the S&P 500 has returned 235%, which translates to a 12.9% CAGR. During this period, the all-world (ex-U.S.) MSCI ETF (ACWX) returned 44%, which shows the massive benefit of investors investing in the United States.

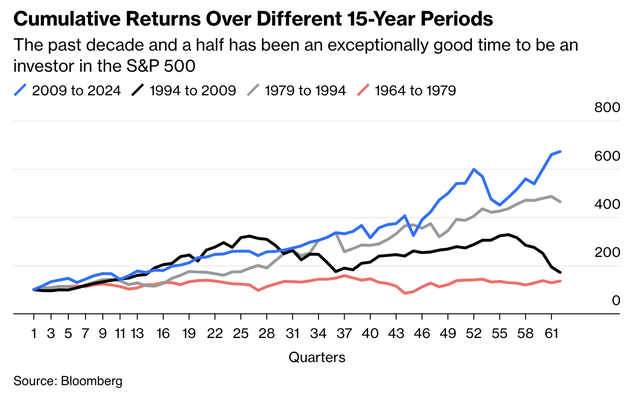

In fact, the past 15 years have been exceptionally good for S&P 500 investors, as the index performed highly favorably compared to previous 15-year periods.

Bloomberg

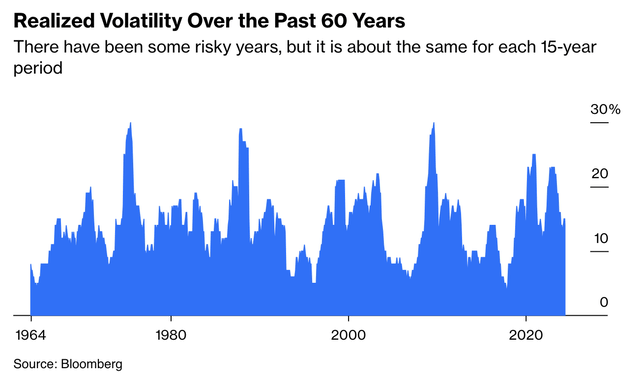

Moreover, going back 60 years, we find common volatility patterns, with some peaks and periods of extended “calmness.” The past 15 years were nothing special in that regard, which means in light of elevated returns since 2009, the risk-adjusted performance was even better compared to prior 15-year periods.

Bloomberg

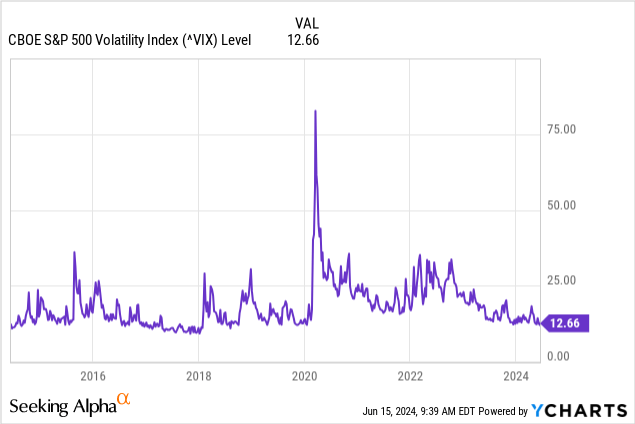

Right now, this is still true, as the market is rallying with a subdued CBOE S&P 500 Volatility Index, suggesting the market expects the market to remain calm.

Although the point of this article is not to predict a market crash, get people to sell the S&P 500, or similar, I believe Bloomberg’s Allison Schrager made a great point when she wrote the following:

Don’t get too complacent. A transformative period may well be imminent for the US and global economy – but it will also mean more risk.

First of all, much of the S&P’s growth is being driven by the so-called “Magnificent Seven” technology stocks. There have been other periods of extreme concentration – the “Nifty 50” biggest stocks dominated markets in the 1950 and1960s, when the top 10 stocks were a bigger share of the S&P than they are today. But concentration levels are rising, and at the rate the big tech stocks are growing, market concentration will reach record highs in the next few years. – Bloomberg (emphasis added)

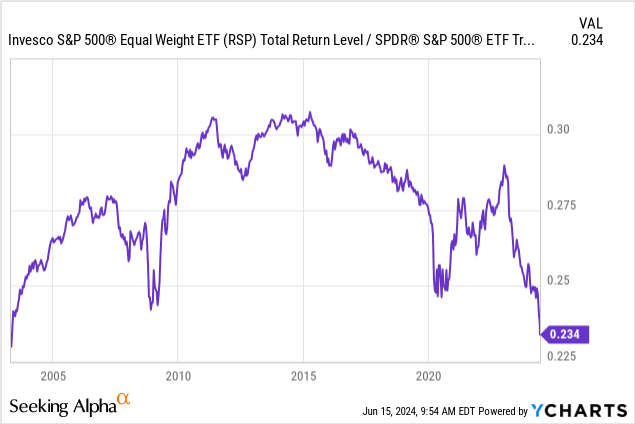

Based on this context, in a number of articles in the past, I have shared the chart below, which shows the ratio between the equal-weight S&P 500 (RSP) and the “normal” market-cap-weight S&P 500.

It’s blowing my mind how much the equal-weight S&P 500 is underperforming, which indicates that a handful of stocks is driving the market.

In this case, I often use the example of a good sports team. Does it matter if your favorite team wins the championship based on many above-average players or a few select world-class players?

A win is a win.

While that is true, it comes with risks, including diversification risks.

Going back to what Allison Schrager wrote:

Still, the concentration does leave investors (and the broader economy) more exposed to whatever happens to a few stocks instead of many. And in terms of diversification, seven is much less than 50 – and all seven stocks are in the same not-yet-fully-mature industry. That argues that this era of concentration will be more risky than in the past.

She brings up a great point, which is that innovation is a risk. While all of the “big guys” in the S&P 500 are stellar tech companies, nobody knows what the future holds. Competition is getting fiercer, and predicting future trends is tough.

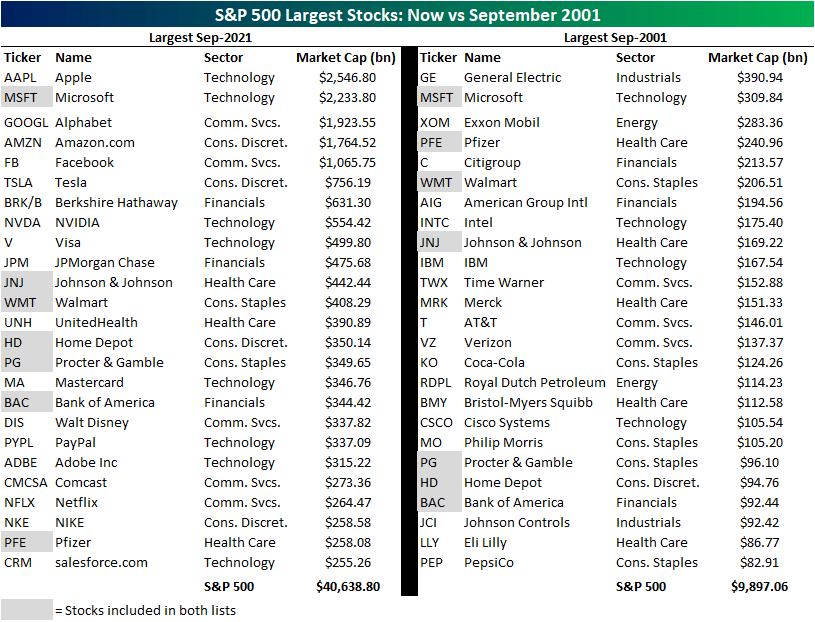

In fact, it is perfectly normal that major changes happen in the top 10 of the S&P 500.

Bespoke

Especially if interest rates and inflation remain elevated – driven by geopolitical changes, labor dynamics, more favorable oil price developments, and secular commodity demand growth – a lot could change.

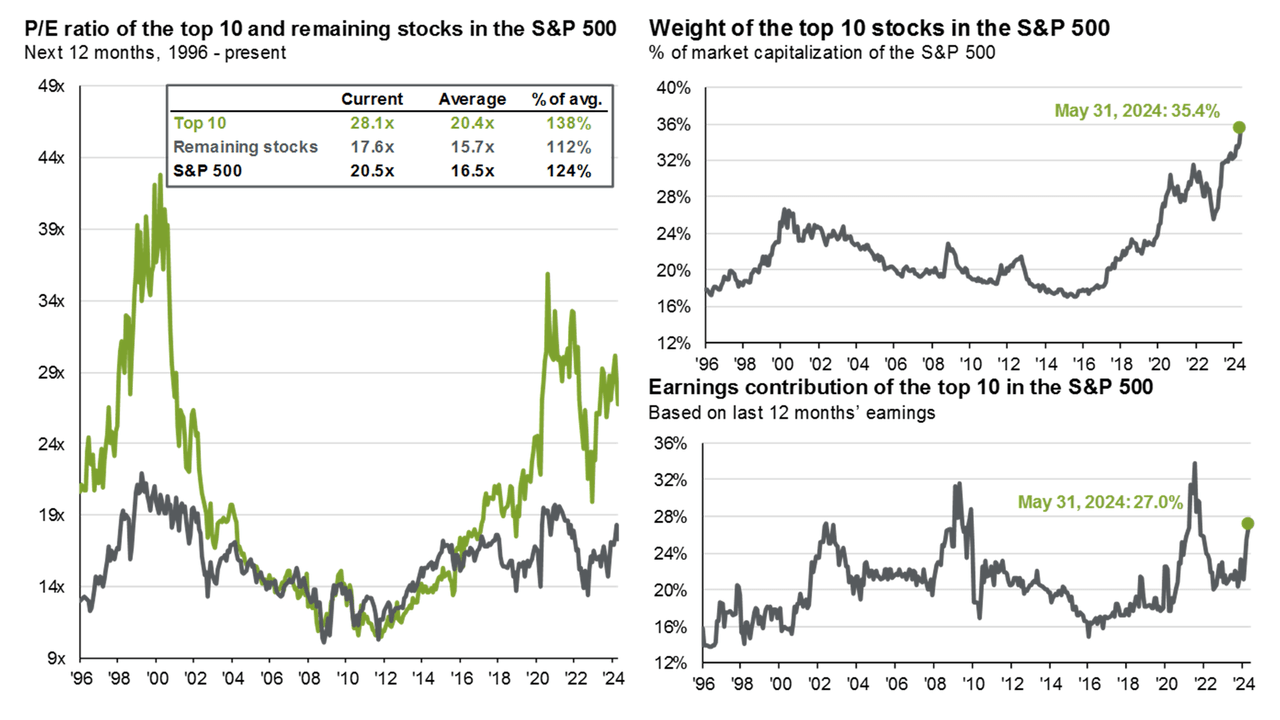

It also does not help that the market is lofty valued.

- The S&P 500 is trading at 21x earnings. Mainly led by the top 10, who are trading at 28x earnings. These top 10 stocks account for 35% of the S&P 500’s market cap and 27% of the index’s earnings.

- The S&P 490 is trading at less than 18x earnings, which is also above the long-term average yet much more attractive than the top-heavy S&P 500.

JPMorgan

While the top 10 could easily keep outperforming, I believe investors are better off finding value in other areas. This includes sectors with secular growth, anti-cyclical demand, and overall favorable risk/rewards for (dividend) investors.

In this article, I present three attractive anti-cyclical investments that I expect to generate tremendous value for investors seeking safety, income, and growth.

Mondelez International (MDLZ) – Anti-Cyclical Dividend Growth At A Great Price

A few hours before I started writing this, I stood in front of the Oreos in my local supermarket. I didn’t buy them.

The last time I bought Oreos, I finished an entire role in one sitting. I regretted that very quickly.

As you may have guessed, Mondelez owns Oreos. It also owns a wide range of other snacks that have made it one of the best-performing consumer staples on the market.

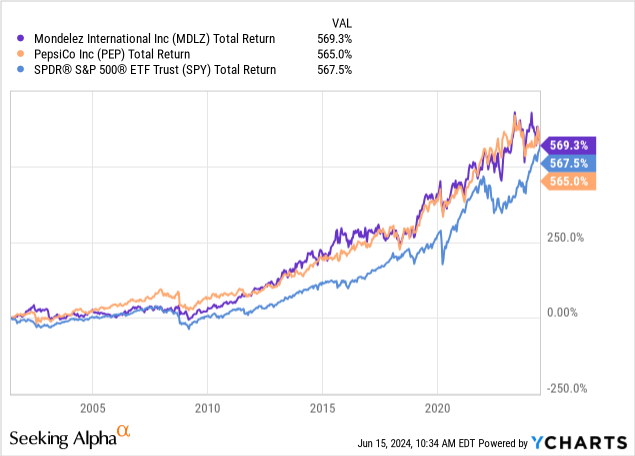

Together with its peer PepsiCo (PEP), which I own, it has been one of the best performers over the past 25-ish years, returning roughly 570%.

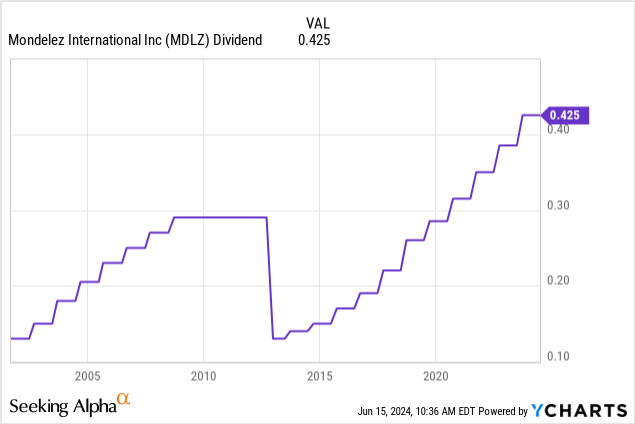

It also has a 2.6% dividend, which comes with a sub-50% payout ratio, a five-year CAGR of 10.7%, and ten years of uninterrupted annual dividend growth after the company spun off Kraft, which is now Kraft Heinz (KHC).

Currently, the stock is trading roughly 15% under its 52-week high, which opens up new opportunities, as the company is doing quite well.

While it is fully understandable that the market does not really love consumer staples in an environment of sticky inflation, MDLZ has strong pricing power and an attractive valuation that makes it a good pick on weakness.

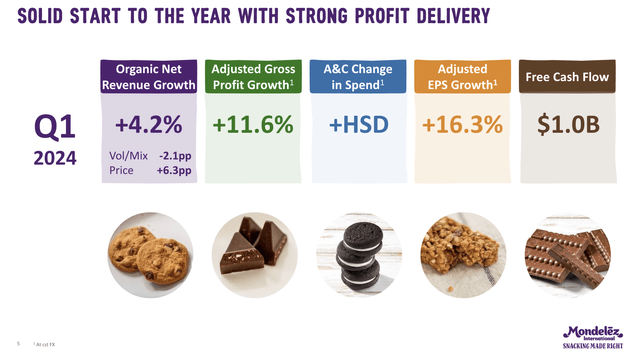

For example, the company reported a solid start to the year with organic net revenue growth of 4.2%, adjusted gross profit growth of 11.6%, and an adjusted EPS increase of 16.3%.

Mondelez International

Despite challenges in the broader food and beverage market, categories like biscuits, chocolate, and similar have shown lower price elasticity and better consumer loyalty.

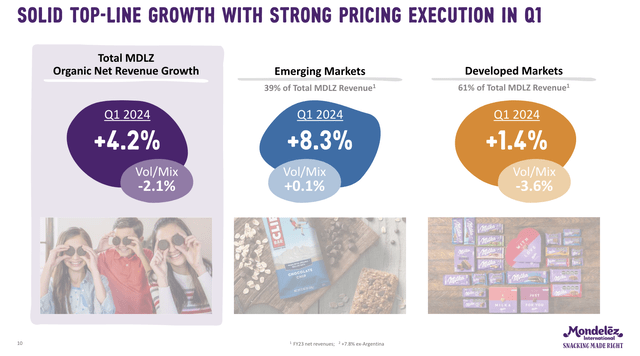

Mondelez also benefits from its international exposure, including emerging markets.

That segment saw 8.3% revenue growth in the first quarter, fueled by strong consumer confidence and high demand for premium brands.

This was also the only segment with positive volume.

Mondelez International

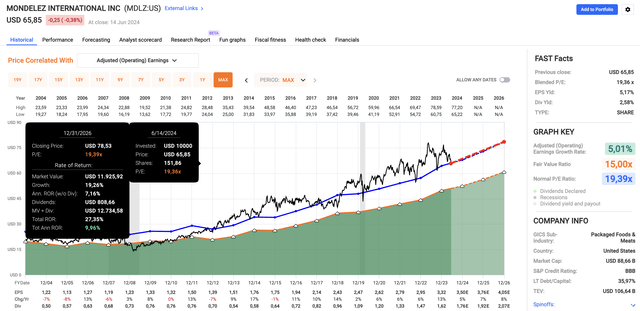

Moreover, the company has entered the buy zone, trading at 19.4x earnings, in line with the 20-year average.

FAST Graphs

Using the FactSet data in the chart above, analysts expect 5% EPS growth this year, potentially followed by an acceleration to 8% in 2026.

While all of this is subject to change, I believe MDLZ is in a good spot to return 10-12% annually in the years ahead, making it a great dividend growth stock with an anti-cyclical demand profile.

Huntington Ingalls Industries (HII) – Because The Navy Needs Subs

Huntington Ingalls sells to the U.S. government, as it is one of two major producers responsible for more or less every single major ship and submarine the Navy uses.

It’s also the only producer capable of producing aircraft carriers, the backbone of U.S. defense forces overseas.

The former Northrop Grumman (NOC) segment manages three segments: Newport News Shipbuilding, Ingalls Shipbuilding, and Mission Technologies, which includes asset-light operations to capture a bigger share of government contracts.

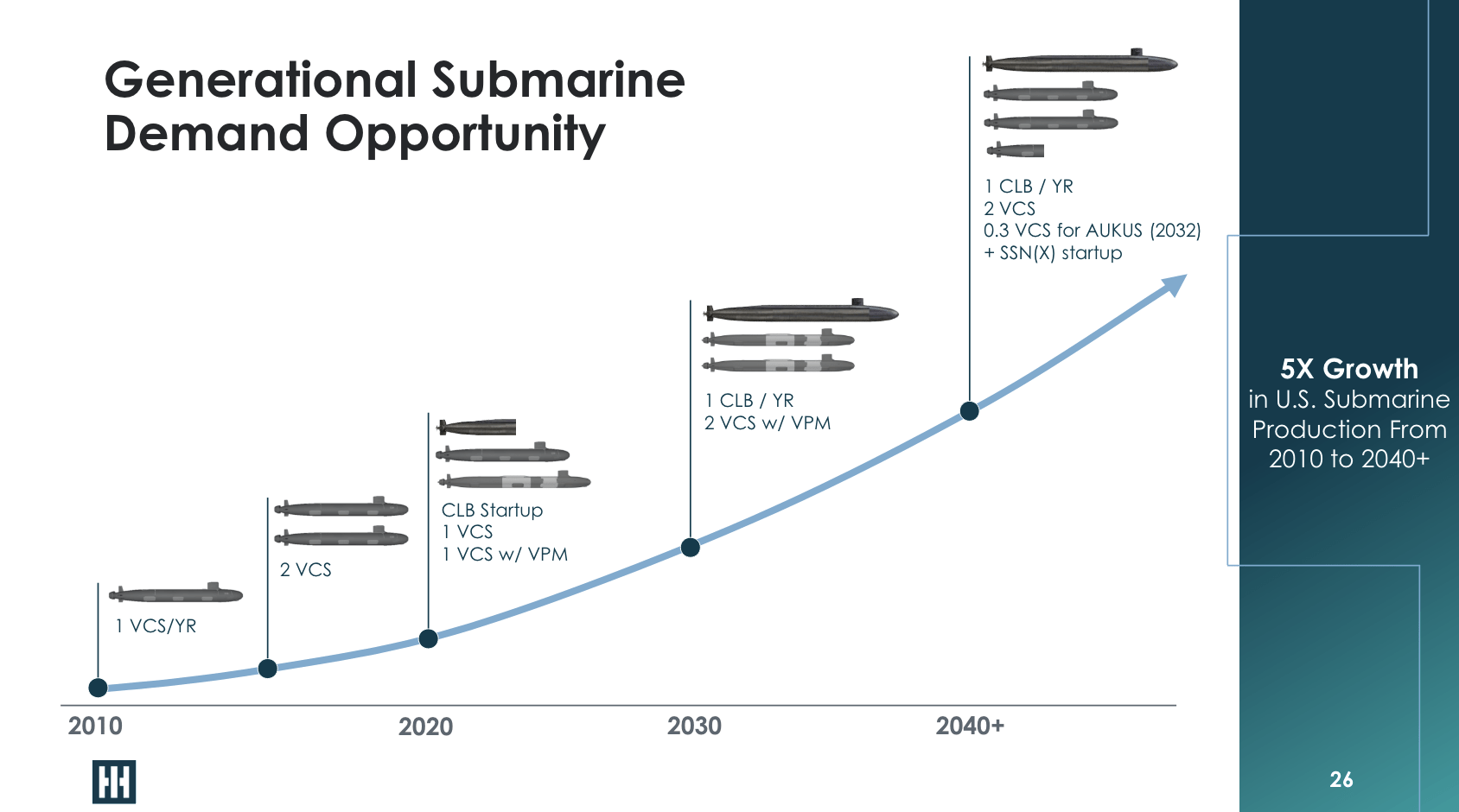

The company has an ultra-wide business moat with strong secular demand for, i.e., submarines. Production is expected to grow 5x between 2010 and 2040.

Huntington Ingalls Industries

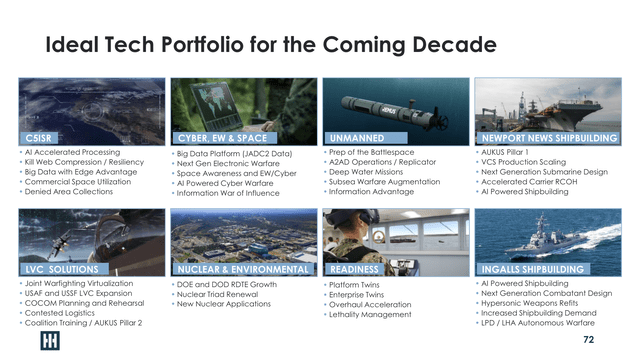

Moreover, the company is increasingly benefiting from secular growth, including the drivers I mentioned in an article I wrote this year:

- Refitting ships for new technologies, including hypersonic weapons.

- Working on autonomous ships (smaller, mass-produced weapons).

- Renewing the Nuclear Triad.

- Implementing next-gen electronics.

- Applying AI to ships and shipbuilding processes.

- Boosting “big data” applications in C5ISR.

Huntington Ingalls Industries

In the first quarter, HII secured $3.1 billion in new contracts, which added to a total backlog value of almost $50 billion.

Key orders include contracts for shipbuilding and maintenance, including the advanced planning contract for CVN 75 USS Harry S. Truman’s refueling and complex overhaul.

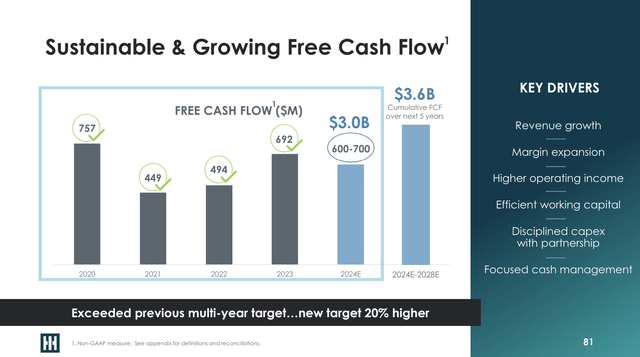

On top of that, years after aggressive investments in growth, the company is finally looking at a future of elevated free cash flow. Free cash flow through 2028 is expected to be $3.6 billion. That’s $720 million per year (on average), or 7.7% of its $9.4 billion market cap.

Huntington Ingalls Industries

This is a very high free cash flow yield, which bodes well for its dividend.

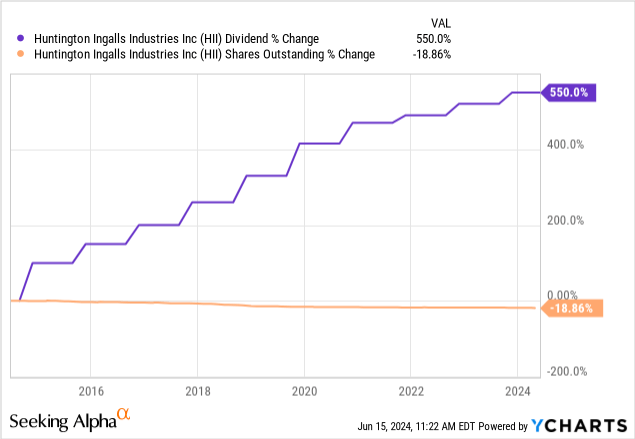

The company currently yields 2.2%, which comes with a payout ratio of less than 30% and a five-year CAGR of 9.3%.

Even more important, we can expect 4-7% annual dividend growth, according to its 2024 Investor Day comments.

Since 2013, we provided an annual dividend, and we’ve increased that dividend each year since then. We guide to mid-single digit annual dividend growth rate with a net pension adjusted income payout ratio of approximately 30%. We’ve increased the dividend in the last 2 years at 5.1% and 4.8%, respectively. – HII 2024 Investor Day (emphasis added).

While that may not be a lot, these dividends come with buybacks. Over the past ten years, HII has bought back almost a fifth of its shares.

Moreover, given the size of the expected free cash flow, we can expect buybacks to remain a substantial part of the total return.

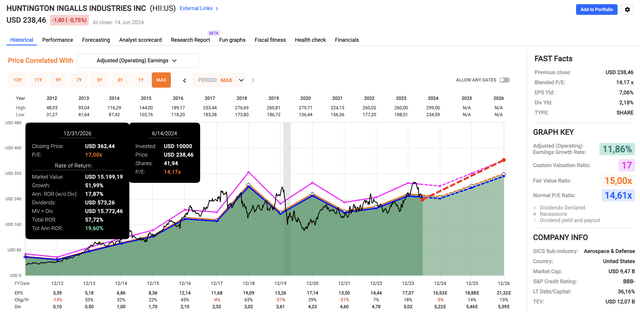

Speaking of expectations, the company trades at a blended P/E ratio of just 14.2x. While this year’s EPS is expected to decline by 3%, growth is expected to rise to 14% and 13% in 2025 and 2026, respectively.

FAST Graphs

In my previous coverage, I applied a 17x multiple, which indicates a $362 stock price target, more than 50% above the current price.

This makes HII one of the most undervalued dividend growth stocks on my radar.

Abbott Laboratories (ABT) – A Dividend King With A Post-COVID Comeback

With a 16% weighting, Abbott is the largest holding of the iShares U.S. Medical Devices ETF (IHI), which covers one of my favorite healthcare segments.

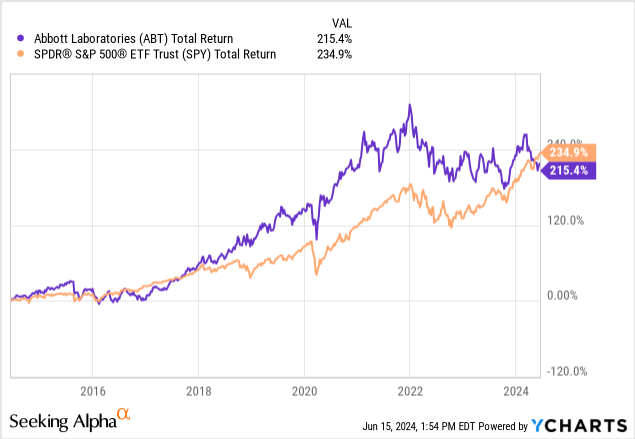

Over the past ten years, the company has returned 215%, slightly lagging the S&P 500’s 235% return.

Underperformance is mainly due to the weak post-pandemic period, which has caused significant weakness in business segments that provided it with skyrocketing growth in 2020 and 2021.

However, the company is back on track.

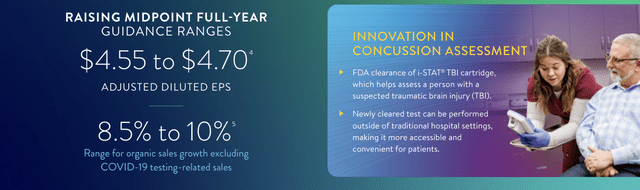

As I wrote in an in-depth article on April 22, the company is increasingly upbeat about its future, as it raised its full-year guidance for organic sales growth, excluding COVID-19 testing, to a range of 8.5% to 10.0%.

Abbott Laboratories

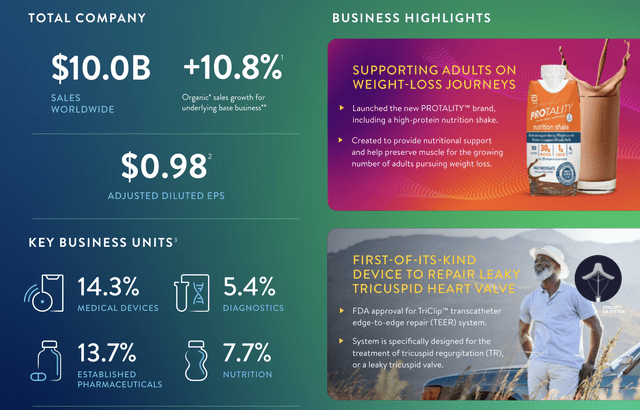

This is after it reported 10.8% ex-COVID organic sales growth in the first quarter, supported by 14% growth in both Medical Devices and Established Pharmaceuticals.

Abbott Laboratories

Moreover, the Nutrition segment saw an 8% increase in sales, led by double-digit growth in Pediatric Nutrition.

Meanwhile, the launch of new products, such as Protality, which supports nutritional needs for adults looking to lose weight, benefits from secular growth related to weight loss pills.

On top of that, the company is making great improvements in glucose monitoring, as sales of its continuous glucose monitoring product, FreeStyle Libre, rose by 23%.

Abbott Laboratories

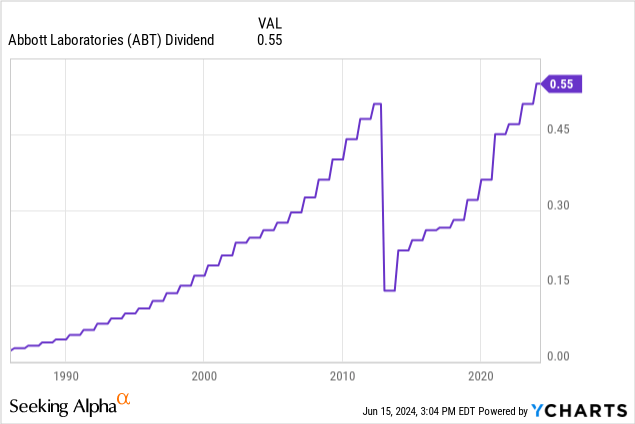

It also helps that ABT has a fantastic dividend growth profile.

Currently yielding 2.1%, the dividend comes with a 48% payout ratio, a five-year CAGR of 12.1%, and more than 50 consecutive annual dividend hikes, making ABT one of the few Dividend Kings on the market.

In fact, it’s a Dividend King that is still capable of elevated growth.

Please note that the dividend growth chart below shows a decline. That’s due to the AbbVie (ABBV) spin-off.

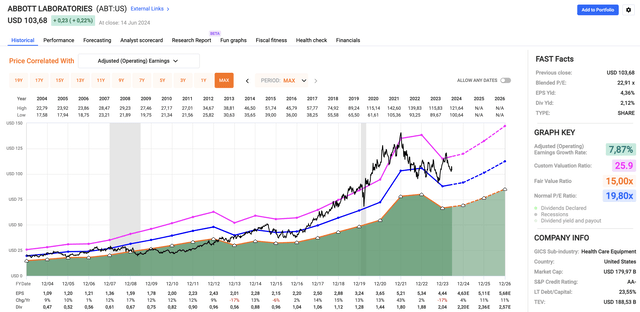

Valuation-wise, I believe the company, which has a double-A credit rating, is highly attractive.

Using the FactSet data in the chart below, the company trades at a blended P/E ratio of 22.9x. While this is well above its long-term average of 19.8x, this is mainly due to a 17% EPS contraction in 2023.

FAST Graphs

Going forward, analysts expect 4% growth in 2024, potentially followed by 11% growth in both 2025 and 2026.

Hence, in my prior article, I used the company’s five-year average P/E ratio of 25.9x, which implies a fair stock price of $147, 40% above its current price.

While this makes me more bullish than others, given the consensus price target of $126, I believe this is warranted, as Abbott has a perfect product portfolio for long-term wealth creation.

Takeaway

Investing in the S&P 500 has yielded impressive returns, outperforming global markets by a huge margin.

However, the concentration in a few tech giants poses diversification risks.

Therefore, diversifying into high-quality, anti-cyclical stocks like Mondelez, Huntington Ingalls, and Abbott can provide balanced growth and income growth.

Mondelez offers steady dividends and strong pricing power, Huntington Ingalls benefits from its crucial role in supporting the Navy, and Abbott Laboratories is rebounding with impressive growth in medical devices, nutrition, and other areas.

All things considered, I believe these picks present attractive valuations and potential for long-term gains, making them solid choices for investors seeking growth, income, and opportunities to potentially outperform the top-heavy S&P 500 in the years ahead.