loongar/iStock via Getty Images

CB stock and Warren Buffett’s position

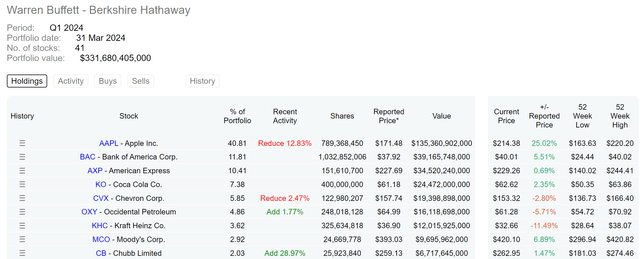

If you are reading this, you must have already known that Warren Buffett’s Berkshire Hathaway Inc. (BRK.A, BRK.B) recently acquired a sizable chunk of Chubb Limited (NYSE:CB) shares. The chart below shows the most filing of BRK’s equity portfolio holdings. As you can see, Apple (AAPL) remains the largest holding by far (comprising more than 40% of the $331 billion portfolio), followed by several other legacy holdings such as Bank of America (BAC) and American Express (AXP). The CB stake is one of the latest added positions.

BRK only started accumulating CB shares in 2023 Q3 – though at a very aggressive pace. In the past one year or so, the stake has reached a market valuation of more than $6.7B as seen, and now ranks as the 9th largest in the Berkshire portfolio. It also represents 6.1% of CB’s current market cap.

DataRoma

Against this background, the thesis of this article is to argue that there is a possibility for a full buyout. Such a possibility, combined with CB’s reasonable valuation and solid performance, creates a very skewed return/risks profile in my view and thus leads to a BUY rating.

In the remainder of this article, I will analyze the top 3 reasons on my list why a full buyout of CB by Berkshire is a possibility. These reasons are CB’s reasonable valuation, BRK’s large cash position, and Warren Buffett’s fondness for the insurance industry.

CB stock: solid performance meets attractive valuation

CB’s current valuation is very attractive, largely due to a temporary factor, in my view: the collapse of the Francis Scott Key Bridge in Baltimore. This situation echoes with Buffett’s style of buying good business on the operating table (although to a much less dramatic degree compared with his other more famous cases). More specifically, CB shares had been enjoying a strong rally in the past 1 year (see the next chart below) thanks to the strength of its business fundamentals. However, the rally was interrupted by a sizable correction following the Francis Scott Key Bridge collapse in Baltimore.

Due to the incident, CB could be on the hook for a $350 million pretax payout (roughly $0.70 per share). The share prices corrected from a peak of ~$260 in March to a temporary low of $240 after the incident as seen.

Seeking Alpha

The share prices have recovered to the current level of $264. But I think the valuation is still very attractive, and the market may be still overestimating the impact of the incident.

First, the aforementioned payout is Maryland’s upper limit for coverage on the structure, thus representing the worst-case scenario already. Second, my view is that CB has a good chance of recouping its losses through litigation against the owner of the ship responsible for the disaster (Synergy Marine Group of Singapore). Thus, the actual loss could be substantial less than what the market is pricing in now.

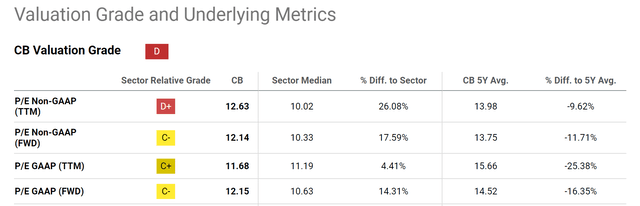

Finally, the current valuation discount is too large to ignore for such a stable business. To wit, the chart below summarizes CB stock’s valuation grade. As seen, CB’s P/E ratios are currently trading at a discount of 9~26% compared to its 5-year average. Its FWD non-GAAP P/E ratio of 12.14x is 11% below its 5-year average of 13.7. The FWD GAAP P/E ratio shows an even larger discount. Its FWD GAAP P/E ratio of 12.15x is more than 16% below its 5-year average of 14.5.

Seeking Alpha

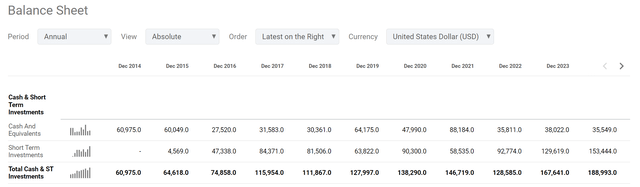

BRK’s cash position

The second reason for the possibility of a full buyout is BRK’s large cash position. Berkshire’s cash pile is approaching $190B now (see its balance sheet in the next chart below). I expect it to exceed $200 billion by the end of this year based on projections of its financial and investment income. As aforementioned, BRK’s current holding already represents more than 6% of CB’s current market cap of about $110 billion at the price as of this writing. Thus, digestibility is not an issue at all even if the whole buyout is a cash transaction. In addition, Berkshire could also use some combination of cash and its own shares in such a transaction. BRK shares are highly valued currently (trading at ~21x FWD P/E), compared to CB’s ~12x mentioned above.

Seeking Alpha

Other risks and final thoughts

Finally, CB would also be a good fit to the BRK portfolio and Buffett’s style. Buffett has displayed his fondness for insurance companies on numerous occasions. He has called Berkshire’s P/C (property/casualty) insurance segment the core of the BRK conglomerate he’s built over the years. And his actions are certainly well aligned with his words. He has been buying a range of sizable insurance companies outright over the years, including National Indemnity, GEICO, Gen Re, and most recently Alleghany in 2022. Adding a gem (or another gem) such as CB to its mix of wholly owned subsidiaries seems to be a very logical move considering this pattern, in my view.

In terms of downside risks, CB faces a set of common risks together with all other insurance companies. Significant catastrophe losses (either natural or man-made) could strain their financial reserves. Uncertainties in interest rates pose another risk to their investment returns. CB also has a significant exposure to certain insurance lines, such as Commercial Property & Casualty (“C&P”), which could cause some concentration risks. Specific to the thesis of this article, the analysis of a buyout always entails an element of speculation.

However, as mentioned upfront, my thesis is that the possibility of a buyout adds further skewness to the return/risk profile. Even if the buyout does not materialize, Chubb Limited is a good investment opportunity by itself thanks to its reasonable valuation and solid performance.