Guido Mieth

Whenever you look at a banking stock’s financial reports, you either find them ill prepared for changes in interest rates and economic conditions or operational ineffectiveness making them inefficient at generating above average returns. It is very rare to find a bank holding company like Esquire Financial Holdings, Inc. (NASDAQ:ESQ) that does well in all departments.

With its niche presence in the Litigation market, Esquire Financial Holdings, Inc. is serving the $443 billion U.S. tort industry, which was equivalent to 2.1 % of U.S. GDP in 2020. The bank generates more than 50% of its loans and 76% of its deposits from the litigation industry. It is heavily focused on increasing its market share and presence in the litigation market and very successful in generating above average returns and growing at much more than double-digit growth rates by serving the tort industry. Esquire’s past five years performance in revenue and Diluted EPS is 25% and 28% CAGR.

Looming Liquidity squeeze

As interest rates have increased to historical highs, customers are shuffling their savings to safe heavens offering higher returns, this is causing liquidity squeeze across banking industry at present. Deposits are the baseline to any banks’ lending, complete dependence on deposits to fund loans is a strong sign of banks’ ability to do its operations smoothly and profitably without depending on borrowings. ESQ has a Loan to Deposit ratio (LDR) of 85.6% at Q1, 2024, which is a highly desirable number for any high-quality bank, with high interest rates banks are trying to squeeze more out of their funds as the cost of funds is increased too. In addition, it also has $823 million liquidity capacity which includes cash, borrowing capacity and available reciprocal client sweep balances. This provides a cushion to the bank to explore any loan or bank acquisition opportunities with more ease. Most underperforming banks will have their LDR above 90% while also depending on borrowings to cover their poor liquidity position, which negatively hurts their financial health and earnings. 493 banks (10%) out of 4756 banks had their LDR > 100% in Q4 2022. Esquire Financial Holdings has 100% unutilized borrowing capacity at present, and it has a strong liquidity buffer to meet any sudden opportunities or requirements.

Liquidity and Asset quality

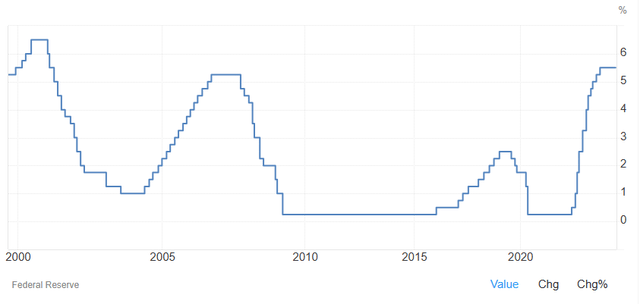

U.S. Interest Rates (Trading Economics)

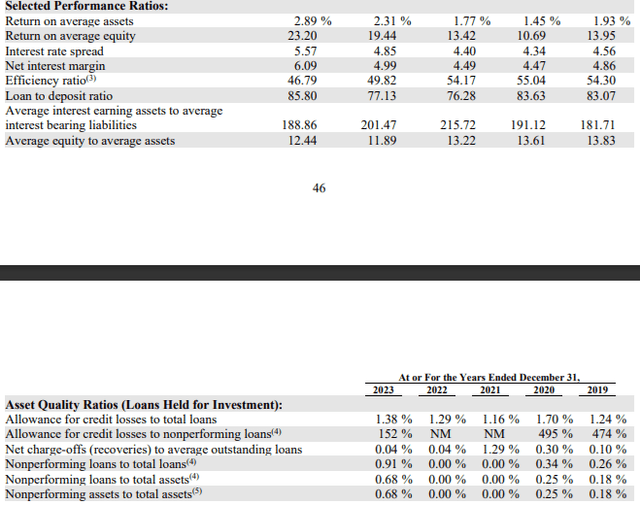

The U.S. economy is facing historically high interest rate levels, which were observed only twice from the year 2000. The pressure of high interest rates and a slow-growing economy creates a ripple effect on every industry, and mostly on underperforming industries. It’s also negatively impacting banks’ financial performance in cost of funds, inflow of funds (deposits) and asset quality. When we look LDR again, once the interest rates declined sharply in 2020, the LDR ratio of ESQ also declined sharply from 83.63% in 2020 to 76.28% in 2021. As interest rates inched up quickly in 2022 and 2023 LDR of ESQ increased to 85.80% by the end of 2023. In their pursuit to decrease the interest expense dent to the bottom line, ESQ tried to exhaust their available funds to the maximum, which is reflected in 2023 and Q1, 2023’s LDR ratio. But that is not a cause to worry as ESQ has taken proper measures to retain and keep attracting new deposits, which should slow down the LDR ratio from moving towards 90%.

Loan to Deposit Ratio of ESQ (Company Financial Reports)

To keep the deposit inflows strong, ESQ has increased many of its deposit products’ interest rates, which is reflected in interest rates on deposits increasing substantially. Cost of funds increased from 0.18% in 2021 to 1.11% in 2023 to 1.48% by Q1, 23. By the end of Q1,23, I assume more than 20% of banks must be LDR>100%. Not only liquidity, the asset quality position is also experiencing severe changes after a lot of favorable results in 2021 & 2022.

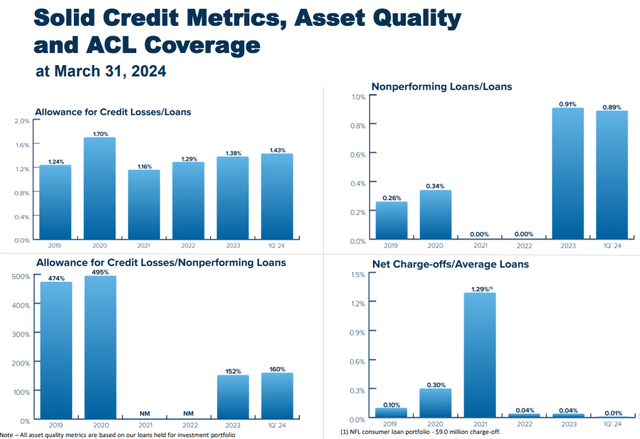

Asset Quality Ratios of ESQ (Company Filings)

Except for one NFL consumer loan portfolio worth $9.0 million charge-off in 2021, there is not much concerning that investors need to be worried about immediately. The Federal Reserve projected one rate cut this year and four reductions in 2025. These rate cuts are much needed for the banking industry in the coming quarters, which will soften the liquidity crunch and let the industry sail smoothly without much turbulence. This one rate cut is revised from three rate cuts in March 2024, and if it doesn’t happen, I expect some asset quality deterioration impacting earnings of ESQ in late 2024 and 2025. If interest rates do decline, ESQ’s asset portfolio is well protected because most of its loan assets have interest rate floors, which will slow down the negative impact of decreasing interest rates.

Unlike most banks ESQ is much more resilient, its nonperforming loans increased to 0.91% in 2023 and 0.89% at Q1, 2023 from nil in 2022, allowance for credit losses to the nonperforming loans was 160% on Q1,2024. Management marked loans totaling $521.1 million as possibly risky (but not included in special mention or substandard) with two loans having DSCR of 1.36 and 1.49 with remaining loans having DSCR of above 1.50. These results are indicative of increasing aggressive pressure from high interest rates, and Esquire Financial Holdings is sitting in a comfortable position since it is a well-managed bank posting double-digit growth in loans, deposits and earnings most of the time.

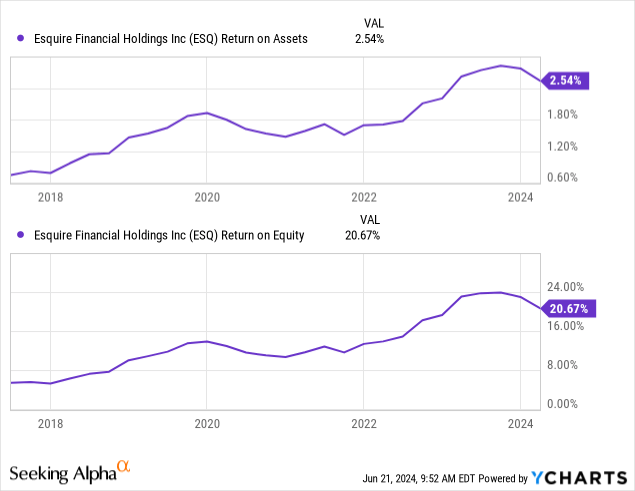

Earnings Quality

Earnings quality of the bank is top notch, only very few banks I have analyzed in the past have above 1.50% return on average assets (ROAA) during a low interest rate environment, under present conditions, ESQ posted 2.59% ROAA in Q1 2024, and return on equity of 20.14%. The negative impact of high interest rates is not at all visible in financial performance, barring a slight deviation in asset quality, which is much more than covered, in fact. High interest rates actually helped ESQ post historically high profitability numbers.

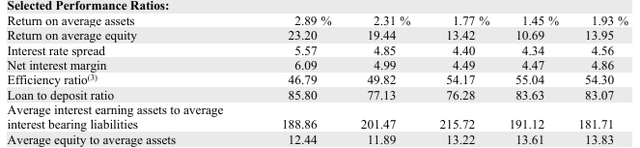

ESQ is not your average bank; I mean, most banks try to follow template models while conducting their operations. They only react or change something when there are changes in economic policy or a significant shift in their results, because of the way they are conducting business. While also posting exceptional results due to favorable economic conditions, ESQ also improved its efficiency ratio from 54.17% in 2021 to 49.8% in Q1, 2024. At the same time, its return on average equity improved from 13.42% to 20.14%. I believe it is a human tendency to become complacent after knowing you are about to post good results. Management did not stop from improving, while also maintaining better performance ratios shown in the picture below.

Financial Performance Ratios of ESQ (Company Filings)

It generates 22% of total revenue from noninterest income sources by serving 85,000 merchants across 50 states through its payment processing vertical. It has processed $33.0 billion worth of transactions in 2023 and $8.6 billion in Q1, 2024.

The current conditions are not that conducive to banks’ asset quality and liquidity, and if you are in the wrong position, it will result in unhealthy financial performance. But to banks like ESQ, which are operating well and performing very well across all metrics, current conditions are not that punitive in my opinion, even in the coming quarters except in some special cases.

Conclusion

The market is not appreciating ESQ stock enough recently even after stellar performance because of concerns related to the banking industry, not entirely related to ESQ. Once these tensions soften, I believe this stock will see above average returns, much more than what it has generated in the past few years, in my view. ESQ is trading at 9.93X Price to earnings, 1.85X book value, with a dividend of $0.15 and yield 1.18% in Q1,24, which was increased by 50% from $0.10 at the start of 2023. Except for book value per share, ESQ can be considered a cheaply valued stock, but a lot of value is generated because of how fast the company is growing its loan portfolio and the bottom line every year, making it a good opportunity for long-term investors.