Huber & Starke

Investment overview

I give a buy rating to Calix, Inc. (NYSE:CALX). CALX next-generation products enable its customers to compete effectively against incumbents and also at a lower cost structure. Demand for the CALX product is evident through its historical growth rates, customer operating metrics improvements, and adoption by Verizon (a large tier-1 customer). I don’t think the recent slowdown is representative of CALX growth, as it is being dragged down by temporal headwinds. As CALX moves past this weak period, growth should inflect back upward.

Business description

Calix provides broadband service providers (BSPs) with hardware, cloud, and software platforms, systems, and services that gather, analyze, and return data from their respective subscriber bases that can offer direction for the BSPs to best improve their customer experiences and help reduce operating expenses. Breaking down revenue by geography, CALX is primarily focused on the US markets, where it derives more than 90% of revenue as of FY23. In terms of customer base, CALX core customers are the small BSPs (81% of total revenue) that have less than 250 thousand underlying subscribers.

CALX is a disruptor to a mature industry

The broadband service provider industry is a mature industry that is arguably commoditized in terms of service offerings, and it really boils down to who can service the customer better. In the past, BSPs were able to differentiate themselves by bundling on-demand video and live sports, and this advantage is mostly available to large players as they have more financial resources and a larger subscriber base to amortize the fixed cost. Fast forward to today, and the arrival of over-the-top players like Netflix, Disney+, and direct live sports streaming (ESPN Live, NBA League Pass, etc.) has basically crippled BSPs ability to differentiate to a large extent.

CALX

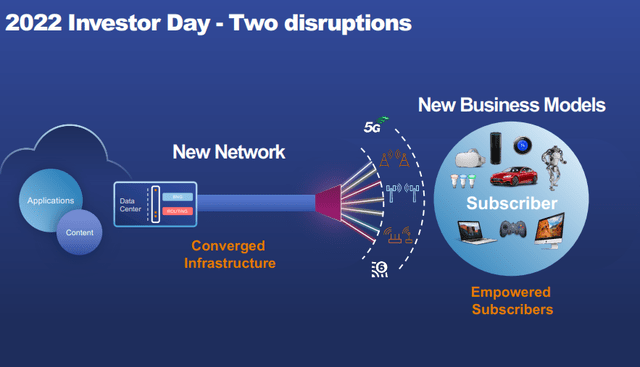

I believe CALX next-generation products are major disruptors in that they provide BSPs with a way to differentiate themselves and compete more effectively. CALX does this by simplifying the hardware platform (i.e., the underlying infrastructure), wherein CALX focuses on delivering a platform that can deliver the required capabilities while at the same time reducing the reliance on hardware.

Essentially, the next-generation products include AXOS, EXOS, and Calix Cloud. AXOS and EXOS are operating systems based on software-defined networking that sit on top of the network and simplify network operations. In simpler terms, AXOS and EXOS use software modules to virtualize various hardware functions. This is huge for BSPs because:

- Reduces churn by achieving greater network reliability: hardware goes through wear and tear, and they eventually break down, which is a hassle because it disrupts operations. From the customer perspective, they don’t care about the underlying reason for network disruption. Any disruption will be blamed on the network brand, which leads to a bad reputation and an increase in customer churn. This is especially hurtful for smaller BSPs that need to rely on a lot of customer service to differentiate themselves (they don’t really have other ways to compete since the products they offer are commoditized).

- Faster upgrades with no disruption: BSPs are able to conduct upgrades without having to take hardware offline, which is a huge positive, as they don’t need to risk subscribers’ dissatisfaction. Also, it is a lot easier and cheaper to just update software (with a couple of clicks) rather than deploying hundreds of man-hours to upgrade each piece of hardware.

- Lastly, because CALX platforms are hardware-agnostic, it allows BSPs to swap out hardware from a different vendor anytime they want. This relieves them of any price increase from incumbent hardware providers (assuming there is a cheaper alternative).

Through all of these, CALX allows BSPs to achieve significant cost savings (lower subscriber churn, smoother network operations, and less labor needed). Another benefit is that this gives BSPs more room to compete on price.

CALX

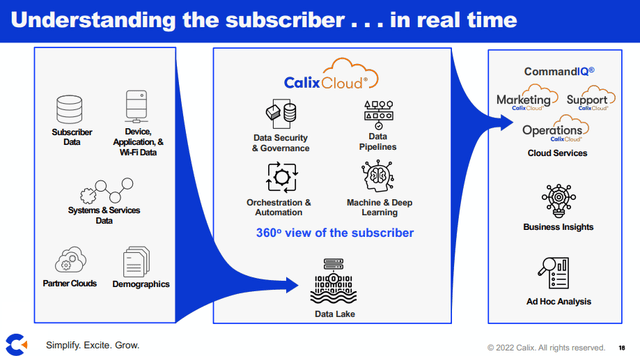

The adoption of CALX platform enables BSPs to take advantage of Calix Cloud (the other next-gen product mentioned above). Calix Cloud is an analytics platform that has two main products: the marketing cloud and the support cloud. The key thing here is the network and subscriber behavior data that CALX is able to capture and provide BSPs. This opens up a lot of revenue growth opportunities for BSPs, where they can now identify which subscribers are most likely open to upgrades or new services.

Additionally, BSPs are able to step up on customer service now that they have better visibility into subscribers’ behavior. Through the Support Cloud module, BSPs support team can quickly identify issues with the network or equipment. It even has automation capabilities that fix many common issues without manual intervention. This eventually drives down the overall operating cost of BSPs as they do not need to deploy manpower to fix the issue on-site, and it also reduces customer churn as subscribers remain satisfied.

CALX

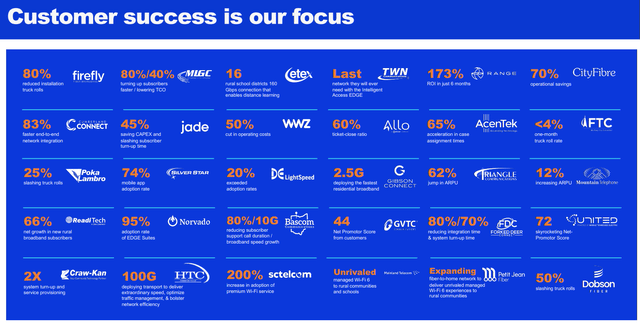

Given that this is a disruptive model, the question is whether there is strong demand for it and if the products do work. The most solid evidence for strong demand can be seen from CALX Financials, where revenue from its small customer base saw exceptional growth post-launch of these next-gen products (revenue grew from $294 million in FY19 to $764 million in FY23). In terms of whether the product works, I believe the improvements in operating metrics for CALX customers (as shown above) are a great proof of that. Finally, the fact that Verizon, a large tier-1 BSP, decided to deploy AXOS is a very big statement. Moreover, CALX is the sole supplier for Verizon, which lends further credence to CALX’s product quality and value proposition.

Why did growth slow recently?

The market clearly recognizes CALX’s ability to disrupt the market, as the stock surged from sub-$10 to $80 between 2020 and late 2021. However, the stock took a beating afterwards as growth plummeted from -9% in 1Q24 to ~30% in FY20/21/22. This is an interesting set-up for investors because there is no structural change to the CALX products or long-term growth potential. What caused the slowdown was the weak macro environment—basically, high interest rates—that drove up the cost of capital for many BSPs (causing them to delay deployment). Remember that CALX main customer cohorts are small BSPs, and as such, increases in rates have a huge impact on them vs. tier-1 BSPs. On top of that, the difficult process with the BEAD program is another reason I believe is causing delay in purchasing decisions as customers are still evaluating how to leverage this program.

The way I see it, this situation is more of a temporal slowdown. It should get better when the macro situation recovers and when there is more progress with the BEAD program (so far, four states have completed all steps). What investors should note to take their eyes off is that Calx continues to win customers despite this soft environment. In 1Q24, they added 10 new BSPs and managed to secure its largest ever cloud deal.

1Q24 results and my expectation for 2Q24

In CALX latest quarter (1Q24), the business reported revenue of $226 million which was in-line with consensus of $228 million, and management’s guided range of $225 to $231 million. Meanwhile, gross margin was to 54.9%, beating consensus modestly by 50bps but in-line with the guided range of 53.5% to 55.5%, driven by better product mix. At the EBIT line, CALX reported a margin of 7%, beating consensus estimate of 6.7%, and this drove an EPS result of $0.21. Overall, 1Q24 was another slow quarter that did not show any major progress that customers were stepping up in deployment. Balance sheet wise, the good thing is that CALX is in a net cash position of $64 million. Given that CALX is also profitable, despite the poor demand today, there should be no risk of capital raise in the foreseeable future.

As for 2Q24 (set to be released in a couple of weeks), I am not expecting any major turnaround in demand as well, given how the economic situation is, and that management has already guided for further slowdown.

Valuation

CALX

May Investing Ideas

May Investing Ideas

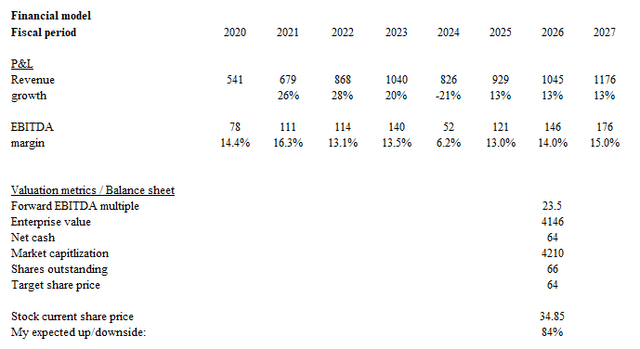

Based on my research and analysis, my expected target price for CALX is $64 (CALX traded at ~$60 levels in early 2023).

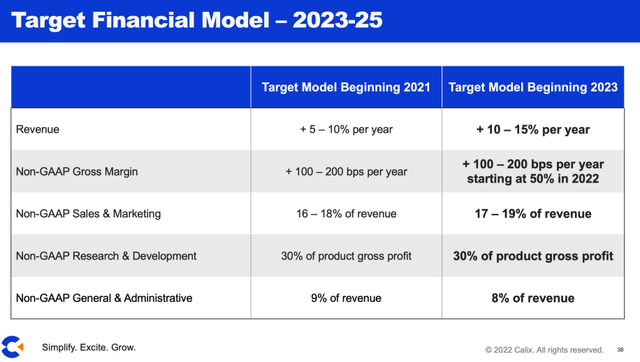

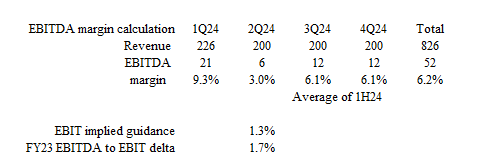

- As I view the slowdown in growth as a temporary one, I am modeling revenue to inflect back to management medium-term guidance post FY24. As for FY24, I am expecting the rest of the year to see poor performance, as it is unlikely for the macro situation to recover. Assuming 2Q24 guidance for $200 stays flat for the rest of the year, I got to $826 million in revenue for FY24.

- CALX should see poor EBITDA performance in FY24 as well, given the major slowdown in growth. The guidance provided in 2Q24 implies ~1.3% EBIT margin, which is about 3% EBITDA margin using historical EBITDA to EBIT delta. Assuming 2H24 has the average EBITDA margin of 1H24, I got to around 6.2% EBITDA margin for FY24. That said, once we get past this weak period, I expect EBITDA margins to inflect back to the mid-teens range where they used to trade.

- I don’t see any upside to multiples from here, as CALX is already trading at its average multiple (it seems to me that the market is already pricing in some sort of recovery). The upside for the stock will largely stem from EBITDA growth.

Risk

The risk is industry consolidation. Given that CALX customers are mainly in the lower-tier cohort, when tier 1 customers acquire them, it is likely that they will stop using CALX as they integrate with their own operating systems. While I expect growth to recover in FY25, the current turmoil could take a lot longer than expected to resolve, and that would delay the timeline to recovery, potentially causing the stock to get hit again as the market resets expectations.

Conclusion

I give a buy rating for CALX. I see CALX as a disruptor in the mature BSP industry with its next-generation products. These products enable BSPs to compete more effectively through improved customer service, and also increase monetization opportunities. These lead to reduced churn, streamlined operations, and lower operating costs. While the recent slowdown is concerning, I believe it is temporary due to the weak macro environment and the BEAD program uncertainties.