Visivasnc/iStock via Getty Images

Booking Holdings Inc.’s (NASDAQ:BKNG) stock is today’s focus. I decided to examine the stock’s prospects due to the northern summer holiday season paired with a structural shift in the global holiday demand scene, which introduces numerous talking points. Furthermore, Booking Holdings’ stock has risen by about 45% year over year, naturally raising the possibility of it being overbought.

BKNG Stock Y/Y Performance (Seeking Alpha)

After examining numerous aspects, I concluded that a Hold might be the most appropriate course of action; here’s why.

Operational Talking Points

Key Metrics

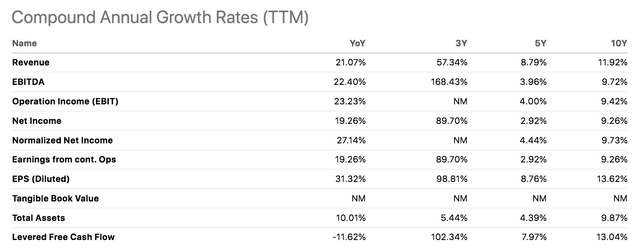

A parsimonious view of Booking Holdings shows it has experienced robust short—and long-term growth rates. Roll back ten years, and I think the company was perfectly placed to benefit from exponential growth in industries like digital advertising, freelance promotions (think influencer-driven Instagram promotions), enhanced third-world and frontier nation accessibility, and the development of the travel credit market.

BKNG CAGR (Seeking Alpha)

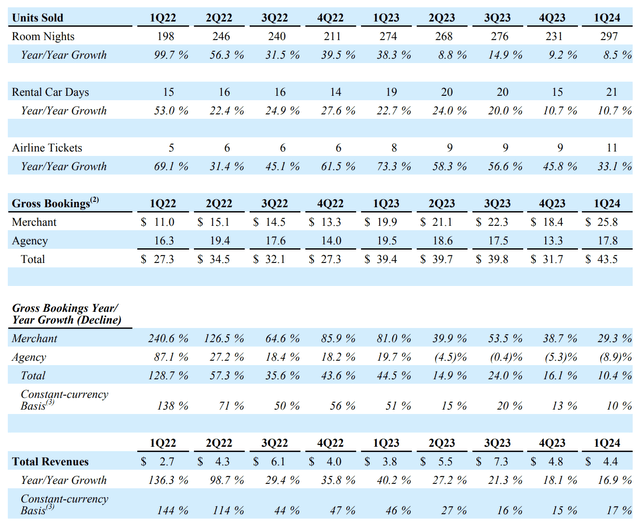

A look at Booking Holdings’ key metrics shows that it has retained growth across the board (as per Q1). In fact, the firm’s total bookings and revenue scaled by 10% and 17% year-over-year, respectively, in Q1. However, the fact remains that Booking Holdings is growing at a diminishing rate, with its unit and value-based sales illustrating much softer growth than it has in the past. I flag this as a concern because it might illustrate a few factors, namely a potential increase in industry competition or diminishing end-market capacity.

Key Value Drivers (Bookings Holdings)

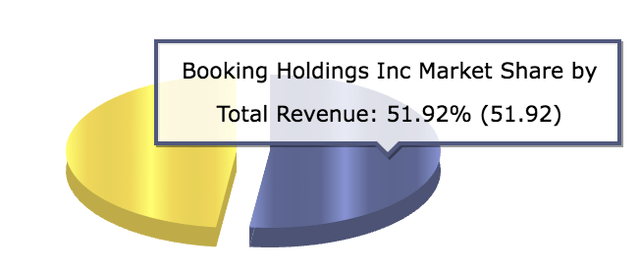

Booking Holdings’ broad-based market share is highly respectable, and it will likely carry the firm for a while as its exposure allows it bargaining power over its suppliers. Nevertheless, I still see the bookings industry as a low-barriers-to-entry business with little pricing power. Therefore, I fear that rising industry competition paired with price-seeking consumers will dent its prospects.

Broad-Based Market Share (CSI Markets)

Financials

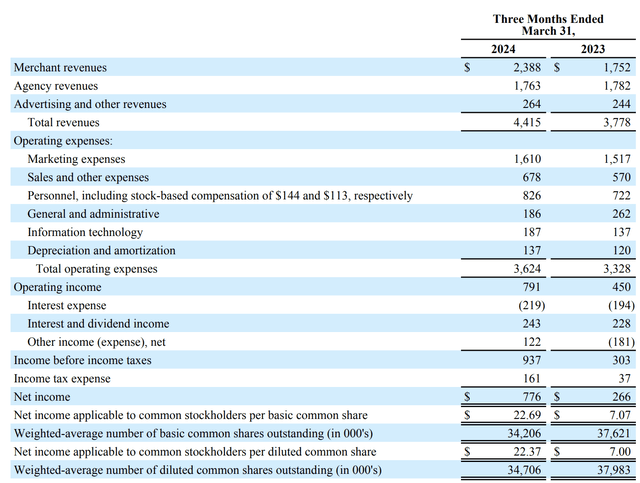

Booking Holdings’ financial results echo the aforementioned fundamental metrics.

In the firm’s C-Suite’s own words: “Our travelers booked nearly 300 million room nights across our platforms in the first quarter, which exceeded our expectations and grew 9% year-over-year. First quarter revenue of $4.4 billion grew 17% year-over-year, and adjusted EBITDA of about $900 million increased 53% year-over-year. Both revenue and adjusted EBITDA were ahead of our first-quarter expectations. Finally, adjusted earnings per share in the first quarter grew 76% year-over-year, helped by improved profit levels as well as our strong capital return program, which reduced our average share count by 9% versus the first quarter last year.”

Bookings Holdings Income Statement (Bookings Holdings)

What’s my take here?

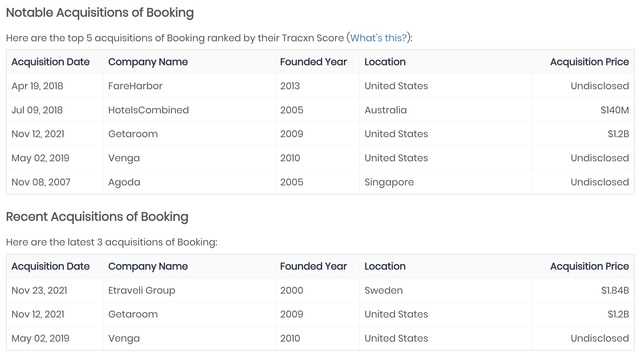

As mentioned before, I think Booking Holdings will sustain its positive growth but at a decelerating rate. However, moving down the income statement is where matters get interesting. For example, Booking Holdings spent about $1.61 billion in marketing expenses during Q1, but I think it will have to up that number in the coming quarters or else surrender market share (considering its slowing growth). Furthermore, Booking Holdings has a history of growth through acquisitions. As such, the question becomes: Will there be additional acquisitions, and what would the integration costs look like?

Notable Acquisitions (Tracxn)

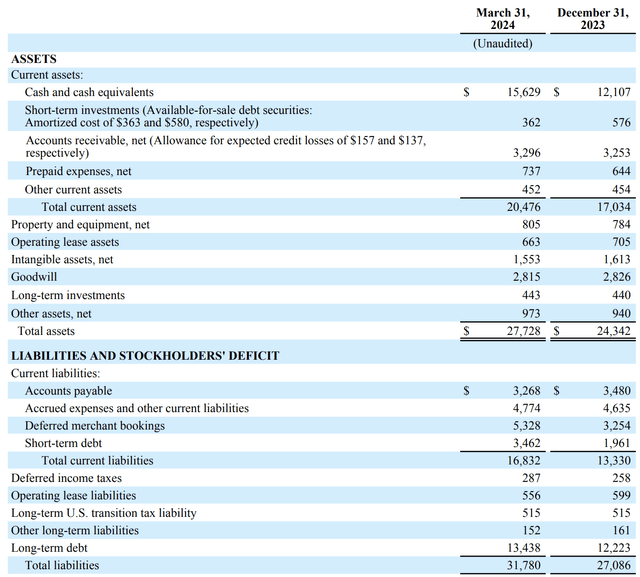

Furthermore, Booking Holdings’ balance sheet shows considerable short—and long-term debt. As a result, the company has a debt/total capital ratio of around 130.23 and a current ratio of 1.22. I don’t like the look of these metrics, as I don’t think they protect against unexpected economic tail risk or lower economic persistence.

Statement of Financial Position (Booking Holdings)

I won’t say I’m overly worried about Booking Holdings’ financial statements. However, as previously explained, I fear its growth might stagnate, concurrently adding stress to its balance sheet. Additionally, I think it might soon decide to ramp up expenses to stay ahead of its peers.

Valuation

Relative

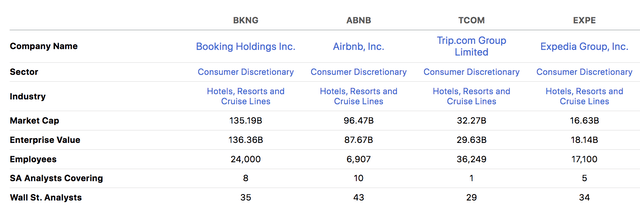

To conduct a relative valuation of Booking Holdings, I pieced together a peer group, including Airbnb (ABNB), Trip.com (TCOM), and Expedia (EXPE). Note that this is a self-created peer group and should not be considered the only available one.

Peer Group (Seeking Alpha)

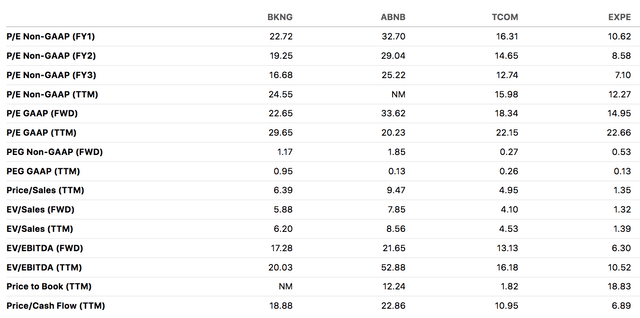

I don’t see any relative value in Booking Holdings’ stock. For example, its salient price multiples, such as its P/E, EV/EBITDA, and P/S ratios, aren’t in the upper quantile. Although I think its price-to-earnings-growth ratio of 0.95x is encouraging (from an absolute vantage point), a comparison to the stock’s peers suggests the contrary.

Valuation Figures (Seeking Alpha)

Absolute

I utilized a P/E expansion formula, aka Forward P/E formula, to add an absolute valuation to the analysis. According to my calculations, Booking Holdings has a target price of around $3834, which is lower than the stock’s current value. Although the forward P/E method is often inaccurate and simplified, I believe it provides a solid guideline.

| Metric | Value |

| 5-Y AVG P/E Ratio | 21.86 |

| Dec. 2024 Forecasted EPS | $175.41 |

| Price on Close (July 10th) | $3977.48 |

| Price Target | $3835 (rounded) |

Source: Author’s Computation; Data from Seeking Alpha

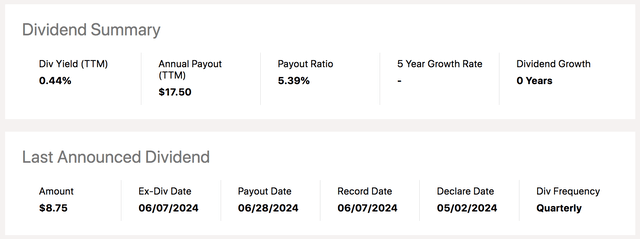

Dividends

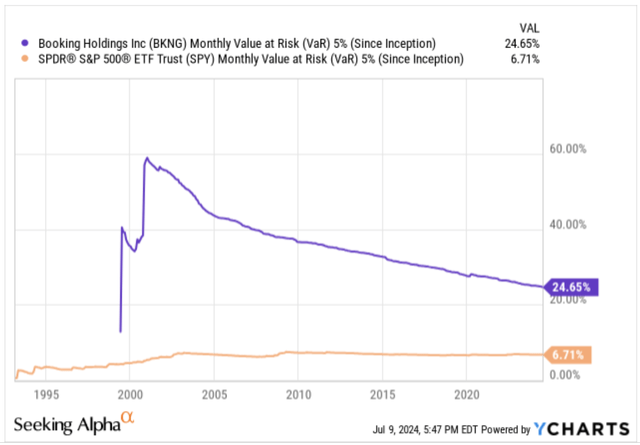

Booking Holdings pays a dividend, which it recently hiked to a quarterly amount of $8.25 per share (the ex-dividend date was July 7th). Despite paying a dividend, I think Booking Holdings’ payout is moderate, given its trailing yield of 0.44%, which I don’t think provides much from an income-based perspective. Additionally, the stock has a high value-at-risk (VaR) reading, suggesting its payout likely won’t add a floor to its stock price either.

Seeking Alpha

The following diagram illustrates Booking Holdings’ VaR. For those unaware, Monthly VaR (5%) shows the minimum amount the stock has lost in 5% of its traded months; it’s a tail risk metric.

Seeking Alpha; YCharts

Conclusion

After assessing Booking Holdings’ stock, I concluded that it might not be the best time to enter a position. Although the firm’s past success is commendable, Booking Holdings is growing at a decelerating rate. Moreover, the firm’s balance sheet raises a few question marks, especially regarding its liquidity ratios.

Furthermore, I see no relative value in Booking Holdings and my absolute valuation of the stock deems it slightly overvalued. I’m not in favor of selling the stock. However, I think a correction is needed for Booking Holdings’ stock to be at an investable level.