funky-data

The Thesis

The first half of 2024 has been solid for Powell Industries (NASDAQ:POWL) due to strong project activity across all three major end markets, Oil & Gas, Utility, and Commercial. I expect this growth to continue further as the company enters into the second half of the year as quoting activity remains favorable and new booking remains elevated. The company also has a strong backlog of approximately $1.3 billion, which should further drive topline growth for the company in 2024. Long term, on the other hand, should benefit from tailwinds across the end markets, but primarily due to the growing data center market and increasing number of projects associated with electrification, hydrogen, and carbon capture. The margin outlook also appears to be good, mainly due to higher margin backlog and improved operational efficiency. The company’s stock valuation looks attractive versus its historical averages and peers, which, along with a good long-term outlook, makes this stock a decent buy at the current level.

Business Overview

Powell Industries is among the leading providers of custom-engineered solutions that through its subsidiaries involved in the management and control of electrical energy and other critical process. The company serves globally across various industries including Oil & Gas, utilities, and Commercial and Industrial end markets. The company’s product portfolio includes principal products like integrated power control substations, custom-engineered modules, electrical houses, circuit breakers, monitoring systems, switches, and switch gears. These products support a wide range of voltage support and primarily serve in sectors like LNG facilities, pipelines, refineries, utilities, rail, mining, data centers, and other industrial markets.

Last Quarter Performance

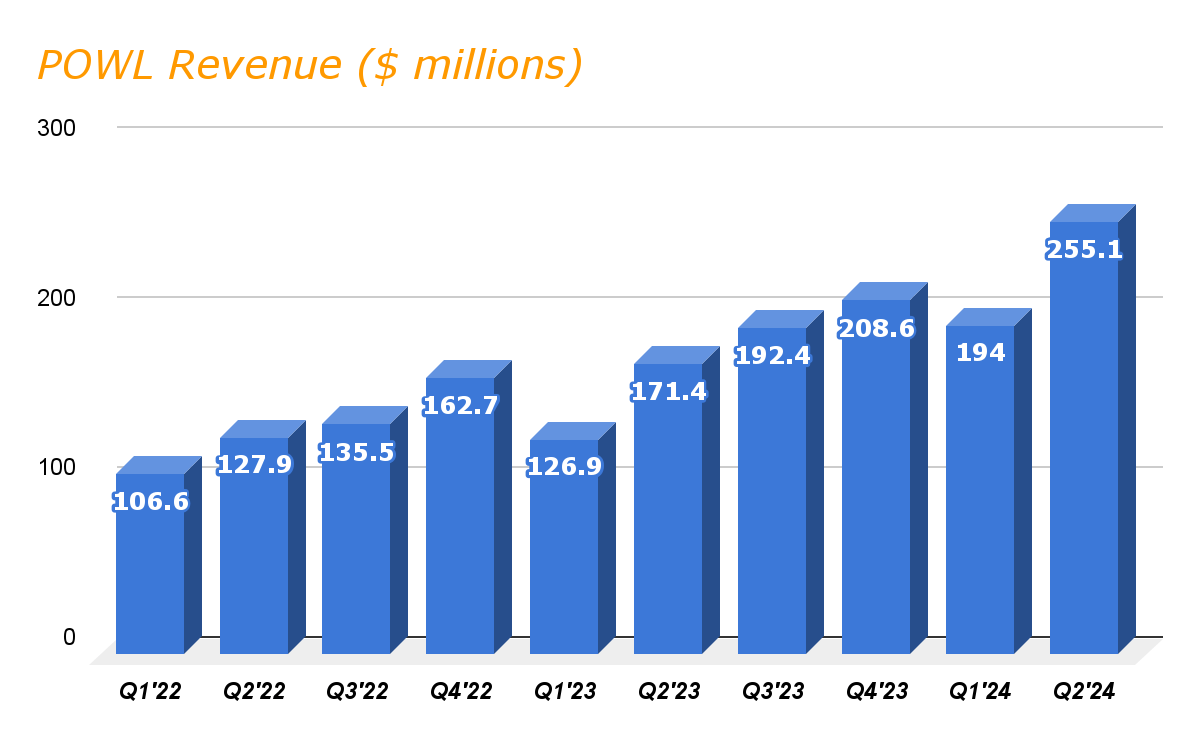

Following a solid start to 2024 with over 50% topline growth, the company reported another great quarter as its topline climbed by approximately 48.8% year-on-year to $255 million during the second quarter of 2024. This strong growth was a result of continued strength in the company’s largest markets, Oil & Gas and Petrochemical, which climbed in high single digits and the revenue in the Petrochemical market nearly doubled during the quarter with 93% year-on-year growth.

Other end markets, including Commercial and Utility, also remain strong, growing 57% and 11% respectively during the quarter, as new order booking showed positive momentum across both these end markets. Continued strength in new booking also continued to support backlog levels which was $225 million higher than a year ago, reaching $1.3 billion as of Q2, 2024.

POWL revenue (Research Wise)

While the topline grew significantly during the first half of 2024, the company’s margin has also seen a notable improvement as the company’s operating margin jumped to 15.5% during the quarter from just 5.9% a year ago. This significant margin expansion was primarily driven by the quality backlog containing a favorable margin profile. Volume leverage and improvement in operational execution also benefited the company’s margin during the second quarter of 2024. Strong profit growth also benefited the company’s bottom line as the company’s adjusted EPS nearly quadrupled during the quarter, reaching $2.75 and beating the consensus estimates by a notable $0.98.

Outlook

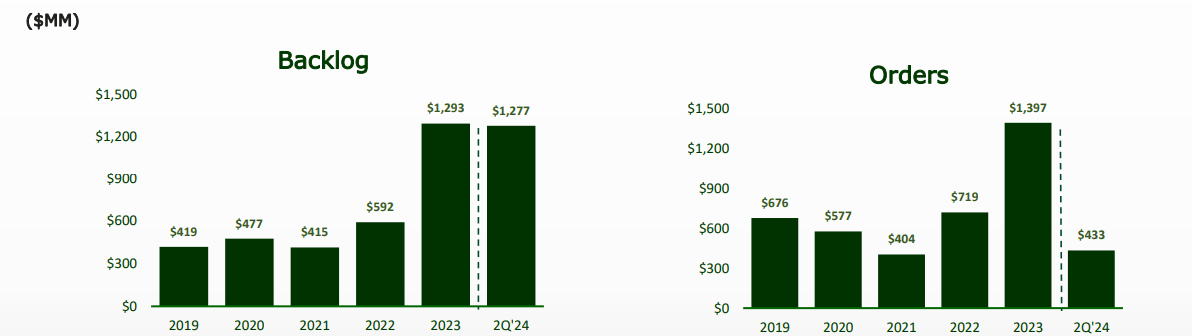

The first half of the company showed strong year-on-year growth, demonstrating the continued strength and healthy levels of project activity across all the end markets but mainly in the core industrial end market. I expect project activity and new order booking to continue to drive the company’s revenue as quoting activity remains strong. New Order bookings normalized during the second quarter, but remain elevated as the book-to-bill ratio remains above 1 at 1.3x, leading to a strong backlog level, currently standing at approximately $1.3 billion as of Q2’24. This should further fuel volume growth, driving revenue growth for the company in 2024.

Backlog and Orders Trend (Company Presentation)

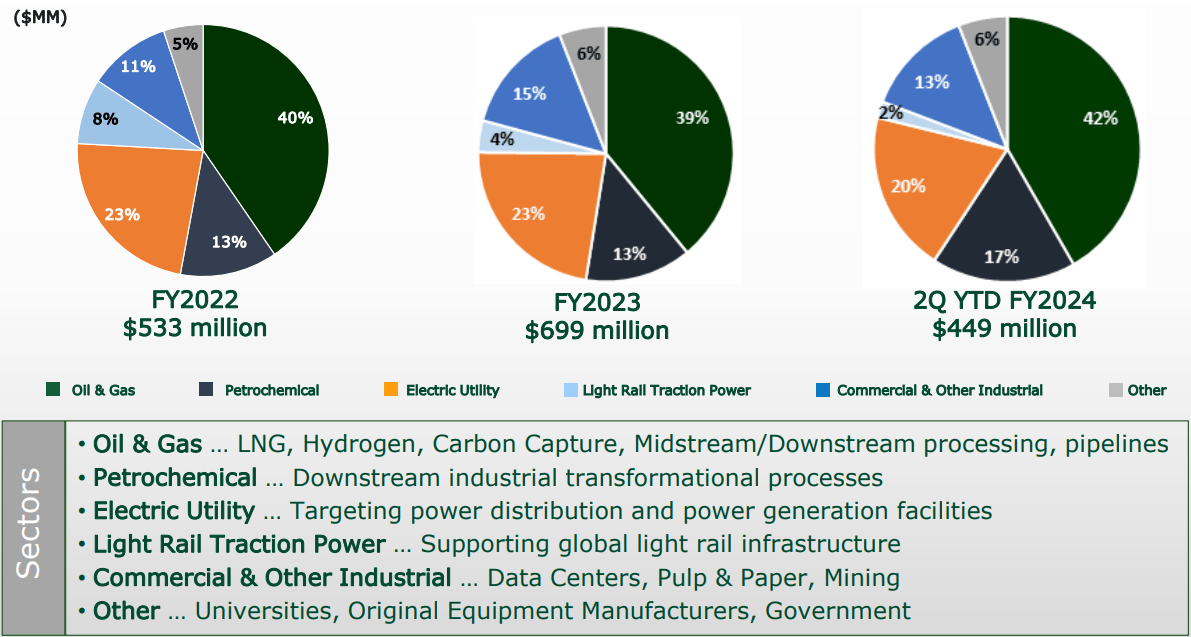

Talking about the end market that POWL operates in, starting with the Oil & Gas, and Petrochemical market, the largest among all accounting for nearly 60% of the total revenue, continues to show strength exceeding the company’s expectations due to tailwinds from energy transition project related to biofuels, hydrogen and carbon capture, which should continue to support the company’s sales in the end market beyond 2024. In the Utility end market, the company has positioned itself to be a leading provider of utility distribution substations, which is a core project type for POWL in the end market. However, apart from substations, the company is also seeing few new generation work due to rising electrical power demand associated with data center growth which is expected to drive growth for the overall power generation capacity across the U.S. leading to new projects and orders for the company in the coming quarters.

Revenue distribution (End market wise) (Company Presentation)

Activity with the Commercial and Other Industrial markets also remains healthy, and this is among the fastest-growing market for the company due to its growing presence in the data center market. As data centers become more advanced, they will require companies like POWL to provide sophisticated power solutions to ensure the reliability and performance of the data center servers to store and secure data. The company is also prepared to capitalize on this opportunity and continue to develop new products and services for this important end market, which should fuel topline growth for the company in the coming years.

Apart from these, the company continues to focus on its capacity expansion initiative, under which it has already completed the expansion of the Houston facility on the Gulf Coast, which is already helping the company with incremental fabrication and integration support for power control rooms. Another expansion is also in progress, which is of the company’s electrical products factory in Houston and is expected to be completed in the middle of 2025, which, in my opinion, should support the company in addressing anticipated strong demand in the quarters ahead. The company also plans to launch a range of new products in 2025 across the end market to support topline growth in the longer term.

Overall, I expect the company to continue its strong topline growth going forward due to continued strength in project activity across all the end markets and robust backlog levels. And, as the company continues to focus on growing across the end markets by expanding services and diversifying its product and solution portfolio to provide value to its customers, the company’s business should benefit in the longer term, leading to topline growth in the coming years.

Valuation

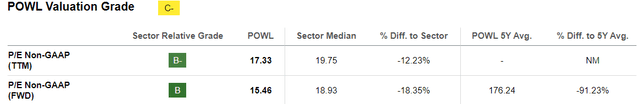

YTD, the company’s stock has zoomed more than 60% as the company reported excellent Q1’24 results in January last week reflecting strong top and bottom line growth during the quarter. Q2’24 results were also strong continuing the growth further. Currently, the company’s stock is trading at a forward Non-GAAP P/E ratio of 15.46 based on the FY24 EPS estimate of $9.2. When compared to the five-year average P/E of 176.24, the stock appears to be at a significant discount.

POWL Valuation grade (Seeking Alpha)

The sector median also represents the company’s stock to be attractively valued. While the company’s valuation is at a discount to its closest peers including companies like Array Technologies (ARRY), Vicor Corporation (VICR), and Shoals Technologies Group (SHLS), the company’s forward revenue and EBITDA growth is also better than its peers as we can see in the table below.

| Company | Forward Revenue growth | Forward EBITDA growth |

| (POWL) | 20.15% | 103% |

| (ARRY) | -0.31% | 40.92% |

| (VICR) | -1.73% | 26.93% |

| (SHLS) | 20.39% | 24.63% |

I expect the company’s topline growth to continue further due to healthy project activity and robust backlog levels across the end markets. This strong volume growth should drive volume leverage for the company, benefiting the company’s margin in the coming quarters. In addition to this, most of the $1.3 billion backlog contains higher-margin projects, which, along with benefit from operation improvement and improved SG&A as a percentage of sales, should help the company in margin expansion in the coming quarters.

In the past few years, the company’s profitability has improved significantly as the company’s operating margin has reached 15.5% in the last quarter from just 0.2% in the same quarter two years back, which has improved the company’s valuation notably in the past years. I expect the company’s margin to continue its strong performance in the quarters ahead, which should result in bottom-line expansion leading to further improvement in the company’s valuation in the coming quarters.

Risk

The company has seen significant growth from top to bottom line in the past few quarters due to strong demand for the company’s products and solutions across all the end markets that the company operates in. My thesis is built upon the expectation that this growth should continue further as the company still has a significant amount of backlog that favors margin which along with improved efficiency should drive margin growth in the future, further enhancing the valuation. However, if the company, couldn’t perform as per expectation and the margin growth suffers, the company’s bottom line might get impacted negatively, potentially leading to poor stock performance in the future.

Conclusion

As we discussed above, the company stock is trading at an attractive discount to its historical average and sector median. I expect the company’s topline to continue to benefit from a healthy demand environment across all the end markets and strong backlog levels in 2024. Volume growth along with a higher margin backlog, on the other hand, should support margin growth in the quarters ahead. The long term also looks good, with favorable end market demand conditions and the company’s continuous focus on capacity expansion initiative. The POWL stock is currently priced attractively and considering the company’s promising growth prospects in the future, I would recommend to “BUY” this stock at the current levels.