Derick Hudson/iStock Editorial via Getty Images

Investment overview

I wrote about Foot Locker (NYSE:FL) previously with a buy rating as I expected the business to see growth recover in FY24/25 as the demand backdrop gets better. Share price performance has been moving in the right direction since my post at the end of January, going up from $30 to $35 (my target price was $41). However, I must admit that the 4Q23 results were disappointing, as was the guide, and that has led me to take a more conservative view in the near term.

4Q23 results (6 Mar 2024)

Total sales grew 2% to $2.38 billion, coming in above consensus estimates of ~$2.28 billion. Gross margin saw a decline of 350 bps to 26.8%, below consensus estimates of 26.9%, driven by higher markdowns. Weak gross margin performance and an increase in operating expenses (SG&A) of 2.3% led to an EBIT margin decline of 343 bps vs. 4Q22. This impact was also felt at the bottom line, where pre-tax profits saw a major decline of from $131 million to $51 million, as was the case for adj EPS, reported at $0.38 vs. $0.97 in 4Q22.

SSS traction is frankly disappointing

FL’s SSS performance did not live up to my expectations. In 4Q23, it saw a like-for-like growth (including stores and direct-to-consumer) decline of 0.7%. While I take comfort in knowing that there was an acceleration in revenue growth trends (recovering from the -8% growth seen in 3Q23), with comps coming in positive at select banners, the worrisome factor is that FL saw a same-stores-sales-growth [SSSG] decline of 2% as traffic was down vs. 4Q22. If not for the higher ticket size, SSSG could have been worse. In my opinion, this was a very bad indicator of underlying demand and growth ahead, as FL cannot possibly keep increasing prices to support growth.

More importantly, this trend seems to have worsened in 1FQ24 as SSSG over the past few months saw further decline. In November, SSSG was up LSD; December saw a slight SSSG decline; and January saw SSSG fall by a mid-single-digit [MSD] percentage. While I do acknowledge that there were some weather impacts in January that impacted traffic, if we look at the guidance for 1FQ24 (for FL, this is February to April), management is effectively saying that traffic remains poor and there has been no improvement since December. For context, they guided for SSSG to be flat of low-single digits in 1FQ24. Assuming January was an outlier year, and we take December moderate SSSG decline as the “normalized” SSSG performance for January, the midpoint of the 1FQ24 guide—that was given at the start of March—means management already has 5 weeks of 1FQ24 data, which suggests SSSG is down ~1%, which is somewhat the same as what FL saw in December 2023. If we add on the fact that Champs Sports is going to see comparable negative growth in FY24 due to the repositioning, it really makes forecasting near-term SSSG performance a tough one.

Guidance was not positive too

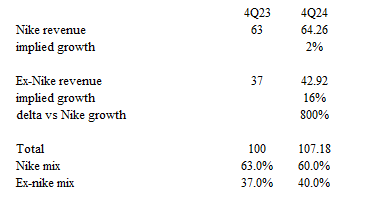

The FY24 guidance failed to deliver any positive sentiment support as well. In fact, I would think that it has worsened the equity story. For FY24, management guided revenue growth of -1% to 1%, with SSSG guidance of 1% to 3%. On an absolute basis, it seems like the FY24 guide is easily achievable; however, I believe that is not the case. Remember that 1FQ24 performance is likely to be weak (following December’s performance) as per the SSSG guide, which means that for FL to hit the FY24 SSSG guide, it implies sequential SSSG improvements or a very strong 2FH24 to balance out the weak 1Q24 (and potentially 2Q24 if the demand environment does not recover). In both cases, I think it is hard to have a convicted view today for two reasons. One, FL intends to shift away from its promotional and discounting strategy in 2Q24. In my view, consumers’ habits die hard, and especially regarding promotions, it becomes a very sticky habit that is likely to cause further traffic loss as consumers have the mindset that promotions will come back eventually. Secondly, do not forget that there is going to be a headwind from Nike shifting its distribution strategy to direct-to-consumer that is going to continue to be a headwind to FL’s performance. Despite the good news regarding the partnership that management has shared regarding Nike, the factual data shows that sales from brands outside Nike (FL’s biggest) increased to 40% in 4FQ23 (up from 37% last year). This suggests that either other brands are really growing a lot faster than what Nike is contributing to FL, or Nike is simply contributing less. I believe the latter is more plausible given that the former implies that non-Nike brands grew a lot faster than Nike. It is mathematically tough for 37% of the business to outgrow 63% of the business by 300 bps. Assuming Nike grew 2% (same as FL top line growth), this implies ex-Nike brands to grow 16%, which I think is hard to believe given the underlying demand environment. Hence, I am skeptical of FL’s ability to meet FY24 guidance.

May Investing Ideas

Near-term profitability is going to get volatile too

FY24 gross margin was guided at 29.8 to 30%. While FL has reduced its inventory, I am worried that the shift away from the promotional strategy will cause lower volume, which results in a lack of revenue to cover the high fixed cost base. Also, FL is going to see headwinds from the rollout of its new loyalty program, including a $15 million charge to convert existing member points in 2Q24 and a modest gross margin drag in 2H24 as points are accrued. Because of these, my view is that near-term gross margins are going to be volatile with little visibility. At the operating profit line, FL is also going to see pressure from a step-up in operating expenses (SG&A as a percentage of sales guided to a range of 24.4 to 24.6%), due to ongoing investments in technology, digital, brand-building, and normalized levels wage compensation (potential higher due to labor inflation).

Valuation

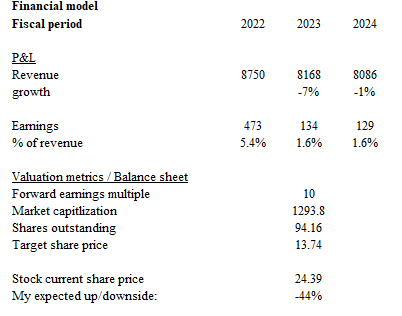

If I were to join the points together, I believe there is very little visibility to both FL’s top line and operating profit line performance in FY24 (and FY24 performance is important because it impacts the expectation for FY25). Hence, instead of focusing on the upside potential, I have restructured my model to show the potential downside if FL FY24 disappoints.

May Investing Ideas

In the downside scenario, my expected target price for FL is $13.74, a 44% downside.

- I am skeptical of FL’s ability to meet FY24 guidance, and if my worries play out as expected, FL is unlikely to meet the midpoint of its FY24 revenue growth guidance. I modeled -1% growth for FY24.

- Although management is guiding for $1.60 adj EPS, which implies ~$150.1 million in adj earnings, my skeptical view is that the step up in operating expenses, shift away from promotional strategy, and continued labor inflation will eat away all the potential margin benefit that FL could see.

- The valuation multiple is likely to quickly re-rate from the current 14x forward PE to below the historical average (11x) at 10x as the market realizes that FL is still facing headwinds. Note that the current 14x forward PE is above average, and I take this as a reflection that the market is expecting a recovery soon (so a lot of positive expectations are embedded already).

Risks

The upside risk (reason I am not recommending a sell rating) is that near-term earnings could come in a lot more positive than I thought (I noted above the volatility of earnings) if the loss of traffic (due to lack of promotion) is being well covered by the improved margins from reduced promotions. Also, management could pull the lever of reducing pace of investments in technology to smoothen out earnings in the near-term. If that happens, valuation could see some support. All in all, from a risk perspective, it is tough to put a sell rating on the stock. I rather stay neutral for the near-term.

Conclusion

I give a hold rating for FL due to a lack of visibility in near-term performance. Recent results and guidance were disappointing, raising concerns about FY24. Notably, SSSG decline suggests weak underlying demand and challenges in maintaining growth, and this makes me skeptical about FL’s ability to meet its FY24 guidance, especially given the shift away from promotions and headwinds from Nike’s distribution strategy that I expect to hurt traffic. Near-term profitability also seems to be volatile given the potential lower traffic and program rollout costs. Given the uncertainty, I believe a hold rating is a more conservative choice of action.