JHVEPhoto/iStock Editorial via Getty Images

Usually when I’m looking for value stocks, I like to find companies that are in the lower half of their 52-week range. Sometimes, however, the numbers don’t support this strategy, especially with the broader market going so strong. It is inevitable that companies will surge toward the peak of their 52-week range, and keep going if their earnings are strong enough.

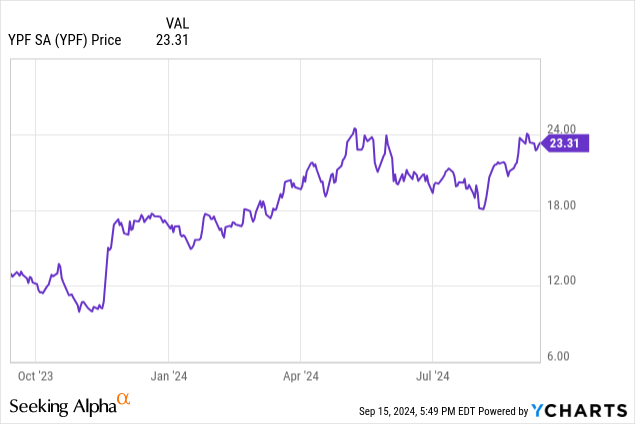

Today I’m going to be looking at YPF Sociedad Anonima (NYSE:YPF), a company that very much is at the top of its 52-week range but is still showing up on a lot of value screener searches. We’ll be looking at the company for its potential discount to sector medians, and for its future earnings, which may suggest that it is still a worthwhile value pick.

Understanding YPF – A Regional Potential

YPF is a seller of gasoline and diesel fuel and natural gas in the South American nation of Argentina. The company’s main business is internal to Argentina, but it has interests in regional business across South America, with an exploratory interest in Bolivia. The company also sells jet fuel and natural gas to neighboring Chile, and offers lubricants and derivatives to Brazil. Perhaps the biggest potential future business is the liquified natural gas business, as the company is looking to become an LNG exporter at a time when a lot of the world is eagerly buying what is available.

While a lot of the oil and gas exploration is done traditionally, YPF is also a powerful player in the shale production in the region, as they are exploiting a lot of shale in the Vaca Muerta formation.

Consolidated Balance Sheet

|

Cash and Equivalents |

$1.0 billion |

|

Total Current Assets |

$7.1 billion |

|

Total Assets |

$27.5 billion |

|

Total Current Liabilities |

$7.6 billion |

|

Total Liabilities |

$16.9 billion |

|

Total Shareholders Equity |

$10.4 billion |

(Source: most recent quarterly report in 6-K from SEC)

YPF is a business with a lot of existing assets and liabilities, and with a current ratio under 1.0, it is not what you would call super flexible for changes in the marketplace. That’s not necessarily a terrible thing, of course, as the company has strong profitability right now, and isn’t expected to have to lay out huge amounts of cash any time soon.

Right now, YPF trades at a price/book ratio of 0.85, quite a discount for such a profitable company. The sector median for global oil and gas giants tends toward the low side, but right now is 1.54, so YPF is still quite a bit cheaper than your average foreign oil stock on the basis of book value.

The Risks

Doing business almost exclusively in Argentina, YPF’s business depends heavy on the relative economic conditions of Argentina. That’s a country that has had some struggles, but it is also a decent growing economy overall.

The company’s business also depends on the fluctuation of the Argentina peso to the US dollar, and if the peso becomes unusually weak, YPF could struggle in the near term.

Some 8% of YPF’s debt is also sensitive to variations in interest rates. That’s not such a huge number that a change in interest rates is going to devastate the company, but it could be an issue, especially for a company with a sub-1 current ratio.

Finally, the company is a big producer of oil and natural gas, and would be sensitive to any big changes in the price of either. That probably isn’t a huge near-term risk, but any flooding of the global market with oil could really impact their pricing power going forward.

Statement of Operations

|

2021 |

2022 |

2023 |

2024 (1H) |

|

|

Revenues |

$13.7 billion |

$18.7 billion |

$17.3 billion |

$9.2 billion |

|

Gross Profit |

$3.0 billion |

$5.1 billion |

$3.5 billion |

$2.8 billion |

|

Operating Income |

$699 million |

$2.5 billion |

($1.2 billion) |

$1.3 billion |

|

Net Income |

$16 million |

$2.2 billion |

($1.3 billion) |

$1.2 billion |

|

Diluted EPS |

7¢ |

$5.67 |

($3.35) |

$2.98 |

(Source: most recent 20-F and 6-K from SEC)

2023 was something of a struggle for YPF, and the company ended up losing money as a result. Times appear to be back on track, however, and the company is back to being a very profitable operation.

Estimates are that the company will report $18 billion in revenue this year and earn $4.20 per share. That’s a P/E ratio of 5.41, very cheap for the company’s current earnings. It’s not just a one-off year, either, as 2025 estimates are $16.8 billion revenue and even better earnings of $4.63 per share. That gives us a forward P/E 4.91, which seems like an absolute steal.

If there is a downside, it’s that YPF doesn’t pay a dividend right now. That could ultimately change if they continue with strong earnings like this, but the company has a lot of debt to deal with and probably is going to want to improve its cash balance and current ratio substantially before revisiting the dividend. So it’s probably not a realistic want in the near-term.

Conclusion

YPF has gone up in price quite a bit this year, but any time you can get a P/E and forward P/E both of under 6 and the price/book is under 1.0, that’s a very good sign we have a reasonable value stock on our hands here.

I’m going to rate YPF a buy, and the thing which is keeping them away from a strong buy would be a strong dividend. Other than that, there is everything here you could want as a value investor.

I would suggest investors keep an eye on the company’s LNG export business, as that seems to be the most likely source for them to grow from a mostly single-nation business to a regional energy powerhouse.