jodiecoston/E+ via Getty Images

Investment Thesis

According to its website, the American Conservative Values ETF (NYSEARCA:ACVF) is an actively managed large-cap blend ETF that “seeks to boycott as many companies hostile to conservative values without sacrificing performance.” While the fund’s promotional materials use loaded phrases like “woke liberal agenda,” I focused on ACVF’s fundamentals and generally found them to be solid. In this article, I will evaluate ACVF against the SPDR S&P 500 ETF (SPY), list the most impactful stocks ACVF excludes, and compare ACVF with the other ETFs that could appeal to investors with conservative values. I hope you enjoy the read.

ACVF Overview

Strategy Discussion

ACVF launched on October 29, 2020, and has a 0.75% expense ratio. That fee is steep, and along with its 0.20% 30-day median bid-ask spread, trading costs can add up quickly. However, it’s a specialty fund you won’t want to trade frequently, and if the strategy appeals to you, the price may be worth paying. The fact sheet lists several important pieces of information that describe the process, which is generally exclusionary and avoids companies engaged in the following activities:

- suppression of conservative voices and services (e.g., big tech, social media, banking)

- woke corporate culture and liberal activism

- contributions to socialist candidates and causes

- undermining freedom of religious expression and viewpoint diversity

- undermining the right to bear arms and the sanctity of life

As you might imagine, ACVF’s managers have plenty of discretion to determine what constitutes a “woke corporate culture” or which businesses tend to “suppress conservative voices and services.” It’s not black and white, and like any values-based investment strategy, it’s unlikely you will agree with all its exclusions. However, regardless of your political leanings, ACVF deserves credit for transparency by maintaining a website listing the “worst of the worst” companies most hostile to conservative values. I’ve listed them below in order of market cap.

- Apple (AAPL)

- Alphabet (GOOGL, GOOG)

- Amazon (AMZN)

- Meta Platforms (META)

- JPMorgan Chase & Co. (JPM)

- Walmart (WMT)

- UnitedHealth Group (UNH)

- Visa (V)

- Johnson & Johnson (JNJ)

- Bank of America (BAC)

- Coca-Cola (KO)

- Netflix (NFLX)

- Salesforce (CRM)

- American Express (AXP)

- International Business Machines (IBM)

- Verizon Communications (VZ)

- Goldman Sachs Group (GS)

- Walt Disney (DIS)

- Pfizer (PFE)

- Comcast (CMCSA)

- Progressive Corp. (PGR)

- AT&T (T)

- Lowe’s Companies (LOW)

- BlackRock (BLK)

- Nike (NKE)

- Starbucks (SBUX)

- Chipotle Mexican Grill (CMG)

- PayPal Holdings (PYPL)

- Target (TGT)

- General Motors (GM)

- Nasdaq (NDAQ)

- Delta Air Lines (DAL)

- Tyson Foods (TSN)

- Dick’s Sporting Goods (DKS)

- Warner Bros. Discovery (WBD)

- New York Times (NYT)

Recall how part of ACVF’s investment objective is not sacrificing performance, so achieving that without four Magnificent Seven stocks (Apple, Alphabet, Amazon, and Meta Platforms) is challenging. Therefore, let’s see how it’s performed since November 2020.

ACVF Performance Analysis

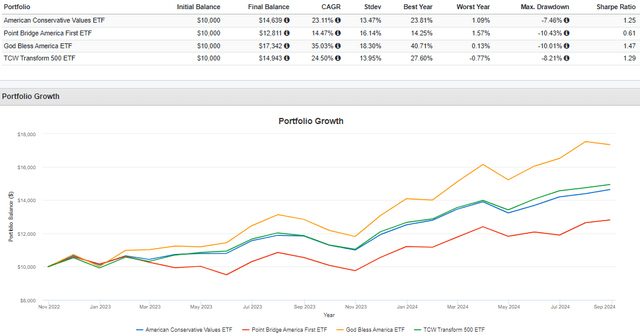

To my surprise, ACVF has delivered a solid 16.48% annualized return since its inception, trailing SPY by just 0.21%. Notably, ACVF’s downside risk-adjusted returns (Sortino Ratio) were better, and that’s because it slightly beat in 2022 when several of its exclusions declined substantially. For example, Amazon lost 49.62% that year, and even though it recovered with an 80.88% gain the following year, that’s still an 8.87% loss over two years. Investors were better off without this stock from a returns and risk perspective.

Portfolio Visualizer

A couple of other ETFs might appeal to conservative investors, too. They include the Point Bridge America First ETF (MAGA), the God Bless America ETF (YALL), and the TCW Transform 500 ETF (VOTE). Their total returns since November 2022 are shown below and look pretty impressive. In particular, YALL delivered an annualized 35.03% return, so I’ll also quickly check on these ETFs to determine their unique risk and return profiles. The fundamentals always tell the story, and it’s important not to rely solely on recent performance metrics when making investment decisions.

Portfolio Visualizer

ACVF Analysis

Sector Allocations and Top Ten Holdings

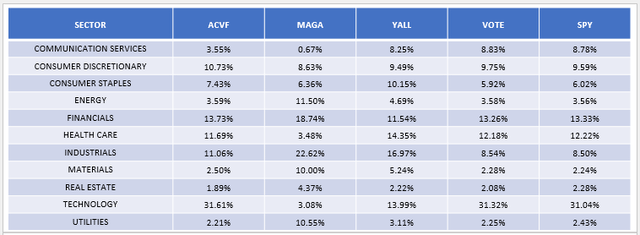

The following table highlights the sector allocation differences between ACVF, MAGA, YALL, VOTE, and SPY. The first thing I noticed is the similarities between ACVF and SPY in every sector except for Communications, one which Alphabet, Meta Platforms, and Netflix dominate. It’s a clever way to improve the chances of tracking a benchmark, and I’m confident this approach is how ACVF has succeeded in its objective of not sacrificing performance.

The Sunday Investor

MAGA has significantly less exposure to Technology stocks at 3.08%, which explains the worse total returns noted earlier. YALL will likely produce inconsistent returns, given that it only holds 40 stocks. Lastly, while VOTE looks extremely similar to SPY, it doesn’t exclude companies its managers believe require change. Instead, VOTE works to change them, so this may not work for truly conservative investors looking to align their investments with their values.

ACVF’s top ten holdings are next, totaling 26.64%. This concentration level is lower than SPY’s 35.47%, so while it’s not the main draw of the fund, one potential benefit is stronger diversification. Nvidia (NVDA), Microsoft (MSFT), and Berkshire Hathaway (BRK.B) are the top three, and although these are all mega-cap stocks, it doesn’t look like the portfolio is entirely market-cap-weighted. Instead, it’s market-cap-influenced and likely aided by software to get the risk and return profile close to SPY’s.

American Conservative Values Website

ACVF Fundamentals By Company

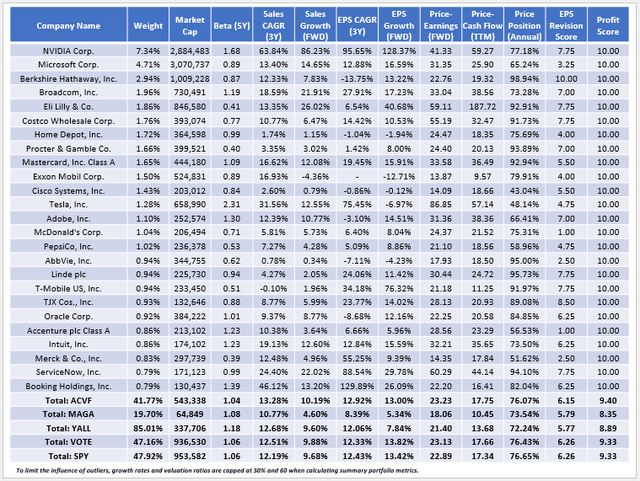

Lastly, let’s look closer at ACVF’s fundamentals. I’ve listed selected metrics for ACVF’s top 25 holdings, which total 41.77%. Summary metrics for MAGA, YALL, VOTE, and SPY are at the bottom.

The Sunday Investor

Here are three observations to consider:

1. ACVF is a high-quality fund. In my view, that’s crucial and why conservative values investors will likely find it to be a successful long-term hold. All of its top 25 holdings have 10/10 sector-adjusted profit scores, which correspond to “A+” Seeking Alpha Profitability Grades, and overall, the fund’s profit score of 9.40/10 is on par with VOTE and SPY. MAGA and YALL are of lower quality at 8.35/10 and 8.89/10.

2. ACVF trades at 23.23x forward earnings and 17.75x trailing cash flow, both of which are slightly more expensive than SPY. The reason is that ACVF overweights stocks like Nvidia, which has a 41.33x forward P/E, and excludes stocks like Alphabet, which trades at just 21.22x forward earnings. Moreover, ACVF doesn’t compensate with better growth potential. Despite overweighting Nvidia, the portfolio’s weighted average estimated sales and earnings growth rates of 12.92% and 13.00% are no better than SPY’s. Therefore, it’s difficult to justify the fund’s 0.75% expense ratio. I don’t see ACVF offering anything obvious in terms of superior fundamentals, so it really comes down to whether you are satisfied paying this fee to avoid the excluded stocks listed earlier.

3. MAGA is an option geared more toward value investors, evidenced by its 18.06x forward P/E and 5.34% estimated earnings per share growth rate. YALL is slightly higher on the growth spectrum (21.40x forward P/E, 7.84% earnings growth), but its 1.18 five-year beta suggests it’s the riskiest of the five. Meanwhile, VOTE has a low 0.05% expense ratio and similar fundamentals but has a 96.41% overlap with SPY. As I mentioned earlier, this strategy might not appease conservative values investors, but it’s worth considering from a total returns perspective.

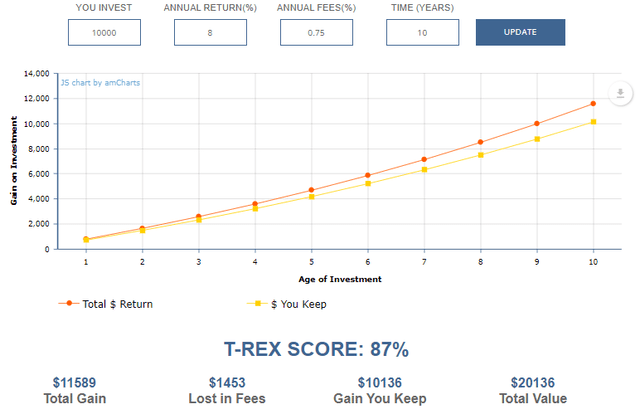

ACVF’s Expense Impact Is Huge

To illustrate the impact of fees, consider how ACVF shareholders will pay 13% of their total gains over the next ten years, assuming an 8% annual return over ten years. Using the same calculator, that figure is less than 1% for low-cost S&P 500 Index funds like IVV, VOO, and SPLG.

Larry Bates

The gap only widens as you increase your time horizon because fees compound. Therefore, since there’s nothing obvious that suggests ACVF’s holdings are any better than SPY’s from a fundamentals perspective, the lower-cost options make more sense.

Besides, ACVF is a very niche product. I don’t consider myself a supporter of the “liberal woke agenda” just because I own an iPhone, perform Google searches, shop at Walmart, or stream movies on Netflix, so extending this to my investment selections is tough for me to rationalize. The same applies to ESG products like the iShares ESG Aware MSCI USA ETF (ESGU). For the most part, these ETFs are designed to mimic the sector exposures of SPY but always seem to come with higher fees.

Investment Recommendation

I appreciate ACVF’s transparency, as its website clearly outlines which stocks it avoids. However, my main finding was how similar ACVF’s fundamentals were to SPY, especially regarding quality, growth, and value. Its 0.75% expense ratio is steep, and it’s best to assume ACVF will lag SPY by this amount over time. Therefore, I suggest prospective investors carefully examine whether ACVF’s approach accurately reflects your conservative values, but given the alternatives, a “hold” rating is most appropriate. Thank you for reading, and I look forward to your comments below.