Kittisak Kaewchalun /iStock via Getty Images

Investment Thesis

In 2020, Alto Ingredients, Inc. (NASDAQ:ALTO) pivoted its business direction and expanded from only being a low-carbon renewable fuels company to a renewal fuel, specialty alcohols, and essential ingredients one. This was meant to lead to better efficiencies, higher margins, and better returns.

There are no clear signs that the company has achieved these. Nevertheless, the market is pricing ALTO as if there will be an immediate 10% improvement in the revenue and contribution margin, and a 15% improvement in capital efficiency. As such, I do not see ALTO as an investment opportunity at the current market price.

Background

“Founded in 2003, ALTO today describes itself as a producer and distributor of renewable fuel and essential ingredients. It is also the largest producer of specialty alcohols in the United States.”

- Its renewal fuel includes fuel-grade ethanol and distillers corn oil used as a feedstock for renewable diesel and biodiesel fuels. On average, this product category accounted for about 80% of its total alcohol volume sold over the past 3 years.

- Specialty alcohols are used in various industries, such as for mouthwash, cosmetics, hand sanitizers, alcoholic beverages, paint applications and fertilizers. Over the past 3 years, this product category accounted for 20% of ALTO’s total alcohol volume sold.

- Essential ingredients include dried yeast, corn protein meal, and liquid feed used in commercial animal feed and pet food. I estimated that over the past 3 years, this product category accounted for about 14% of ALTO’s total revenue.

Prior to 2020, ALTO described itself as “a leading producer and marketer of low-carbon renewable fuels in the United States.” This changed in 2020 with the following:

“…repositioned our business to focus on specialty alcohols and essential ingredients. As a result, our business is service oriented and focused on specialty products compared to a price-oriented business focused on commodity products.” Form 10k 2020.

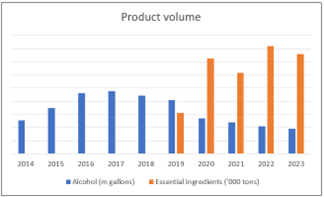

Chart 1 illustrates this change.

Chart 1: Product volume trends (Author)

Notes to Chart 1:

1) The company only provided data on essential ingredients from 2020 onwards.

2) Although plotted in the same chart, the alcohol volume is reported in different units than that for essential ingredients.

The key raw material for alcohol (ethanol) production is corn. The raw materials for the essential ingredients are generated as co-products from the production of alcohol.

In the context of the company’s production, the key metric is the crush margin. This is the processing margin between the prices of ethanol and its co-products and the cost of corn.

Operating trends

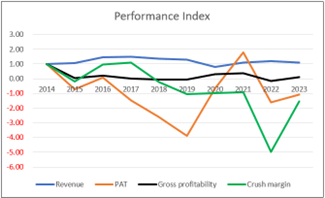

From a high-level perspective, ALTO is not a wonderful company in the Buffett sense. Refer to Chart 2.

- There was hardly any revenue growth over the past decade.

- The company incurred after-tax losses in 7 out of the past 10 years. According to the company, the ethanol industry, as a whole, experienced significant adverse conditions throughout most of 2018 and 2019. This was a result of industry-wide record low ethanol prices due to reduced demand and high industry inventory levels.

- Post-2014, capital efficiency as measured by gross profitability was lower than that in 2014.

Chart 2: Performance Index (Author)

Note to Chart 2: The company did not provide data on its crush margin. I estimated a rough crush margin by comparing the CBOT ethanol price per gallon and the corn price per bushel, based on 2.8 bushels per gallon.

You can see that PAT was more volatile compared to revenue. The company attributed the volatile PAT to changes in the crush margin. You can see that the crush margin has been deteriorating over the past decade.

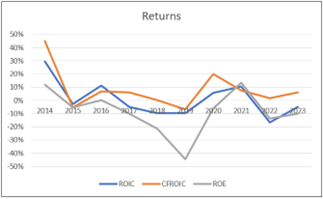

Given the profit pattern, you should not be surprised to see volatile and declining returns over the past decade. Refer to Chart 3. Over the past decade, the average ROIC and ROE was 1% and negative 8% respectively. ALTO did not create any shareholders’ value.

Chart 3: Returns (Author)

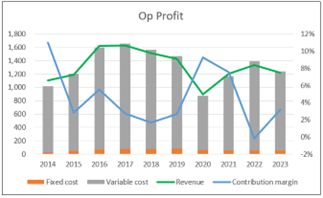

The volatile crush margin is also reflected in the volatile contribution margin. Refer to Chart 4.

In 2020, the company pivoted its strategy to focus on specialty alcohol and essential ingredients.

- This did not seem to improve the contribution margin. You can see that while the contribution margin improved in 2020, it declined thereafter.

- However, a DuPont analysis showed that post-2020, there was an improvement in the asset turnover while leverage remained relatively stable.

Looking at the overall post-2020 performance, I would conclude crush margin is still a key factor.

Chart 4: Operating Profit (Author)

Note to Chart 4. I broke down the operating profits into fixed costs and variable costs.

- Fixed cost = SGA, Depreciation & Amortization and Others.

- Variable cost = Cost of Sales – Depreciation & Amortization.

- Contribution = Revenue – Variable Cost.

- Contribution margin = Contribution/Revenue.

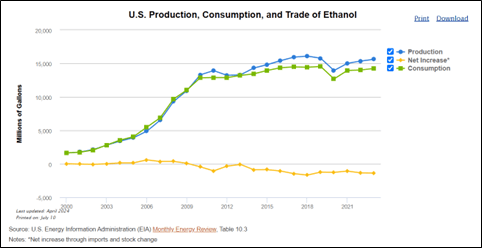

Peer comparison

ALTO claimed to be the largest producer of specialty alcohol in the US based on annualized volume. In its Form 10k, ALTO listed several competitors in this product category. Of these, 2 were publicly listed companies with financial information readily available – Archer Daniels Midland and MGP Ingredients.

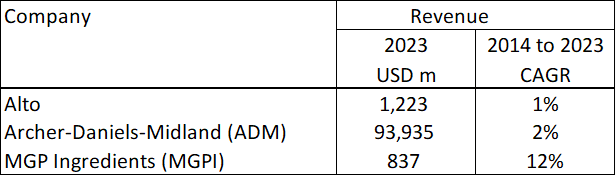

I thus compared ALTO performance with these 2. ALTO performed the worst among them in terms of revenue growth, return on capital, and EBIT margin.

Table 1: Peer Revenue (Author)

Chart 5: Peer comparison (Author (from TIRK.com))

Financial position

Despite its poor business performance, ALTO’s financial position does not look so dire. Its positive points included the following:

It had USD 29 million in cash and short-term investments as of the end of March 2024. This was about 7% of its total assets.

As of March 2024, it had a debt-capital ratio of 28%. This had come down from its 2019 high of 54%. According to the Damodaran Jan 2024 dataset, the debt-capital ratio for the chemical (basic) sector was 31%.

Over the past decade, despite 7 years of losses, it generated positive cash flow from operations for 8 out of the 10 years. From 2014 to 2023, it generated USD 231 million in cash flow from operations despite having a cumulative loss after tax. This is a good cash conversion ratio.

It has an average negative Reinvestment from 2014 to 2024. I defined Reinvestment = CAPEX + Acquisition – Divestiture – Depreciation & Amortization + Changes in Net Working Capital.

The negative Reinvestment was because the Depreciation & Amortization, and Divestiture in certain years far exceeded what was spent on CAPEX + Acquisition and Net Working Capital. This meant that ALTO did not have to channel a lot of its funds to grow its business.

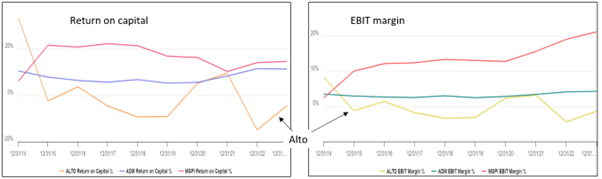

The main concern I have is its capital allocation track record, as shown in Table 2.

- There was not much excess left for shareholders after CAPEX.

- Despite the CAPEX, there were no improving returns. I am not sure if it is money well spent.

Table 2: Sources and Uses of Funds 2014 to 2023. (Author)

Is there hope?

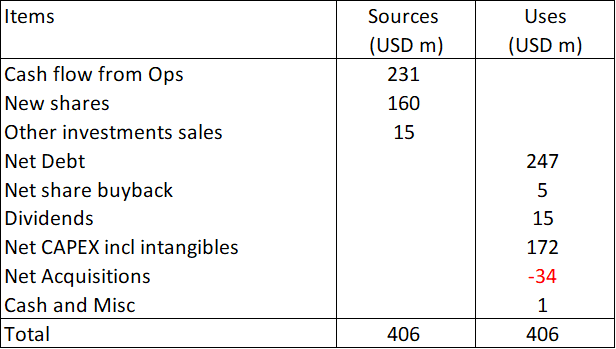

ALTO is not operating in a sunset sector. But it is also not in a high-growth one, as exemplified by the following quotation and Chart 6.

“The U.S. ethanol market size was valued at USD 34.02 billion in 2023… rising at a CAGR of 4.90% from 2023 to 2032.” Precedence Research

Chart 6: US Production, Consumption of Ethanol. (Alternative Fuels Data Centre)

The challenge for ALTO is that ethanol is a commodity where ALTO does not have much pricing power. This is illustrated by the 98% correlation between ALTO unit alcohol selling price and CBOT ethanol price over the past 5 years.

The company has tried to address this by focusing on specialty alcohols and essential ingredients. In its 2023 Form 10k, the company stated that its business strategy included:

“…make our business ever more customer-centric…to support premium prices and new differentiated and higher-margin products.”

“…to broaden our product offerings to appeal to a wider range of customers and uses in our key markets…”

“…implement new equipment and technologies to increase our production yields, improve our operating efficiencies…”

Although the company started on this journey in 2020, there are no clear trends yet for improving margins, operating efficiencies, or sales volume.

I estimated that specialty alcohol and essential ingredients accounted for less than 40% of the 2023 revenue. To deliver the strategic goals, these will probably have to be a bigger portion of its revenue.

I suspect that the company has a few more years to go to get all the cylinders firing before we can see better, sustainable results. It is not something that can be achieved by next year.

To be fair, there are some positive points as well:

- Over the past 2 years, the company’s production is only at around 80% capacity.

- Fixed cost is a small component of the total cost. This lowers the break-even level and can also help boost profit margins.

- It is not in some dire financial position.

Valuation

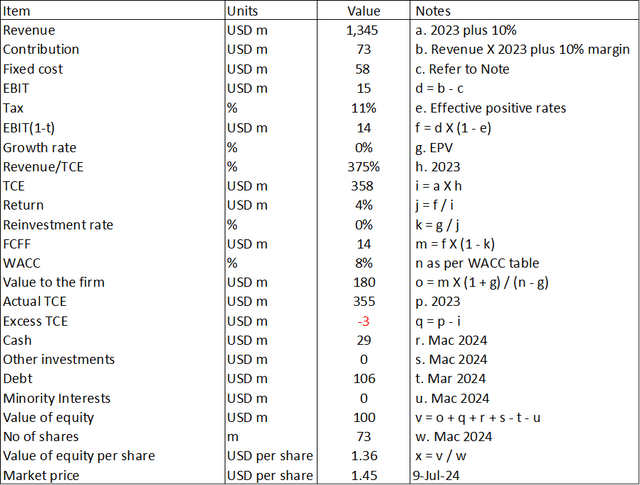

The company is transforming. This will take time. Since I do not have a crystal to know how long it will take, I decided to reverse-engineer the current market price of USD 1.45 per share (9 Jul 2024).

I used a single-stage Free Cash Flow to the Firm model for this. Given the historically low revenue growth, I reverse-engineered ALTO based on its Earnings Power Value.

There were 3 critical parameters in my model – revenue, contribution margin and capital efficiency (revenue / total capital employed). I varied these 3 parameters to get a value that was close to the market price.

The current market price would be for a situation where:

- The revenue is 10% higher than the 2023 revenue.

- The contribution margin is 10% higher than the average 2021 to 2023 contribution margin.

- The capital turnover (revenue / total capital employed) is 15% higher than the average 2021 to 2023 capital turnover.

My valuation showed that the market is running ahead of its performance.

Risks and limitations

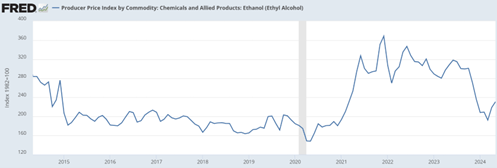

I have assumed the base revenue to be 10% higher than the 2023. Over the past few years, prices of ethanol have been unusually high, as illustrated in Chart 7. Prices currently seem to be coming down to the 2015 to 2020 level. In view of this, a 10% higher price may be challenging.

Chart 7: Ethanol Producer Price Index. (FRED)

To deliver the improved 10% contribution margin, the company would have to reduce the impact of the crush margin. This meant being more productive as well as selling significantly more of the specialty alcohols and essential ingredients. I have not seen strong signs of these over the past few years. This can be very challenging for the company.

The only variable that seems more likely is the 15% improvement in the capital turnover. This is because there is a track record of improving asset turnover since 2020.

Finally, my valuation assumed that all the 3 improvements would be achieved immediately. Any delay would reduce the intrinsic value due to the time value of money.

Given the above, you can understand why I think the market price has outrun the transformation plans.

Reverse-engineering model

I reverse-engineered ALTO based on a single-stage Free Cash Flow to the Firm (FCFF) model where the EBIT was determined based on the business set-up as shown in the Chart 4.

FCFF = EBIT(1 – t) X (1 – Reinvestment rate) X (1 + g) / (WACC – g).

For the Earnings Power Value case, g and Reinvestment rate are both zero.

Value of equity = Value of firm + cash + Other investments – Debt – Minority interests.

Table 3 illustrates the calculation.

Table 3: Reverse engineering the market price (Author)

Notes to Table 3:

- Item c = 2023 Fixed cost + past 10 years average other costs for restructuring and write-downs.

- Item e. I took the average of only the historical positive tax rates

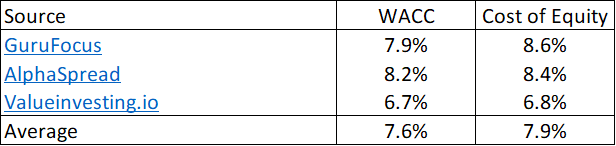

- Item n. The cost of funds was based on the first page of a Google search for “ALTO WACC” as summarized in Table 4

- Item x. I wanted the % increases in the key parameters (revenue, contribution margin and revenue/TCE) to be in multiples of 5%. As such, the nearest value to the market price was USD 1.36 per share, as shown.

Table 4: Estimating the cost of funds (Various)

Conclusion

Since 2012, the company’s performance has been going downhill. You can see this from the returns as well as from operating and capital efficiencies.

I suspect that management understood this and pivoted the business direction in 2019. From “a leading producer and marketer of low-carbon renewable fuels,” the company became a producer and marketer of renewal fuel, specialty alcohols, and essential ingredients.

But changing business direction is more than describing the new direction. The company has to deliver the change. The results for the past 4 years do not provide a clear indication that this is going to be achieved soon.

Unfortunately, the market price has run ahead of the deliverables. My reverse-engineering model suggests that the market is pricing more than a 10% immediate improvements in revenue and contribution margin, and a 15% improvement in capital efficiency. I think that is it a tall order.