Driendl Group/DigitalVision via Getty Images

Summary

If anyone has spent time working in the investment industry, it’s pretty common knowledge that you’ll have a lot of wrong calls. For those who haven’t, even the best sell side analysts on the street are right just over half of the time. Last year, I assigned a Sell rating to ArcBest (NASDAQ:ARCB) based on the freight recession bringing down shipping volumes and rates (link to article). Although I was correct on that point, the stock didn’t move where I thought it did. At the time of my initial Sell call, Yellow Freight was nearing bankruptcy. For some industries, such as banking, trouble at one company breeds fear in the entire sector. Oddly enough, trouble at Yellow has been viewed and valued as a positive for remaining players by investors.

Reasons To Hold

Improved Market Conditions: Since our previous sell recommendation on ARCB, the overall market sentiment for the trucking industry has shown signs of improvement. Contract rates have somewhat stabilized in 1Q24, which leads me to believe the market is healing from the freight recession experienced throughout much of 2023. This positive shift in the industry outlook could benefit ARCB in the near term.

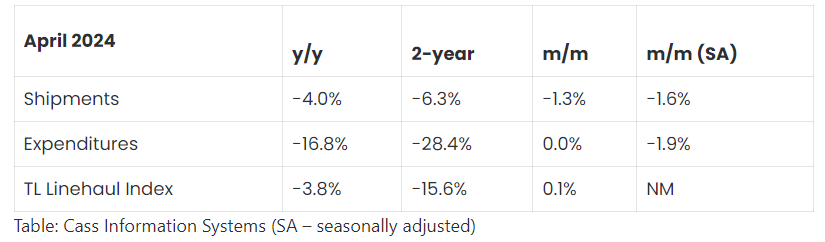

Linehaul Index and Freight Volumes (FreightWaves, Cass)

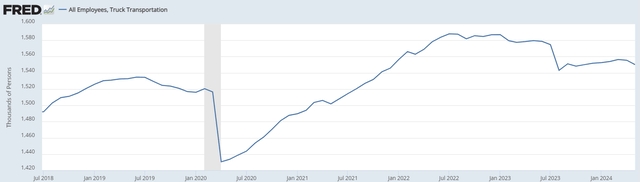

Another piece of data we can look into is the health of employment in this sector. We can see the huge tick down from COVID in 2020, followed by a staircase to the right stemmed from huge tailwinds from the 2021-ish supply chain disruption. There is a peak in 2022 followed by some trail off, which implies there may have been too much hiring as supply chains have rebalanced themselves to current demand levels. Overall, sector employment is relatively healthy and is right around pre-COVID levels of employment.

Trucking Industry Employment (FRED)

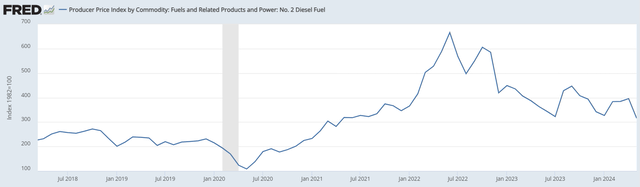

The price of diesel fuel tells a similar story where there was a glut in demand and hence price in 2020, followed by a spike and settle around 300 (1982 is the 100 value for this index as a reference, so we’re at ~3x 1982 prices).

#2 Diesel Fuel (FRED)

Company Developments: While some headwinds remain, ARCB has taken steps to address previous concerns as quoted below from the 1Q24 Earnings Call. The Asset-Light portion of the business has bolstered overall company profitability, while management remains diligent in optimizing the more capital intensive parts of the business. These efforts could help ARCB navigate the challenging market environment and potentially improve its profitability.

“Our asset-light shipment volume has grown significantly with double-digit growth in the managed transportation solutions. This is a testament to our commitment to helping our customers optimize their supply chains.” – Judy McReynolds – Chairman, President & Chief Executive Officer

“Moving on to our asset-based business. First quarter revenue was $672 million, a per day decrease of 3%. The segment’s non-GAAP operating ratio was 92.0%, an improvement of 30 basis points versus the first quarter of last year and 430 basis points above the fourth quarter of 2023. The sequential performance was generally in line with the past performance we have seen in softer freight environments. As we move from a strong fourth quarter into our first quarter with more muted demand and higher union benefit and profit sharing costs, we optimize our freight mix, maintain pricing discipline, manage costs lower and improve productivity, which all contributed to our results for the quarter. First quarter tonnage per day decreased by 17% and daily shipments were 6% below prior year levels, primarily due to lower transactional volumes and lower tonnage levels more broadly for the industry. However, our core LTL shipments and tonnage continued to grow, contributing to improved productivity and better financial results.” – Matt Beasley – Chief Financial Officer

One product in particular caught my eye while conducting my follow up research – Vaux (Vaux). It’s an integrated hardware and software solution to make the docking/undocking process more efficient and, in my opinion, pretty cutting edge. Management’s focus on innovating is what sets it apart from peers in my view.

Vaux Freight System (ARCB Website)

Valuation Adjustment: Since my Sell rating call last year, the stock has enjoyed some nice upside, going north of $140 a share at some points before falling back down to ~$100 a share, which is roughly where we found ourselves at the time of my call. The recent decline in ARCB’s share price has brought its valuation metrics closer to historical averages. While not necessarily cheap, the current price may better reflect the company’s risk profile.

1Y ARCB Stock Price (Seeking Alpha)

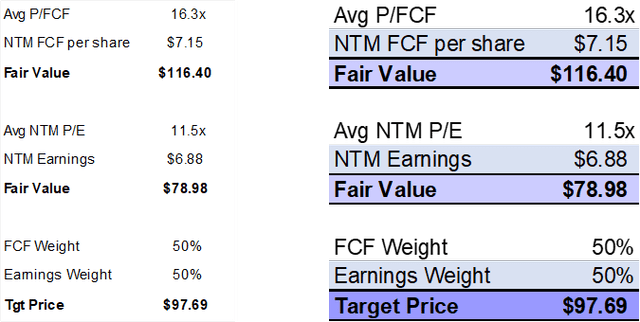

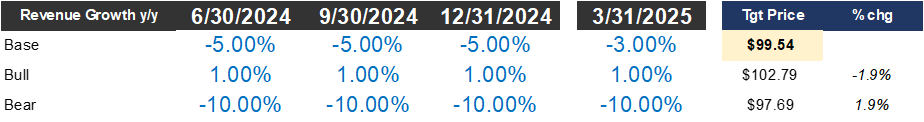

With my three statement financial model now refreshed, my target price of $98 a share in a base case scenario, where I’m assuming mid single digit revenue declines. This is less than the $108 ARCB is trading at the time of this writing, but given what has transpired in the past year, I have less conviction in this short thesis. Some investors are very talented at short selling, such as Hindenburg Research. I clearly am not and never found comfort in being short – it’s like playing the Don’t Pass line at the craps table, at least to me. I think Holding and waiting for a better entry point is the appropriate move here.

ARCB Valuation Update (Author)

ARCB Valuation based on different revenue scenarios (Author)

Remaining Uncertainties: Despite the positive changes, some uncertainties remain. Increased global tension could wreak havoc on fuel prices, negating any positive momentum on top line revenue. In addition, 2024 being an election year could materially impact the outlook for this sector in the near term. These factors could still impact ARCB’s future performance.

Given the highly bullish sentiment in the sector, improved market outlook, recent company efforts, and a more balanced valuation, we are upgrading our recommendation on ARCB stock from Sell to Hold. While some uncertainties persist, the current risk-reward proposition seems less unfavorable.

Conclusion

My previous Sell rating on ARCB, which was based on the freight recession, did not lead to the anticipated stock movement. However, recent market conditions have shown signs of improvement, with stabilized contract rates and healthy sector employment levels. ARCB’s strategic steps, particularly in the asset-light segment, have bolstered profitability despite industry challenges.

The valuation adjustment of ARCB stock, with its recent decline bringing metrics closer to historical averages, also plays a role in the revised outlook. While uncertainties such as global tensions and the upcoming election year pose risks, the improved market sentiment and company developments provide a more balanced risk-reward proposition.

Given these factors, we recommend ARCB as a hold at this time.