Andy Andrews

Investment thesis

Arm Holdings (NASDAQ:ARM) stock is one of the hottest amid the AI-fueled stock market craze. In these circumstances, it is crucial to differentiate bubbles from true disruptors. ARM definitely does not look like a bubble. Its undisputed dominance in CPUs for smartphones generates above 90% gross margin, which provides the company with vast potential to reinvest in innovation. In recent years, ARM has significantly diversified its revenue mix and currently has solid exposure to various hot end markets. I think that Arm has vast potential in data centers, as its architecture for data center chips is disrupting legacy x86 architecture, which is evident from the expanding market share. ARM’s valuation is sky-high, but it is normal for a disruptor. I am initiating a position in ARM and give it a “Strong Buy” rating but realize that the stock can easily dip by 40-50% like all other big disruptors did. However, I will be happy in this case because a big drop will give me an opportunity to significantly expand my position in this disruptor.

Company information

Arm Holdings is a semiconductor company, the proprietor of the Acorn RISC Machine architecture. This architecture serves as the foundation for 99% of premium smartphone CPU cores worldwide. Apart from smartphones, ARM also holds a strong market position in various other smart gadgets such as wearables and tablets.

ARM’s latest earnings presentation

Arm generates revenue from royalties and also licenses out its architecture, providing diverse license options tailored to the specific requirements of each customer.

ARM’s latest earnings presentation

Financials

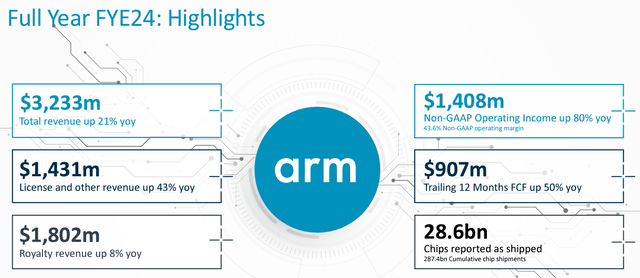

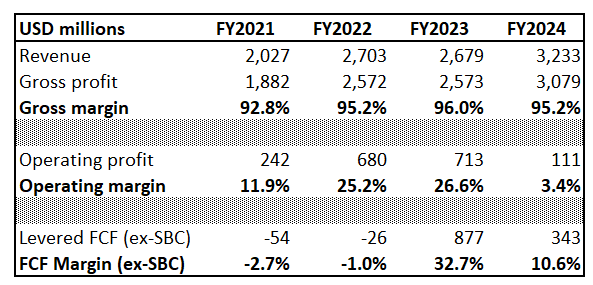

As usual, I start my coverage of a new company by looking at long-term trends in performance. ARM delivered a 16.8% revenue CAGR between FY 2021 and 2024. The gross margin profile is staggering, well above 90%.

Author’s calculations

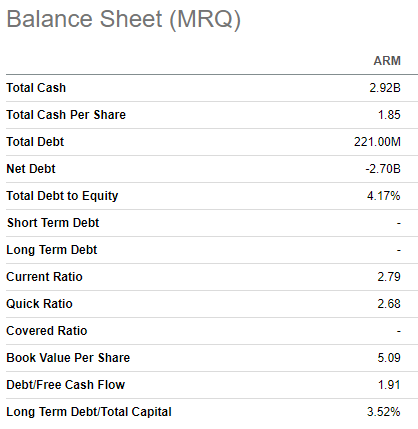

ARM’s operating margin also demonstrated impressive expansion over the last four years and FY 2024 is just an outlier due to sharply increased R&D spending. The company’s free cash flow [FCF] is positive, which allows it to maintain a healthy balance sheet.

Seeking Alpha

Having a robust balance sheet with a $3 billion cash pile and almost no debt positions ARM well to continue investing heavily in R&D and fuel revenue growth. ARM does not pay out dividends, but it repurchased shares worth $158 million in FY 2024.

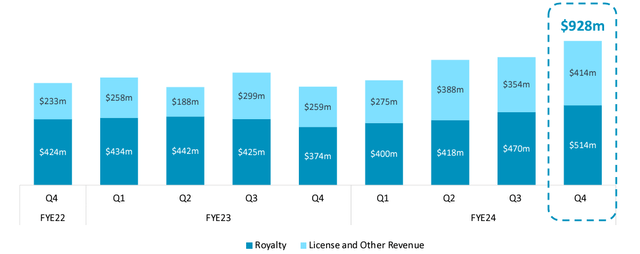

The latest quarterly [fiscal Q4 2024] earnings were released on May 8, when ARM surpassed consensus estimates both from revenue and EPS sides. Revenue grew by 47% YoY, the highest in the company’s history, according to the latest earnings presentation.

ARM’s latest earnings presentation

Both revenue streams demonstrated impressive growth: Royalty revenue grew by 37% YoY and License & Other grew by 60% YoY. The latter demonstrates massive growth momentum, which was driven by multiple new ATA agreements and the increased demand for Arm’s power-efficient and high-performance technology in applications from AI to datacenters to edge computer. Royalty revenue benefitted from Armv9 CPU adoption in smartphones and market share gains in automotive and cloud hyperscalers.

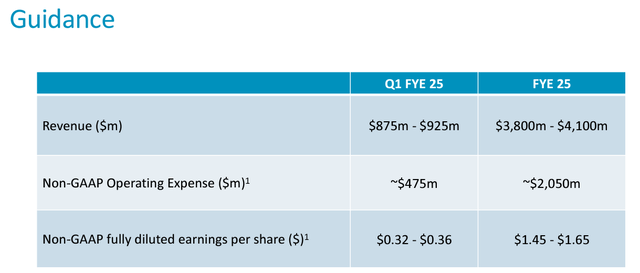

Annualized contract value [ACV] expanded YoY from $1 billion to $1.18 billion, suggesting robust growth in the company’s contracted business and highly likely indicates that stellar revenue growth momentum can last for longer. Another crucial business metric signaling that revenue strength will likely last for longer is the remaining performance obligation [RPO] which grew by 45% YoY. Strong growth in ACV and RPO persuades me to agree with the management’s optimistic guidance for fiscal Q1 2025 and full year.

ARM’s latest earnings presentation

The management expects a 30% to 37% YoY revenue increase in fiscal Q1 2025. The adjusted EPS is expected to be approximately in line sequentially, and I like this short-term stability in EPS despite the uncertain and challenging macro environment. For the full fiscal 2025 the management expects revenue to be around $4 billion, which means a 24% growth compared to FY 2024. To sum up, ARM demonstrates strong financial performance and is poised to continue enjoying momentum in FY 2025.

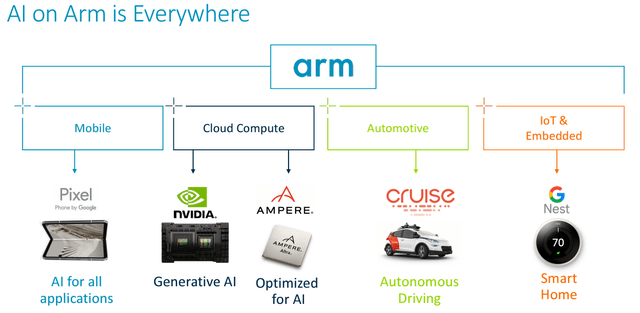

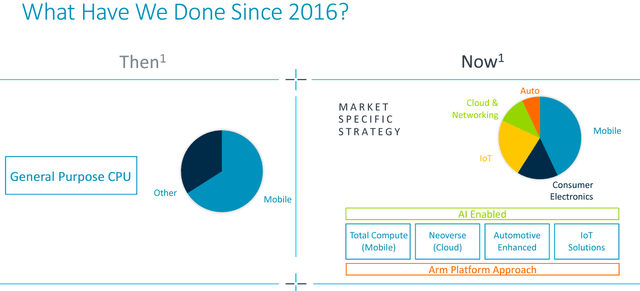

Now, let me shift away from financial and other performance metrics and look at ARM from the perspective of secular trends. As I mentioned, ARM dominates the smartphones’ CPU market. The smartphone market is mature and Statista expects below 4% market CAGR between 2025 and 2028. This does not look quite optimistic for a growth company, but ARM is not only about mobile CPUs. The company made impressive progress in diversifying its business mix and currently serves a wide set of end markets, most of them are emerging industries.

ARM’s latest earnings presentation

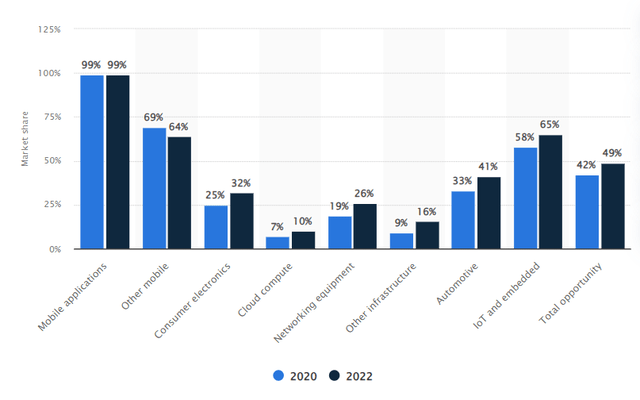

According to Statista, ARM has notably expanded its market shares across various industries between 2020 and 2022. Out of these industries, automotive, IoT & embedded, and cloud compute seem to be the hottest industries. While automotive and IoT currently experience temporary weakness due to the harsh macro environment, cloud compute and AI continue to thrive, and I want to focus more on this industry from ARM’s perspective.

Statista

The cloud computing industry is experiencing strong momentum as technological giants are fighting fiercely to get a competitive edge amid the AI revolution. Cloud giants like Amazon (AMZN), Microsoft (MSFT), and Google (GOOGL) are ramping up their investments in data centers. Each of these companies announced their multibillion plans to expand their data center infrastructure across the world, which I describe in one of my recent articles. Historically, x86 CPUs dominated the market for data centers. However, as technologies move forward, more efficient solutions are needed. According to an article from exxactcorp.com, ARM CPUs provide higher computing efficiency, and they also consume less power compared to x86 processors.

The strong potential of ARM-based processors is evident from recent announcements from tech giants. Google recently unveiled its new ARM-based data center AI chip. In late 2023, Microsoft announced its in-house ARM-based CPU as well. Amazon, the undisputed global leader in cloud computing, owns more than half of all ARM server CPUs in the world. Therefore, it appears that ARM can likely move to the forefront of the chip revolution for data centers and cloud computing, which opens vast growth opportunities for the company due to its ownership of the intellectual property for the Acorn RISC Machine architecture.

Valuation

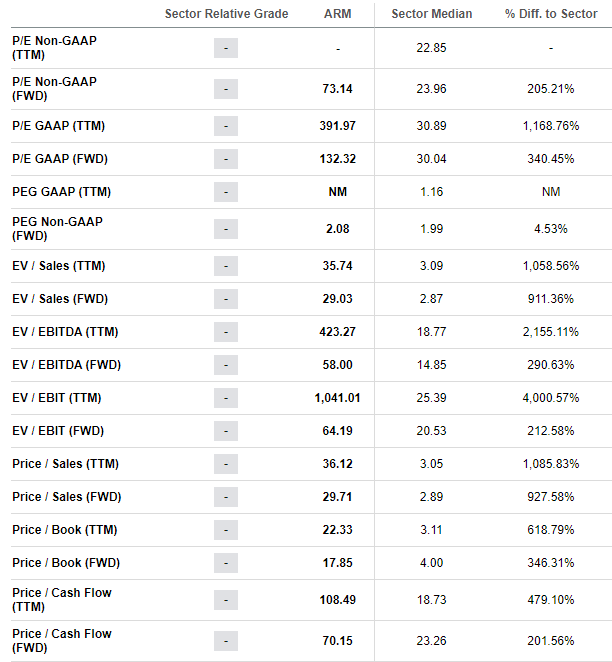

When I look at ARM’s valuation ratios, I realize that the stock is apparently overvalued from this perspective after the stock rallied massively since its IPO. The stock grew by 52% YTD, but there was a 7% pullback over the last month. However, valuation ratios for disruptors like ARM are not about TTM and FWD ratios, and we have to look at longer-term horizons.

Seeking Alpha

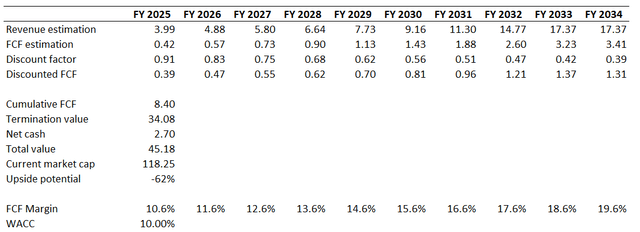

To figure out by how much ARM is overvalued, I want to simulate the discounted cash flow [DCF] model. I will simulate two scenarios to give readers more understanding of how the fair value will change under various assumptions. I will start with a conservative scenario based on consensus revenue growth estimates, projecting a 17.8% CAGR for the next decade. With a 95% gross margin, I have high conviction in ARM’s ability to expand its FCF margin rapidly as the business ramps up. I use a 10.6% FCF ex-SBC margin [FY 2024 level] and expect a one percentage point yearly expansion. Future cash flows are discounted with a 10% WACC, recommended by Gurufocus.

Author’s calculations

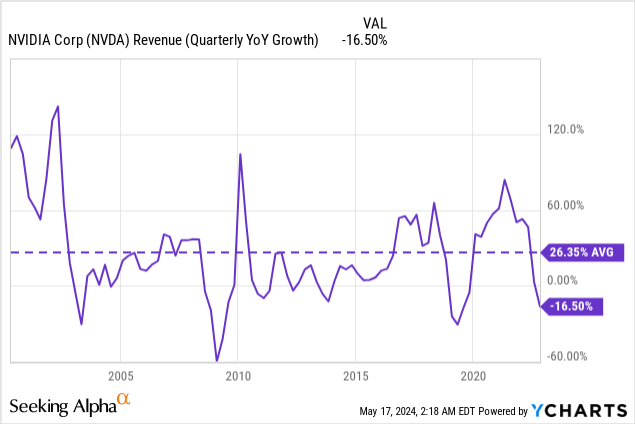

According to the conservative scenario, the business’s fair value is $45 billion. This is multiple times lower than the current market cap, indicating a massive overvaluation. However, there is a great chance that CPUs based on ARM architecture might become a new golden standard for data centers, which will mean a massive revenue growth, way faster than a 17.8% CAGR. For example, Nvidia delivered a 26% revenue CAGR between 1999 and 2022. I have purposely excluded Nvidia’s calendar 2023 revenue spike to be more conservative.

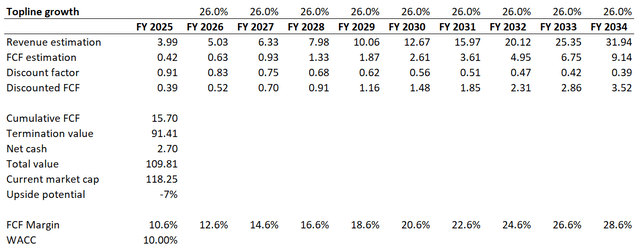

That said, projecting a 26% revenue CAGR for my second scenario looks like a sound choice. With a faster revenue growth assumption, it is also reasonable to project a more aggressive FCF margin expansion profile. For my optimistic scenario, I project a 200 basis points yearly expansion, peaking at 28.6% at the end of the next decade.

Author’s calculations

Under a more optimistic scenario, the stock looks fairly valued with a slight premium. For a company that already disrupts the huge data center CPUs market, a 7% premium is nothing, in my opinion. Therefore, from the perspective of future growth potential, ARM’s valuation does not look ridiculous.

Risks to consider

History teaches us that all disruptors face sharp swings in share price, including deep drawdowns. Before its crazy 2023 rally, Nvidia’s share price dropped by 50% in 2022. We see approximately the same situation with Tesla (TSLA) this year, as the stock currently trades 30% lower than it started this year. All other big disruptors like Amazon or Meta (META) also experienced 50% and deeper drawdowns in their history. ARM’s valuation is hot at the moment, and it is only justified with a 26% revenue CAGR and rapid FCF expansion, which I demonstrated in my DCF analysis. Any business has its own cyclicality and faces headwinds from time to time. That said, some of ARM’s quarters will not be as strong as recent ones, which might lead to big stock selloffs. I want to warn investors that ARM is a long-term play, and big drawdowns are inevitable. Investors should be ready for them and to increase their position in ARM during selloffs.

The technological landscape is not constant, and the pace of evolution is rapid. That said, there is a high level of uncertainty regarding the secular durability of the ARM architecture. Five years ago, the position of x86 CPU technology was intact in data centers. However, currently there is a significant risk that x86 CPUs will be entirely disrupted within the next few years. ARM’s long-term success heavily depends on the sustainability of its potential dominance in data centers, but there is a substantial level of uncertainty surrounding this longevity.

Bottom line

Timing the market for stocks like ARM is gambling, in my opinion. Stocks of disruptors are usually extremely volatile and can swing sharply in both directions. The stock looks like a must-have since its disruptive potential is massive. I am initiating a position in ARM and will be happy to expand it in case the stock drops sharply.