FangXiaNuo

Synopsis

Armstrong World Industries (NYSE:AWI) is a leading provider of ceiling and wall solutions across the Americas, serving both commercial and residential construction and renovation markets. It has demonstrated a strong track record of consistent revenue growth and maintains robust profitability margins. Strategic acquisitions and organic growth from a mix of large, medium, and small projects, with major contributions from large airport projects like Pittsburgh and Seattle, have driven this quarter’s performance. Amid economic uncertainties, AWI has modestly upgraded its outlook for the second half of the year, driven by steady demand in healthcare and education, strong growth in transportation, and rapid expansion in the data center market, with ~100 projects in the pipeline. Overall, I am giving a buy recommendation for AWI stock because of its strong growth prospects and robust track record.

Historical Financial Analysis

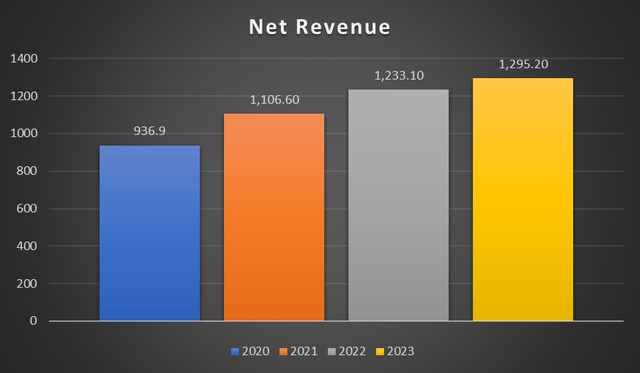

Author’s Chart

Over the years, AWI has demonstrated robust and consistent revenue growth. Its upward trend in net revenue is consistent, hitting a record-setting $1.29 billion. In FY23, the company reported net revenue of $1.29 billion, indicating a year-over-year growth of ~5%, primarily due to an improved average unit value [AUV] of $43 million and a stronger sales volume of $19 million. Acquisitions of BOK Modern and GC Products primarily drive net sales growth in the Architectural Specialties segment. In FY22, its net sales have grown significantly by 11.3% year-over-year. Favorable AUV drives the mineral fiber segment’s sales, but lower sales volume from reduced inventory levels in the first half of the year and weaker demand in the latter half offset this growth. Growth in the Architectural Specialties segment was broad-based, with sales increasing across various product categories, contributing significantly to the overall segment revenue increase.

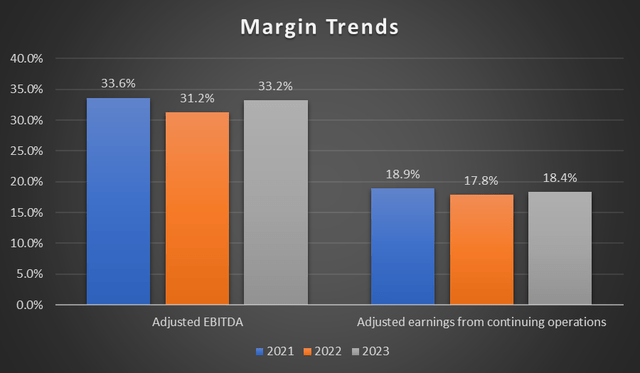

Author’s Chart

Despite a slight dip in adjusted EBITDA and earnings from continuing operations margins, the company’s margins have generally remained robust throughout the years. In FY22, adjusted EBITDA margins have contracted slightly to 31.2% before recovering in FY23, achieving 33.2%. Adjusted earnings also fell in FY22 to 17.8%, and AWI made an effort to regain margin strength in FY23, achieving 18.4% in adjusted earnings margin. The Mineral Fiber segment’s adjusted EBITDA margin has expanded by 180 bps, reaching 39.1% as a result of favorable AUV and strong contributions from its WAVE joint venture. The Architectural Specialties segment’s adjusted EBITDA margin has expanded by 230 bps, reaching 18.1% due to improved operating performance in that year.

Second Quarter Earnings Analysis

AWI has reported a strong Q2 performance with double-digit net revenue growth and record earnings. Net revenue is up by 12.2% year-over-year, from $325.4 million to $365.1 million. Operating income went up by 9.2% from $87.0 million to $95.0 million, while adjusted EBITDA grew by 12.5%. Adjusted net earnings per shares rose by ~17%, marking it the 6th consecutive quarter of year-over-year growth. Both segments have performed exceptionally well. The mineral fibre segment sales grew by 7% year-over-year as a result of favourable AUV and stabilizing market demand. While its Architectural specialties segment grew by 26% year-over-year, mainly driven by $20 million contribution from BOK and 3form acquisitions. Overall operating income margin has declined slightly by 70 basis points. The Mineral Fiber segment saw an increase in operating income margin, improving by 40 basis points, while the Architectural Specialties segment experienced a decline, dropping by 90 basis points to 12.4%. The management has raised its full-year 2024 guidance due to the robust performance this quarter.

Business Overview

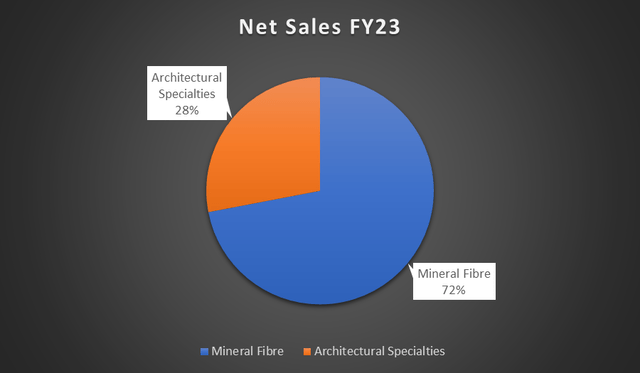

AWI is a market leader in innovation, manufacturing, and design of commercial and residential ceiling and wall solutions in the Americas. They produce their products crafted from a wide variety of materials, such as glass-reinforced-gypsum, wood, felt, metal, mineral fiber, and fiberglass wool. AWI’s joint venture with Worthington Enterprises, Worthington Armstrong Venture [WAVE], manufactures ceiling suspension system products. We can segregate its business into two segments: Mineral Fiber and Architectural Specialties. Mineral Fiber accounts for the majority of the sales, manufacturing suspended mineral fiber and soft fiber ceiling systems. They are mostly sold to resale distributors, contractors, wholesale, and retailers. This segment also accounts for WAVE’s performance, which manufactures suspension systems and ceiling component products. The Architectural Specialties segments account for the remaining sales. This segment manufactures, designs, and sources ceilings, walls, and facades for commercial uses.

Author’s Chart

Growth Opportunities in Data Centers

Surrounded by uncertainties from inflationary pressures and interest rates and their overall impact on the economy, AWI has modestly upgraded its outlook for the remaining half of the year. As the office sectors continued to be challenged, it has shown signs of stabilization with improved regional activity. San Francisco is experiencing renewed activity driven by AI demand for office space. There has also been a resurgence of tech projects in the Pacific Northwest. The healthcare and education sectors are holding steady, providing consistent demand. The transportation sector remains strong, contributing positively to AWI’s business. Data centers are identified as an area of rapid growth, offering higher value opportunities for grid and component sales. At the moment, AWI is tracking ~100 data center projects.

In addition, WAVE has recently acquired all the assets of Amherst, Data Centre Resources, LLC [DCR]. This acquisition includes its Cool Shield brand, which specializes in designing and manufacturing aisle containment solutions for data centers. It is a trusted and reputable brand among data centers in the United States. DCR Solutions specializes in maximizing data center power usage and improving cooling efficiencies, which helps to reduce operating costs and stress on electrical grid infrastructure. These products also address long construction lead times and shortages of skilled labor in the growing data center industry.

Tailwinds in the Architectural Specialties Business

Strategic acquisitions like 3form and BOK Modern have significantly boosted this quarter’s performance in the Architectural Specialties segment. The segment has grown by 26% year-over-year, mainly due to acquisition contributions as well as organic growth driven by large transportation projects. BOK Modern, which was acquired in 2023, has been performing in line with expectations. The firm’s expertise lies in designing and developing architectural metal systems, which positions AWI’s presence in the accretive Architectural Specialties market. In addition, the acquisition of 3form also expands AWI’s Architectural Specialties portfolio, bringing in unique capabilities with translucent finishing, particularly for color, texture, and light to elevate the design of spaces.

In addition to its strategic acquisitions, AWI has been awarded with multiple transportation projects that will provide consistent tailwind for at least three to four years. These include large transportation projects, such as Pittsburgh and Seattle airports. Tampa and Fort Myers airports are more recent ones. Continuous involvement in large transportation projects demonstrates AWI’s ability to secure and execute large, long-term contracts, which are significant growth drivers in this business.

Relative Valuation Model

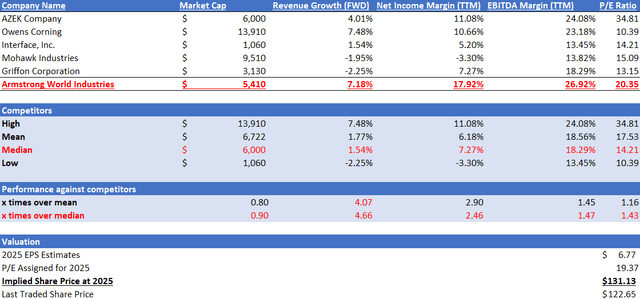

Author’s Relative Valuation Model

According to Seeking Alpha, AWI operates in the building products industry. In my relative valuation model, I will compare AWI against its peers in terms of growth outlook and profitability margins trailing twelve months [TTM].

Starting with growth outlook, AWI significantly outperformed its peers’ median. AWI has a forward revenue growth rate of 7.18%, which is 4.66x over the peers’ median of 1.54%. In terms of profitability margins TTM, AWI also outperformed its peers’ median in both EBITDA margin TTM and net income margin TTM. For EBITDA margin TTM, AWI reported 17.92%, compared to peers’ median of 7.27%. For net income margin TTM, AWI reported 26.92%, higher than peers’ median of 18.29%. Overall, AWI outperformed peers in both growth outlook and profitability margins.

Currently, AWI’s forward non-GAAP P/E ratio is 20.35x, while peers’ median is 14.21x. Given AWI’s strong outperformance, I argue that it is fair for AWI to be trading at a premium. AWI’s 5-year average forward P/E is 19.37x. To remain conservative in my valuation approach, I will be adjusting my 2025 target P/E for AWI down towards its 5-year average.

For 2024, the revenue estimate for AWI is approximately $1.43 billion, while EPS is $6.09. For 2025, the revenue estimate is approximately $1.52 billion, while EPS is $6.77. Based on my forward-looking analysis as discussed, these estimates are justified as they are supported by the favourable outlook of the growth drivers discussed in my analysis. Therefore, by applying my 2025 target P/E to its 2025 EPS estimate, my 2025 target share price is $131.13.

Conclusion & Risk

AWI has been pulling strong numbers this quarter, driven by its strategic acquisitions and organic growth from multiple projects, which has led to an upgrade in its full-year guidance. However, a slowdown in construction starts, particularly in commercial construction, would impact AWI’s growth if such demand does not compensate for the decline. Even though market conditions are stabilizing, there are encouraging signs in transportation, healthcare, and data centers, which are key areas of opportunity and strength. Given its strong track record of profitability and promising growth forecast, I would rate AWI a buy.