uschools

The Federal Reserve’s August 2024 version of the Beige Book was released at 2 pm (EST) on Wednesday. It provided an update on current economic conditions through anecdotal information. The general sentiment of the report was one of a slowing economy, as a higher number of Federal Reserve Districts reported “flat or declining” economic activity in August (9 Districts) than in July (5 Districts). The remaining three Districts were noted as seeing just slight growth, a significant downshift from other 2024 reports.

The general assessment of US economic activity was consistent with recent macro data that reflected a slowdown in growth. However, all eyes were on comments surrounding the labor market condition in this edition of the Beige Book, as it has become a priority for FOMC members.

Labor Market

The labor market showed signs of cooling, but in general, employment levels “were steady overall” with at least five Districts reporting “slight or modest increases in headcounts.” This appeared to be slightly cooler than the assessment of employment conditions in the July 2024 report, when employment “rose at a slight pace.” However, some firms were becoming more cautious, focusing on filling only essential positions and reducing work hours and shifts. Importantly, the Fed noted that firms reporting layoffs remained “rare,” suggesting businesses were not ready to shed workers despite economic uncertainties. Firms attributed the weaker hiring trends to concerns about demand and an uncertain economic outlook. Regarding compensation growth, companies noted a significant shift from previous reports, sharing that there was less pressure to raise wages and salaries. However, the job market for skilled and unionized workers continued to be tighter than the overall job market, which meant those employees were able to command stronger wage increases. This nuanced picture of the labor market aligns with the Federal Reserve’s goal of achieving a soft landing, where inflationary pressures are reduced without triggering widespread job losses.

BLS

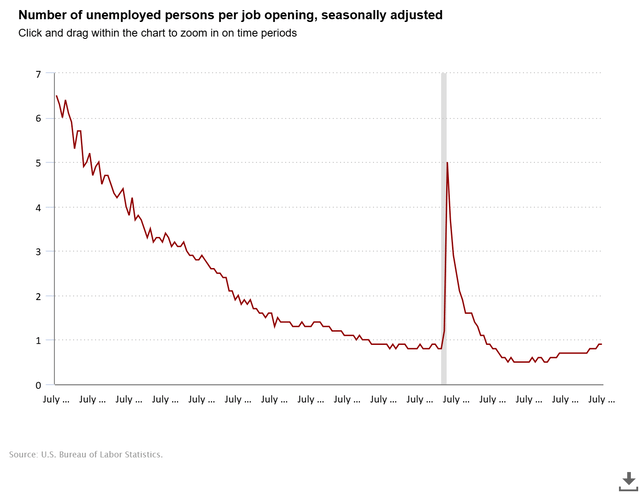

The July JOLTS report, released four hours before, showed trends similar to the notes in the Beige Book. Job openings fell -237,000 on the month and landed at the lowest point since January 2021, and the job openings rate eased -0.2 ppts to 4.6%, down from 5.3% a year ago. Despite the decline in openings. Hiring increased by 273,000 with the private sector adding 285,000 to staffing levels, which meant there was a slight decline in government hiring. Alongside the increase in hires was a larger increase in separations of 336,000 which included a 202,000 increase in layoffs and 63,000 quits. The data show that hiring is still outpacing layoffs, which is consistent with the “steady overall” employment levels, but that gap is closing. Indeed, total separation growth was higher than total hires and job openings fell, suggesting that firms are reluctant to try to fill staff lost to attrition or quits. The broad indicator of labor market tightness, the total number of job openings per unemployed person, continued to normalize today and has fully reached pre-pandemic levels.

Prices

Concerning inflation, there was a general sense that price growth was continuing to ease while cost pressures were mixed. The Fed specifically noted that prices increased “modestly.” Non-labor costs showed growth ranging from modest to moderate, but with a trend described as “generally easing.” Insurance and freight costs were observed as “continuing to increase” which aligns with movements in insurance PPI changes and trends in shipping costs. Regardless, firms were largely confident that the trend of easing inflation would continue as the Fed noted that “the outlook appears cautiously optimistic, as contacts surveyed by the Fed broadly anticipated that both price and cost pressures would either stabilize or continue to ease in the coming months.” The current and expected trends should give the FOMC more confidence in inflation data going into the September meeting.

Regional Comments

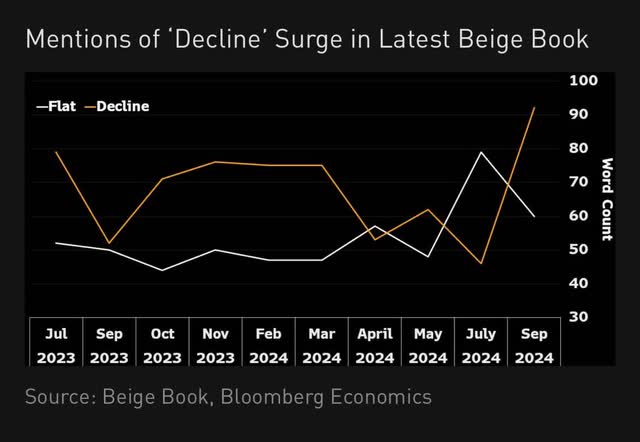

Anna Wong

In the regional comments, most Federal Reserve Districts noted flat or declining conditions. The Districts reporting growth were Boston, Chicago, and Dallas, with expansions ranging from “slight” to “modest.” Other Districts such as Philadelphia, Cleveland, Atlanta, and Minneapolis experienced slight declines in economic activity, while Richmond was the sole District where economic activity declined “mildly.” The remaining Districts, New York, St. Louis, Kansas City, and San Francisco, reported stable conditions. Overall, there was a distinct increase in the use of the word “decline” compared to “flat” in this month’s edition, according to a post on X from Anna Wong of Bloomberg. Many of the mentions of the words described trends in consumer spending, enough for the Fed to point out that spending “ticked down in most Districts.” In particular, mentions of consumers spending less on discretionary items like restaurants and retail were evident in at least 6 Districts’ comments.

Market Reaction

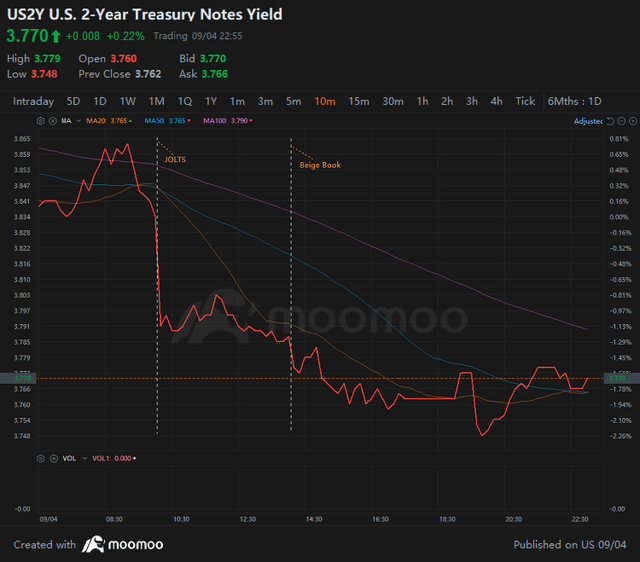

MooMoo

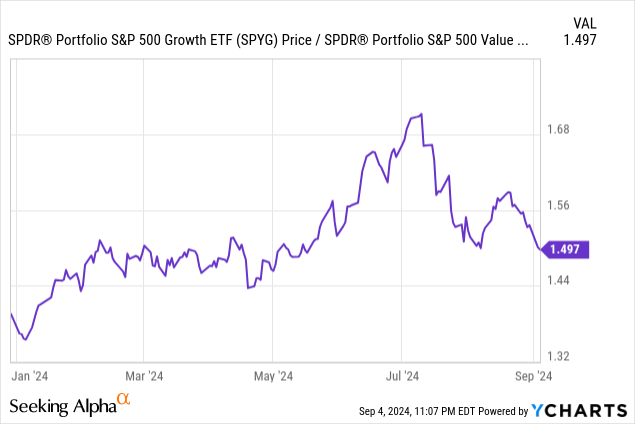

The market did not have much of a reaction to the Beige Book, as it had already reacted dovishly to the JOLTS data that came out early in trading. The 2-year Treasury yield (US2Y), one of the short-term interest rates that have been adjusting to shifts in market expectations for rates, saw a sharp -4 pt drop right after the release of JOLTS, and a much smaller reaction following the Beige Book drop. Through the end of the session, the yield continued to fall as the two dovish macro releases had a hold on the market. Both appeared to have minimal impact on trading in US equity markets, as those major indexes remained slightly negative for most of the day. In general, however, it appears that a weakening economic outlook and an increase in rate cut expectations have become a negative impulse to equity risk sentiment. The rotation away from growth into value, as seen in the relative performance of the S&P 500 Growth ETF (SPYG) and the S&P 500 Value ETF (SPYV), has been noticeable since the beginning of July.

Will this Beige Book be an important factor in the FOMC’s September meeting? It very well could be. In the January FOMC meeting press conference, Fed Chair Powell noted that he “really likes anecdotal data” and expressed the value he finds in the Beige Book and the connections that Fed Reserve Bank presidents make with the business leaders in their respective Districts. He ended the praise by saying, “I think you hear things before they show up in the data sometimes.” This Beige Book release paints a holistic picture of economic softness that is difficult to fully develop in a few scattered data points. This is especially since most Districts pointed to flat to declining growth, even when GDP data are telling a different story (the Q3 GDPNow nowcast is at 2.1%, by the way). If the cool JOLTS report is followed by another rise in the unemployment rate on Friday, this dovish Beige Book could help seal the deal for a 50 bps rate cut later this month. However, for now, I lean towards a 25 bps rate cut in September with a dovish Summary of Economic Projections that indicates the cutting cycle has begun and will continue through the end of the year.