SewcreamStudio/iStock via Getty Images

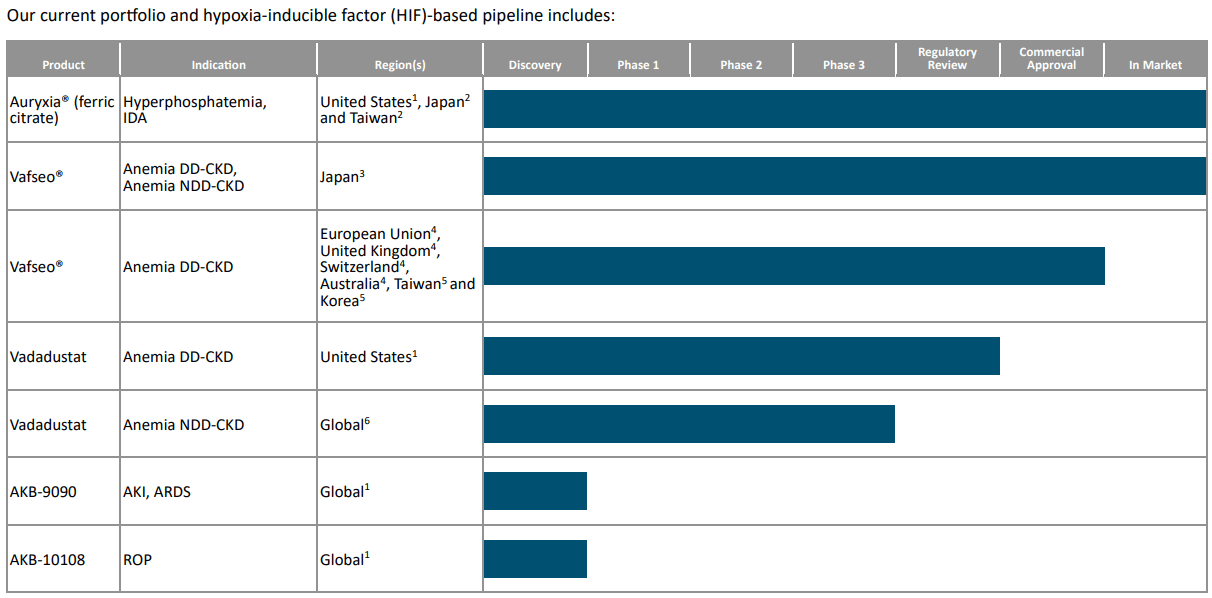

Akebia Therapeutics, Inc. (NASDAQ:AKBA) is a biopharmaceutical company specializing in anemia management due to chronic kidney disease [CKD]. Its drug, Vadadustat, known commercially as Vafseo, received FDA approval in March 2024 for adults on dialysis that could treat a demographic of 558,000 patients in the U.S. This drug offers an improved anemia management medication that can stand out in the U.S. and worldwide market. Auryxia, a ferric citrate tablet, is the other AKBA FDA-approved drug that has produced steady yearly revenue increases but will be exposed to generic competition after [LOE] in March 2025.

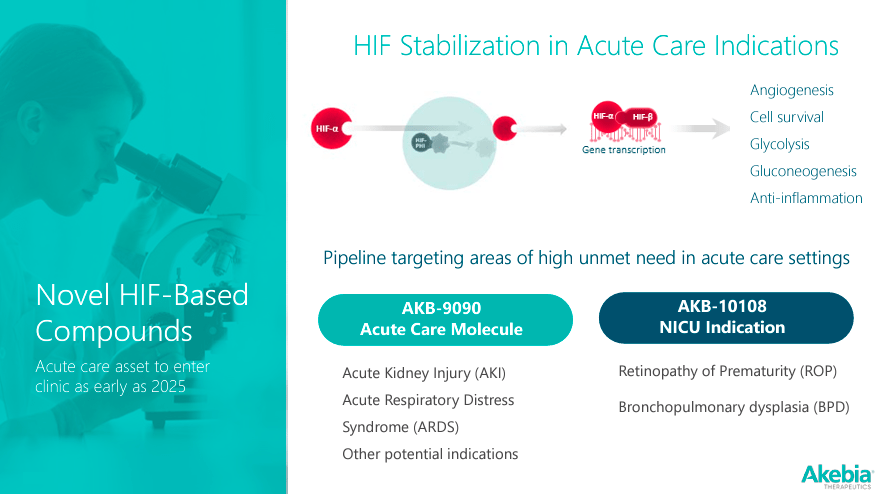

AKBA is also working on a research pipeline of acute care drugs expected to enter clinical trials in 2025. Beyond 2025, Vafseo should become AKBA’s main value drive and be a very rewarding investment if it reaches similar success levels as Auryxia.

Kidney Drugs: Business Overview

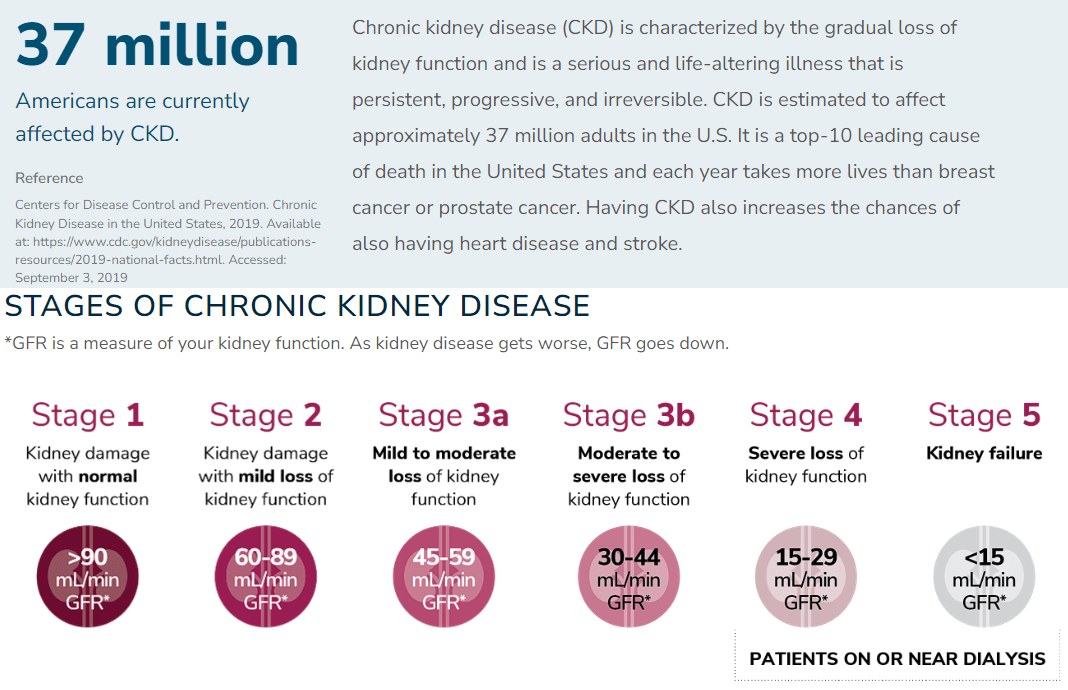

Akebia Therapeutics is a biopharmaceutical company founded in 2007 and headquartered in Cambridge, MA. AKBA is focused on developing and distributing kidney disease treatments, addressing a relatively large market of up to 37 million patients in the U.S. alone. AKBA’s lead product has historically been Auryxia, but will gradually become vadadustat, commercially known as Vafseo. It has been FDA-approved for use in the U.S. since March 2024 for adults who have been receiving dialysis for at least three months. Vafseo has also been approved for use in 36 other countries. Today, most of AKBA’s revenues come from product sales of its flagship IP, Auryxia, and some related licensing revenues, which are winding down.

Source: AKBA’s website.

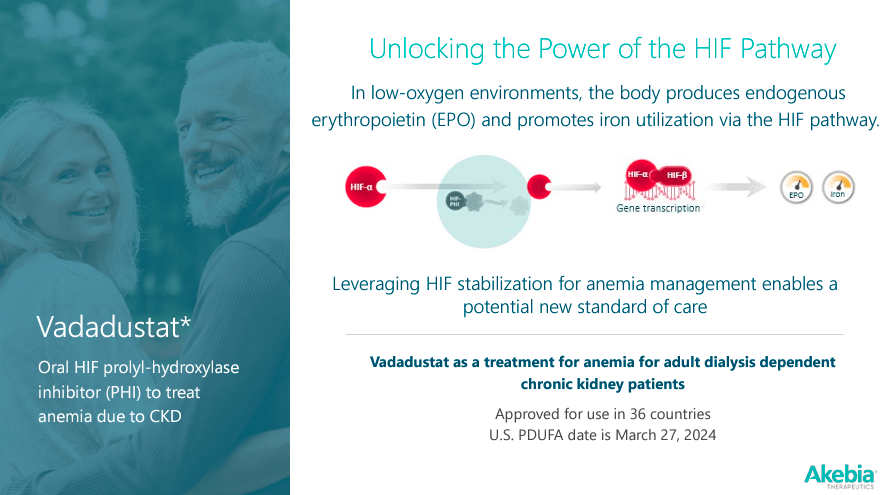

AKBA’s Vafseo is an oral medication that blocks an enzyme called hypoxia-inducible factor prolyl hydroxylase (HIF-PH). This enzyme regulates the body’s response to low oxygen levels (hypoxia). HIF-PH plays a role in preventing the overproduction of red blood cells under normal conditions. However, in certain disorders, inhibiting this enzyme can provide a therapeutic effect, overriding the insufficient response to hypoxia artificially provoking the production of Erythropoietin [EPO], a hormone produced by the kidneys. EPO stimulates the bone marrow’s production of red cells when oxygen levels are low. This way, the HIF-PH inhibitor promotes the production of EPO and addresses the anemia associated with chronic kidney disease [CKD].

This matters because anemia is a common complication of CKD and leads to adverse clinical developments. Managing anemia in CKD patients is a burden in terms of costs and impacts on the patient’s lives and healthcare providers and caregivers. The current standard treatment involves injectable erythropoiesis-stimulating agents [ESAs], most commonly administered in dialysis centers. In this context, Vafseo is a new treatment that could offer improved anemia management and represents an advancement in nephrology care. After all, orally administered drugs tend to be perceived as more patient-friendly, which could bode well for commercialization.

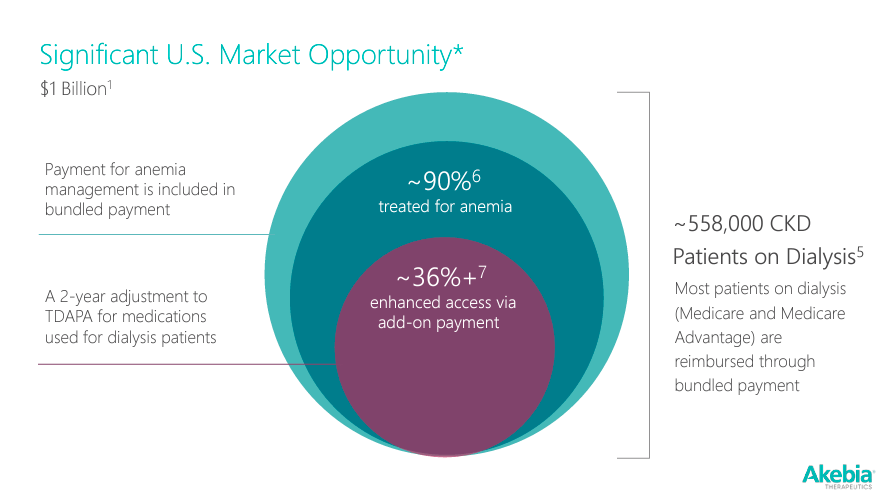

Source: Investor Presentation, January 2024.

As previously noted, AKBA’s main product today is the FDA-approved Auryxia. This phosphate binder was approved 2014 to control serum phosphorus levels in dialysis patients and treat iron deficiency anemia [IDA] in adult patients with CKD who are not on dialysis. In March 2021, in Japan, under the name Riona, it received an additional indication approval from the Pharmaceuticals and Medical Devices Agency [PMDA] to treat adult patients with IDA. Naturally, this is a relatively older IP, so it’s now on the verge of losing exclusivity [LOE], increasing competition from generic alternatives by March 2025.

Since Auryxia is AKBA’s main revenue source, this will undoubtedly become a revenue headwind post-LOE. Nevertheless, management still expects Auryxia’s revenues to increase in 2024 due to exiting unfavorable payer contracts and expanded access to providers interested in vadadustat. So, the LOE will become a factor next year, and for the short term, AKBA must prepare for that paradigm change.

Auryxia, Vafseo, Product Pipeline, and Key Concerns

Beyond vadadustat and Auryxia, it’s undeniable that AKBA’s R&D pipeline lacks late-stage product candidates that can secure its long-term sustainability. So, at this stage, new investors in AKBA are betting on Auryxia holding some competitive edge against generic alternatives past the LOE and vadadustat, which are performing in line with management’s commercial expectations. These are not unreasonable assumptions, but if both were to fail, AKBA’s prospects would worsen significantly.

Source: Investor Presentation, January 2024.

Nevertheless, it’s worth noting that AKBA’s pipeline includes other HIF-based compounds to target acute care indications, such as: 1) AKB-9090, labeled as an Acute Care Molecule for Acute Kidney Injury [AKI] and Acute Respiratory Distress Syndrome [ARDS]; and 2) AKB-10108 for Neonatal Intensive Care Unit [NICU] indications like Retinopathy of Prematurity [ROP] and Bronchopulmonary Dysplasia [BPD]. These acute care medications are expected to enter clinical trials in 2025.

Yet it’s impossible to downplay how vital Auryxia has been for AKBA since 2019. For context, Auryxia’s sales increased from 2019 to 2023, with a cumulative revenue of $726.6 million. The company expects revenue to continue growing in 2024. However, in March 2025, the patent exclusivity will expire, and a generic version may come to market, reducing Auryxia’s revenue. Regardless, there is potential increased revenue in 2025 and 2026 due to policy changes that may allow phosphate binders like Auryxia to be grouped with other products for dialysis patients and to be eligible for additional payment adjustments under Medicare’s program for Transitional Drug Add-on Payment Adjustment [TDAPA]. This system helps ensure dialysis patients access more effective and safer treatments.

Source: AKBA’s latest 10-K report.

Lastly, AKBA’s recently approved Vafseo has an expected $1 billion market opportunity in the U.S. for managing anemia in a population of 558,000 CKD patients on dialysis. Most patients are under Medicare and Medicare Advantage, which reimburse payments through bundled systems, including anemia management. So, as long as AKBA manages the winding down phase of Auryxia gracefully while successfully increasing the commercialization of vadadustat, it should sustain operations long enough to develop these new drugs in its pipeline. I doubt Auryxia will become worthless after the LOE. Instead, I expect a gradual winding down period, which can be reasonably offset by vadadustat.

Promising Horizon in Anemia Management

Consequently, despite the incoming LOE, Akebia can stand out by offering Vafseo, a new oral medication with benefits like:

- ease of use compared with other medicines requiring intravenous [IV] administration for ESAs;

- Vafseo works by stabilizing HIF, mimicking the body’s natural response to low oxygen levels, leading to more physiological production of EPO and the formation of red blood cells;

- Regarding cardiovascular events, Vafseo may have a better safety profile than ESAs;

- Vafseo’s oral administration allows flexible dosing according to individual needs.

- Vafseo may reduce the need for IV iron supplementation, which is often needed during treatments with ESAs.

- An oral medication is cost-effective in terms of requiring fewer clinic visits or health care services.

Additionally, Vafseo’s launch includes a commercial team ready to support sales and distribution. A partnership with CSL Vifor is being formed to facilitate fast market penetration, providing 60% of the market’s potential access. The product is manufactured and expected to meet the market demands at launch. AKBA can quickly scale Vafseo’s sales if the market accepts its new value proposition.

Source: Investor Presentation, January 2024.

Moreover, AKBA collaborates with Medice with a license agreement to market Vafseo in the European Economic Area, the UK, Switzerland, and Australia, with an expected launching date during 1H 2024. The region has at least 325,000 dialysis patients being treated for anemia due to CKD, so this region alone has tangible market potential that can sustain meaningful sales. Another AKBA partnership is with Mitsubishi Tanabe Pharma (“MTPC”) for development and commercialization rights in Japan and other Asian countries. These strategic partnerships expand the global reach of Vafseo, increasing the product’s commercial potential and worldwide market penetration. So, as previously noted, I believe there are good reasons to expect Vafseo to offset Auryxia’s revenue decline post-LOE gradually.

Looks Cheap Despite Headwinds: Valuation Analysis

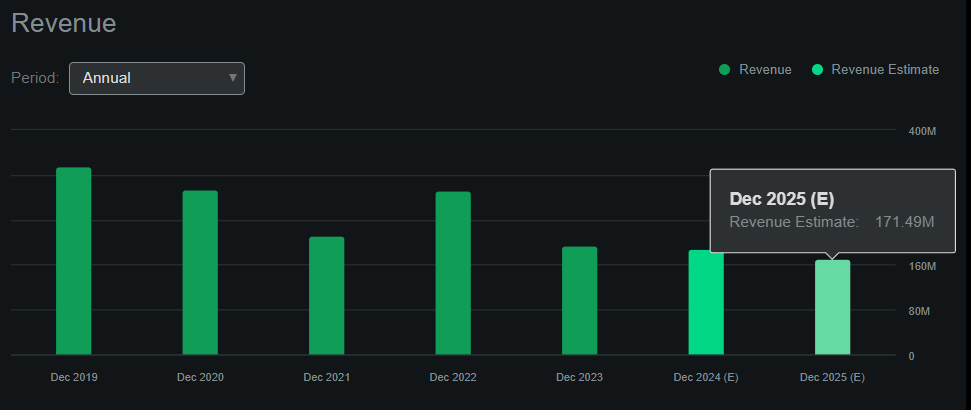

From a valuation perspective, AKBA currently trades at a relatively small market cap of $330.8 million. Seeking Alpha’s dashboard shows that the company should make roughly $189.1 million in sales in 2024 and $171.5 million in 2025. This tapering revenue pattern matches the expectation of Auryxia’s sales winding down, but the wildcard remains Vafseo’s future revenues.

Overall, I think for now, it’s reasonable to anticipate AKBA’s sales to stay around these mentioned levels. This is key because, by 2025, its pipeline will be more robust, with Vafseo potentially being a fully-fledged flagship product.

Source: Seeking Alpha.

Furthermore, AKBA’s balance sheet holds $42.9 million in cash against $34.7 million in debt. I estimate its cash burn at just $2.3 million for the quarter ended in December 2023. I obtained this estimate by adding its latest quarterly CFOs and Net CAPEX. If we annualize this cash burn figure, the implied yearly cash burn should be about $9.2 million. That also suggests a cash runway of 4.7 years, which is quite healthy for biotech companies, especially microcaps like AKBA.

Naturally, the cash burn might increase a bit into 2024 and 2025 as revenues decline slightly, but I don’t anticipate cash burn will be much higher than this estimate. Regardless, I think it’s reasonable to conclude that AKBA has enough liquidity to navigate Auryxia’s winding down, Vafseo’s scaling, and R&D efforts on its upcoming product pipeline. I find it hard to be outright bearish on AKBA’s prospects, as there’s no clear reason for its demise.

Lastly, if we look at AKBA’s valuation multiples, the company seems cheap by comparison. Its forward P/S ratio is 1.93, which, compared to the sector median forward P/S multiple of 3.73, makes AKBA look undervalued. Moreover, its balance sheet doesn’t hold an unsurmountable debt burden nor appears to need additional financing, which might lead to shareholder dilution. So, taking it all into perspective, I believe there’s a reasonable argument for leaning cautiously bullish on AKBA, carefully monitoring Auryxia’s winding down and Vafseo’s initial commercialization efforts post-approval.

Investment Risks

Nevertheless, it’s important to note that the key risks to my bullish rating on AKBA are: 1) how quickly Auryxia’s revenues decline; and 2) how commercially successful Vafseo becomes. These variables are hard to predict, but I would argue they’re not as risky as betting on an FDA approval for a speculative drug. I believe the risk profile of successfully navigating through the LOE of a flagship product, cost-cutting, and cash management, plus commercialization efforts on a newly FDA-approved drug, is lower than betting on a new FDA approval.

AKBA is starting to look cheap after its recent selloff and recent FDA approval. (Source: TradingView.)

After considering that AKBA is trading at a discount relative to more speculative peers, I believe the risk-reward equation on AKBA favors the bull case despite these inherent risks. Vafseo’s recent FDA approval significantly de-risked its investment proposition, and I think the market is undervaluing its longer-term implications.

Naturally, this is an inherently speculative investment and viable only for investors with that kind of risk tolerance.

For more risk-averse investors, I think it’s reasonable to wait until we get more tangible data about Vafseo’s commercial performance. However, I certainly wouldn’t advise shorting AKBA based on the current set of facts.

Lean Bullish: Conclusion

Overall, AKBA is in a transitional stage. It will start preparing for the winding-down process of its previous flagship product, Auryxia, while ramping up sales on its newly approved IP Vafseo.

This is not without its risks. Execution risks are considerable, especially for a relatively small company like AKBA. Also, market adoption for Vafseo remains relatively speculative at this stage, and we don’t yet know how favorable reimbursement policies will be for this new IP, which is a key factor for any drug’s commercial success.

Yet, despite these risks and headwinds, I see a company with enough resources to sustain this transition process and continue developing its product pipeline beyond LOE. AKBA could be a very rewarding investment if Vafseo reaches similar success levels as Auryxia did. So, at the current valuation multiples, I think AKBA’s valuation seems reasonable for new investors aware of the inherent risks.