Userba011d64_201/iStock via Getty Images

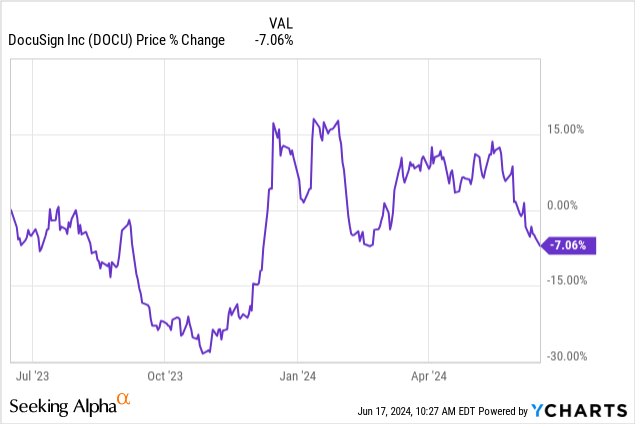

DocuSign (NASDAQ:DOCU) reported better than expected first fiscal quarter results, which were released on June 6, 2024. The e-Signature leader reported slowing top-line growth, which was expected, and also revealed persistent risks to its dollar net retention rate, a key performance metric for software companies. Although DocuSign is facing challenges in terms of customer monetization, I believe the e-Signature company could be an attractive investment due to its strong free cash flows and high margins. In the first fiscal quarter, DocuSign achieved yet again a 30%+ free cash flow margin and while shares are not a completely bargain, I believe it is worth holding on to shares of the e-Signature company.

Previous rating

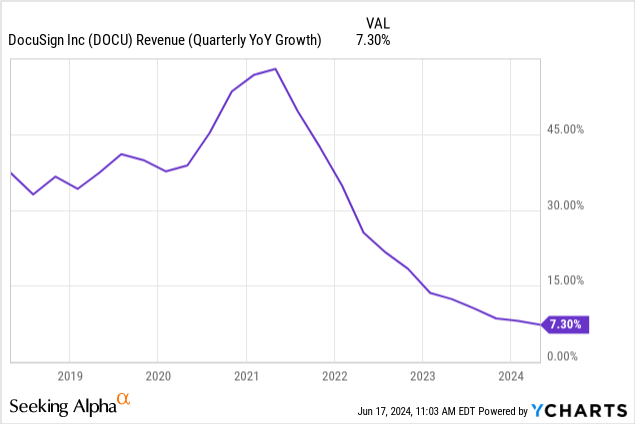

I rated shares of DocuSign to hold in November 2023 due to persistent dollar net retention risks and weakening customer monetization, which has mostly played out the way that I predicted. In the first fiscal quarter, DocuSign generated only 7% top-line growth, extending its streak of successively slowing revenue growth, in part because customers are more discriminatory with their software spending. However, DocuSign is exceptionally free cash flow profitable, which limits the downside, in my opinion.

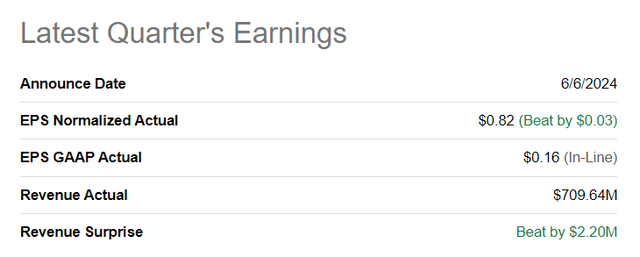

DocuSign beat the Street’s expectations for FQ1’25

The e-Signature leader reported first fiscal quarter earnings at the beginning of June, which resulted in a top and bottom-line beat: DocuSign had $0.82 per-share in adjusted earnings on revenues of $710M. Earnings beat by a small margin of $0.03 per-share, while revenues came in more than $2M above consensus expectations.

Seeking Alpha

DocuSign’s core value proposition and dollar net retention risks

DocuSign’s core product offering is its e-Signature solution that allows its customers to decentralize agreement processes and quickly and cost-effectively sign contracts and agreements between multiple contract parties. DocuSign also offers complimentary services that allow companies to streamline business processes, such as contract lifecycle management, which helps companies to keep track of contracts and customize agreements at the click of a button.

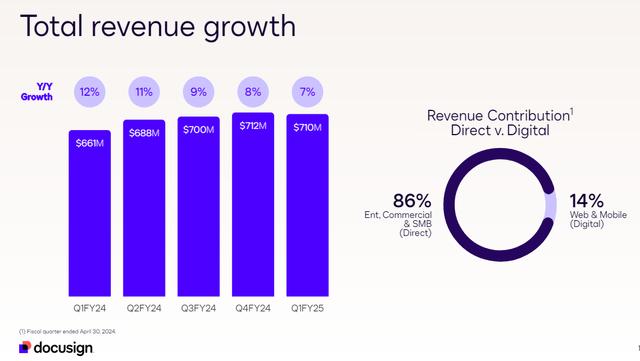

DocuSign generated $710M in revenues in the first-quarter, showing a year-over-year growth rate of 7% which marked the fourth straight quarter of revenue deceleration for the software company in the last year. The good news is that DocuSign’s customer base is still growing – the software firm had 1.56M customers on its platform, showing an 11% year-over-year growth rate.

DocuSign

At the same time, there are revenue risks for DocuSign and these risks have been reflected in a moderating top-line growth, especially since the pandemic.

DocuSign’s problem is that existing customers spend less money on the platform. This spending can be measures by a figure called dollar net retention, which is measures how quickly a software company is growing its revenues organically. In the past, DocuSign’s dollar-based net retention rate has fallen, and net retention risks specifically have been a reason why I adopted a hold rating for shares of DocuSign in Q4’23.

In the most recent quarter, DocuSign’s dollar-based net retention rate was 99%, showing a 1 PP increase over the previous quarter. However, a retention rate below 100% still indicates that customers are not increasing their spending, which will remain a risk for DocuSign going forward. Only if DocuSign were to grow its dollar-based net retention to a rate of 100% or, ideally, higher than I would, I consider a rating upgrade to buy.

Strong free cash flow offsetting retention risks

DocuSign is a very free cash flow-profitable software company and generated $232M in free cash flow just in the last quarter. From a margin point of view, DocuSign is doing well despite facing downward pressure on its revenue growth and net retention rate: the company kept 33 cents for every dollar it brought in free cash flow in the first fiscal quarter. While the free cash flow margin didn’t change much on a year-over-year basis (+1 PP Y/Y), DocuSign nonetheless squeezed out 8% Y/Y free cash flow growth.

|

$ in M |

Q1’24 |

Q2’24 |

Q3’24 |

Q4’24 |

Q1’25 |

Y/Y Growth |

|

Total Revenue |

$661 |

$688 |

$700 |

$712 |

$710 |

7% |

|

Free Cash Flow |

$215 |

$184 |

$240 |

$249 |

$232 |

8% |

|

Free Cash Flow Margin |

32% |

27% |

34% |

35% |

33% |

– |

(Source: Author)

DocuSign’s valuation

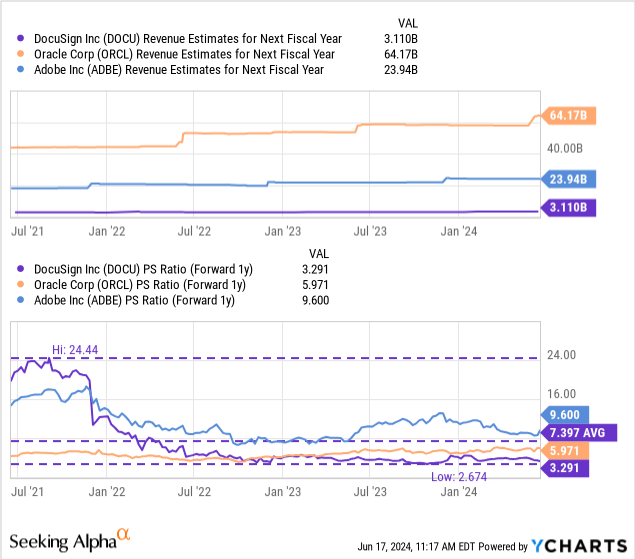

DocuSign’s shares are valued at a P/S ratio of 3.3X, which is significantly below the company’s long term price-to-revenue valuation average of 7.4X. Shares have been valued highly in the past, especially during the pandemic, but with slowing top-line growth, investors have also reevaluated DocuSign’s valuation factor. Other software companies with comparable software offers, like Adobe (ADBE) and Oracle (ORCL) have much higher valuation ratios, but these companies have longer operating histories, are also profitable on a net income basis and are growing faster.

Adobe is expected to grow its top line 13% in FY 2025 compared to 11% for Oracle and 6% for DocuSign. I believe shares of DocuSign could trade at the industry average P/S ratio of 6.3X in the long term, but only under the condition that the company improves its retention rate and advances its product offer to such an extent that the company benefits from stronger revenue growth. If DocuSign traded at the industry P/S ratio of 6.3X, shares could have a fair value of up to $95.

Risks with DocuSign

There are two major risks that I see with DocuSign. The first relates to its slowing top-line growth rate and the second related to the company’s dollar net retention risks, which indicates the potential for negative revenue growth. If customers continue to slow their spending on the DocuSign platform, there is a real chance that the company’s top-line growth will fall into the low-single digits in the near future. Only if DocuSign managed to reverse its dollar-based net retention trend in a sustainable manner (at least three consecutive quarters of retention growth with a rate above 100%), then a rating upgrade may be justified, in my opinion.

Final thoughts

DocuSign continues to see slowing revenue growth which is, in part, related to weakening customer monetization for the software company, as shown by a dollar net retention rate of 99%. DocuSign, however, is quite profitable on a free cash flow basis and delivered solid FCF margins in the last quarter. To a certain extent, DocuSign’s high FCF margins offset weakness in customer monetization, in my opinion, and therefore the firm’s downside potential may also be limited. I could only agree to a rating upgrade to buy if DocuSign were to make improvements in terms of customer monetization and its dollar net retention rate. If it achieves that, I believe shares could revalue higher relatively quickly. As long as that doesn’t happen, however, I will confirm my hold rating for DocuSign’s shares.