Does making more money make you happier? Turns out the answer is no, not really.

But let’s tease this out a little bit. Let’s explore why this might be the case because it goes against our instincts on the subject. After all, money impacts every single one of our lives. If more doesn’t make us happy, does money and happiness intersect at all? Let’s dive in.

Finding Happiness

Happiness has been on my mind a lot lately. In fact, I recently spent seven days in Abu Dhabi at a conference centered on the topic of happiness. It explored questions like “How can we live happier?” and “How can we help our family and loved ones become happier?”

As doctors and scientists, I don’t think many of us realize that there is a formula for greater happiness. So wouldn’t it be worth finding out how to better ourselves and those around us?

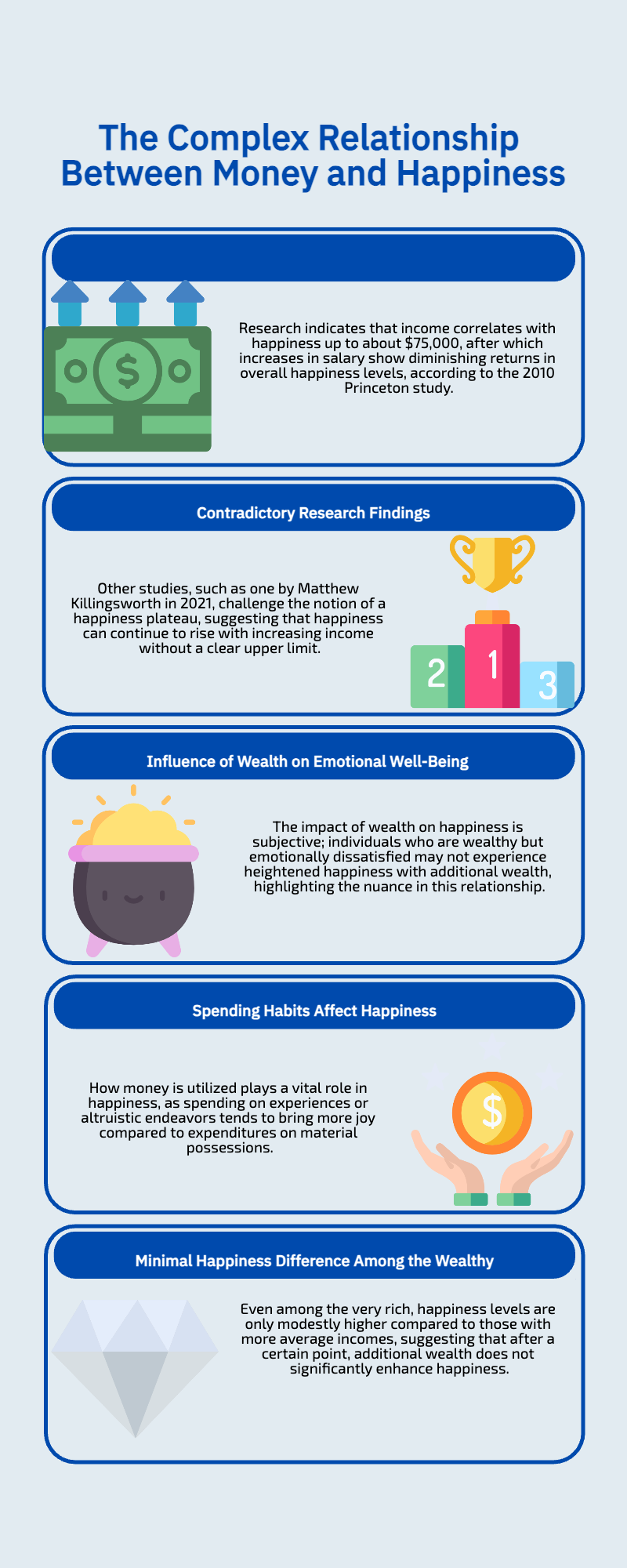

At the conference, of course money came up. Does money make you happy? Lots of folks have their own opinions. Researcher Elizabeth Dunn wrote, “If money doesn’t make you happy, then you probably aren’t spending it right.” And that got me thinking: Is happiness related to how much money you have or is it really about how you use it?

That’s an interesting dichotomy. How much vs. how it’s used. Can either impact our happiness?

The Money-to-Happiness Ratio

Let’s start with how much. A landmark study led by Nobel Prize winner Daniel Kahneman of Princeton University concluded that the money-to-happiness ratio maxes out at $75,000 of annual income. After that, additional income doesn’t increase or decrease one’s overall happiness.

That seems right to me. I’ve learned over time, both through my own experience and from hearing people I’m close to, that money doesn’t actually change who you are. It can’t turn you from sad to happy.

Instead, it seems to amplify who you are but not change your levels of happiness. More money could give you more opportunity to pursue your priorities and values. If you are generous, more money will help you continue to be generous. It simply amplifies your traits.

Spending That Increase Happiness

I believe that money is a tool. Its value is in spending it appropriately and purposefully. Perhaps that’s why science shows there’s a plateau of happiness at $75,000 of income. So if happiness isn’t affected by more money, could how we use it be more important?

Among my favorite books is Die with Zero by Bill Perkins. One of its core ideas is that experiences, especially the ones that we can have while young and healthy, bring us the most happiness and fulfillment. Much farther down on the “what makes us happy” list is just accumulating wealth for a later retirement.

I know that many of us think about our wealth in terms of retirement. There’s some magic number we’ve targeted. Between now and when we retire, the plan is to hit that number (and hopefully not run out of money before we die). Perkins takes issue with traditional perspectives on retirement. He argues that, someday, you’re going to have the money but, by that point, not have the health or energy to be able to spend it and enjoy life.

Perkins calls for the importance of balance—of maximizing the moments you have now while you’re healthy and planning for the future. It’s more of a rebalance, really. The idea is to be more focused on the present moment than most retirement gurus would suggest.

For Perkins, and for me, how you spend your money can bring a lot more satisfaction and enjoyment in your life. It’s not about what you have; it’s about how you use it. Even better, psychological research backs this up. It shows that spending money to travel, engage with your hobbies, learn something new, or spend time with loved ones, will increase your happiness levels.

Experiences bring a smile to our face, especially when spending time with others. Even on a tough day, a memory might flash in our mind to make us laugh, warm our heart, and pick us up a little bit. It therefore seems that how you spend your money can actually be priceless. It can create a cycle of happiness where reflecting on these moments and maintaining a sense of happiness is the standard.

The Spending Spectrum

There’s a spectrum of spending habits. On one end, there are those who seem almost fearful of spending money. They’ll drive a few miles further to the next gas station to save a couple of cents on fuel. They avoid buying anything except what’s absolutely necessary.

Then, on the other end of the spectrum there are those that spend freely. They don’t put much thought into where their money is going. Even if they find themselves under financial strain, they’re still apt to spend money. I don’t mind admitting that I’ve been on both extremes of the spectrum at some point in my life. Maybe the same is true for you.

But if we really understand how we spend—finding a balance between here-and-now experiences and planning for the future—we’re more likely to use money in a way that enhances our lives and increases our happiness.

Use Your Money Intentionally

Here’s a piece of advice. Create a spending plan that aligns with your values. When you do this, you feel like you’re spending intentionally to bring your life what it needs while making room for joy and fulfillment.

Maybe you can adjust your spending, even if in small ways, to create a better alignment with your values. I’ve found that this can make a big difference in happiness. Doing this will improve your understanding of how you spend your money. It will marry your finances with a greater purpose.

But this is just one idea. There’s no silver bullet, no single strategy to help you increase your happiness with how you spend your money.

I encourage you to talk with other like-minded people on how they boost their happiness. Here in the Passive Income MD community, you can do just that. Whether in our Leverage and Growth Accelerator Community or at the Passive Real Estate Academy, we talk about money, life, financial freedom, happiness, and everything else that ties into what it takes to achieve the life of one’s dreams. We hope to see you there!

Don’t be a stranger, and in the meantime I hope that you stay motivated to amplify the best parts of who you are.

Peter Kim, MD is the founder of Passive Income MD, the creator of Passive Real Estate Academy, and offers weekly education through his Monday podcast, the Passive Income MD Podcast. Join our community at the Passive Income Doc Facebook Group.