Daniel Grizelj

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note’s date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Leave Your Emotions – And Opinions – At The Door

The always-good Josh Arnold posted a great note recently, covering the 3x daily levered ProShares UltraPro QQQ ETF (NASDAQ:TQQQ). You can read his note here.

By way of a refresher, allow us X = 12.6%; SPX = 8.0%; DJI = 4.1%.

Now, an exchange-traded fund to remind you that the NASDAQ 100-Index (NDX) is diversified by sector to some extent, representing 100 of the largest non-financial companies of the Nasdaq, about 50% Tech, 10% Communications, and 40% broader market. As a result, the Tech and Comm names, which lead the market, also lead TQQQ in the direction that the market will follow. In the later stages of a bull phase, when the market broadens out, the remaining 40% of holdings allow TQQQ to be even more productive. Since the inception of the Nasdaq 100 on Jan. 31, 1985, it has led the Dow and the S&P, producing greater growth than either of the other two major market indices. Average Annual Total Return for the three indices over that period: NDs aren’t much of a dinner party topic, but at least amongst stock bores like ourselves (and you, most likely, since you’re reading this!), leveraged ETFs inspire hate, fear, and awe in apparently equal degree. Mr. Arnold explains why in that note above. In essence, if you choose to own a leveraged ETF, leverage will do what leverage is designed to do – it will amplify matters. In the case of TQQQ, a fund that’s intended to deliver 3x the daily percent change of the Nasdaq-100, if the unlevered ETF QQQ is up 1% on the day, then TQQQ will probably be up around 3%. If QQQ is down 1% on the day, TQQQ will probably be down around 3%. There are exceptions – the fund pays a dividend which means some days around that time don’t see a 3x return vs. the QQQ – but most days this holds true.

It doesn’t take a genius to work out the appeal and the worry about owning this fund. During periods when the Nasdaq is only up, TQQQ will print money for you all day long. During periods when the Nasdaq keeps committing acts of self-harm, TQQQ will break your heart. And, worse in some ways, if the Nasdaq is range bound, sideways, but with quite some daily volatility, then after a month of that kind of thing QQQ might be back where it started, but TQQQ will have dropped, maybe materially because the compounding is working against you, not for you.

So what do you do? We think there are three ways to take advantage of this ETF.

1 – Stay away from it. It’s a tricky beast and requires careful observation and sometimes active intervention, and not everyone has the time, appetite, or unemotional frame of mind to do this well. Nobody, so far, has gotten poor by simply by dollar-cost-averaging the S&P 500 or, for that matter, the Nasdaq-100 – don’t need to overcomplicate things.

2 – Buy a moderate allocation at major market lows, and hold on for dear life. Take gains when you’ve used up all the stomach acid you can bear to assign to this thing.

3 – Learn to hedge, decide the timeframe of market volatility that you plan to manage to (hours, days, or weeks are all suitable we think), then, buy a modest allocation of TQQQ and get ready to protect gains when a downturn comes by hedging using its inverse, SQQQ.

(3) It’s easy to say, hard to do, but if you can learn and sharpen the skill it can provide a lifelong new tool set for trying to make money from the market.

If you choose (3), this is a method we think can work.

Get Good At Technical Analysis

Insofar as markets actually relate to reality at all, they certainly don’t do so in a way which can be predicted and measured. So when it comes to hedging, we think technical analysis is the key basis.

So, if you’re interested in getting good at (3), then, firstly, find a technical analysis method that works for you. Our preferred analysis methods are Elliott Wave and Fibonacci tools. But there are many other systems that are effective, you just have to find one with which you are comfortable and which gives you reasonably effective results. What you’re looking for is how to spot likely moves to the upside and moves to the downside over a timeframe that matters to you. Again, hours, days, or weeks make sense to us. No technical analysis method is perfect, as you know. You just want to be able to make a reasonable guess at which is the dominant trend and which is the countertrend.

Draw Out An Idealized Trading Plan

Then, sketch out a schematic for how your trading plan may work.

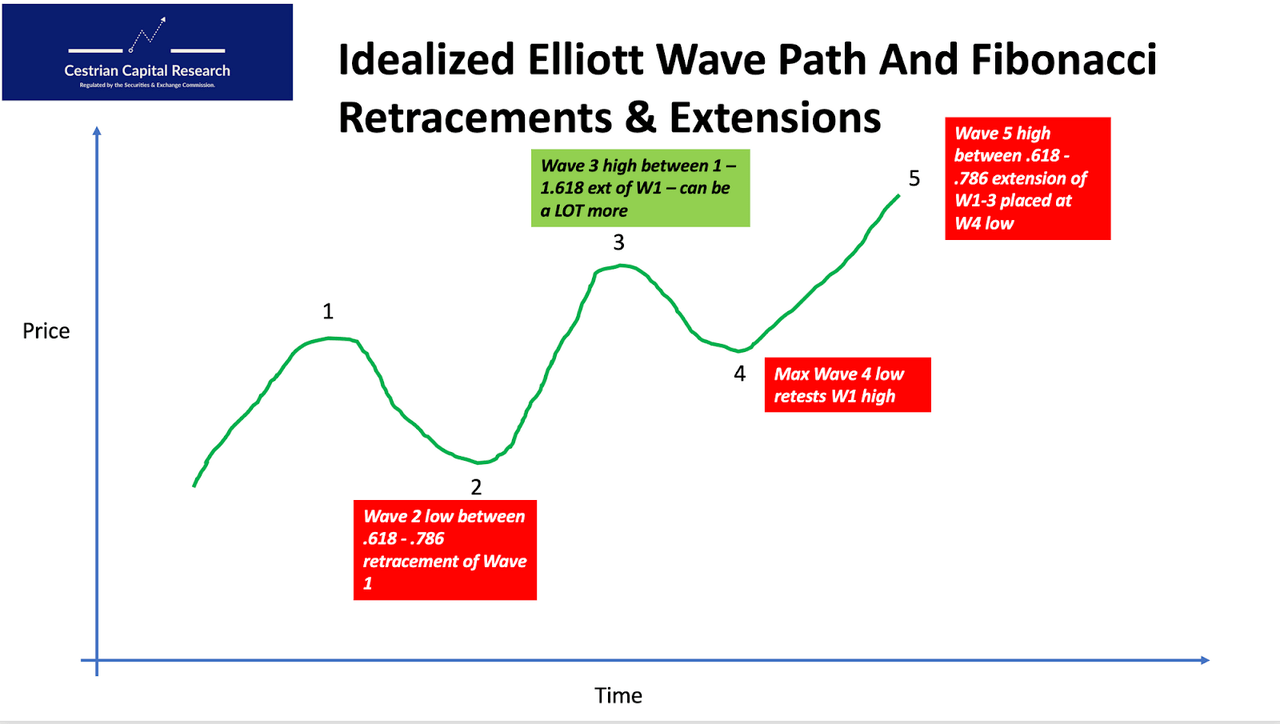

Here’s ours – this is for any major liquid market. The Nasdaq is a perfect use case. This is just a pro forma model of what a bullish move in a liquid market looks like through the lens of Elliott Wave and Fibonacci measurements.

Idealized Market Cycle (Cestrian Capital Research, Inc)

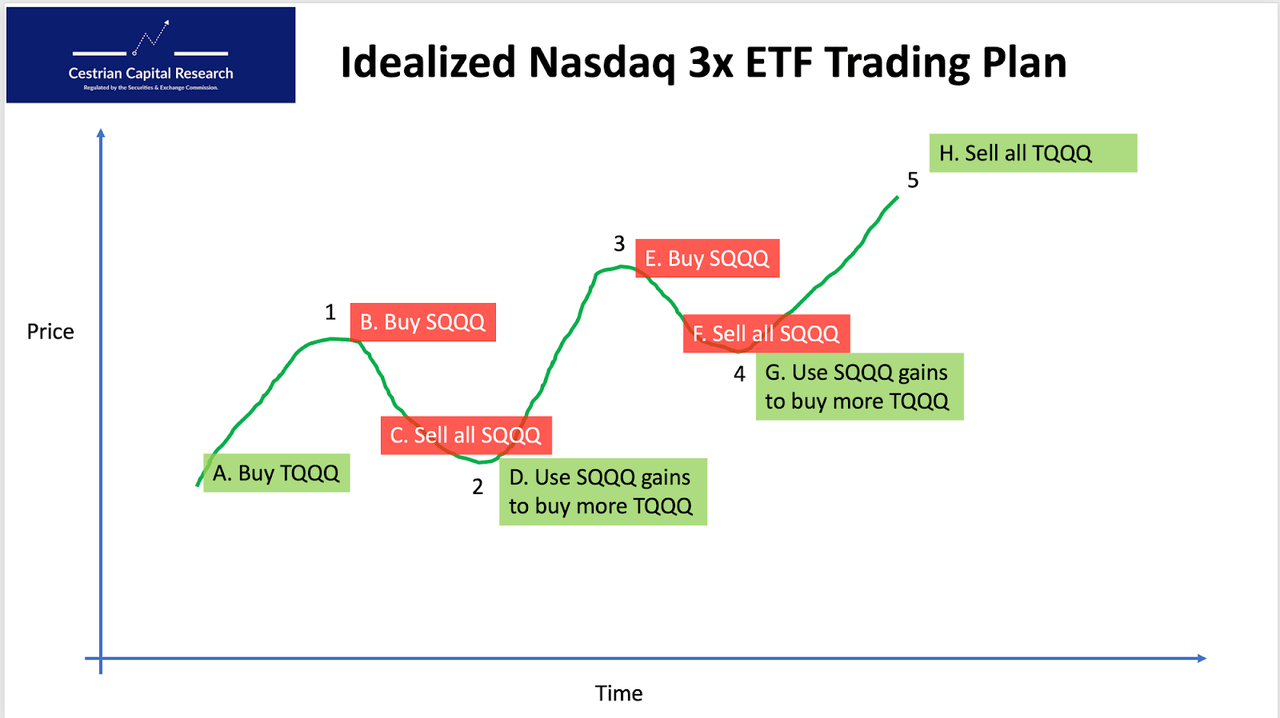

If you were to apply this idealized plan – and, note, idealized plans never come to fruition – to TQQQ and SQQQ, here’s how it would look:

Idealized Trading Plan (Cestrian Capital Research, Inc)

The timeframe would, again, be down to you. Hours, days, weeks in our view.

Forget Your Opinions About What Should Happen

Nobody cares if you think the market should go up, down or sideways tomorrow. Even one determined member of the Big Money set cannot in and of themselves move a market as liquid as the Nasdaq. Predicting which way the market is going to move based on exogenous factors is a fool’s errand in our view.

Rates up, equities down? Sure, except the data doesn’t support that argument over say a 1-2 year period. The Nasdaq is just a little bit below its all-time highs, and the 20-year Treasury yield is also pushing up strongly.

QQQ vs US20Yr Yield (TradingView)

Sometimes rates go up when equities go down, sometimes the reverse, and sometimes they move together. There’s no rule of thumb that’s useful beyond very short periods of time.

Earnings up, stocks up? The S&P 500 has more or less flat earnings over the last couple years. The bull market since the lows of 2022 has been fueled primarily by multiple expansions, not earnings per se.

And so on.

Execution Is Everything

If you’re aiming to take advantage of TQQQ on the long side, and protect against its brutal drawdowns in periods of market weakness, trying to guess when those periods will come is, in our view, too difficult. It’s better achieved by the technical analysis method of your choice. When you chart starts to show market weakness, if you hold only TQQQ, consider adding say a 25% or 50% hedge using SQQQ. So, if you held $10k of TQQQ by market value, a 50% hedge would mean buying $5k worth of SQQQ at that moment in time.

-

If your technical analysis is correct, your SQQQ will increase in value whilst your TQQQ is dropping. At which point you would look to cash in your SQQQ, ideally when you thought a market low was in (bearing in mind your choice of timeframe), and then take the profits and use them to buy additional shares of TQQQ, thus adding to your long position at a lower cost than the recent peak.

-

If your technical analysis is wrong, TQQQ will go up but SQQQ will go down. But your blended position will still go up, because you own 2:1 TQQQ : SQQQ. You can decide what to do about that – cut your losses on SQQQ probably.

If you get bogged down and you can’t watch the market? Want to not have a stomach ulcer? Hedge in whatever ratio helps you do that. Hedging 1:1 – in the above case that would mean $10k TQQQ and $10k SQQQ – suspends time whilst you go do your other thing – then you can come back and pick up the pieces with no overall damage to your account.

If you get absolute conviction that a major selloff is afoot? Overhedge short – say 2:1 SQQQ to TQQQ – or just go 100% SQQQ having already cashed your TQQQ gains.

Lifelong Learning

All of the above constitutes a wonderful trading strategy when executed correctly. It isn’t easy and it requires practice to get good at it. We think it’s worth learning the method. It’s a way to enjoy the benefits of that 3x fund leverage without always also being at its mercy.

Any questions, reach out in comments below!

Cestrian Capital Research, Inc – 15 April 2024