Art Wager

Investment Thesis

Since I took up Dorian LPG (NYSE:LPG) coverage a year ago and gave it a Hold rating, the stock has had a total return above 40 percent. Just three weeks after I posted that analysis, Hamas conducted the most severe attack on Israel in years. A month later, the Houthi rebels of Yemen hijacked a cargo ship in the Red Sea and effectively closed off the Suez Canal for most of the world’s shipping.

That’s how quickly the basis of a thesis could fall apart.

Three quarters later, it seems unlikely that the Red Sea transit will be possible in the short to medium term. While the Panama Canal has returned to some normalcy, with a new reservoir planned to improve reliability, it will remain a problem for LPG shippers. Those factors and muted fleet growth in the coming years will support a business such as Dorian’s.

U.S. LPG exports are set to increase, and demand from essential markets in China is forecast to grow, too. Combined with Dorian’s healthy balance sheet, the business looks promising.

The recent equity raise rattled markets, sending the share down 10 percent, but for reasons explained below, this reaction was overblown. Dorian’s move was sensible, providing an entry point for investors, as the price was pushed down to approximately its NAV. My verdict: LPG is a Buy.

Short Company Overview

Dorian LPG is an NYSE-listed LPG shipping company incorporated in the Marshall Islands. It owns and operates 25 VLGCs, having an average age of 8 years, deployed in a pool co-owned with MOL, providing scale.

Two arbitrages underpin a business such as Dorian LPG’s:

The East-West arbitrage is the difference between LPG prices in the U.S. and Asia. A widening arbitrage provides healthy freight rates.

The LPG-naphtha spread. Steam crackers use a mix of feedstock to produce essential substances such as olefins, ethylene, and propylene, which have many uses. When LPG is cheaper to use as a feedstock than naphtha, there is a basis for LPG exports.

About 50 percent of LPG is used for cooking and heating in residential and commercial settings. This is a relatively stable demand, as cooking and heating are primary needs. Approximately 40 percent of demand comes from the petchem industry (steam crackers and PDH plants (propane dehydrogenation)). The remaining LPG is used in niche segments such as autogas, farming, and off-the-grid businesses.

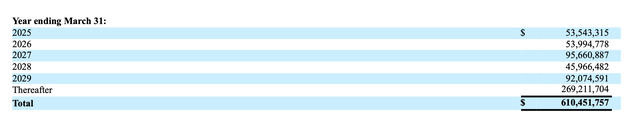

Debt: No Balloon Payments Coming, and LPG Can Amortize

As many shipping companies have done during the last few years, LPG has greatly de-leveraged its business. As of fiscal Q1 2025 (June 30, 2024), it had long-term debt of $690 million on total assets of $1.9 billion (debt-to-capital ratio of 36%). Add its $353 million cash on hand, and we’ll see a net debt ratio of just 19%.

LPG’s debt is structured around amortizations rather than balloon payments:

Future debt payments (FY 2023 report, p. F-23)

Additionally, it expects payments of about $40 million annually on its operating leases (Note 8, FY25 Q1 report). In summary, it has a debt service requirement of roughly $90 million in 2025-2026 and $130 million in 2027.

Let’s review the past few years’ cash flows to get an idea of how LPG can sustain these payments:

| FY2023 | FY2022 | FY2021 | |

| Cash Flow From Operations | 388.4 | 224.1 | 118.7 |

| – Cash Flow From Investing | (34.8) | (76.3) | 68.8 |

| = Free Cash Flow | 353.6 | 147.8 | 49.9 |

| For context: | |||

| Average TCE ($/day) | $65,986 | $50,462 | |

| Average BLPG1 Ras Tanura-Chiba ($/ton) | $105 | $87 | |

| Fleet utilization | 93.9% | 95.0% |

In its latest report (Fiscal Q1 2025 – March-June 2024), Dorian reported slightly lower figures, at

- TCE per available day: $49,911

- Utilization: 90.4%

In the same period, the BLPG1 rate has hovered around $100/ton, comparable to FY2022 results.

The LPG rates exhibit seasonality: The first two quarters are generally weaker than the latter in the calendar year. Consider this graph from Dorian’s latest investor presentation, which I’ve annotated:

LPG rate seasonality (Investor presentation. Annotated by author)

In conclusion, current market conditions are conducive to LPG’s ability to service its debt. As we can see, calendar year 2024 has had a softer start than last year. It is reasonable to expect rates to lift slightly in the previous few months of the year.

Fleet Strategy: Upgrade, Rather Than Renew and Increase Fleet Size

Dorian’s newest (owned) ship is the dual-fuel Captain Markos, which it took delivery of in early 2023. On Feb 1, 2024, the company reported its fiscal 2024 Q3 earnings and announced that it had ordered a VLGC/VLAC for delivery in late 2026. LPG said it “believe[s] in the long-term fundamentals in the LPG market and the potential for ammonia transportation.”

Consider Dorian’s fleet composition:

Dorian LPG’s fleet composition (Dorian LPG website. Furnished by author)

Most of its owned fleet was delivered close to 10 years ago, making the average age of its owned fleet about nine years. Adding in its time-chartered vessels, the average age goes down to 8 years. In other words, it has not prioritized newbuilds recently, but rather chartered in vessels.

With a useful life of 25 years, a fleet of 25 vessels must replace one ship a year to maintain its average age. LPG appears to be doing this.

I don’t fault it for not adding more newbuilds at this point. Its fleet is younger than the world average of about ten years. The uncertainty regarding future propulsion also requires prudent decisions. Vessels coming on the water today will still sail in 2050 when IMO requires a 50 percent emission reduction. While alternative fuels, such as ammonia, methanol, and renewable natural gas, will play a role, I have yet to find a credible forecast that fossil fuels (compliant fuels, LNG) will be entirely out of the mix by 2050. Instead, it will still play a significant role. That leaves emissions reductions by using efficiency gains as a genuine option.

Dorian is doing just that. Recently, it took its sustainability efforts one step further. Spearheaded by the CEO’s son, who, as Chief Information, Security, and Sustainability Officer, is building competencies to take over the helm one day, it elaborated on its sustainability strategy. It reported successful fuel savings on new silicone paint on five vessels and a raft of other measures it is undertaking.

The takeaway is that this company is proceeding cautiously and hedging its bets. It is not looking to grow—it doesn’t need to. It achieves scale with the Helios Pool—and is not going wild on alternative fuels, either. Its VLGC/AC will carry LPG and ammonia, and the company has not discussed its propulsion systems.

Issue of New Shares: Maybe Not Such a Bad Idea

In June came the news that LPG would issue 2 million new shares. The share almost immediately dropped about 10 percent on the news. Shipping investors like dividends and buybacks, not share issuances. Greg Miller of Lloyd’s List called it “a well-valued, larger-cap shipowner with a strong balance sheet selling shares to fund corporate needs from a position of strength.”

Why would LPG issue new shares from a position of strength (healthy balance sheet, share price at an all-time high, positive market sentiment)?

By utilizing its high share price, it could raise capital ($89 million in the end) without causing too much dilution of existing shareholders. It preserves its leverage ratio and avoids taking on future interest payment commitments, which would have been the case had it issued debt.

Instead, it has secured financing. LPG did not disclose what it intends to do with the funds.

Finally, this move is also congruent with LPG’s relentless messaging on its dividends. They are “irregular,” although it has been somewhat comical reading about its regular declarations of irregular dividends. But it’s true: Cash flows in shipping are unpredictable. Given enough time—now we’ve seen a market upcycle—cash flows and, thus, dividend capacity will deteriorate.

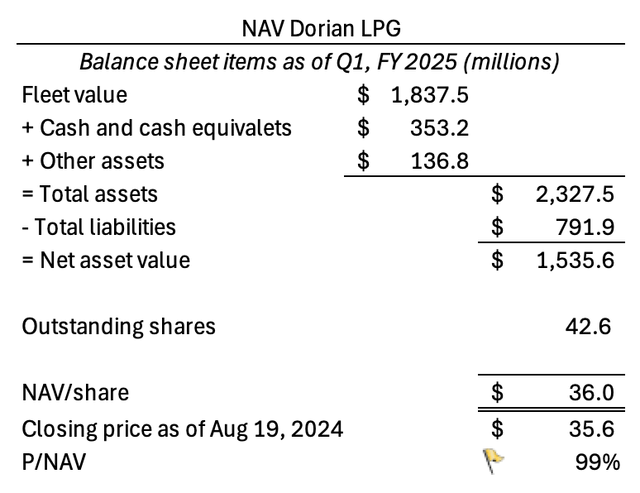

Valuation

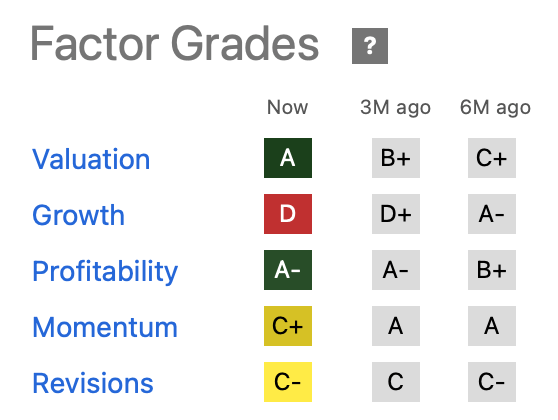

LPG trades in the middle of its 52-week range currently and is rated thus by Quant:

Quant Ratings (Seeking Alpha Quant, Sept 10, 2024)

The stock has seen improvements in valuation, but otherwise, it is a mixed picture.

As it happens, recent figures are available on the values of a fleet similar to LPG’s. Avance Gas recently sold its VLGC fleet to BW LPG. The 12 vessels, built between 2015 and 2022, were valued at $1,050 en bloc ($87.5 million per vessel). As this is a recent deal, and the characteristics of the ships are similar to Dorian’s, I will use this as an anchor point to value LPG.

Using the most recent available figures, LPG is estimated to trade approximately at NAV as of September 10, 2024:

NAV estimate, Dorian LPG (Author’s calculation)

Market Outlook

The U.S. is the largest producer, and Asia is the largest consumer.

The U.S. delivers more than 50 percent of global exports of LPG, while Asia takes up about 60 percent of demand for seaborne exports worldwide.

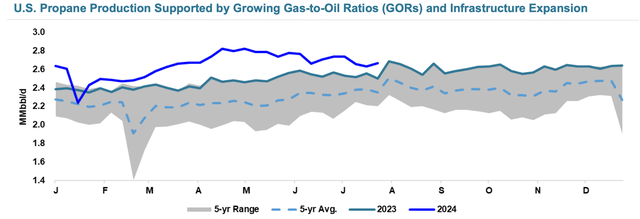

Supply: U.S. Production Expected to Grow

It’s important to remember that LPG has never been produced – anywhere.

It is a by-product of oil and gas, and one should look at oil and gas production forecasts. Wood Mackenzie recently wrote a bullish report, expecting the U.S. to add 1 million barrels/day by 2026.

Increasing gas-to-oil ratios support further production growth:

Production figures (LPG investor presentation, Aug 2024)

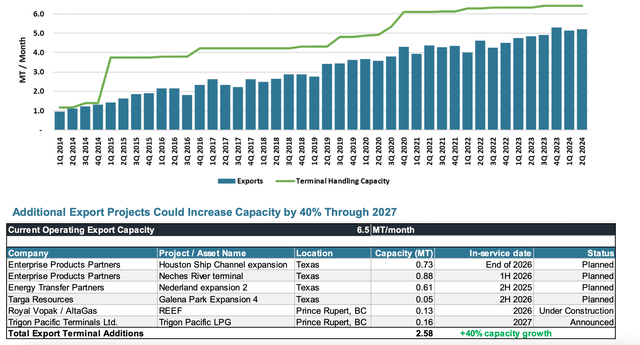

Furthermore, it expects export capacity to increase by 40% through 2027. Note also how exports have grown fivefold in ten years:

LPG export capacity (Investor presentation, 2024)

Demand: Continued Growth

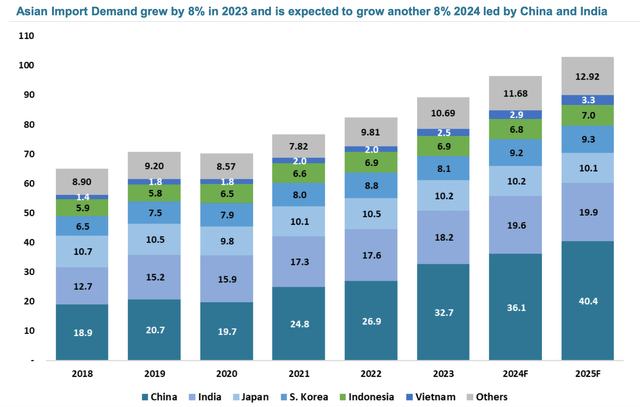

Chinese and Indian import demand is expected to continue increasing. If the 2025 forecast hits the mark, China and India will have increased demand by 50% and 25% since 2020.

Demand outlook through 2025 (Investor presentation, Aug 2024)

Fleet Growth: Two Years of Low Growth Coming

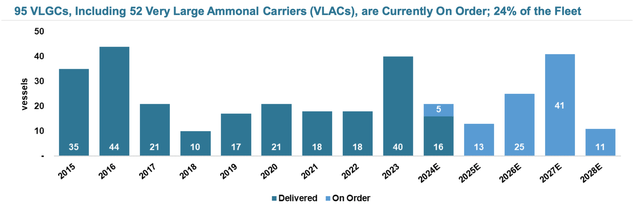

There was some concern last year, as many new ships were coming on the water. However, that additional capacity seems to have been absorbed by demand. In the next two years, relatively few ships will come on water. Shipyards are also more or less fully booked until 2027, with skills shortages and high newbuilding prices creating additional entry barriers.

Additionally, LPG cites estimates that 87 and 97 ships (about 20 percent of the fleet) are due for maintenance in 2025 and 2026, respectively. Assuming 300 trading days and a 20-day average dry dock length equates to a 2 percent supply reduction.

Global order book (Investor presentation, August 2024)

2027, though, could be an exciting year, as 41 ships are expected to come on the water. That’s a ten-year high. Given the massive export growth expected in the following years, that additional supply could be absorbed – if the demand exists. Also, 15 percent of the world fleet (59 ships) is aged 20 or older. If the demand is not there in 2027, we could see more scrapping.

Conclusion

This article has analyzed marine LPG transport company Dorian LPG’s business and considered how the factors driving its business could develop over the next few years. It has found that the market conditions are favorable. Maritime choke points, like the Red Sea, seem unlikely to sort themselves out soon, and fleet growth will remain muted. Dorian LPG is a Buy.