Manuel Milan

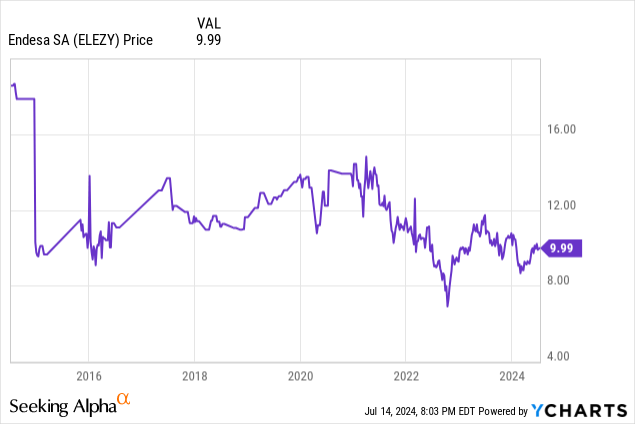

Endesa (OTCPK:ELEZF)(OTCPK:ELEZY) is continuing to reduce its exposure to thermal generation sources, which is consistent with a pan-European effort by utilities to do so. Remaining thermal exposure is quite limited at this point, but the declines YoY have had a meaningful impact on overall production, affecting EBITDA. Moreover, margins have been damaged by the ongoing YoY declines in electricity prices, which we mentioned in our last coverage. Ultimately, while some might be excited by the relatively depressed price action and want to take action, particularly as headline multiples of around 6x EV/EBITDA seem compelling, we would stay away due to large nuclear provisions, with nuclear phaseout in Spain likely to happen with no extensions expected in 2027. The cost to Endesa will be around half of its current market cap.

Latest Results

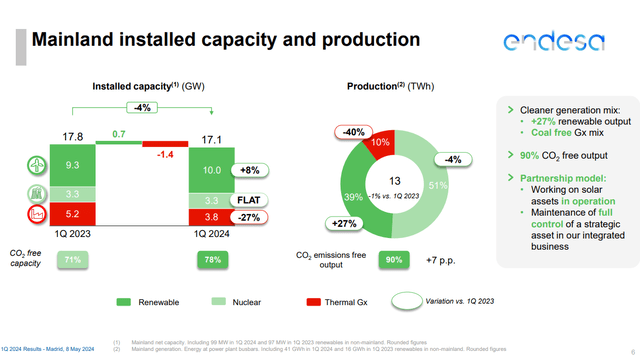

The big effect on the results is the reduction in thermal production.

Slight capacity decline driven by thermal (Q1 Pres)

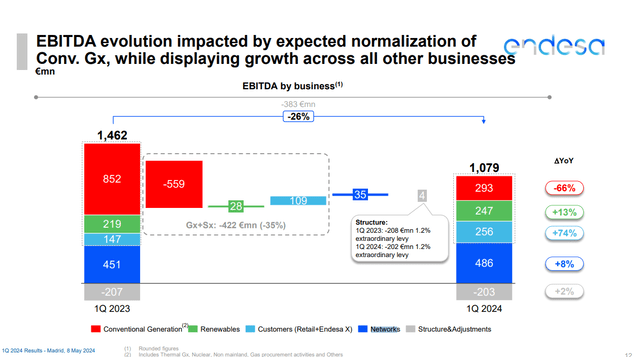

The shift to renewable energy is going fine, with continued increases in production from renewable sources. But the substantial decline in thermal production of 40% has had a significant impact on EBITDA, as the sole reason for EBITDA declines, with Endesa’s other segments doing fine. Note that the generation business is also characterised by significant operating leverage.

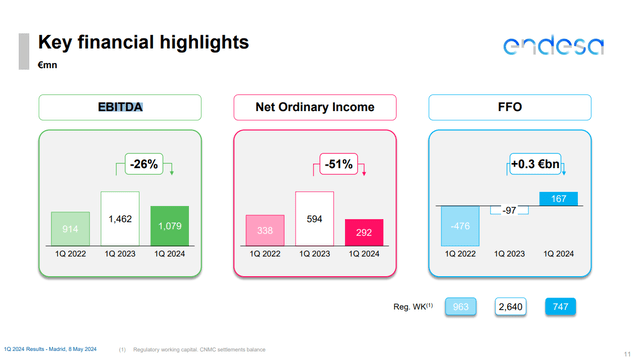

EBITDA down Yoy (Q1 Pres)

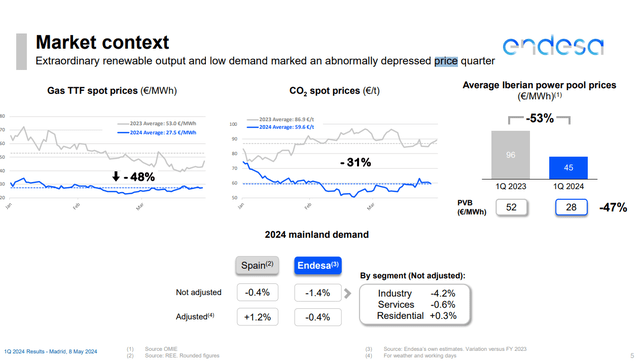

On top of reduced production and capacity, there is also a margin issue in the generation business. Electricity prices were at very high levels, particularly at the beginning of 2023 on the tail end of the gas hoarding after the breakout of the Ukraine war in 2022.

Lower electricity prices (Q1 Pres)

Networks is at run-rate the biggest segment by EBITDA due to the negative operating leverage and unit margin effects on the generation business.

EBITDA Segments (Q1 Pres)

Networks is focused on distribution in various provinces in Spain. This should put them under the CNMC, which is the Spanish regulated utilities authority. They are generally not very friendly to shareholders, and their system works a bit differently than in other countries, wherein they have more direct control over remuneration. Gas assets were hit worse in the last tariff change with a 10% decline slated over a 5 year period, but transmission and distribution also had to eat a 5% reduction in remuneration over 5 years, of course, having to foot higher costs as inflation kicks in. Endesa has done a good job though increasing Networks’ EBITDA thanks to cost management, in particular lower headcounts, able to generate growth in the face of lower remuneration every year by about 1%.

Bottom Line

We’re not fans of Endesa’s valuation due to the outstanding burdens from what will be a costly nuclear cleanup once its capacity, responsible for more than half of Spain’s nuclear energy capacity of around 7.1 GW, starts getting phased out in 2027. Costs could become higher as well, which also reduces the likelihood of any extensions, despite the increasing concerns around energy scarcity. Endesa is unfortunately, therefore not the best way to play nuclear either. Costs could be around 10 billion EUR in total, around half of the current market cap and 33% of the current Endesa EV. Where its P/E is in line with other good picks like the another Iberian utility, EDP (OTCPK:EDPFY) that doesn’t have these sorts of burdens, we’d rather park our money elsewhere.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

If you thought our angle on this company was interesting, you may want to check out our idea room, The Value Lab. We focus on long-only value ideas of interest to us, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our gang could help broaden your horizons and give some inspiration.