bashta

Epsilon Energy (NASDAQ:EPSN) has long been in an enviable position. This company continues to report a relatively large cash (and short-term investment) balance for its size, without any long-term debt. Since it does not operate any of its projects, there is not a lot of need for personnel.

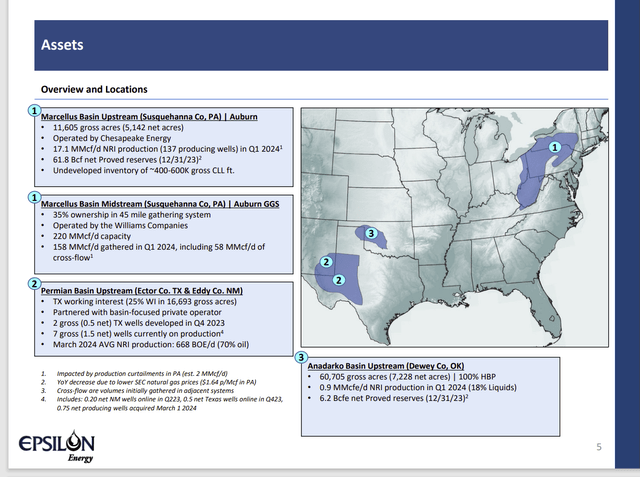

Meanwhile, the operators of the projects are familiar names. The last article touched upon the quality this brings to a small company investment idea like this one. Chesapeake Energy (CHK) handles the Marcellus acreage, while Williams Companies (WMB) operates the midstream operation. Rarely does a small company like this manage to attract the attention of such “name” operators. That gives this company a credibility that few companies its size have. It also means that for investors, not only is the balance sheet relatively less risky, but the corporate strategy has less risk than is typical for small companies similar to this one.

Marcellus

For a long time, this company had one main asset. That asset was the dry gas production in the Marcellus run by Chesapeake Corporation. That asset included the midstream operations run by Williams Companies. Long-time readers may remember when this was the only business that the company engaged in.

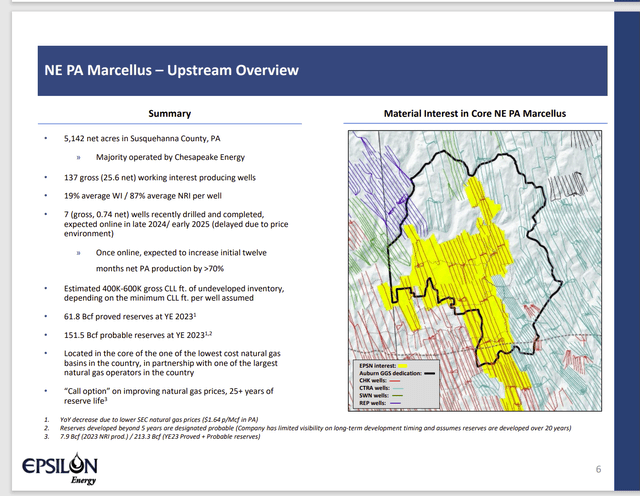

Epsilon Energy Summary Of Marcellus Operations (Epsilon Energy First Quarter 2024, Earnings Conference Call Slides)

Management did mention that some production was shut-in due to low natural gas pricing. The Marcellus basin is oversupplied and therefore prices are weaker here in what is widely regarded as a weak natural gas pricing environment. What will likely help the situation is the startup of the Mountain Valley Pipeline because that pipeline will get natural gas to a market that is not nearly as oversupplied as this one.

Management did mention in the quarterly report that they are expecting more natural gas production in the second half. This may be a confirmation that seems to prevail in the industry that natural gas prices will strengthen in the second half of the fiscal year. That view appears to be aided by the hot start to the summer.

The slide shows the Williams Company operated pipeline. This combination of upstream and midstream led to earnings that have a lower volatility in this area than was the case with pure upstream operators because the midstream operations provided a steady and fairly predictable source of income.

Probably the new item with the midstream business was a brief mention of extra midstream capacity that is available when the time comes. Pipelines can often accommodate additional volumes without a lot of capital costs needed for that addition. In this case, the idle capacity is likely caused by the low natural gas prices. It is a source of additional income when natural gas prices recover.

Permian

This is a relatively new growth area, and it marks a management desire to add more valuable liquids to the production mix of the company.

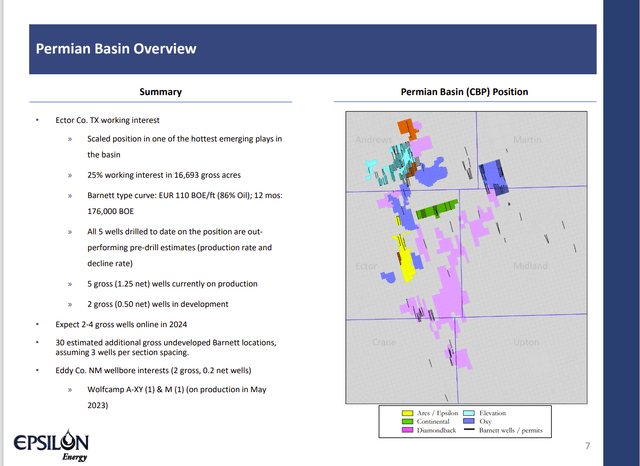

Epsilon Energy Permian Business Summary (Epsilon Energy First Quarter 2024, Earnings Conference Call Slides)

The Permian has the largest single amount of capital allocated to it. The current commodity price environment actually has some very favorable payback characteristics, even for small operators.

Many times, these smaller operators do not have access to the latest technology, nor do they have the acreage to take advantage of longer, more profitable wells. Therefore, the commodity price environment is very important so that they can hedge to ensure a minimum well profitability for the capital dollars spent (if they feel they need to).

On the other hand, some operators do reasonably keep up with technology advances, even if they are not at the leading edge. The prospects above appear to be more than reasonable.

Oil can be a valuable addition to the production mix that often varies independently with natural gas. This should allow Epsilon to have better profitability in a wider variety of commodity price scenarios.

Anadarko

The company has had operations in Oklahoma for some time. So far, it appears management has not felt any justification for investing any money in this part of the business. Therefore, this acreage could at some point be sold in the future, should the current decision persist.

The acreage could benefit from the strengthening of natural gas prices as production continues to decline until supplies of natural gas are low enough to justify a natural gas pricing recovery.

This acreage could also benefit from the increasing ability of North America to export natural gas as more of these exporting projects come online over the next two years.

But for the time being, this acreage does not appear to be a material contributor to the company’s future.

Summary

Epsilon Energy is slowly diversifying away from the oversupplied Marcellus natural gas basin. The startup of the Mountain Valley Pipeline may improve the basin pricing in the future.

Epsilon Energy Map Of Operations And Summary Of Material Business Considerations (Epsilon Energy First Quarter 2024, Earnings Conference Call Slides)

In the meantime, the capital expenditures are largely heading to the Permian, where there are hopes of adding significant oil and liquids production to the production mix to help offset some of the natural gas pricing weakness.

Should natural gas pricing improve as much as many in the industry expect in the second half of the fiscal year, this company could see substantial production growth not only in the Marcellus production, but also from new wells brought online in the Permian.

That likely means that earnings for the current fiscal year are back end loaded. We may, as investors, see the effects of a cyclical low when second quarter earnings are reported for this company. The expected growth could overshadow industry conditions even if weak pricing persists longer than expected.

Investment Strategy

Epsilon Energy is a small company with a stellar balance sheet. The debt free balance sheet combined with a significant cash and short-term investments balance should significantly mitigate the risk of a small company investment.

Similarly, the partnership with some well-known partners like Chesapeake Energy and Williams Companies as operators will likewise minimize that small company risk.

For that reason, the strong buy remains for this company, as it may interest a lot of investors that normally would avoid a small company.

With that in mind, the market is not exactly very efficient when it comes to small company stocks. Therefore, this stock can remain significantly valued at a different valuation from fundamentals for a long period of time. This can frustrate holders.

However, the conservative strategy of no long-term debt should allow a buy and hold investor to reasonably hang onto this investment throughout the business cycle. The acquisitions would indicate a long-term growth strategy is underway that should eventually result in a more efficient market for the stock, as well as more attention from Mr. Market in general. The timing of that would be uncertain, though.

So far, cash generated has been invested in various ventures that allow for less dependence upon the Marcellus business. The expansion of the business has succeeded to the point where a dividend is now paid to investors.

A company like this should be bought and held until the story changes or until the company attracts enough attention when it gets larger that it is no longer a bargain. That can take some time and some investor patience. But a no-debt company rarely runs into serious financial issues.

Risks

Any upstream company is subject to the volatility and low visibility of future commodity prices. In this case, the no debt on the balance sheet allows for this company to possibly shut-in production and cash checks until commodity prices recover. It would take quite a downturn to financially impair this company, in my opinion. Much of the industry would suffer far more.

Any acquisition can fail to meet expectations and slow the company’s long-term strategy of getting larger.

The loss of key personnel can be devastating to a small company. This is one of the few risks that this company shares with other small companies of its size.