Vasyl Cheipesh/iStock via Getty Images

Ethan Allen Interiors Inc. (NYSE:ETD), the furnishings and interior design manufacturer, has reported two quarters of financials after my previous article on the stock. The company’s headwinds have deepened with a weak furnishings industry, but Ethan Allen has overall continued to post healthy financials in a turbulent macroeconomic setting with great margin resilience.

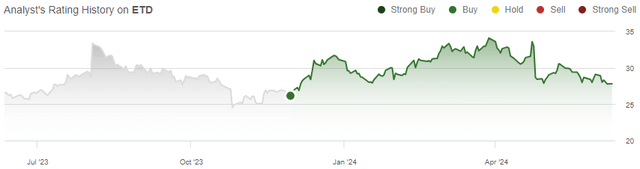

My previous article, published on the 29th of November 2023, was titled “Ethan Allen Interiors: Impressive Resilience”. In the article, I initiated Ethan Allen at a Buy rating due to the company’s great resilience in wide industry turbulence – Ethan Allen posts healthy margins despite a flooding on the company’s manufacturing plant in addition to macroeconomic pressure. Since, the earnings slump has gone slightly deeper than I previously anticipated, and the stock has only returned a total of 3% compared to the S&P 500’s return of 17% since the article.

My Rating History on ETD (Seeking Alpha)

Q2 & Q3 Show Continued Revenue Weakness, Impressive Margin Resilience

The Q2/FY2024 financial report was published in January after my previous article, showing a revenue decline of -17.7% to $167.3 million, and Q3 results followed with a revenue decline of -21.4%. The weak performance is related to a challenging post-pandemic furnishings industry, and looking at competitors, the weakness has continued for them as well. Bassett Furniture (BSET) reported a revenue decline of -19.6% in the latest quarter, and Hooker Furnishings (HOFT) saw a decline of -23.2% – the revenues continue to perform in line with the weak industry.

Due to the weaker sales, margins have taken a moderate hit. The trailing operating margin stands at 13.0% after Q3, down from 16.9% in FY2023. Compared to the dramatic sales drop, the margin performance is still incredibly resilient. Ethan Allen has attributed the resilience to lower headcount and other cost discipline measures, counteracting the wide negative effect of negative operating leverage from lower sales.

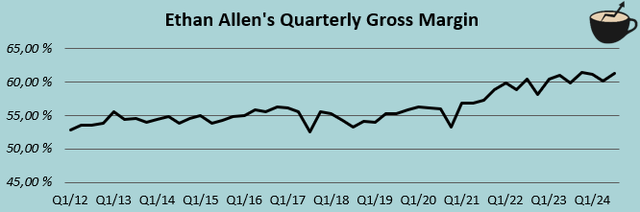

Author’s Calculation Using TIKR Data

In addition, increased gross margins were mentioned as a factor to good margin resilience. Gross margins have stayed at a great level and even saw an increase of 1.4 percentage points year-over-year in Q2 to 61.3%. The Q3 gross margin is now Ethan Allen’s second-highest margin posted in any quarter during the past decade, and seems to continue the company’s greatly reduced headcount’s benefits and good pricing power.

Looking for a Mid-Term Recovery

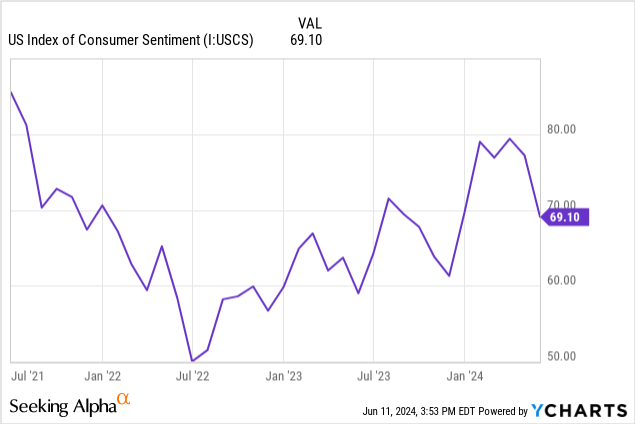

It’s likely in my opinion that Ethan Allen’s earnings will rebound to a higher level in the mid-term as the macroeconomic setting improves – lower interest rates and ultimately an improved consumer sentiment should aid demand back in the industry. Interest rates have continued at a relatively high level in the United States, with the 10-year bond yield still at 4.40%. Consumer sentiment has seen some elevation in recent months, but continues at quite a weak level for the time being.

In my previous article, I noted a risk that my long-term margin level estimate could be too high. I now believe that the recovery should highly likely bring back the operating margin into my estimate level of 15.0% – the currently trailing 13.0% level has been achieved during highly pressured demand. Total headcount has been reduced from 5120 at the end of Q3/FY2019 to 3448 at the end of Q3/FY2024 as told in the most recent earnings call, without manufacturing capacity seeing too much of an impact. Weak long-term revenues are the most notable long-term risk for earnings, as costs seem highly flexible.

An economic recovery in coming years could position Ethan Allen to pay out a great special dividend, or to use significant capital for other opportunities, as the company has built up an impressive fortress on the company’s balance sheet during the financial turbulence that Covid started. Of Ethan Allen’s market cap just above $700 million, around a fifth is in either cash or short-term investments after Q3 at $146.2 million combined.

Ethan Allen’s Stock Valuation Remains Attractive

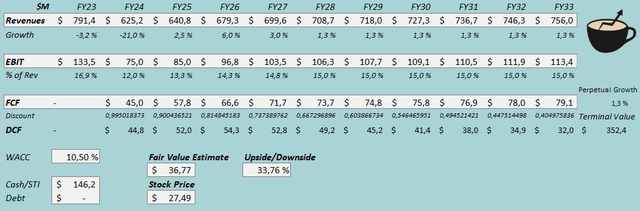

I updated my previous discounted cash flow [DCF] model to account for the recent financial performance – after revenues have seen large declines, I now estimate weaker mid-term financials with -21% in FY2024 revenue declines followed by a modest 2.5% recovery in FY2025 and a more significant improvement of 6% in FY2026. Afterward, I still estimate a slowdown into the weak historical revenue growth of 1.3%.

For the EBIT margin, I estimate more softness in the short- to mid-term, but still the same eventual level of 15.0%. The cash flow conversion estimate hasn’t seen any reason for significant tweaks.

DCF Model (Author’s Calculation)

The estimates put Ethan Allen’s fair value estimate at $36.77, 34% above the stock price at the time of writing – the stock has a good amount of upside, still, as the stock price has stagnated from my previous article. The estimate is up slightly from $35.42 previously due to a lower cost of capital and a very similar long-term financial scenario.

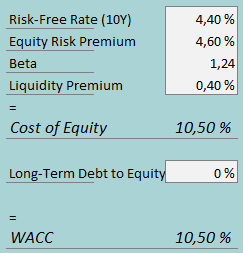

A weighted average cost of capital of 10.50% is used in the DCF model. The used WACC is derived from a capital asset pricing model:

CAPM (Author’s Calculation)

Ethan Allen continues to leverage no debt in financing. To estimate the cost of equity, I use the United States’ 10-year bond yield of 4.40% as the risk-free rate. The equity risk premium of 4.60% is Professor Aswath Damodaran’s latest estimate for the United States, updated on the 5th of January. I have kept the beta estimate the same at 1.24. Finally, I add a liquidity premium of 0.4%, creating a cost of equity and WACC of 10.50%. The WACC is down from 12.03% previously due to a lower equity risk premium.

Takeaway

The furnishings industry’s struggles have continued, dragging Ethan Allen’s revenues deeper in recent quarters than was previously thought. Still, the company has managed to keep up great profitability considering the dramatic revenue decline. With great gross margins and significant cost cuts done from the pre-pandemic situation, a mid-term economic recovery looks likely to rebound Ethan Allen’s earnings into an attractive level. The valuation continues to undermine the company’s financial potential, and as such, I remain with a Buy rating for Ethan Allen.