haydenbird

The Eaton Vance Tax-Advantaged Global Dividend Opportunities Fund (NYSE:ETO) is a popular global closed-end fund that investors can use to earn a high level of income without needing to sacrifice their equity exposure. The fund manages to do fairly well at this task, as it yields 8.25% at the current price, which is substantially higher than any of the major domestic or global equity indices:

|

Index |

TTM Yield |

|

S&P 500 Index (SP500) |

1.26% |

|

MSCI World Index (URTH) |

1.54% |

|

MSCI All-Countries World Index (ACWI) |

1.69% |

However, as is frequently the case with Eaton Vance funds, the yield of the Eaton Vance Tax-Advantaged Global Dividend Opportunities Fund is lower than that of many of its peers:

|

Fund Name |

Morningstar Classification |

Current Yield |

|

Eaton Vance Tax-Advantaged Global Dividend Opportunities Fund |

Hybrid-Global Allocation |

8.25% |

|

Calamos Global Dynamic Income Fund (CHW) |

Hybrid-Global Allocation |

8.82% |

|

Clough Global Opportunities Fund (GLO) |

Hybrid-Global Allocation |

11.01% |

|

LMP Capital and Income Fund (SCD) |

Hybrid-Global Allocation |

8.68% |

|

PIMCO Global StocksPLUS & Income Fund (PGP) |

Hybrid-Global Allocation |

10.88% |

|

Virtus Total Return Fund (ZTR) |

Hybrid-Global Allocation |

10.45% |

As can be clearly seen, the Eaton Vance Tax-Advantaged Global Dividend Opportunities Fund has a lower yield than other global hybrid funds. This could prove to be something of a turn-off for potential investors, particularly since many investors who would otherwise be interested in a fund such as this one are looking to maximize the incomes that they receive from their assets.

With that said, the Eaton Vance Tax-Advantaged Global Dividend Opportunities Fund does focus its attention more on equities than some other hybrid funds, and this could give it some advantages over its peers. In particular, the fund will probably do much better at protecting its shareholders against inflation than a fund that is more heavily weighted toward bonds. As I explained in a recent article:

One of the nice things about this fund is that it invests in equity securities, so it provides a certain amount of protection against inflation, which may be a bigger problem going forward than it has been in the past. After all, the projections for large fiscal deficits going forward are well-known, and it is difficult to see any way for these deficits to be funded by any method apart from the creation of new currency. Historically, equities, real estate, and gold have been the best ways to preserve the purchasing power of your money against inflation.

The fact, then, that the Eaton Vance Tax-Advantaged Global Dividend Opportunities Fund primarily focuses on equities might make it more attractive than bond-focused hybrid funds for long-term investors who have to worry about inflation chipping away at the purchasing power of their money.

As regular readers might remember, we previously discussed the Eaton Vance Tax-Advantaged Global Dividend Opportunities Fund in mid-February of this year. The equity market, both domestically and internationally, has been remarkably strong since that time. Thus, we might expect that this fund has provided a fairly attractive return for its investors over the intervening six-month period.

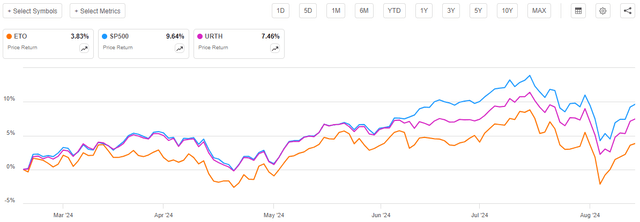

This has been the case, but unfortunately, the fund’s performance was not nearly as good as might be expected. As we can see here, the fund’s share price only increased by 3.83% since the publication date of my previous article. That is worse than both the S&P 500 Index and the MSCI World Index delivered over the same period:

Seeking Alpha

This is certainly not what most potential investors want to see. While the fund delivered a positive return over the period, nobody likes to underperform the broader market by nearly 600 basis points. Investors who are attracted to income are sometimes willing to accept a lower return in exchange for a higher level of income, but this could be too much underperformance to stomach.

However, it is important to keep in mind that investors in this fund will always do better than the share price performance suggests. As I explained in my previous article on this fund:

The above chart does not accurately show the return that investors in the Eaton Vance Tax-Advantaged Global Dividend Opportunities Fund received over the period. This is because the modus operandi for a closed-end fund like this is to pay out all of its investment profits to the shareholders in the form of distributions while attempting to maintain a relatively stable net asset value. As such, the distributions play a much larger role in the total return that investors receive than it does in an index fund. As such, we need to include the distributions in the performance chart above to see how investors in the fund actually did.

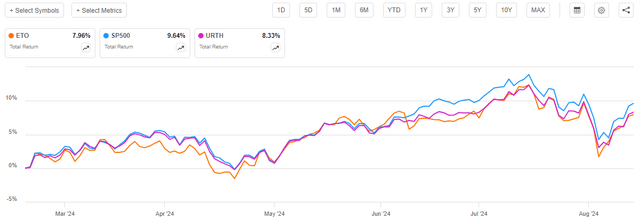

This alternative chart shows what happens when we add the distributions paid by both the indices and the Eaton Vance Tax-Advantaged Global Dividend Opportunities Fund to the share price performance:

Seeking Alpha

This certainly makes it easier to stomach the performance of the Eaton Vance Tax-Advantaged Global Dividend Opportunities Fund. As we can see, the fund’s shareholders received a 7.96% total return over the period, which is still shy of both indices but not nearly to the same extent. There are definitely some investors who might be willing to accept this relative performance in exchange for the higher yield provided by this fund.

As six months have passed since our previous discussion, we can expect that a lot of things have changed that may have an impact on our thesis regarding this fund. This article will focus specifically on those changes, with a focus on the contents of the fund’s recently released semi-annual report.

About The Fund

According to the fund’s website, the Eaton Vance Tax-Advantaged Global Dividend Opportunities Fund has the primary objective of providing its investors with a high level of after-tax total return. This makes a certain amount of sense for an equity fund, since equities are by their nature, total return vehicles. Investors who purchase common equities typically do so because they wish to receive a certain amount of income via the dividends and distributions paid out by the issuing company to its stockholders as well as benefit from the fact that the securities should rise in price as the issuing company grows and prospers.

However, we saw in the introduction that the Eaton Vance Tax-Advantaged Global Dividend Opportunities Fund is classified as a hybrid fund by Morningstar. This suggests that the fund invests in both common equities and fixed-income securities. No mention is made of this on the website, although the fact sheet does state that the fund invests in both common and preferred stocks. From the fact sheet:

The Fund invests primarily in global dividend-paying common and preferred stocks and seeks to distribute a high level of dividend income that qualifies for favorable federal income tax treatment.

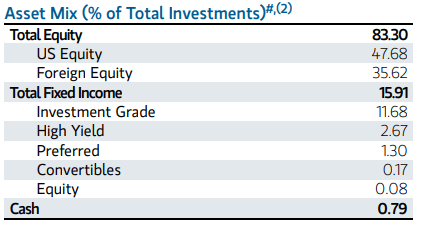

The fact sheet says nothing about the expected weights that the fund will assign to common equities or preferred stocks. As of right now, the fund’s portfolio is primarily invested in equities:

Fund Fact Sheet

However, the fact sheet does not state whether or not this will always be the case. Those investors who are seeking inflation protection would probably prefer that the fund remain focused on equities due to the fact that inflation causes corporate profits to rise and that should push up the price of common equities issued by those companies that are benefiting from these rising profits. Fixed-income securities have no such protection, since there is no link to the growth and prosperity of the issuing company.

However, fixed-income securities (especially preferred stocks) do have significantly higher yields. We can see that quite simply in the fact that the ICE Exchange-Listed Preferred & Hybrid Securities Index (PFF) has a trailing twelve-month yield of 6.32%. That is obviously much higher than the yields of the common equity indices provided in the introduction. Thus, by increasing the proportion of its portfolio invested in these securities, the Eaton Vance Tax-Advantaged Global Dividend Opportunities Fund could earn a higher level of income that can be distributed to its shareholders. There is, therefore, a trade-off in place. It is worth noting though that the MSCI World Index has delivered a substantially higher total return than preferred stocks over the past five years:

Seeking Alpha

The higher yields of preferred stocks were clearly not enough to make up for the fact that they have very limited capital appreciation potential. There is no reason to suspect that this dynamic will change in the future, so investors will probably be best served by this fund focusing its efforts on common equities. This is currently the case, but there is nothing in the fact sheet or on the website that says anything about whether or not management can change their minds.

The fund’s prospectus likewise says nothing about a specific mandate being in place for the degree to which the fund will invest in common stocks versus preferred stocks. This document describes the fund’s strategy thusly:

Under normal market conditions, the Fund will invest at least 80% of its total managed assets in dividend-paying common and preferred stocks of U.S. and foreign issuers that the portfolio managers believe at the time of investment are eligible to pay dividends that may constitute qualified dividend income and, therefore, qualify for federal income taxation at rates applicable to long-term capital gains. Distributions of investment income properly reported by the Fund as derived from tax-advantaged dividend income will be taxed in the hands of individuals at the rates applicable to long-term capital gain, provided holding period and other requirements are met at both the shareholder and Fund level. The remainder of the Fund’s portfolio may be invested in stocks and other investments that pay dividends, distributions or other amounts taxable for federal income tax purposes at rates applicable to ordinary income. The portfolio managers retain broad discretion to allocate the Fund’s investments in a manner that they believe will best effectuate the Fund’s objective.

The last sentence in this quote is the only statement that the fund’s prospectus makes about the relative weighting between common and preferred stocks, and it basically says that management can use its best judgment. This has, over the past decade at least, favored common stocks, but there is no guarantee that this will always be the case. High-rated bonds are usually considered to be preferable to common stocks during a recession, which might extend to preferred stocks as well. The only thing that could be classified as a recession over the past ten years was a very short period of time in 2020 when the lockdowns were in full force, and everybody was scared of the COVID-19 virus. From the start of February 2020 until the start of May 2020, preferred stocks did outperform the MSCI World Index:

Seeking Alpha

It is possible that this will happen again when the next recession strikes. There is certainly no guarantee of this, however, and considering that various central banks would probably implement quantitative easing pretty quickly and begin flooding the world with more money, we would probably see any advantage that preferred stocks might have quickly get erased. As such, I cannot really perceive a time when it would be appropriate for the fund to be more heavily weighted toward preferred stocks than common stocks. It is nice to know that the fund has that option, however, even if it does make us a bit less certain about what the fund might be holding at any given moment.

In various previous articles, we have seen that many of the Eaton Vance closed-end funds have very high exposure to the American mega-cap technology companies that have become an outsized proportion of many portfolios over the past fifteen years. This one is no exception, as we can see by looking at the largest holdings in the fund:

Eaton Vance

We can see here that there are six company companies on the list – Microsoft (MSFT), Alphabet (GOOG), NVIDIA (NVDA), Amazon.com (AMZN), Apple (AAPL), and Micron Technology (MU) – which combined account for 24.34% of the fund’s net assets. Interestingly, this is slightly below the allowable level. According to the fund’s prospectus (linked earlier):

The Fund may not invest 25% or more of its total managed assets in the securities of issuers in any single industry. The Fund may invest a significant portion of its assets in the securities of any single industry or sector of the economy if companies in that industry or sector meet the Fund’s investment criteria. The Fund may invest a significant portion of its assets in each of the energy, raw materials, real estate, utilities and financial services sectors.

As the six technology companies shown in the fund’s largest positions list put it just under the 25% maximum allowable level, we would make the assumption that the fund has no other technology holdings. However, the schedule of investments found in the semi-annual report lists Adobe (ADBE), Intuit (INTU), Taiwan Semiconductor Manufacturing (TSM), ASML Holding (ASML), and Infineon Technologies (OTCQX:IFNNF) in addition to the companies shown above. The fund gets around this 25% mandate by claiming that Amazon.com is a retailer and Alphabet is a media company. Many investors will likely question these classifications, especially given the fact that all of them have multiple lines of business and in Amazon’s case, its cloud computing offering has long been believed to be far more profitable than the retail arm. Thus, we could make a good argument that the fund is in violation of its own diversification mandate with these holdings.

Most investors, especially American investors, tend to already have a substantial amount of exposure to all the mega-cap technology companies due to their dominant positions in all of the major indices that include U.S. common stocks. Thus, this fund holding them does little to improve the diversification of an average portfolio that is already reliant on the performance of a handful of large companies. Potential investors should take this into account before purchasing this fund.

Leverage

As is the case with most closed-end funds, the Eaton Vance Tax-Advantaged Global Dividend Opportunities Fund employs leverage as a method of boosting the effective yield and total returns that it earns from the assets in its portfolio. I explained how this works in my last article on this fund:

In short, the fund borrows money and then uses that borrowed money to purchase common stocks or other assets. As long as the purchased assets deliver a higher total return than the interest rate that the fund has to pay on the borrowed money, the strategy works pretty well to boost the effective return of the portfolio. As this fund is capable of borrowing money at institutional rates, which are considerably lower than retail rates, this will usually be the case.

However, the use of debt in this fashion is a double-edged sword. This is because leverage boosts both gains and losses. As such, we want to ensure that the fund is not using too much leverage because that would expose us to too much risk. I do not generally like to see a fund’s leverage exceed a third as a percentage of its assets for that reason.

As of the time of writing, the Eaton Vance Tax-Advantaged Global Dividend Opportunities Fund has leveraged assets comprising 19.12% of its overall portfolio. This is a slight increase over the 18.92% leverage that the fund had the last time that we discussed it, which is rather surprising. After all, the fund’s share price has increased since the date of our previous discussion, so we would expect that the leverage ratio would have come down a bit.

The fact that the fund’s leverage ratio has increased is even more surprising when we consider that the fund’s net asset value has increased since our last discussion. We can see that quite clearly here:

Barchart

As shown, the fund’s net asset value has increased by 2.87% since our previous discussion. Logically, that should have reduced the fund’s leverage ratio, since the leverage ratio is a percentage of debt to total assets. However, if the fund actually borrowed more money in the last six months, that would explain the increase in leverage. In fact, that is the only possible explanation here.

Despite the increase in leverage, the fund remains well below the one-third maximum that we ordinarily consider to be acceptable for an equity closed-end fund. It is also below the level of most of its peers:

|

Fund Name |

Leverage Ratio |

|

Eaton Vance Tax-Advantaged Global Dividend Opportunities Fund |

19.12% |

|

Calamos Global Dynamic Income Fund |

31.83% |

|

Clough Global Opportunities Fund |

30.48% |

|

LMP Capital & Income Fund |

19.06% |

|

PIMCO Global StocksPLUS & Income Fund |

18.01% |

|

Virtus Total Return Fund |

30.63% |

(all figures from CEF Data)

We can clearly see that the current leverage of the Eaton Vance Tax-Advantaged Global Dividend Opportunities Fund is in line with its more conservatively financed peers. It is nowhere near the aggressive ratios used by the Calamos, Clough, or Virtus funds. As such, we can conclude that the fund’s current level of leverage is reasonable given its strategy. We should not worry about it too much.

Distribution Analysis

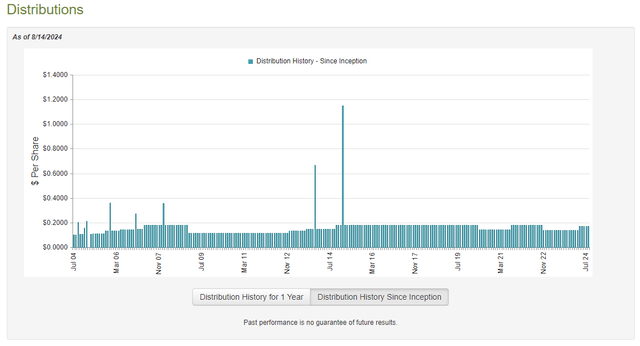

The primary objective of the Eaton Vance Tax-Advantaged Global Dividend Opportunities Fund is to provide its investors with a very high level of total return. As is the case with most closed-end funds, it primarily delivers this return through direct payments to its shareholders. In accordance with this strategy, the fund pays a monthly distribution of $0.1733 per share ($2.0796 per share annually). This gives the fund an 8.25% yield at the current share price, which as we have already seen is a bit lower than many of its peers possess.

The fund has not been especially consistent with respect to its distributions over its history:

CEF Connect

From my previous article on this fund:

This may reduce the fund’s appeal to those investors who are seeking to earn a safe and secure income from the assets in their portfolios. The fact that the fund cut its distribution back in 2022 could be especially disheartening because of the incredibly high level of inflation that we have seen since the end of the pandemic. This inflation has reduced the purchasing power of the distributions that we receive from funds like this, so investors need a higher level of income to maintain a certain lifestyle. A distribution cut has the opposite effect, as it reduces income and greatly reduces the number of goods and services that can be purchased with the distribution. Thus, investors who are dependent on the distribution that this fund pays out have undoubtedly felt themselves getting poorer and poorer over the past few years.

The fund did, fortunately, increase its distribution back in April and the current payment is 26.13% higher than what the fund was previously paying out. This certainly beat inflation over the past year or two, but it is still lower than what the fund was paying out prior to the 2022 cut. Thus, income investors are still worse off than they were back in 2021.

We still should investigate the fund’s ability to maintain its distribution at the current level, since that is by far the most important thing for any potential investor who might be considering purchasing the fund’s shares today.

As of the time of writing, the most recent financial report that is available for the Eaton Vance Tax-Advantaged Global Dividend Opportunities Fund is the semi-annual report for the six-month period that ended on April 30, 2024. A link to this report was provided earlier in this article. This is a much newer report than the one that was available the last time that we discussed this fund, which is nice, as it will work well for an update.

For the six-month period that ended on April 30, 2024, the Eaton Vance Tax-Advantaged Global Dividend Opportunities Fund received $10,439,404 in dividends and $2,347,747 in interest from the assets in its portfolio. When combined with a small amount of income from other sources, the fund had a total investment income of $12,809,995 for the period. It paid its expenses out of this amount, which left it with $7,165,715 available to shareholders. That was not nearly enough to cover the $14,098,715 that the fund paid out in distributions over the period.

As might be expected, given the distribution increase, the fund was able to make up the difference through capital gains. For the six-month period that ended on April 30, 2024, the Eaton Vance Tax-Advantaged Global Dividend Opportunities Fund reported net realized gains of $12,376,371 along with net unrealized gains of $58,356,277. The fund’s net assets increased by $63,799,648 after accounting for all inflows and outflows during the period.

Thus, it certainly appears that the distribution is safe right now, although a market correction could still jeopardize it if the fund fails to realize some of those unrealized gains.

Valuation

Shares of the Eaton Vance Tax-Advantaged Global Dividend Opportunities Fund are currently trading at a 7.39% discount to net asset value. This is not as attractive as the 8.60% discount that the shares have averaged over the past month. As such, it might be possible to get a better price by waiting for a little bit.

Conclusion

In conclusion, the Eaton Vance Tax-Advantaged Global Dividend Opportunities Fund is an interesting closed-end fund that invests in both fixed-income securities and common stocks from around the world. The fund’s management appears to have a great deal of freedom regarding the weightings of each security type, but historically common stocks have delivered better total returns, so the fund is focused on those for now. This flexibility might work to the fund’s advantage in the event of a recession or similar economic event, however. It is uncertain whether or not the U.S. economy will enter into a recession in the near future, but that could still be a protection that is worthwhile to have.

The fund is fully covering its distribution, and it is trading at a discount, although its yield is lower than some peers.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.