Richard D. Affolder/iStock via Getty Images

Evolution Petroleum Corporation (NYSE:EPM) is an energy small-cap focused on onshore oil and gas in the United States. Its strategy is to build a portfolio of diversified assets by developing and acquiring non-operating interests in several fields across the USA. In the first quarter of 2024, EPM had an average daily production (BOEPD) of 7,209. However, while production has been up 1.7% since last year, prices weighted per unit were actually down 39.3%, destroying margins (2024Q3 MD&A, page 33).

After recently transitioning towards more oil fields, its reserves are split as follows: 49% natural gas, 32% oil, and 19% NGL (natural gas conversion ratio of 6:1). Evolution’s large gas production means it profited heavily on the spike in gas prices but also got hurt by the subsequent crash. Evolution tends to use little hedges, leaving a large upside when gas prices eventually recover.

Evolution’s strategy is to buy counter-cyclical assets, sharply priced by the low commodity prices. Their recent SCOOP/STACK and Chaveroo acquisitions show they are now evolving towards long-life production, making them more resilient to commodity price downswings.

Management’s effective strategy, in combination with their great set of diversified assets at ridiculously low prices, makes it a clear, strong buy in my opinion.

Asset Overview

From October 2019 through February 2024, Evolution has participated in six major transactions, putting over $119 million to work for our shareholders. During that time, we’ve paid down over $41 million of borrowings, while our share count has remained virtually unchanged. (2024Q3 Earnings Call).

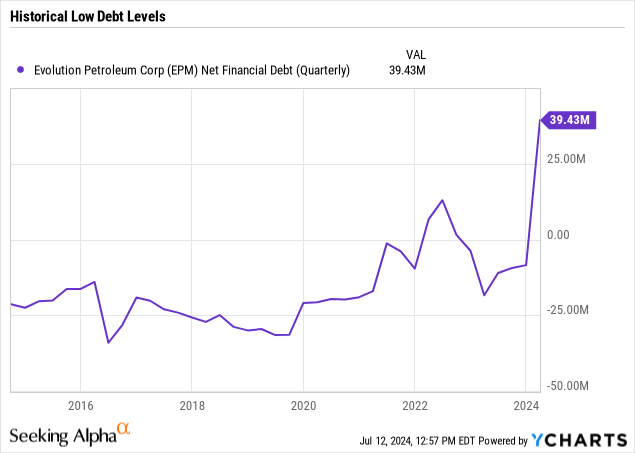

Starting in 2023, Evolution has taken a new direction with the Chaveroo and SCOOP/STACK acquisitions. Evolution used to purchase mature wells, late in the stage of production, meaning small depletion rates, but little resiliency to low commodity prices. Now, with gas prices hitting lows of $1.53/MMBtu in 2023, management had opportunities to buy counter-cyclical assets at depressed prices, explaining the $42.5M increase in debt.

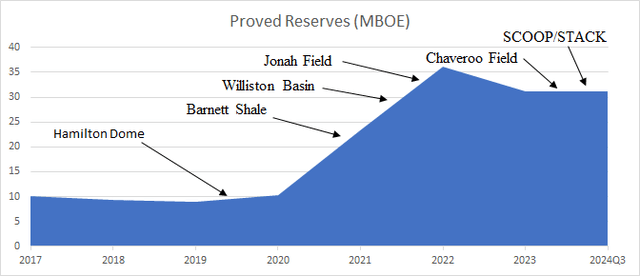

Reserves Growth and Acquisitions (Annual Reports)

Before the acquisitions, the Delhi Field used to be Evolution’s main asset. Last quarter, it produced 1,022 BOEPD, comprising 71% oil and 29% natural gas liquids (NGL). Even though it’s one of Evolution’s legacy assets, its operating partner is still expanding the field. Evolution diversifies by consistently owning small working interests (mostly) in large amounts of wells in different fields.

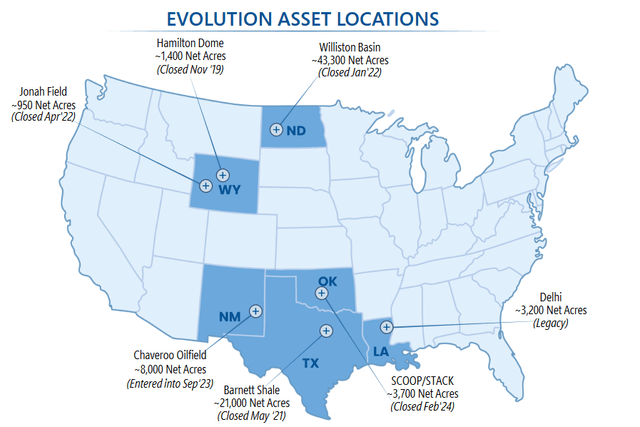

Asset Locations (Evolution)

Let’s focus on the performance of their recent acquisitions, starting with their earliest.

Hamilton Dome/Williston

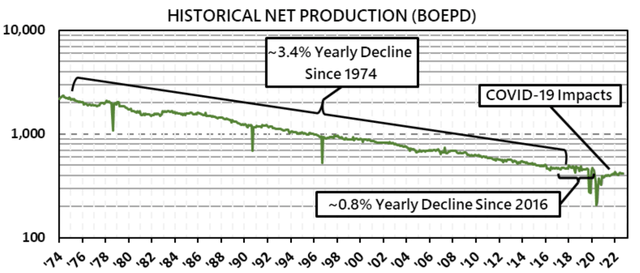

Evolution acquired the full oil Hamilton Dome field for $9.5M in November 2019. Since then, production has been quite consistent, besides the COVID disruptions. The depletion rate has been slowing down and is now at 0.8% annually since 2016. Their investment has done magnificently, and I calculated a 21% internal rate of return with the following criteria.

Last quarter’s production sat at 385 BOEPD, sold at oil prices of $61.21/bbl for the past 91 days. This resulted in $1.56M of revenues, and $578K of pre-tax quarterly profit, excluding administrative costs. And keep in mind, these numbers are slightly impacted by workover projects at the beginning of the quarter. Annually, this transfers to $2.3M of operating cash flow.

For the IRR calculation, assume a 2% annual decline rate. And calculate it over the next 15 years because Hamilton Dome’s current Net PDP Reserves/ Net Production sits at 16 years. At its production price of $9.5M, the internal rate of return sits at 21%, conservatively calculated, which is noteworthy.

Hamilton Dome’s Net Production (EPM)

Similarly to Hamilton Dome, the Williston field is largely an oil field (74%). With 462 BOEPD, it adds another layer of diversification and exposure to oil for Evolution.

Jonah Field/Barnett Shale

Realized natural gas prices decreased 71.7% from the prior year period, which was the largest portion of the driver of the decrease in revenues. This was partially attributed to the prior year period benefit of strong natural gas price differentials received at the Jonah Field where we realized an average natural gas price of $20.31 per MCF in the prior year period compared to $3.94 per MCF in the current year quarter. (MD&A 2024).

The Jonah Field was purchased for $27.5MM and closed on April 1, 2022. Its commodity split looks as follows: 88% natural gas, 7% NGL, and 5% oil. It produces 10.4 MMCFEPD, which equates to 1,736 BOEPD with a 6:1 conversion ratio. Based on current prices, that ratio is actually closer to 40:1, so don’t put too much trust in the weighted BOEPD numbers. The Jonah Field significantly profited from the spike in gas prices, repaying the investment in two years.

Jonah Field sits at 21% of Evolution’s total reserves, and Barnett Shale sits at 40%. These percentages are likely overstated because they use the 6:1 natural gas conversion ratio. However, when gas prices revert to their mean, this leaves a large upside for Evolution.

SCOOP/STACK and Chaveroo

The addition of Chaveroo and SCOOP/STACK are perfect fits for our evolving strategy of both adding long-life production during commodity price downswings and adding undeveloped locations by making acquisitions through the drill bit. (Q3 Earnings Call).

For their new acquisitions, SCOOP/STACK reaches around 1,550 BOEPD at a 6:1 natural gas conversion ratio, comprising 40% oil, 13% NGL, and 47% natural gas. For $40.5M, Evolution bought a ~3% working interest in 247 active wells, with the possibility of cooperating on 300+ more with its operators. This makes it highly diversified, but difficult to sell in the event of a liquidation. The low liquidity on these small interests creates buying opportunities for management.

SCOOP/STACK receives the highest sales prices of all Evolution’s fields. Just assuming stable production with stable prices at a 30% netback margin leads to $3.2M of funds from operations (FFO) for a single quarter. For only $40.5M!

Chaveroo is another great addition to Evolution, especially adding to its oil exposure. There are currently three wells in production, with a 41% NRI. Additionally, according to their Q3 Earnings Call: In conjunction with the operator, we are planning to drill the next four wells beginning in September 2024, followed by another six wells beginning in April 2025.

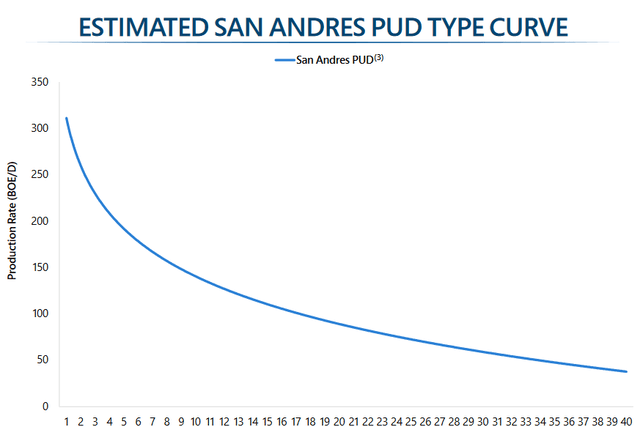

These are wells paying back in 16 months! After each pays itself back, assume a long-term, slowly decreasing production of around 50 BOEPD. Annually, at a $40/bbl netback at a 41% NRI, this adds an extra $300K of yearly cash flow per well.

Chaveroo well production curve (Evolution Investor Presentation)

Heightened Leverage

The recent SCOOP/STACK acquisitions were funded by taking out $42.5M in borrowings under the Senior Secured Credit Facility. This does not yet reflect the impact of net cash Evolution expects to receive for the final purchase of the acquisitions. Management aims to keep their net debt to pro forma EBITDA ratio below 1x. This suggests management is dedicated to quickly paying down debt. However, they did state that this shouldn’t be a reason to pass on any other attractive deals coming their way.

As can be seen by Evolution’s historical net debt levels, it is very unusual for management to take out such a large debt position, this heightens the risk of default in the case of sustained lower prices. On the other hand, this suggests management’s confidence in higher prices going forward and the attractive price of its recent acquisitions. As will be discussed later, this risk is balanced out by them selling gas futures, which stand significantly higher looking a year later.

According to their 10-Q (Note 5. Senior Secured Credit Facility):

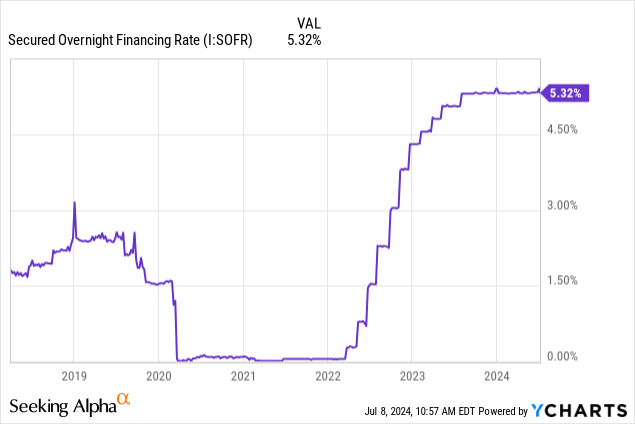

On May 5, 2023, Evolution extended the maturity of its debt contract to April 9, 2026. They’re borrowing at the Secured Overnight Financing Rate (I:SOFR) plus 2.80%, with a minimum of 0.50%, or at the Prime Rate plus 1.00%. Simultaneously, the value of the assets backing the loan was increased to $95 million. Their renewed contract now allows for more flexible hedges.

Their current interest rate amounts to 8.12% (5.32% + 2.80%). Assuming they don’t extend the maturity date, and they pay down the debt in three years, they’d start off paying $3.45M in interest, going down quickly afterward as they pay down 14.2M of the principal annually over three years. This excludes the net cash they already received after the completion of the acquisition.

Gas Prices

Evolution’s Proved Reserves are made up of 49% Natural Gas and 19% NGL. Its 2024Q3 revenue consisted of 63% of oil, however, as gas prices have been hitting lows, down 85% from their 2022 peak. The inherent cyclic nature of the gas market makes for some great counter-cyclical buys, now EPM is down 45% in almost a year.

While the gas industry will continue to slowly grow at least over the next 15 years, it will lose market share to renewables. However, gas will remain an integral part of the global energy market. As the world seems to be destroying its energy infrastructure, natural gas will be there to back up the failures of unreliable renewables. According to the EIA, in 2023, 33% of U.S. energy consumption still came from natural gas.

I think this quote sums it up quite well: Coal is too dirty. Oil is too messy. And renewables are too intermittent. But natural gas is just right. -Chris Tomlinson

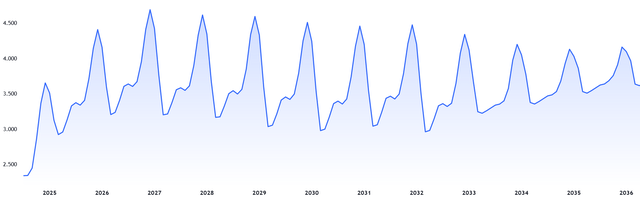

The biggest reason this opportunity exists is because of fear around future gas prices. But, looking at gas futures, higher prices seem to be partially certain. Especially considering what Evolution announced in their Q3 earnings call:

We also hedged natural gas beyond the required 12-month period to capitalize on the high prices available in the calendar year 2025 and beyond.

Gas Futures Forward Curve Henry Hub USD/MMBTU (TradingView)

Risks

While hedging future commodity prices takes away a large chunk of possible risks, their heightened leverage makes them more susceptible to other risks. Evolution owns small working interests in fields it doesn’t operate. Operators could make Evolution contribute capital expenditures when it is already tight on cash. Additionally, its field operators’ self-interest may not always be aligned with that of Evolution.

Evolution’s operations may encounter more workover than anticipated. Their legacy assets especially, since these shallow reserves require more expensive drilling. Most important of all, is its commodity pricing risk. If oil prices fall and gas prices stay low or go even lower, they’ll struggle to pay down debt, and it could get ugly, even with hedges in place.

Valuation And Dividend

Evolution has been paying out $4 million in quarterly dividends for the last 7 quarters. Here’s a model breaking down their last-quarter production and prices. I added a section pointing out what would happen if gas prices were to normalize, which they’ve already partially capitalized on with future contracts.

| 2024Q3 | Nat Gas (MBBL) | LNG (MMCF) | Oil (MBBL) | Total |

| Total Production | 2,115 | 104 | 199 | |

| Current Price | $2.77/MCF | $25.26/bbl | $73.06/bbl | |

| Revenues | $5.9M | $2.6M | $14.5M | $23M |

| Potential Price | $5.00/MCF | $30.00/bbl | $70.00/bbl | |

| New Revenues | $10.58M | $3.1M | $13.9M | $27.6M |

The key assumption here is that natural gas prices were to go to $5.00/MCF. And if gas prices were to go back to $7.50/MCF, that would add another $5M+ to revenues.

Expenses

Let’s deduct all of their expenses: $10M for LOE, $1.5M for CO2 costs, $2M for G&A, including stock-based compensation, and $2.5M for increased interest expenses. And finally, assume $2M tax costs, heavily dependent on revenue. This totals $18M in total costs, which appears slightly conservative, considering Funds From Operations was $8.64M in 2024Q3.

| Lease Operating Expenses | CO2 Costs | G&A | Interest Expenses | Taxes |

| $10M | $1.5M | $2M | $2.5M | $2M |

Dividend

Evolution is devoted to continuing their capital spending even during low commodity prices. Management doesn’t provide any guidance for capital expenditures going forward. It will largely depend on how much free cash flow Evolution can generate after paying down debt and the base dividend.

Assuming prices restore to the “Potential” price I wrote above, we would see around 10M of FFO, after which we’ll see a few million of capital expenditures, $3M would sustain operations and happily support the drilling of new wells in SCOOP/STACK and Chaveroo. Now, with $7M of FCF, we still need the debt principal repayments of $3.5M per quarter. This leaves us with $3.5M for the dividend, just short of the $4M quarterly payments. Considering they have $11M in cash, the dividend will continue to be comfortably payable in the future.

| Revenues on Restored Prices | Total Costs | Capex | Debt Repayment | Dividend |

| $28M | $18M | $3M | $3.5M | $3.5M |

Personally, I’m not a huge fan of consistently paying dividends through downturns as they have to dip into their working capital (currently at $7.5M). Unfortunately, they have to please the market, and it is understandable; that’s how the market works. Currently, Evolution is offering an 8.80% dividend yield.

Evolution Petroleum can’t really be valued using EV/EBITDA, because the recent debt increase disrupts its enterprise value, while production hasn’t followed yet. Here’s a DCF to try to estimate a value for the intermediate run when prices have slightly recovered, as seen above in the “Potential” price.

For its initial annual FCF, we multiply the quarterly $7M by 4. Assume a 3% growth rate over 10 years, since they’re considerably investing in growth. I used a P/FCF ratio of 5, which seems adequately conservative, historically.

| Initial FCF | Period | Discount Rate | Growth Rate | Terminal Value (P/FCF) |

| $28M | 10 Years | 10% | 3% | 5 |

These input variables result in an intrinsic value of $268M, leaving a 42% upside if gas prices recover only partially. That equates to $8.16 per share.

Conclusion

Consider, that all you need is for gas prices to recover, which is already priced in futures contracts. After management pays down debt over the next three years, this leaves room for increased growth capex or a higher dividend. Usually, Evolution aims for little hedging, leaving a huge upside. Everything seems to point to a great investment over the next three years. Exactly how great will depend on how cold the next couple of winters will be and subsequent gas prices.