robertharding/DigitalVision via Getty Images

The iShares MSCI France ETF (NYSEARCA:EWQ) tracks the MSCI France Index and provides exposure to one of the largest economies in Europe. France benefits from its strategic location at the heart of Western Europe and strong global trade relationships. It has deep economic integration with other major European Union economies like Germany. However, an aging population poses long-term challenges for sustaining robust growth. Economic weakness among key trading partners could negatively impact demand in its large manufacturing and consumer goods sectors. France has shown resilience in the post-Covid malaise, but EWQ is a hold for now.

Sluggish economic growth in 2024

France slashed GDP forecasts for 2024 from 1.4% to 1.0% in February, citing global turmoil and economic slowdowns with critical trading partners as contributing factors. The country tallied a 0.9% expansion in 2023. The entire Eurozone has struggled with ECB rate hikes in response to inflation, but France has two other headline economic stories that are impacting its growth prospects and the potential for EWQ.

1.) Labor shortages

France is facing severe labor shortages across both high and low skills occupations, as longstanding concerns around low birth rates and an aging population have emerged in the economic data. As of 2023, the job vacancy rate hit 2.4%. Despite the dearth of labor, France has passed a restrictive immigration bill that would make it more difficult for immigrants to help fill those job vacancies and help grease the wheels of economic growth. With no stopgap in sight, the labor shortages will likely continue to put a damper on economic output in the near term.

2.) Austerity

French national debt levels have marched higher and higher in recent years, exceeding €3T in 2023. As a result, the government has pledged cost-cutting worth €10B of state spending across departments and agencies. This is likely the start of potential further cuts which could have downstream impacts on French consumer confidence and broader economy.

Portfolio Breakdown

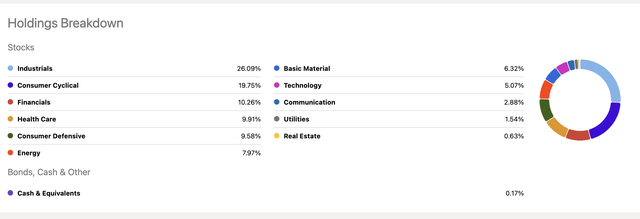

EWQ has $650M in assets and has a track record going back to 1996, when iShares launched their initial suite of single country ETFs. The fund holds 67 securities with heavy weightings towards industrials and consumer cyclicals, followed by financials. Lower PMI numbers in March have shown the challenges of the industrials sector as of late. A combination of inflation, labor shortages, and more sluggish economies with France’s key trading partners have negatively impacted the figure.

Seeking Alpha

Top holdings in EWQ include globally recognized French brands like luxury goods maker Louis Vuitton (OTCPK:LVMHF) and integrated energy major TotalEnergies (TTE). LVMHF is Europe’s second-largest listed company, worth 400 billion Euros. The company has been reliant on demand from consumers in emerging markets, specifically China, which has had a longstanding appetite for luxury goods. LVMHF saw sales slip in Q1 on the back of weakening demand following a period of exuberance in the aftermath of the pandemic.

Seeking Alpha

Performance

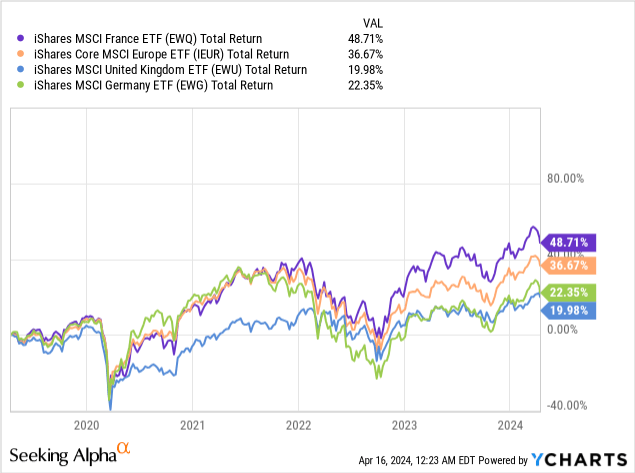

EWQ has generated over 48% total returns over the past 5 years, significantly outpacing the MSCI Europe index, as well as regional peers. France has emerged as the Eurozone’s leader in recovery for the COVID-era economic setbacks.

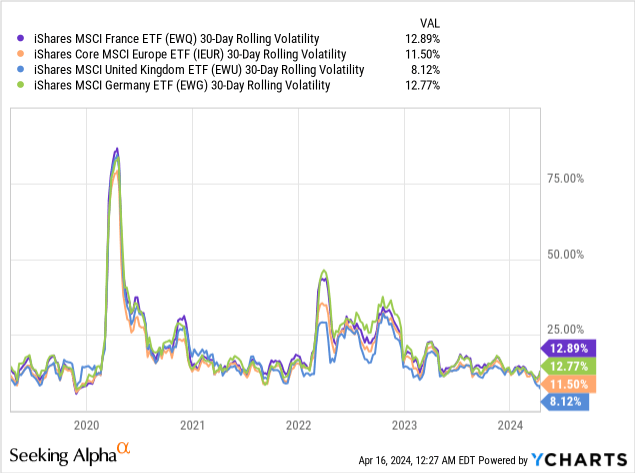

French equities have been marginally more volatile than German equities, and slightly more volatile than the broader European equity market. Even still, France averages just a 1.5% heightened volatility relative to the SPDR S&P 500 ETF Trust ETF (SPY).

Valuation

From a valuation standpoint, EWQ currently trades at around 17x forward earnings, which is trading higher than the broader European market’s 15x P/E. Its 2x price-to-book is on par with the broader European Market. This suggests EWQ is offering a slightly less attractive entry point, though its multiples are still within reason. EWQ’s TTM dividend yield is 2.70% which is above the median yield for all ETFs, but can’t be seen as a strong income play.

Conclusion

EWQ offers investors access to the French economy and its collection of globally recognized multinational corporations. While economic growth has been lackluster in recent years, France remains a leader in industries like luxury goods and tourism that are poised to benefit from an expanding global consumer base.

EWQ is quite concentrated in its top holdings, making the fund’s performance beholden to a handful of French corporate titans. For investors bullish on a European resurgence, EWQ presents a way to invest in the economic engine of France and its major multinationals leveraged to faster growth in emerging markets. I plan to keep an eye on this fund, but will rate it as a hold for now.