Orietta Gaspari/iStock Unreleased via Getty Images

In May 2022, exactly two years ago, I started my journey as a Seeking Alpha analyst because of Ferrari (NYSE:RACE). I had just bought my first shares, but I was continually reading Ferrari was overvalued and was close to becoming dead money. But I thought Ferrari’s economics were so simple and powerful that it was very difficult to imagine the company would have not kept growing, driving the share price along this path. This is why I argued Ferrari was literally firing on all cylinders and rated it as a “strong buy”.

Since then, the stock has been a neat 2x.

In these two years, I started sharing my whole research on the stock, adding different angles and perspectives along the way.

Ferrari just reported its Q1 2024 earnings and the stock is down over 6%. As we go over the report, I would like to show why Ferrari, though expensive, is a better deal than what apparently may appear to be. In fact, Ferrari plays in a league of its own and hinges on a business model that offers what investors value more than any other metric: high predictability.

While most people are familiar with the brand and the company, there might be several around who don’t know how Ferrari runs its business. In short, here are the main ideas we have to keep in mind:

- Ferrari’s cars are desired – even craved! – all over the world.

- Ferrari’s business plan is to always sell one car less than the market demand, as Enzo Ferrari used to say.

- In this way, Ferrari protects its exclusivity and exercises extreme pricing power.

- Moreover, Ferrari gives precedence to its existing customers: 74% of its 2023 deliveries were to existing clients (which Ferrari calls “the repeaters”).

- This further enhances the race and the competition among non-existing clients who want to own a Ferrari. Translation: Ferrari can charge almost any price it wants to admit non-existing customers to the exclusive club of Ferrari owners.

- Being restrictive on orders and deliveries gives the company a 2-year visibility on its future order books.

- While keeping volumes low, Ferrari keeps growing thanks to personalizations and special cars.

Ferrari Q1 2024 Report

Before we dive in, let’s start from important news. Ferrari reported that 98% of the employees decided to participate in the stock program. This expresses the employees’ confidence in the company and its future. Remember, there is only one reason why insiders buy (or accept to be paid in) their company’s stock: they know they will make money.

Ferrari has just released its Q1 2024 earnings report, and even though I had bullish expectations, the figures announced didn’t only not just surprise me but were genuinely awe-inspiring. Moreover, the earnings call provided such instructive and valuable insights into one of the world’s most renowned companies that it felt like participating in an exceptional business management class.

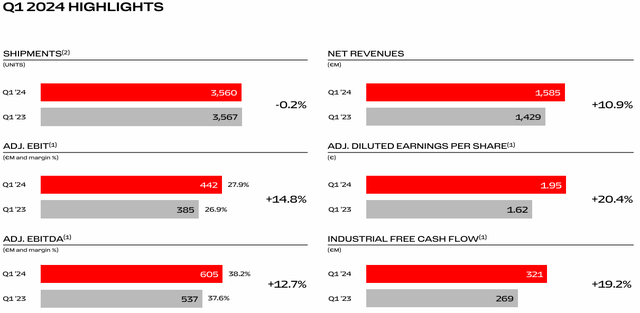

Let’s quickly look at the six most important highlights the company reported:

- Shipments were down 0.2%, that is 7 units less YoY to 3,560

- Net revenues were up 10.9% (with negative FX impact) to €1.59 billion

- Adj. EBITDA was up 12.7% to €605 million

- Adj. EBIT increased by 14.8% to €442 million

- Adj. EPS increased were up 20.4% to €1.95

- Industrial FCF increased by 19.2% to €321 million

Ferrari Q1 2024 Earnings Presentation

These figures show a precise pattern: Ferrari’s profitability appears more and more as we move down the income statement, with each important item increasing at a faster pace than the one(s) it has above. Ferrari is the embodiment of how a business should be run.

Why Ferrari Dropped

And yet, Ferrari plunged.

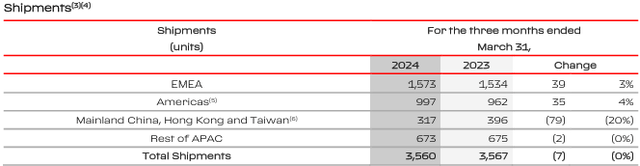

It seems as if investors were concerned with flat volumes. Well, on one side, Ferrari had already guided for flat shipments when it reported FY 2023 earnings. So, it wasn’t a surprise to me. But, what I found odd was the concern over sales dropping 20% in China to 317 units vs. 396 in Q1 2023, as we can see below.

Ferrari Q1 2024 Earnings Report

Let me address these concerns because if we understand Ferrari, what we are seeing is not only perfectly healthy, but it is also quite exciting.

First of all, since its IPO, Ferrari increased its FY shipments from 7,255 in 2014 to 13,663 units ten years later (FY 2023). This is a 6.5% CAGR. However, though we are still talking about very low volumes (Porsche AG, for example, sells over 300k cars per year). Let’s look at a few other items and their CAGR over the last decade.

| in €M, except per share | FY2014 | FY2023 | CAGR |

| Revenues | 2,762 | 5,970 | 8% |

| Adj. EBITDA | 693 | 2,279 | 12.6% |

| Adj. EBIT | 404 | 1,617 | 14.9% |

| EPS | 1.38 | 6.90 | 17.5% |

| FCF | 136 | 932 | 21.2% |

What does this prove? That Ferrari’s growth doesn’t depend mainly on shipments, but it hinges on internal execution and, as we will address more thoroughly in a moment, pricing power.

Facing ever-increasing demand, Ferrari decided to almost double its shipments in a decade. But now it is once again decelerating its shipments growth to protect its exclusivity.

Ferrari has talked about a normalization in shipments. But, please pay attention to the words Mr. Benedetto Vigna, the company’s CEO, used to describe why shipments are not increasing (bold is mine):

Normalization, what does it mean? And so let me say in this way, it’s a simple — it’s a simple math, okay, because we are in a situation where a lot of our models are sold out and we have the two new models, that were announced last week […] the Dodici Cilindri, well, this — the order of these two cars are not yet in our portfolio. So normalization for us meant that, as we said also at the beginning of the year in February, we were expecting the product portfolio to go a little bit down because there was not too much for the client to order. And this question, I would like to take this opportunity to clarify something important. The order book that we have goes well into 2026, this is very important. I want to clarify this because we have models that are, let me say, for which we have a long, long waiting list.

Let’s say you decide today to buy a Ferrari. Chances are you will wait until late 2026 or even 2027, considering those waiting before you. This is why I keep on saying Ferrari’s predictability is unique. De facto, the company already knows its income statement for FY 2024 and FY 2025, with almost a full picture for FY 2026, too. It is no joke saying Ferrari can report the net income it wants to. This is why we have learned over the years that Ferrari’s guidance is usually conservative and then allows the company to keep improving during the fiscal year and always end with a nice beat at the end. If we learn how to handle Ferrari’s numbers and guidance, it is almost impossible to make estimates that won’t come close to Ferrari’s real results. For example, while everyone in 2022 was expecting Ferrari to reach €6 billion in revenues by 2024, I wrote several times back then that this would happen at the end of FY 2023. You can see for yourself what happened.

I say this not to brag, but to encourage more and more investors to get familiar with this wonderful company and its figures as they identify almost full predictability. After all, investing is about future returns and when a company is as reliable as Ferrari, investors do value it with the right premium.

Let’s look at the second issue related to shipments in China. First of all, Ferrari reported that in China hybrid models have stronger traction compared to ICE.

This confirms the environment other automakers have talked about. But here is what matters most. China is not yet a market contributing to the company’s margins. It is a very young market where the brand awareness Ferrari requires from its customers is still not as mature as elsewhere. Ferrari intentionally keeps its sales low there and did choose from time to time to reallocate to other markets those cars first thought for China. Mr. Vigna explained it better than anyone else:

we want to keep Greater China below 10% because we want this market to get more acquainted with our brand, to be in the family of Ferrari, you need some time and you need to give time to the client in a country to understand, what it means to be our client. So having said that, it’s clear that in China, we had this kind of normalization, that was also our, if you want, deliberate choice because the number of models we can sell there are not so many. And we wanted to keep always below — below 10% [of total shipments]

So, to wrap things up, what Ferrari reported regarding its shipments sounded to me like very positive news. First, the company won’t pursue volume growth but will make its cars even more scarce as its TAM increases. Second, China is an important market but still not mature enough to be margin accretive to the company. Therefore, as a shareholder, I applaud the limited exposure the company wants to have.

The Magic of Ferrari’s Contribution Margin

We are not done with the report. There is plenty to be added to this symphony.

Let me start with a keen observation Bank of America analyst John Murphy made during the Q&A session:

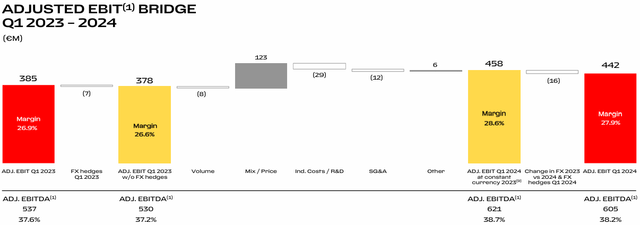

The quarter was a very Ferrari like-quarter, with volumes flat, and very significant revenue growth from price and mix and personalization. So it really proved out the model. But I think if we look at the two walks, I was just wondering if you could give us some information on or color on the EBIT change versus the revenue change because it was a very clean quarter with volumes almost — almost flat year-over-year, but EBIT up Euro 123 million versus revenue up Euro 166 million, which would give you a 74% contribution margin, which I think is — is not being appreciated necessarily in the stock at the moment. So I don’t know if you can talk about that on a relative basis. But you could give us a sort of color of how we should think about contribution margin, ex-volume, because it was very strong in the quarter, about 74% as far as I can tell.

I found this question as one of the best ever made during an earnings call.

I bet most SA readers are familiar with what contribution margin is. But let’s imagine a few readers are not. Let me explain it in brief.

Contribution margin is used in managerial accounting to gauge the impact of variable costs on total sales. In other words, it measures the scalability of a company because it tells the volumes a company needs to cover its variable costs.

The contribution margin is calculated as sales revenue minus variable costs.

Let’s consider a hypothetical company that sells its products for $50 apiece.

The variable costs per product are mostly materials and labor and they are $20 per unit.

The contribution margin per unit is $30.

Let’s imagine the company sells 1,000 units. This gives total sales revenue of $50,000. At the same time, the company’s total variable costs were $20,000 ($20×1,000).

So, the total contribution margin would be $30,000. Expressed as a ratio it would be 60% ($30,000/$50,000=0.6).

This means that for each dollar of revenue the company makes, it has $0.60 left after paying for its variable costs. With these 60 cents the company can cover its fixed costs and, if they are less than 60% of total revenues, earn a profit.

This is particularly helpful in calculating the break-even point of the company. Let’s imagine the company’s total fixed costs are $15,000. If we divide this by the contribution margin ratio of 0.6 we know the break-even point in sales revenue the company needs to achieve. In this case, it would be $25,000. This means that if the company makes over $25,000 in revenue, it will be profitable. This can also be used to calculate the break-even point in units, that is, how many units a company needs to sell to be profitable.

In this case, we would need to divide the total fixed costs by the contribution margin per unit, which we have previously calculated to be $30. So, $15,000 divided by $30 gives us 500 units, which is the threshold the company needs to sell to cover its fixed costs and begin making a profit.

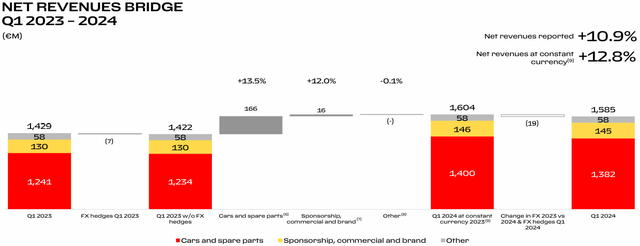

Back to Ferrari and Mr. Murphy’s observation. He started by taking a look at the YoY net revenues bridge. In particular, he focused on the industrial business (cars and spare parts). We see in the bridge below that cars and spare parts added €166 million YoY. Remember, volumes were flat. This is an increase caused by pricing power and volume mix.

Ferrari Q1 2024 Earnings Presentation

Mr. Murphy then saw this second bridge, linking Q1 2023 EBIT to this quarter’s. We see that mix/price contributed with €123 million to the overall result.

Ferrari Q1 2024 Earnings Presentation

What did Mr. Murphy see? To be honest, contribution margin ex-volume is not a standard term in accounting. However, it shows the impact of the contribution margin without considering the number of units sold. In this case, with flat revenues, it was particularly easy to see it. If we calculate the contribution margin on a per-unit basis, we eliminate volume.

Ferrari sold 3,560 units and its industrial revenue was €1.4 billion. This gives us an ASP of €393,258 per car. The cost of sales was €782 million, which means the variable costs per car were €219,560. This gives us a contribution margin per unit of €173,698. The ratio is 44.2%.

But Mr. Murphy wanted to highlight another aspect. He sees that those €123 million coming from mix/price reflect the company’s pricing power and favorable mix comprising cars with higher ASPs.

What does this mean? In short, 74% of the increase in revenue will go directly to the bottom line after taxes.

When we talk about pricing power, here is an example. And understanding is key to finding Ferrari a very attractive stock.

During the earnings call, Ferrari’s CFO Antonio Piccon disclosed that this strong performance was linked not only to a favorable product and country mix but to the important role of Daytona and Purosangue sales and China’s lower sales. But what is catching more and more attention is the impact of personalization. Currently, it is 19% of sales and it could be above 20% by the end of the year. There is no need to say how this is a margin-accretive business. And it is the way Ferrari has recently learned to keep growing at a double-digit rate without needing to keep increasing volumes that much. Ferrari’s CEO openly admitted that personalization prices were increased and this didn’t turn clients away:

this year, we increased the price of personalization. And you may remember the last call, we said that we increased the price of the new model and we increased the price of personalization. Well, what we saw is that, yes, there was an increase in the price — of the price of personalization, but there has not been any impact on the ratio of personalization. So, this is a lesson learned. We increased the price of personalization but if the client wants to personalize, they keep personalizing.

Two Key Models: Purosangue and the 12Cilindri

Purosangue is basically sold out, with order books full into late 2026. It has been a major success with an ASP estimated to be over €400k By then, the Purosangue will be close to the end of its life cycle (Ferraris usually remain available for 3-5 years).

In Q1, the deliveries of Purosangue were below 16% of the volume Ferrari shipped. So, the 20% target hasn’t yet been reached. The guidance for this fiscal year is around 18% of sales.

Unsurprisingly, the market is already asking whether Ferrari will release a new model. Here is the answer Mr. Vigna gave:

But I don’t want to comment on — I cannot, I would like to, but I cannot because secrecy is a way to fit desirability of what we do. Clearly, we are learning a lot from this model, and usually, let’s put it this way, we like to use what we learned. But I don’t want to say if there will be a successor or whatever.

Of course, Ferrari is working on a successor. But what is more interesting is that Ferrari’s CEO tells us that secrecy is a way to fit desirability. Here he unveils the true driver of Ferrari’s success.

A few days ago the 12Cilindri was announced and we were told

the price is Euro 395,000 for the Coupe and Euro 435,000 for the Spider. The number of the personalization, let me say, what will see — what will be the trend, we will discover together, but I think there are enough personalization options for the client. And as I said, there is a lot of interest in the new colors that let’s say, let them get in love even more. There are many dimensions we can explore over there, but we wanted to start from a price that is higher than the predecessor of these cars.

Valuation

Ferrari’s valuation is demanding, just like its cars. A fwd PE of 48. The fwd P/ FCF is 34. Here, the keys to assessing these metrics are two other factors: growth and profitability. Honestly, though a bit high, these multiples are deserved. I was personally able to purchase my first shares at a 39 PE. However, I have increased my stake at higher multiples because I see Ferrari’s story intact and stronger as the company moves forward.

I expect Ferrari’s revenue growth to keep up at a 10-12% rate, with its EBIT growth to be between 15 to 17% going forward. EPS growth will be well above 20% considering the boost given by stock repurchases. As far as profitability goes, we have already talked about Ferrari’s margins. Its ROTC is above 18%.

With these fundamentals, unless another pandemic or a very dramatic event happens that throws panic around, it is hard to see the stock fall a lot. This is why when Ferrari pulls back, it is time to add here and there some shares.

I bought a few today and have an order for tomorrow and this is why I Rate Ferrari as a buy.