Blue Planet Studio/iStock via Getty Images

I gave Gartner (NYSE:IT) a ‘Buy’ rating in my previous article published in January 2024, pointing out that their pricing increase will continue in FY24. Gartner released its Q2 result on July 30th, reporting 6.9% growth in revenue and 13% increase in adjusted EPS. I am impressed by their strong wallet retention rate and contract value growth during the quarter. I reiterate a ‘Buy’ rating with a fair value of $520 per share.

Strong Retention and Contract Value Growth

In Q2, Gartner delivered a 106% wallet retention rate in Global Business Sales (GBS), along with 12% growth in contract value. During the earnings call, the management disclosed that the headcount in GBS increased by 6% year-over-year, with plans to grow by high-single-digit in FY24.

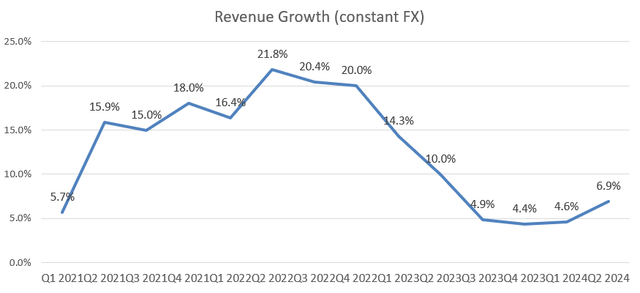

As illustrated in the chart below, Gartner delivered 6.9% constant revenue growth, with Research, Consulting and Conferences growing by 5.5%, 14.9% and 10.8% respectively.

Gartner Quarterly Results

I anticipate the growth recovery will continue in the coming quarters for the following reasons:

- With the increasing complexity of technology and geopolitical relations, enterprise customers are more likely to rely on research reports for strategic decision-makings. Research business represents around 80% of total Gartner’s total revenue, and the company has already witnessed growing demands for their research subscription services over the past few years.

- The high wallet retention rate enables Gartner to further monetize existing customers and generate higher average revenue per customer over time. The high retention rate is driven by Gartner’s broad portfolio and relevant research services tailored to enterprise customers.

- As indicated in my previous article, Gartner possesses strong pricing power over their customers via their subscription services. The price increase can directly contribute to their bottom line, as there are minimal incremental costs associated with these services.

Global Technology Sales

The Global Technology Sales (GTS) grew by high-single-digit during the quarter, below their historical average of 12%-16%. The lower-than-normal growth was caused by the tough capital funding environment faced by small technology companies. The current high-interest rate has created a soft market for tech startups, reducing demand for GTS’s services.

However, I anticipate the growth will start to recover in 2025, as the Fed is likely to start an interest rate cut cycle from this September. With the lower interest rate, the capital funding environment for small tech startups is likely to recover gradually from 2025 onwards.

As mentioned in my previous article, small startups need Gartner’s services to prepare corporate strategy, go public and communicate with potential investors. It is evident that the customer segment is relatively sensitive to interest rate. I think GTS business is currently at the bottom of economic cycle, and the interest rate is more likely to decline in the next 2-3 years.

Outlook and Valuation

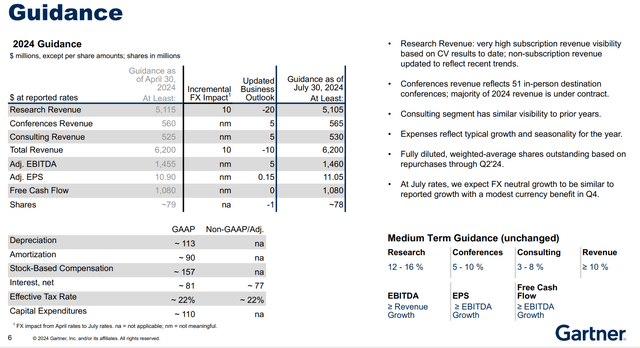

Gartner has not made significant changes for their FY24 guidance, as detailed below:

Gartner Investor Presentation

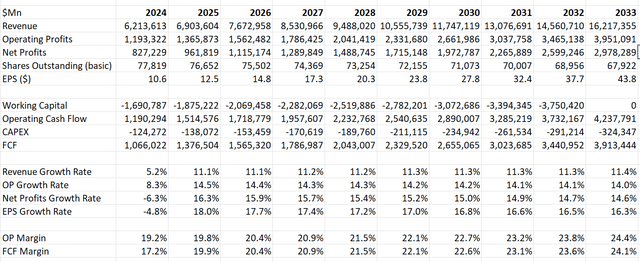

For the three segments, I build my DCF model based on the following outlook assumptions:

- Research: Due to the current tight capital funding environment, I anticipate the weakness in small tech companies sustaining through FY24. However, I estimate the growth will gradually recover from FY25 onwards when the Fed starts to enter an interest rate down cycle. Gartner’s contact value within Research business grew by 10% during the quarter, indicating strong renewals and retention. I anticipate the Research business will grow by 4.5% in FY24, with recovery to 12% aligned with historical average from FY25 onwards.

- Consulting: As indicated over the call, the IT outrage caused by CrowdStrike (CRWD) has generated strong demands for Gartner’s consulting business. Additionally, according to Accenture’s (ACN) Q3 result, the overall IT consulting market has shown some moderate recoveries. I estimate 8% annual growth rate for Gartner’s Consulting business in FY24, then accelerate to 9% from FY25 onwards when the economy starts to normalize.

- Conferences: This is the most volatile business segments, as the financial results depend on the number of conferences Gartner holds during the quarter. I assume 9% growth in FY24, and 5% from FY25 onwards, aligned with historical average.

As such, the total revenue is calculated to grow by 5.2% in FY24, followed by 11.1% from FY25 onwards.

The growing subscription revenue mix will help Gartner expand their operating margin over time. I model 60bps margin expansion driven by: 30bps from gross profits due to mix towards subscriptions and price increase, and 30bps from operating leverage of SG&A expenses.

With these assumptions, the DCF can be summarized as follows:

Gartner DCF

The WACC is calculated to be 11% assuming: risk-free rate 3.8%; equity risk premium 7%: cost of debt 7%; beta 1.1; tax rate 22%; equity balance $38 billion; debt $2.45 billion.

Discounting all the future free cash flow, the fair value of Gartner’s stock price is calculated to be $520 per share, according to my DCF model.

Key Risks

Gartner only repurchased $606 million of own stocks in FY23, much lower than $1 billion in FY22. During the earnings call, the company repurchased around $565 million of stocks this June. To some extent, I think the company’s own repurchase has provided some support for their stock price. Currently, the company has around $1 billion remaining in repurchase authorization, and it is unknown when Gartner will repurchase again this year, as their share repurchase strategy is purely opportunistic in nature.

End Note

I think Gartner will benefit from the potential interest rate cut in FY25, and their revenue is more likely to recover to double-digit growth over time. I reiterate a ‘Buy’ rating with a fair value of $520 per share.