peshkov

We previously covered GigaCloud Technology Inc. (NASDAQ:GCT) in April 2024, discussing its robust e-commerce prospects, attributed to the platform diversification and improved outreach to different groups of manufacturers/ resellers/ consumers globally.

Combined with the recent acquisitions and expansion to Canada/ India/ Latam, it was unsurprising that the management continued to guide double digit-growth ahead. While we had initiated our Buy rating then, we had urged readers to wait for a moderate pullback for an improved margin of safety as well.

Since then, GCT has drastically pulled back by -43.90%, well below our previous fair value estimates of $28.70 while underperforming the wider market at +7.3%.

Much of its headwinds are attributed to the short attacks, along with the market rotation from high growth stocks since mid June 2024 and the CBOE Volatility Index hitting extreme heights by early August 2024.

With the massive volatility already triggering the drastically moderated stock valuations/ prices and the stock breaching numerous support levels, we believe that it may be more prudent to downgrade to a Hold (Neutral) for now.

GCT High Growth Investment Thesis Remains Promising, Despite Market’s Pessimism

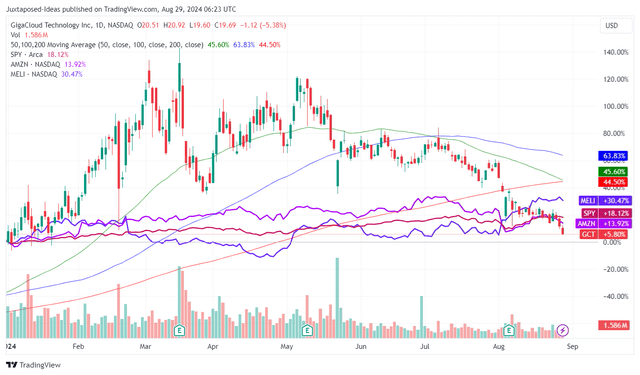

GCT YTD Stock Price

Trading View

GCT has had a rough YTD performance, with the stock already losing all of its 2024 gains and a further breach from the YTD support levels very likely, based on the volatile market sentiments surrounding high growth stocks.

This is despite the double beat FQ2’24 earning results, with total revenues of $310.86M (+23.8% QoQ/ +103% YoY) and adj EPS of $1.03 (+22.6% QoQ/ +68.8% YoY).

Much of GCT’s top-line tailwinds are attributed to the double digit GigaCloud Marketplace GMV growth to $1.09B over the LTM (+80.7% sequentially), as its Active Buyers grow to 7,257 (+66.7% sequentially) and average spend per Active Buyer increased to $151.27K (+8.3% sequentially).

These numbers well exceed the US industry’s retail furniture sales at -7% YoY in H1’24, potentially attributed to the uncertain macroeconomic outlook, the impacted home sales, and the lower home-DIY discretionary spending.

This outperformance have well balanced the heightened Drewry’s World Container Index [DWCI] by +3.3% QoQ/ +121% YoY, attributed to the ongoing geopolitical events in the Red Sea, as reported by ZIM Integrated Shipping (ZIM) and Maersk (OTCPK:AMKBY).

For now, the higher ocean freight costs have already been reflected in GCT’s lower adj EBITDA margins of 13.7% (inline QoQ/ -2.5 points YoY), with H2’24 likely to be similar.

With the summer outdoor furniture season also well behind us, it is also unsurprising that the e-commerce company has offered a relatively underwhelming FQ3’24 revenue guidance of $274M at the midpoint (-11.8% QoQ/ +53.7% YoY) – a seasonal trend observed over the past few years.

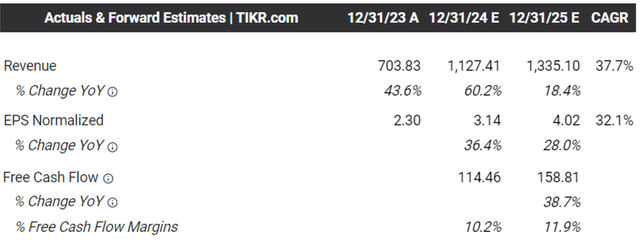

The Consensus Forward Estimates

Tikr Terminal

Even so, the robust YoY growth can not be ignored indeed, building upon the FQ3’23 sales growth at +39.2% YoY, with it implying the growing scale of GCT’s business operations – warranting the intensified LTM capex of $14.42M (+2,002% sequentially).

Combined with the increasingly rich balance sheet at a net cash position of $208.7M (+6.8% QoQ/ +14.9% YoY), we believe that GCT remains well positioned to generate profitable growth over the next few years, despite the tougher YoY comparison from FY2025 onwards.

The US Trade War May Impact GCT’s Growth Prospects

On the one hand, GCT’s growing suppliers, recent Noble House/ Wondersign acquisition, and the launch of its Branding As A Service [BAAS] have already contributed to its robust top/ bottom-lines.

These developments further underscore why the management has continued to expand their fulfillment capabilities across five different countries, given that its “established fulfillment centers across the US are averaging over 90% utilization rate and we are actively seeking additional space to accommodate continued rapid growth.”

On the other hand, while GCT does not specify its supplier/ manufacturers’ locations, with it primarily in Asia, we believe that its e-commerce prospects may face intermediate term headwinds.

This is attributed to the ongoing trade war between the US and China, where higher tariffs of up to 60% (up from the current 25%) is more likely than not, no matter who wins the US Presidential elections in November 2024.

This may be a massive headwind indeed, since its employees in China comprise 70.9% of its overall headcounts as of FY2023 (as last updated), with the country potentially forming a large pool of its existing manufacturers/ sellers.

While the strategic approach of buying furniture in Asia and selling in the US has previously allowed the company to achieve profitable gross margins, it appears that things may not be the same moving forward.

While the GCT management has yet to address this issue, we believe that the sellers and resellers may simply pass on the higher costs to customers, with it potentially impacting its high growth prospects in the US as the macroeconomic outlook remains uncertain.

This is especially since the US product revenue comprises $169.06M (+112.4% YoY) or the equivalent 54.3% (+2.4 points YoY) of its overall FQ2’24 sales.

The impacted sales may also affect its auxiliary revenues, such as ocean transportation/ warehousing/ last-mile delivery/ packaging services, which comprise another $69.76M (+171.4% YoY) or 22.4% of its sales (+5.7 points YoY) in the quarter.

Therefore, GCT investors may want to pay attention to the management’s future commentaries surrounding this issue, since it may impact the consensus forward estimates along with its stock valuations/ prices in the intermediate term.

So, Is GCT Stock A Buy, Sell, or Hold?

GCT 2Y Stock Price

Trading View

Since the March 2024 top, GCT has had a volatile stock performance afterwards, with it also losing much of it 2024 gains while trading below the 50/ 100/ 200 day moving averages.

For context, we had offered a fair value estimate of $28.70 in our last article, based on the FY2023 adj EPS of $2.30 and the FWD P/E valuations of 12.48x. This is on top of the long-term price target of $43.80, based on the consensus FY2025 adj EPS estimates of $3.51.

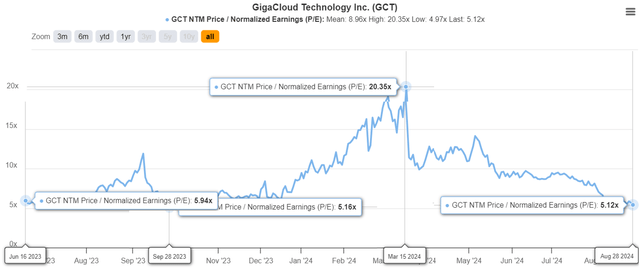

GCT Valuations

Tikr Terminal

It is apparent by now that those numbers are no longer valid, with the short attack moderating much of GCT’s premium FWD P/E valuations from the peak of 20.35x in March 2024 to new YTD lows of 5.12x – with the volatility offering interested investors with a minimal margin of safety.

Based on GCT’s LTM adj EPS of $2.77 ending FQ2’24 and the updated FWD P/E of 5.12x, it is apparent that the stock is still trading at a premium to our updated fair value estimates of $14.20.

Based on the consensus raised FY2025 adj EPS estimates of $4.02, it appears that the stock has also pulled forward much of its upside potential to our updated long-term price target of $20.60.

Lastly, readers must note that GCT remains a battleground stock, as short interests grow to 26.35% at the time of writing, with it now “considered speculative, high-risk investment as it experience higher volatility and lower liquidity.”

Combined with the stock’s lower lows and lower highs over the past few months, we believe that it may be more prudent to downgrade to a Hold rating (Neutral) for now, with the lack of bullish support likely triggering a further retracement to its YTD bottom of $18s, if not December 2023 support levels of $15.00.

Investors looking to add GCT may want to wait until the carnage has ended and bullish support has been observed, barring which, there may be more pain indeed.