Thomas Barwick

Investment thesis: With stock markets reaching new all-time highs regularly, and valuation levels remaining significantly higher than historical trends, it is increasingly becoming hard to find enticing investment opportunities in this market. The Gladstone Land Corp. (NASDAQ:LAND) REIT, part of the “invest in farmland” trend, may be one of a few asset classes left that one can make an argument that it has growth potential. Within the context of what is arguably emerging as a stagflationary economic environment, farmland values and food prices may be among only a few assets that are likely to beat inflation. I see this REIT as a buy at current valuation levels, and I am likely to add to my current modest position in the coming months if the price dips further from here.

A brief description of the Gladstone Land REIT.

- A somewhat fragile financial situation slightly diminishes the great asset position it is sitting on.

Gladstone Farms

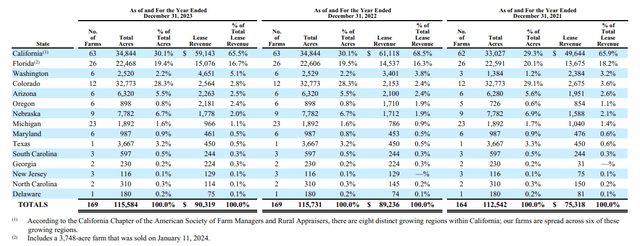

As of the end of last year, this REIT has over 115,000 acres in assets. Given a market cap of about $545 million, its acreage is currently valued at about $4,700, strictly on a market cap/acreage basis. Gladstone values its acreage assets at $1.5 billion, strictly based on the estimated market value of the land, if it were to sell, based on a recent presentation. The average value of its farmland per acre based on this estimate is about $13,000, which is three times higher than the average price of farmland in America.

USDA

It should be noted that most of the acreage it owns is located in California, a high-price area for farm acreage. The difference between its estimated value per acre and the REIT’s market cap per acre can be explained by its financial situation.

With $90.32 million in revenues from land leases, the revenue-to-market cap ratio is just over 6x as of 2023. Based on recent net earnings, the 3.7% dividend that it currently pays is sustainable. Net income for the first quarter of the year was $13.6 million, which more than covers the quarterly shareholder payouts at $11.1 million for the first quarter. Interest expenses came in at $5.6 million. Adding it all up, Gladstone Land’s current financial performance is currently just enough to get by.

The total amount of debt is $615 million, which is a 7.2% decline compared with the same period from a year ago. The debt situation is something that needs to be contemplated within the context of current interest rates, which are significantly higher than they have been in the 2009-2021 period. Given its current level of debt, every 1% in interest on debt costs $6.15 million/year in interest payments, therefore a potential increase in borrowing costs of a few percentage points could wipe out its earnings. Going back to the explanation in regard to the significant discrepancy between the value of its land portfolio and its market cap, the somewhat fragile state of its financial situation provides some insight.

- Gladstone Land’s share price strongly correlated positively with soft commodities markets.

Gladstone Land share price & other metrics (Seeking Alpha)

LAND’s share price is down significantly from its highs of just over $40/share reached in 2022. It should be noted that it correlates with soft commodities price trends, such as CORN or Soybeans, which also saw a spike in prices in 2022 and declined significantly since then. The correlation is somewhat curious because the farmland in the REIT’s portfolio is more focused on fruit & vegetable farming.

Gladstone Land

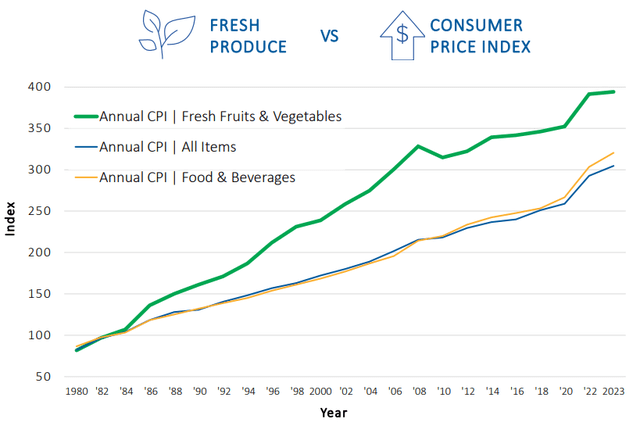

Perhaps the argument in favor of the positive correlation between the price of soft commodities and the share price of LAND is that in the longer term, the price of fruits & vegetables tends to rise faster than the price of crops and the overall CPI. In other words, it is an indirect correlation.

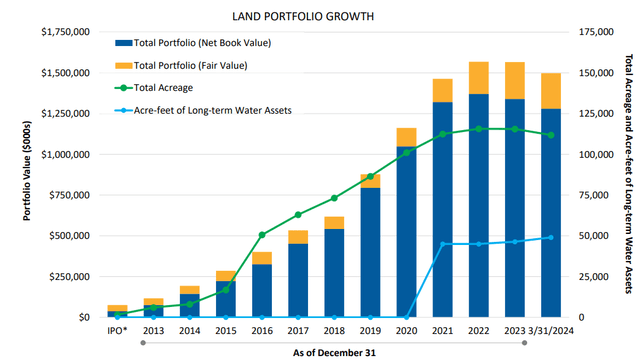

- Land portfolio acreage peaked in correlation with rising interest rates.

Other trends of note include a peak and seemingly a trend of a steady decline in acreage ownership in its portfolio.

Gladstone Land

After many years of rising farmland asset volumes, we have reached a peak in 2022, and we are now seeing a slight decline. The number one causal factor might be that it is probably a reflection of higher interest rates, making it less attractive to borrow money to purchase more farmland. It makes some sense to reduce its debt by selling some acreage, which the market suggests it has appreciated to pay down some of its debt.

The argument favoring farmland continually appreciating is based on long-term supply/demand factors.

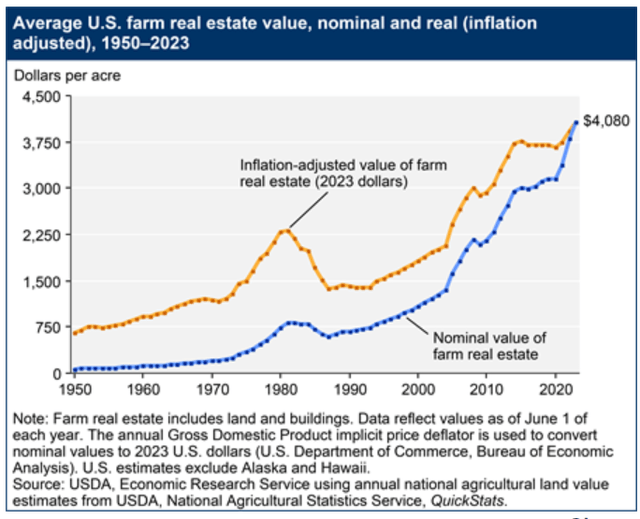

History is on the side of continued farmland value appreciation. We saw more or less steady appreciation for decades. Past performance is never a guarantee of future performance; however, we have to consider the particular factors that can help to continue to make the assumption of continued value appreciation true.

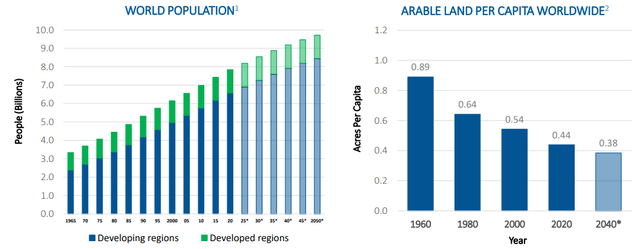

- Global farmland available per capita is in decline.

The world continues to see an increase in the number of people living on the planet, while available farmland for growing food is not increasing.

Gladstone Land

As we can see, the amount of arable land per person globally is set to decline from .44 acres in 2020 to just .38 acres by 2040. This is a roughly 15% decline, which has to be made up by increasing crop yields per acre by roughly the same amount, just to compensate for this one factor.

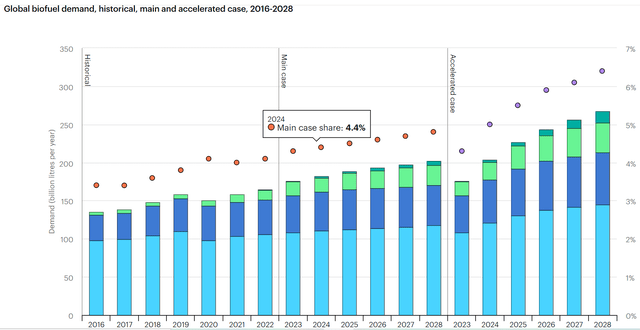

- Demand for cropland-derived products of non-culinary nature is set to increase due to various factors.

We should also keep in mind that demand per capita for the products of the global cropland available to us is increasing, it does not remain steady. Demand for biofuels, for instance, continues to increase.

IEA

My take on the IEA forecast is that the accelerated case scenario is the more plausible one. The reason for my assumption mostly has to do with a little-noticed data point in terms of global crude oil production, namely the fact that on a monthly basis, we reached a peak in supply in the fall of 2018 at 84.6 mb/d.

As of March of this year, the last month for which the EIA provides data, the world produced 82.6 mb/d, even as total liquid fuels production increased slightly for the same period. Even though crude oil production reached a peak almost 7 years ago, it is perhaps still too early to call it a permanent one. Demand factors are likely to come into play that may yet push supply past the 2018 peak. The one thing that we can say about this data point is that we most likely entered a period of permanent crude oil scarcity, where in the absence of stemming demand growth, new sources of energy, such as biofuels will grow in importance.

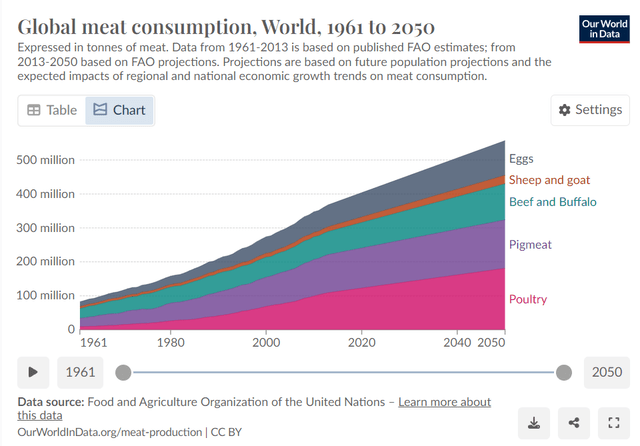

- Demand for crops in the production of animal protein is set to rise.

As the global middle class continues to increase, demand for animal protein in people’s diets is likely to increase as well.

Our World in Data

A roughly 25% increase in demand for animal proteins in the 2020-2050 period will require a significant increase in crop production for animal feed. Currently just over a third of total crops produced around the world are fed to animals to produce proteins.

Investment implications:

- Logic dictates that the acreage that Gladstone Land is sitting on is set to see long-term appreciation in value.

Given all the relevant global trends, as well as historical market precedents, we can expect farmland prices to continue rising. Importantly, US farmland prices rose about as much as the main stock market indexes so far this century. The S&P 500 is up about 3.5X since the turn of the century, while average nominal cropland prices increased about four-fold for the same period, as the chart I shared earlier in the article shows.

With food and soft commodities demand set to rise faster than the rate of global population growth, based on the factors I already alluded to, the rate of appreciation for farmland prices may accelerate and perhaps greatly outperform the stock markets in the long term. It should be noted that if food inflation picks up on a sustained basis, consumers are likely to cut back on spending for most other goods & services, which will, in turn, create a tough business environment for the business sector; thus higher food prices can contribute to lackluster long-term stock market performance, even as it is likely to bolster the performance of this REIT in terms of its share price.

- Higher farmland prices can lead to higher leasing fees, thus higher revenues & earnings for Gladstone Land.

Since its revenues are dependent on the willingness of farmers to lease land for their farming activities, higher land prices should in theory help to bring in higher revenues and earnings. If land costs are rising, farmers might be less eager to buy more land, especially within the context of the current interest rate environment. At the same time, rising soft commodities and fresh produce prices are likely to help increase demand for acreage available for lease, which can push lease prices higher, benefiting Gladstone land.

On paper, most factors align in favor of a bullish long-term thesis for Gladstone Land. Within the context of what is increasingly shaping up to be an emerging era of stagflation, tangible assets producing crucial goods such as food or energy should in theory outperform the stock markets. There are however some potential risks or downsides to Gladstone Land’s business model within the current context.

As farmers might have a harder time buying land within the context of rising land prices and high interest rates, so does Gladstone Land potentially. It might be the main reason why its landholdings peaked and started declining slightly in the past few years. If interest rates persistently remain higher, it will be harder to expand its farmland portfolio. Taking on high-yield debt can be risky to its profitability, even if lease prices are set to rise.

There is also a demographic factor that could potentially negatively impact demand for farmland in the foreseeable future. The fact that the average age of farmers is very high could potentially lead to a decline in farmland leasing demand. This might not be the case with some of the larger farms in California, where the farmers are often more like business managers than actual hands-on farmers, doing the work in the field. Employees do most of the manual labor on such fruit & vegetable farms, so the age of the farmers is not as important. Smaller farmers, however, who are getting older, are less likely to continue seeking out acreage for lease. Many might even sell, or those inheriting the land might sell, which could provide a double hit, at least in the shorter term, to Gladstone Land’s revenues as well as to the value of the farmland.

There is a risk that certain negative factors may override the effects of the positive factors that have the potential to push the shares of this REIT higher. However, chances are that the long-term supply/demand factors that I identified, which are mostly bullish for the prospects of both farmland prices as well as rising revenues from leasing land, will ultimately prevail over other issues, such as an aging farmer demographic, which may create a perhaps short period of farmland demand weakness in some parts of the country.

My conclusive take on the aging independent farmer issue is that independent farms may gradually disappear. Still, large-scale buyers of farmland, such as Bill Gates, now one of the largest farmland owners in the US, will continue buying any farms that are liquidated. Gladstone Land Corp is thus an opportunity for smaller investors to participate in the trend of farmland consolidation into fewer and fewer hands, even as demand for the crops that are produced on the land continues to soar. Within the prospect of a long-term trend where consumer spending will flow increasingly to meeting their more crucial needs, such as food and energy that seem to be headed for scarcity, I believe that Gladstone Land Corp is a strong candidate to beat a stagflationary market in the long term; therefore I started buying shares, cautiously. I see any further decline in its share price as an opportunity to add to my position.