Hiroshi Watanabe

Hercules Capital, Inc. (NYSE:HTGC) is my only VC-focused BDC for which I have assigned a buy rating currently. My first piece on HTGC – Hercules Capital: A Different Type Of VC-Focused BDC – was published in January 2024. As it could be understood from the title, the thesis was based on fundamentals that differ from those of other VC tilted BDCs. More specifically, it was about relatively conservative equity stakes, sound capital structure and disciplined credit underwriting strategy that together warranted, in my opinion, sound cash generation profile (including safe dividend coverage level).

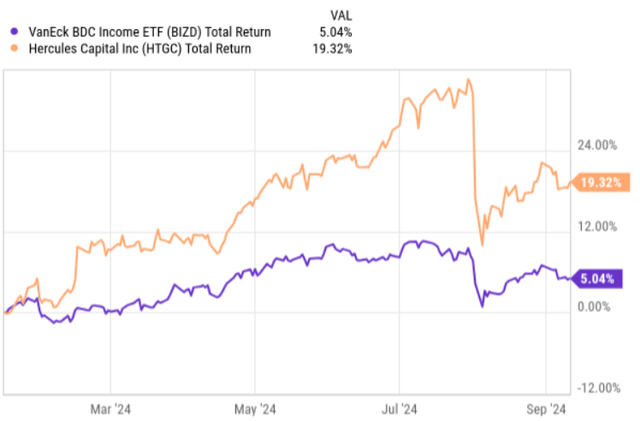

As we can see in the chart below, the investment thesis has paid off quite nicely, where HTGC has delivered a significant alpha relative to the BDC index.

Ycharts

After the release of my initial thesis, I have continued to cover HTGC, assessing each quarterly earnings report – in all cases maintaining a clear buy stance. In early August HTGC circulated Q2, 2024 earnings deck after which, as we can see in the chart above, the stock sharply declined. While there has been now some recovery, the current levels are still well below the peak that was achieved right before the Q2 report was out.

Let’s now review the recent earnings in more detail to see whether the bull case really remains intact.

Thesis review

Core performance wise, the Q2 results were actually solid, giving no tangible reason for the massive repricing of HTGC’s stock price. For example, in Q2 HTGC generated record total investment income of $125 million, which translates to an increase of ~ 8% on a year-over-year basis. Similarly, the net investment income figure grew by 9%, landing at $82.4 million. Factoring in the additional share issuances, the net investment income per share came in at $0.51 of Q2, which provides a base dividend distribution coverage of the 128% – i.e., one of the highest metrics in the BDC sector.

Besides these core cash flow dynamics, the Q2 period marked once again a very strong investment activity, which has been not that common for other BDCs out there. In Q2 HTGC secured total gross funding of $461.5 million, which on a YTD (or H1) basis leads to a total funding volume of circa $1.07 billion that is a historical moment for HTGC as it is the first time in the BDC’s history that the total transaction amount has surpassed $1 billion just in 6 month time. These portfolio additions have warranted an increase of 14.7% in the total asset base compared to Q2, 2023 period.

Granted, in Q2 there was also a slightly elevated repayment activity of $306 million, which partially offset the gross funding component. However, I would not view this as a negative because of three aspects: 1) the net quarterly investment volume is still materially up, 2) these repayments relaxed the pressure for HTGC to tap into its liquidity reserves to fund the new additions, and 3) since almost 45% of Q2 repayments were driven by M&A events, it helped HTGC’s crystalize some of its injected equity value in the underlying companies (i.e., companies that were subject to the M&A moves).

Plus, if we dig deeper into the new investment list, we will notice that most of the capital has been deployed into quality later-stage companies, which have also increased HTGC’s exposure to first lien instruments. Here, it is also worth underscoring the fact that these incremental investments have resulted in a slight yield compression relative to the prior quarters.

The comment in the recent earnings call by Scott Bluestein – Chief Executive Officer & Chief Investment Officer – explains this nicely:

Our balance sheet, with conservative leverage and low cost of capital, remains very well positioned to support our continued growth objectives, and provides us with the ability to go lower on yield for higher-quality assets when warranted. This serves as a key differentiator of our business relative to our closest competition.

In other words, as HTGC has ventured into more defensive businesses, the portfolio yield has fallen accordingly. Yet, the major offsetting factor to this is HTGC’s ability to grow the portfolio in a material fashion by utilizing its robust balance sheet. The idea is that a higher asset base should result in a higher absolute figure of cash generation, which would be more than enough to compensate for slightly decreased portfolio yield (or investment spreads).

The portfolio dynamics at the non-accrual front sends a clear message that this strategy is working. In Q2, HTGC placed only one new position under non-accrual, which on a FV basis accounts for less than 1% of the total portfolio. Given the unfavorable non-accrual recent statistics for other comparable BDCs – especially those that operate in the VC space such as TriplePoint Venture Growth (NYSE:TPVG) and Horizon Technology Finance (NASDAQ:HRZN) – the situation for HTGC looks very solid.

Key risk

The only negative I see in the context of HTGC’s investment case is the further spread compression risk, which might not be offset by the increased portfolio size due to either balance sheet constraints or lack of sufficient M&A activity.

However, when it comes to the probability of such risk actually taking place, in my opinion, the odds are very low. It is unlikely that HTGC will suffer from insufficient financial capacity to accommodate attractive deals, as the current P/NAV premiums allows it to issue fresh equity in an accretive manner, thereby keeping the capital structure in balance when funding larger investment volumes. Plus, the recent dynamics on the M&A front (in general) in combination with a more favorable interest rate curve, seems to bring the M&A markets back in vogue relatively soon. Namely, the risk of HTGC suffering from a low volume of investment offerings is low.

The bottom lines

The recent pullback in HTGC’s market capitalization level provides, in my view, a great opportunity for long-term investors to either open a new position in this BDC or add additional capital to the already existing one.

The core underlying metrics remain strong across the board, with the only major negative being the potential risk or consequences of a further spread compression. Yet, as outlined above, HTGC has a sufficient balance sheet and the right strategic focus in terms of company segments to mitigate this risk.

Moreover, we have to appreciate the fact that HTGC carries a significant chunk of equity injections that it has made for many of its portfolio companies, which will be easier to monetize as the interest rates drop and the M&A markets open.

Putting all of these pieces together, the FWD yield of ~ 10.5% that is underpinned by conservative base dividend coverage of 128% and robust fundamentals still warrants a buy here.