Want more housing market stories from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter.

Since peaking this year at 7.52% in April, the average 30-year fixed mortgage rate, as tracked by Mortgage News Daily, has drifted down, with the current average rate at 6.37%.

How has this slight improvement in rates (and housing affordability) impacted the housing market?

So far, the impact has been only marginal.

Look no further than the Mortgage Purchase Application Index, a leading indicator for existing home sales, which is still hovering around multi-decade lows. This indicates that existing home sales remain in recession and are hovering around multi-decade lows—something that has been ongoing since the summer of 2022.

Why hasn’t the recent rate dip spurred more purchase activity? Housing experts had a few different takes.

“It appears a deflationary-like mindset has taken control over some home shoppers,” Ali Wolf, Zonda’s chief economist, posted on X Wednesday. “Builders report reasonable traffic levels, but many prospective buyers are saying, ‘I know rates are coming down, so I’ll wait.’”

Nick Timiraos, chief economics correspondent of the Wall Street Journal, pointed to affordability. “We may be exhausting the cohort of people who can buy given the affordability constraint from the jump in rates on top of the run-up in prices,” Timiraos posted on X Wednesday. “Just because many markets withstood some initial period of 7% rates doesn’t mean there are pools of buyers who can continue to buy given the affordability constraint even if they think/expect rates will be lower in a few years.”

ResiClub’s view is that barring a significant improvement in housing affordability, the recovery in existing home sales is likely to be slow—a grind. High switching costs continue to suppress resale turnover, as elevated mortgage rates compared to pre-2022 levels have made the prospect of trading a lower monthly payment/rate for a substantially higher one a daunting financial challenge.

Over time, if housing affordability improves—whether through lower mortgage rates, lower prices, or higher incomes—it’ll bring more sellers and buyers into the market, and push up existing home sales.

And as time goes on, life events such as expanding families or other significant changes can act as catalysts in reducing so-called switching costs. For example, a growing family may find the need for a larger home more pressing, making the financial and emotional aspects of moving more palatable. These life events can gradually alleviate switching costs in borrowers’ minds.

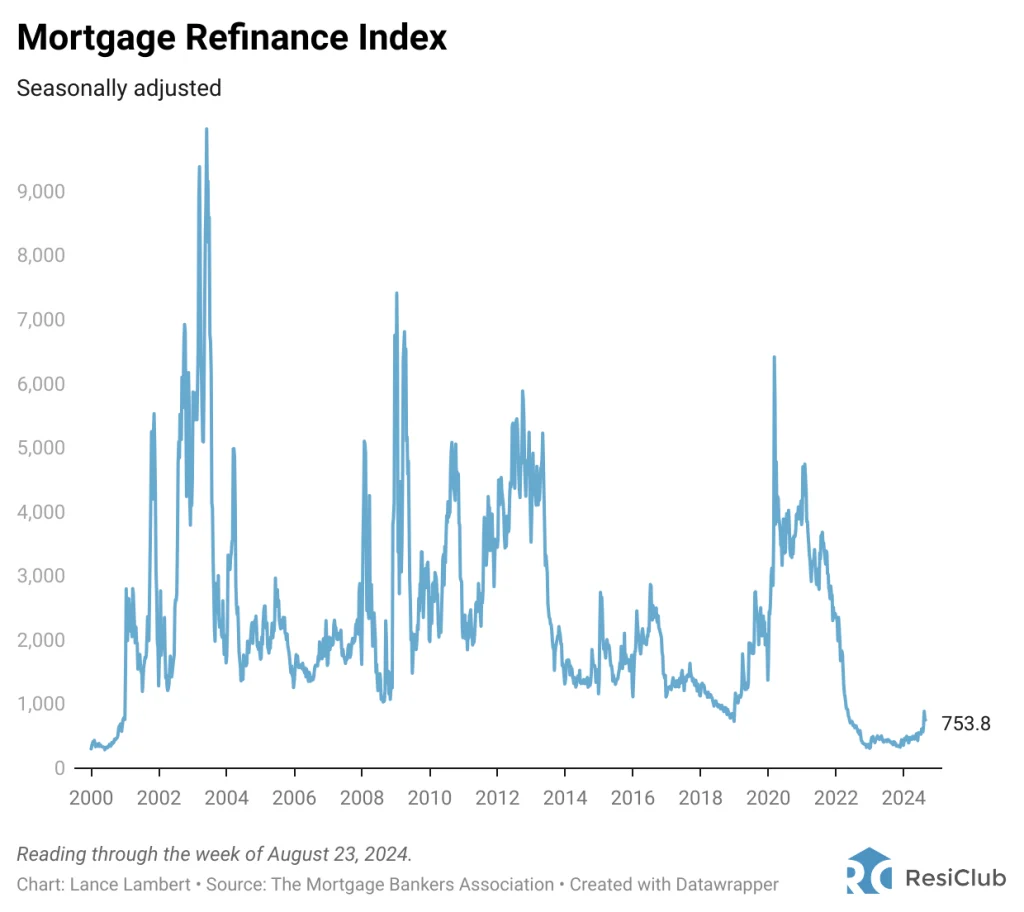

Mortgage refinancing is one area of the market that has gained some recent traction, as borrowers who secured 7% or 8% rates over the past 18 months are taking advantage of the recent rate dip to get some relief.

While this isn’t a refi boom—at least not yet—it is a bounce off the multi-decade lows hit during the mortgage rate shock.

How low would the average 30-year fixed mortgage rate need to get to really see a big change?

“For a real refi boom? Demand and more supply for purchases? 5.5% or below,” Gordon Miller, owner of Miller Lending, a mortgage lender based in Cary, N.C., tells ResiClub.