Investing isn’t just for the big leagues. For solopreneurs and smaller entrepreneurs, it’s a field ripe with opportunity, extending well beyond the traditional realms of stocks and bonds. Learning how to invest in businesses is entirely within reach with the advent of new opportunities paired with powerful technology.

Contrary to conventional business reality, investing isn’t just doable—it’s a strategic move. Smaller players can maneuver through market niches more swiftly, uncovering valuable opportunities that larger investors might miss.

I’ve researched, vetted, and curated a list of 7 investment ideas that align with the nimble nature of smaller-scale entrepreneurship. And you may be surprised to learn that not all of these options require a substantial sum of capital.

Let’s dive in and find the right investment option for you.

7 Business Investment Ideas For Entrepreneurs

Before exploring the seven business investment ideas, let’s touch on the two primary types of investments: equity and debt.

- Equity Investments: Involve purchasing a stake in a company, thereby owning a part of the business and often having a say in its operations.

- Debt Investments: Investors lend money to a business in exchange for interest payments, with the principal amount typically repaid later.

The following ideas cover both types of investments. You can decide which approach aligns best based on your financial goals and risk tolerance.

1. Commission-Based Investments

Commission-based investments offer a gateway for entrepreneurs to earn by promoting other companies’ products or services. Instead of putting any equity into a company, you receive a percentage of sales you have generated by showcasing or distributing on behalf of the company.

This low-barrier entry method requires minimal upfront investment, making it attractive for many. You could earn commissions on the following structures:

- Affiliate Marketing: Earn a commission for marketing another company’s products on your platform.

- Dropshipping: Brainstorm dropshipping business ideas and sell products on your website or a marketplace that a third party fulfills, earning a margin on the sale.

There are plenty of great courses that are both affordable and comprehensive to get started with these methods. I’ve invested in the Authority Site System, which teaches entrepreneurs how to build affiliate relationships and promote services and products on their websites. I appreciate that the company regularly updates the courseware, keeping everything compliant down the line.

For those interested in dropshipping, the popular Udemy program Build a Dropshipping Empire From Scratch can help you get started in this arena.

2. Peer-to-Peer Lending

Peer-to-peer (P2P) lending connects entrepreneurs with small businesses or individuals needing loans through platforms like Honeycomb and Kiva. Imagine lending to a burgeoning coffee shop that needs funding to open a second location. Your return comes as interest payments, offering a financial benefit and the joy of seeing a local business thrive.

P2P platforms often allow starting investments from $25 to $50, enabling easy risk spread by letting you invest in various small loans.

Your maximum investment varies with each platform’s rules, legal limits, and whether you’re an accredited investor. Non-accredited investors face caps based on income or wealth, while accredited investors typically have higher limits.

There’s a lot of upside to this potential investment opportunity:

- Impact small businesses and local economies.

- Diversify your investment portfolio beyond traditional stocks and bonds.

- Access to a broader range of investors, including those who are not accredited investors.

While P2P lending can be rewarding by supporting the growth of small businesses and offering potentially attractive returns, it also carries the risk of loan default and the challenge of predicting variable interest payments. Determine your risk level before getting started with loans.

3. Buy and Hold Stocks and Index Funds

Buying and holding stocks and index funds is a key strategy for long-term growth. This method opens the market to business owners for substantial potential returns, championing the power of patience and time. It’s one of the best passive income ideas for compounding interest to enhance your portfolio’s value significantly.

Are you curious about how to invest in businesses through the stock market? Here are three main approaches:

- Direct Stock Purchase: Pick individual stocks to buy directly.

- Index Funds: Invest in a broad market segment for diversification.

- Dividend Stocks: Choose stocks that pay dividends for regular income.

This method helps investors avoid the complexities and short-term volatility of the market, focusing on steady growth over time. To keep things ultra simple initially, start with an index fund that follows the broad market, such as the S&P 500, which has averaged around an 11% return since its inception in 1923.

4. Buy a Website

Investing in a website is a fast track to owning a business that already makes money. Platforms like MotionInvest specialize in connecting entrepreneurs with online businesses that are ready for a new owner. They’re geared towards affordable sites, making them accessible to smaller investors.

Here’s the gist of how to find the right website for acquisition:

- Explore Listings: Check out websites for sale on website marketplaces.

- Due Diligence: Research the site’s traffic, revenue, and growth potential.

- Make an Offer: If a site fits your goals and budget, make a purchase offer.

- Transition: Once purchased, transfer the website’s assets to your name.

This approach gives small business investors immediate entry into e-commerce, turning digital prowess into profit. Buying websites for sale involves understanding their value, negotiating the price, and managing the transfer. Try to get a sense of the business’s past performance and look for insights on potential growth.

5. Micro Investing Apps

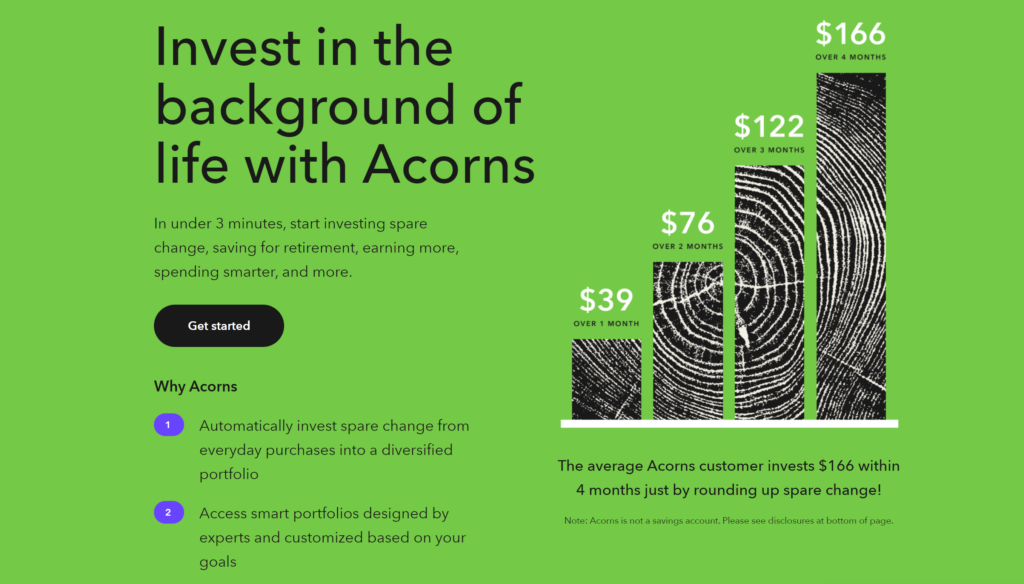

Micro-investing apps like Stash, Acorns, and Fundrise have revolutionized how small business owners and entrepreneurs approach investing.

In addition to making small, flexible investments, you can also use cool features like round-ups and recurring investments for additional earnings. This provides a gamification element that traditional stock and bond investing doesn’t offer, making it easier to keep up with in the long term.

Here’s how micro-investing works:

- Start with Small Amounts: Begin investing with just spare change or a few dollars.

- Automatic Diversification: Your investments are spread across stocks, bonds, or real estate.

- Simple Management: Easily oversee your portfolio via the app, cutting out the financial advisor.

- Educational Tools: Learn about investing with resources provided by the apps.

Micro-investing apps let you invest in a mix of stocks, bonds, and real estate through ETFs and REITs. They cater to varied investment goals and risk tolerances. While the potential returns are generally lower than other methods, micro-investing allows easy and accessible entry into the investing world. It’s a great way for small business owners to dip their toes in the water without committing large sums of money.

6. Partner with Fellow Entrepreneurs

Entrepreneurial partnerships can offer savvy investors a profitable way to build equity and cash flow. You’ll want to find entrepreneurs in complementary industries or markets you know well who can bring different skills and connections.

Imagine teaming up with a tech-savvy friend to create a digital marketing agency. You bring your sales expertise to the table while your friend handles the technical SEO and website optimization.

You each invest time and financial resources into launching the business, planning to split profits once the agency is established.

To decide which partnership works best with your investment goals, consider the following:

- Complementary Skills: Seek partners who bring different skills and expertise.

- Shared Values: Make sure you have similar values and work ethics.

- Communication: Establish clear communication channels and expectations from the start.

This approach taps into the unity of collaboration, offering business owners a savvy way to dive into small business investing and venture capital. It’s about leveraging collective strengths for mutual success, whether securing an equity stake in a burgeoning startup or supporting a local small business’s growth.

By partnering up, entrepreneurs can pursue larger investment opportunities while minimizing personal financial exposure, all within a framework that champions shared success.

7. Experiment with Angel Investing

Angel investing lets you join in on a startup’s adventure. You contribute money to help small businesses or startups grow; you get a piece of the company in return. This is perfect for people who are comfortable with risk and want to be more involved in their investments, aiming for big wins down the road.

Here’s what you can keep in mind when navigating your entry into angel investing:

- Where to Invest: Focus on startups or local businesses with a good chance to boom. By putting your money here, you’re not just helping out; you’re setting yourself up to make more money if the business takes off.

- Checking the Plan: It’s important to review the business plan carefully. A solid plan should show how the business will make money, understand its market, and keep track of its cash flow.

- Putting in Your Own Money: Unlike buying stocks, angel investing is all about using your own cash. You’re betting that your support will help the business grow and that you’ll see a nice return on your investment.

- How to Find Opportunities: Places like credit unions and crowdfunding platforms are great for finding businesses that need investment. They connect people with money to small companies that need financial help.

- Staying Safe: Make sure there are clear rules about how to help the business financially. This includes understanding how you’ll get your money back and what happens if things don’t go as planned.

- Being Involved: Many angel investors don’t just stop at giving money; they also offer advice or help make big decisions to ensure their investment pays off.

Angel investing is exciting because you can help startups grow and potentially make money. But remember, it’s risky. Not every investment will be a winner, so it’s smart to spread your bets and really understand the businesses you invest in.

Check out networks and marketplaces that connect investors to businesses to find the right fit.

AngelList connects investors with startups, offering a platform to find and invest in innovative companies.

How to Invest in Businesses: Best Practices to Follow

If you’re starting your investment journey, here’s a brief guide aimed at educating you on key considerations—helping you navigate your finances with clarity and confidence:

- Sketch Your Financial Landscape: Before diving in, take a moment to map out your finances. How much can you comfortably invest? What’s your timeline? Gauge your comfort with risk. This trio—budget, timeline, risk tolerance—is your compass in the investment world.

- Dive Deep into the Business’s Soul: Look beyond the surface. A company’s history, its place in the market, and how it’s been fueled financially can reveal the potential for triumphs and potential red flags or risks.

- Negotiate with Insight: Treat investment terms as a dialogue, not a monologue. Scrutinize, question, and, when possible, shape these terms to mirror your goals. Clear, mutual understanding paves the way for fairness and avoids future tangles.

- Forecast Financial Returns: Picture the journey of your investment. Will it bear fruit through dividends, grow with interest, or appreciate in equity? Anticipating the when and how of returns crafts a clearer path for your financial strategy.

These steps can help you become a more astute, educated investor and understand how to invest in businesses on your own terms and requirements.

Is a Business Investment Right for Me?

Deciding whether to invest in a business involves weighing the potential pros, cons, and risks. Here are a few self-assessment questions you can ask to determine if it’s the right time to learn how to invest in businesses:

- Do you have experience in running or managing a business?

- Can you afford to lose your investment without impacting your financial stability?

- Are you comfortable with the possibility of not seeing a return on your investment for several years?

- Do you have the time and energy to manage or oversee your investment actively?

If you feel confident in your answers and have a solid understanding of the business you’re investing in, then pursuing a business investment may be the right path for you.

The Bottom Line: Don’t Forget About Sweat Equity

When we talk about investing in a business, it’s not just about putting in cash or owning a part of the company. There’s another super important kind—sweat equity. This is all about what you, the business owner, bring to the table through your hard work, time, and effort.

It’s how you learn the ropes, gain priceless experience, and gather insights you can’t find anywhere else. By rolling up your sleeves and diving into the work, you’re building your business and boosting your value and skills.

So, don’t underestimate this third form of equity when learning how to invest in businesses. It may be the most valuable one of all.