mphillips007/iStock via Getty Images

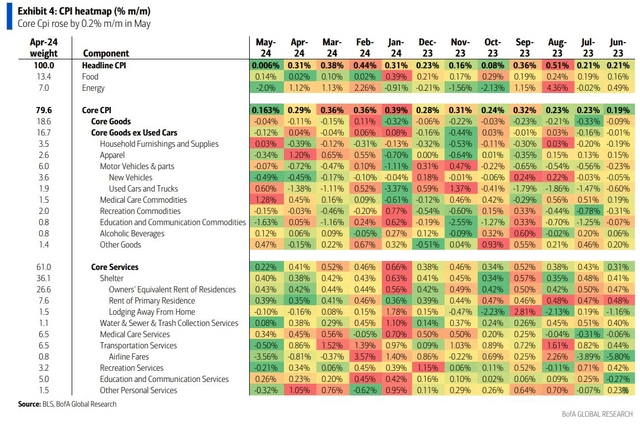

Food inflation continues to trend in the right direction. While this morning’s May CPI report revealed a 0.14% increase in the food component, up from just +0.02% in April, the last four inflation reports suggest food at home costs are less intimidating for families across the country considering the solid rise in wages so far this year. Still, there are challenges facing food companies that face high labor costs and a more price-conscious consumer.

I reiterate a buy rating on J. M. Smucker (NYSE:SJM). While shares have been volatile in the last year-plus, the Ohio-based Consumer Staples stock sports a low P/E, high dividend yield, and robust free cash flow with EPS growth likely in the years ahead.

Food CPI Continues to Steady Since February

BofA Global Research

According to Bank of America Global Research, SJM is one of the largest U.S. food manufacturing and foodservice companies, with $8.179bn in sales and $1.636bn in operating profit in FY24 across its five main sectors: U.S. Retail Coffee, U.S. Retail Frozen Handheld and Spreads, U.S. Retail Pet Foods, Sweet Baked Snacks and International and Away from Home.

Earlier this month, SJM reported a mixed set of quarterly results. Q4 non-GAAP EPS of $2.66 easily topped the Wall Street consensus of $2.33, but revenue of $2.21 billion, down 0.9% year-on-year, was a $30 million miss. Shares jumped 4.6% in the session after the release despite the company serving up guidance that was not all that impressive. Its management team now sees FY 2025 net sales increasing by 9.5% to 10% with adjusted EPS ranging from $9.80 to $10.20 on free cash flow of $900 million.

SJM posted healthy gross margin figures, which offered hope to investors who have endured a steep share-price underperformance in the last 18 months. But the guidance figures were not all that optimistic – higher SG&A costs and uncertain Hostess Brands sales expectations are downside catalysts to monitor. Key risks for Smucker include reduced private-label exposure, which consumers have been increasingly preferring, following years of the firm reshaping itself. Its standout product is Uncrustables, which should continue to benefit from positive sales trends, though.

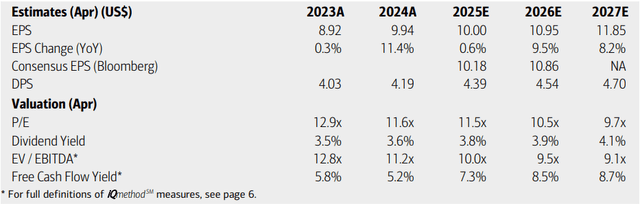

On the earnings outlook, analysts at BofA see EPS rising modestly in FY 2025, which is just now underway. Per-share earnings are then expected to return to a solid growth clip, which could result in a very attractive P/E. The current Seeking Alpha consensus forecast shows comparable EPS trends while SJM’s top line is expected to rise 1% this year and by a mid-to-high single-digit percentage rate in 2026 and 2027.

Dividends, meanwhile, are forecast to inch higher over the coming quarters, which could push the yield closer to the 4% mark. I found that SJM has not traded with a yield above 4% in the past 10 years, so this could mark a solid value opportunity, particularly considering that the company’s free cash flow yield is currently near 6%.

J.M. Smucker: Earnings, Valuation, Dividend Yield, Free Cash Flow Forecasts

BofA Global Research

If we assume $10 of non-GAAP EPS over the next 12 months and apply the stock’s 5-year average earnings multiple of 14.5, then shares should trade at $145. Of course, there are industry headwinds amid a choosier consumer and the elephant in the room – GLP-1 weight-loss drugs potentially casting a bearish cloud on Packaged Food and Meals industry firms. But even if we discount the P/E by two turns, we are still talking about a fair value of $125 with decent earnings growth in the next two years. Thus, I see shares as undervalued today.

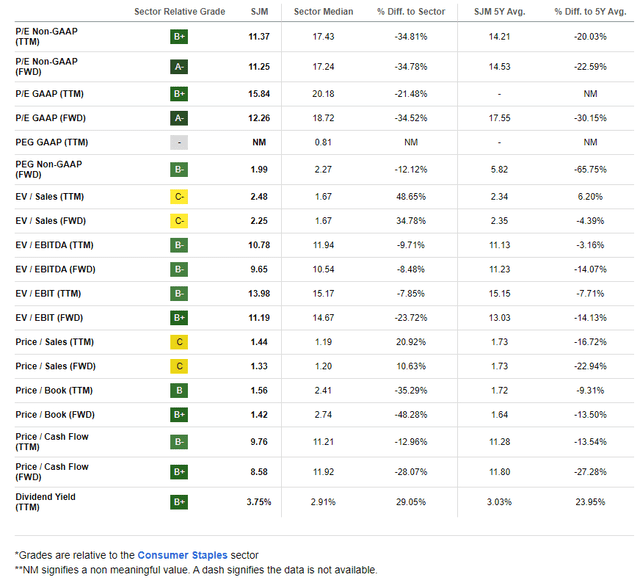

SJM: Compelling Valuation Metrics

Seeking Alpha

Compared to its peers, SJM sports among the best valuation ratings while its previous growth trajectory was particularly soft, though the outlook appears brighter as I discussed earlier. While profitability trends, including free cash flow, look strong, the stock’s price momentum reading is very poor – I will detail the technical view later in the article.

Finally, despite the recent Q4 beat, the firm’s guidance which was below street estimates likely triggered the slew of sell side earnings downgrades along with the top-line miss.

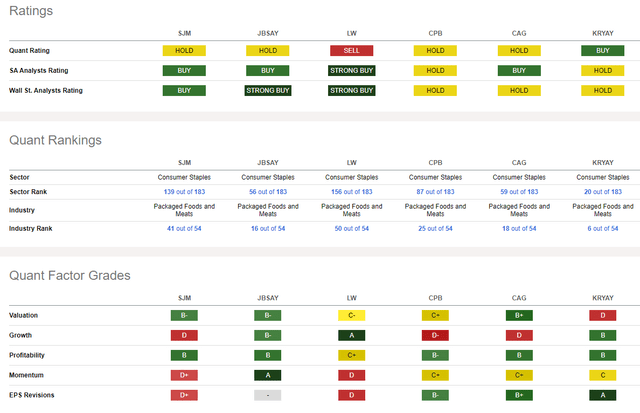

Competitor Analysis

Seeking Alpha

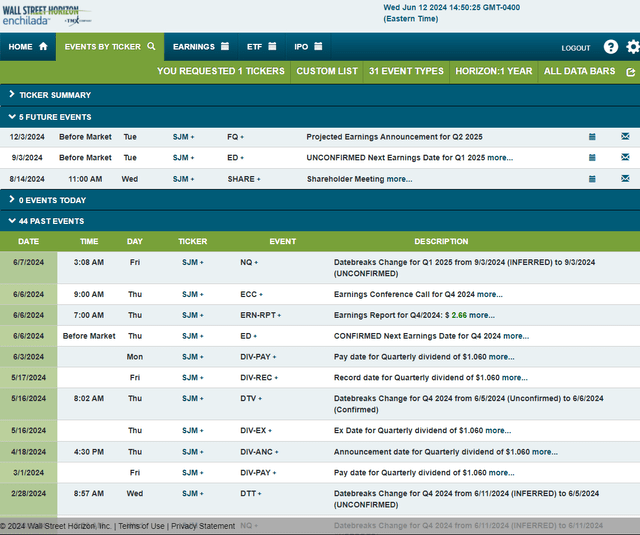

Looking ahead, corporate event data provided by Wall Street Horizon show an unconfirmed Q1 2025 earnings date of Tuesday, September 3 BMO. Before that, the company hosts its annual shareholder meeting on Wednesday, August 14, which could draw some stock price volatility should new forecasts be unveiled.

Corporate Event Risk Calendar

Wall Street Horizon

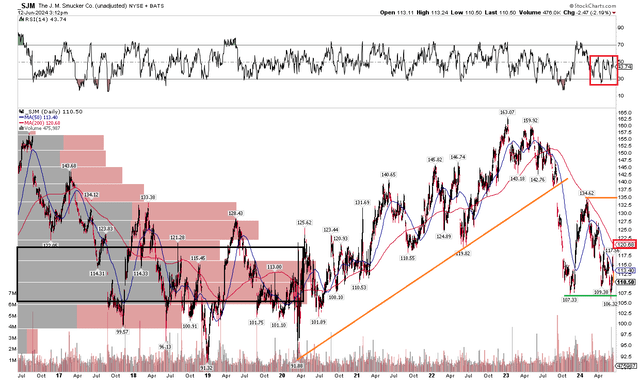

The Technical Take

I normally focus on the last three years of price action when analyzing a chart. In the case of SJM, I zoomed out to view trends since 2016. Notice in the graph below that Smucker was a strong performer from the lows in 2020 through early 2023. But as investors focused attention back on tech last year, Staples stocks like SJM suffered. Shares gapped lower in September 2023, eventually finding a floor at $107 in Q4 last year. A rebound took place into 2024, but the bears came back out when the stock touched its long-term 200-day moving average.

Today, the 200dma remains negatively sloped, suggesting that the bears control the primary trend. SJM also went down and tested the nadir from 2023 just a few weeks ago. So, the $106 to $108 is critical support, while $120 is an upside price of interest based on where the 200dma is today. With the RSI momentum oscillator in a bearish range between 20 and 60, that’s only further evidence that the onus is on the bulls to reverse course. Above $120, the January high of $135 is resistance.

Overall, SJM has underperformed the market since the start of last year and its absolute technical situation is weak.

SJM: Bullish Uptrend Halted in 2023, Shares Now Rangebound

Stockcharts.com

The Bottom Line

While SJM’s momentum is soft, the value case is firm in my view. Considering rising earnings in the years ahead, solid free cash flow, a high yield, and a low current P/E, the fundamental case outweighs the chart situation.