typhoonski

Something momentous happened recently in the soda world that you may have missed: Dr Pepper passed Pepsi as the second favorite soda brand in the United States.

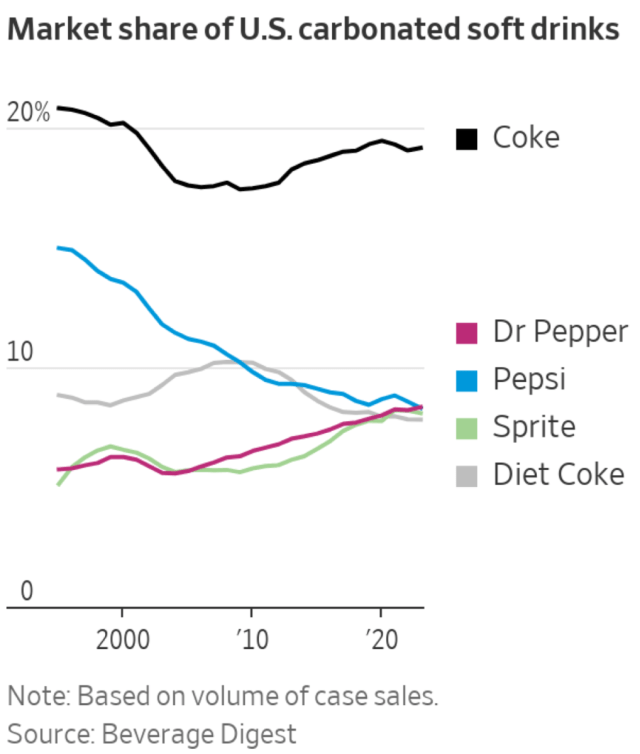

This comes following decades of dominance by the two large industry incumbents, Coke (KO) and Pepsi (PEP):

WSJ, FlowingData, Beverage Digest

While many have been quick to call this a ‘TikTok marketing win’, the underlying trends supporting Dr Pepper’s rise have long been brewing. As you can see above, Dr Pepper – which is owned by Keurig Dr Pepper (NASDAQ:KDP) – has steadily been gaining market share since the mid-2000’s, largely on the back of a wider distribution strategy and investments into the Dr Pepper brand.

While this Pepsi inflection is an interesting data point, it’s emblematic of a broader trend: the rise of KDP as a whole. Since the merger in 2018, the company has grown revenues significantly and more than doubled net income, and the outlook remains positive. KDP’s popular refreshing beverage and coffee products stand to grow EPS steadily into the future, and we believe strongly in the value creation potential of the company’s 45+ brands.

In addition to the potential upside, the company’s stable results are mirrored in the stock’s low-volatility profile. Today, trading at an attractive valuation, shares in KDP appear well suited to a covered-call play – buying shares in the underlying stock while selling call options out of the money. If all works out, this low-risk trade promises to yield an impressive 8% while leaving some room for capital appreciation as KDP’s EPS continues to move northward.

If you’re focused on value, income, or quality in your investing, this could be a great play to consider. Let’s dive in and explore it all a bit more.

KDP’s Financials

As always, let’s start with the financials.

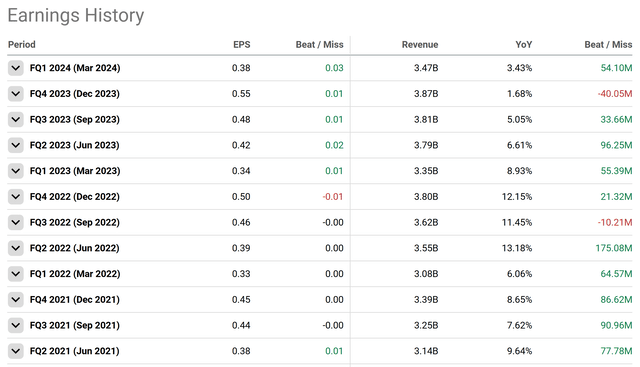

Overall, KDP runs a relatively tight ship, with meets or beats on the top and bottom line for the most part over the last several years:

Seeking Alpha

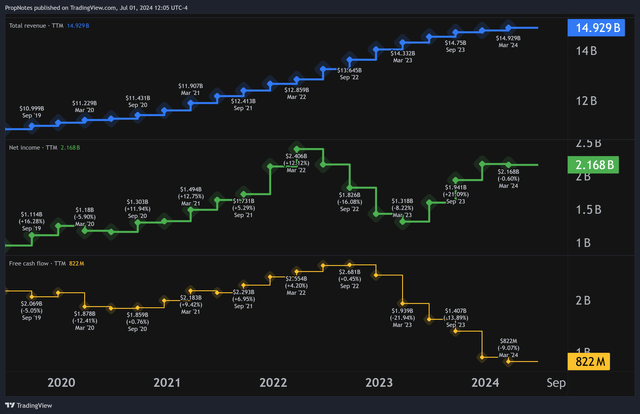

While there have been some misses, the picture here is one of a company that typically comes in a bit ahead of ‘market’ estimates. Nominally, the company has also done well, although net income generation has been a bit choppy:

TradingView

Despite the bumps, over the last 5 years, KDP has managed to grow sales by nearly 50%, and boost net income by more than double. This is highly impressive in an otherwise complicated period for consumer staples companies.

This growth comes largely on the back of optimizations around the company’s core brands, from both a demand (marketing) perspective, as well as an execution (supply) standpoint. More demand for more of the products that customers really want, optimized into the right packaging, in the right places, at the right times.

TTM top line sales have slowed somewhat as of late, but this is largely due to a combination of moderating inflation, as well as a bit of coffee cyclicality that can be seen industry wide.

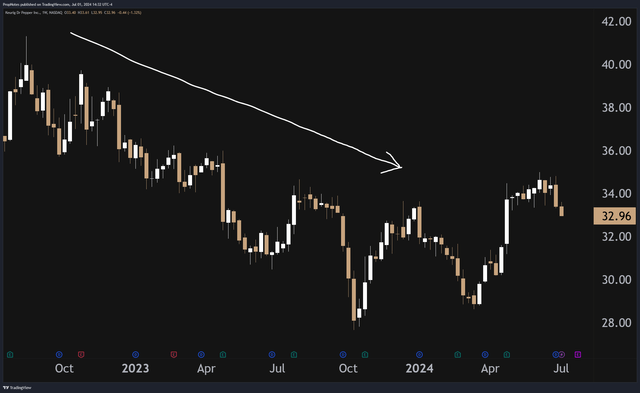

You may notice above that KDP’s FCF has dipped substantially between 2022 and now, from highs of more than TTM $2 billion to under TTM $1 billion. In our view, this is likely what has driven a sustained drawdown in the stock over that period:

TradingView

The good news is that this is largely due to supplier financing and other payables issues that management thinks will work through the system in the second half of this year.

Plus, gross margins are still strong and stable, and there hasn’t really been a material change in company liquidity over time. In our view, these FCF results are not the canary in the coal mine for a larger issue.

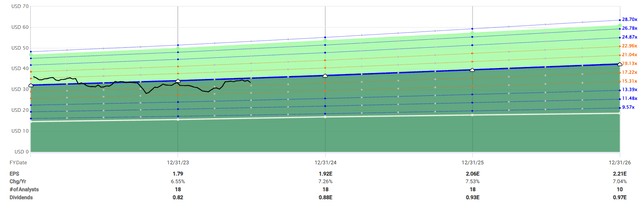

Looking forward, analysts predict that EPS will continue to grow roughly 7.2% YoY into the future, which feels about right to us:

FAST Graphs

It’s also in line with what management has been projecting:

We continue to expect mid-single-digit net sales and high single-digit EPS growth in 2024, both consistent with our long-term financial algorithm. Our plans continue to embed strong top line momentum in our U.S. refreshment beverages and International segments with a relatively muted growth contribution from U.S. coffee. We expect productivity savings to help offset a more normal level of inflation.

We also plan to continue to deploy investment dollars behind brands and capabilities to support our top line growth. The incremental flexibility afforded to us by our Q1 outperformance should enable us to balance these concentrations. As a result, we continue to anticipate healthy operating profit growth and full year operating margin expansion on a consolidated basis.

All in all, KDP appears to be a solid, well-run company focused on steady growth, brand expansion, and shareholder returns.

The Opportunity

In our eyes, the opportunity with KDP here is twofold.

First off, the valuation appears attractive, which supports a ‘long’ entry into the stock.

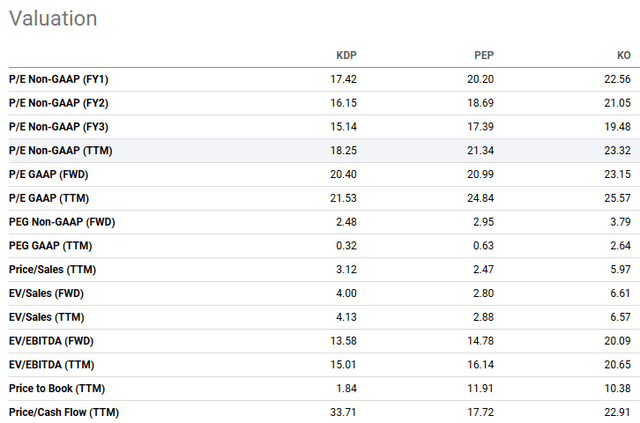

Some may see the stock as expensive on a nominal basis for a consumer staples stock, but in the soda category, it’s actually cheaper than peers KO and PEP:

Seeking Alpha

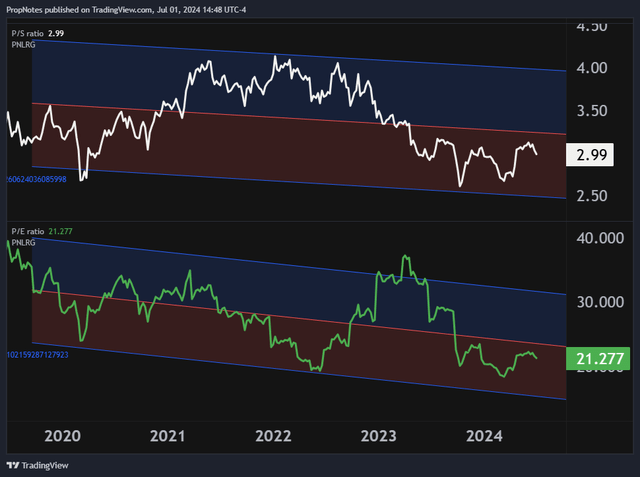

Additionally, on a historical basis, KDP is trading in the lower band of the standard deviation of the last 5 years’ multiple, when it comes to both the top and bottom line:

TradingView

At 3x sales and 21x GAAP P/E, it’s not the cheapest stock on planet earth, but it’s also not as expensive as a large swath of the mega cap market these days.

Secondly, KDP’s stock also exhibits an extraordinarily low level of realized volatility, which is somewhat unique in an otherwise hectic market.

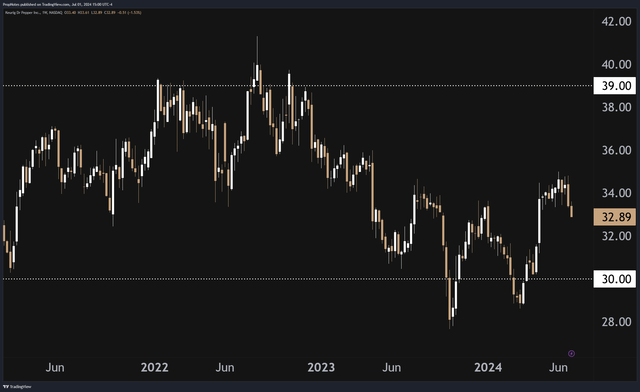

For the last several years, KDP’s stock has traded between $30 and $39, which is a rather stable, predictable range:

TradingView

Additionally, the stock has a beta of 0.23, which means that overall, shares of KDP are not highly sensitive to market moves, which gives us – as traders – our own little volatility playground where we can construct a winning trade.

While option premiums are linked with instrument volatility, KDP’s ATR is very, very low, which, when combined with the valuation, makes it ideal for the aforementioned covered call trade we’ll take a look at now.

The Trade

So – KDP is a healthy, stable, growing company, trading at a decent valuation, with a low-volatility profile. What is the best way to make money on this stock?

In our view, buying shares of KDP and then selling OTM calls is the best bang-for-your-buck opportunity around.

The first step is simple – buy 100 shares of KDP. At ~$33 per share, this should cost you about $3,300 in total capital.

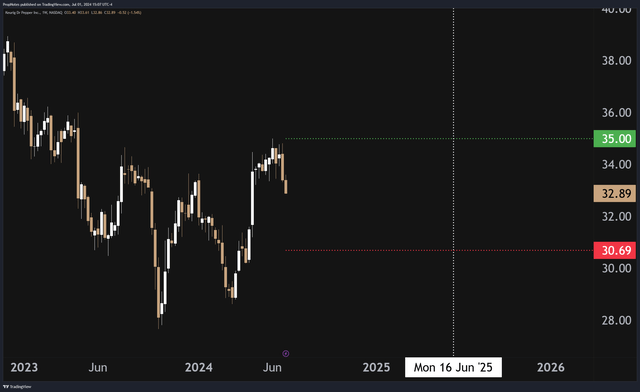

Then, sell the $35 strike, June 20, 2025, options for $2.20 per share, or $220 per contract:

TradingView

As you can see in the chart above, the trade results in a cost basis in KDP of 30.69, which is a roughly 6.5% discount in the stock.

Similarly, as this is your cost basis, $220 per contract in cash, divided by $3,069 per contract collateral, is a return of roughly 7%, over the next year or so.

Finally, the $35 strike contracts allow for 6.5% upside in the share price until potential assignment.

This means that when you buy KDP and sell the recommended calls, one of three things can happen –

- KDP goes up over the next year, and you make 6.5% in capital appreciation in addition to the 7% cash yield you get from selling the calls. Plus, you get the 2.5% dividend. That’s 16% over the next year in total.

- KDP trades sideways over the next year. In this case, you get to keep the 7%, plus the dividend, for a 9.5% total return in a low vol stock. You can then sell calls again to juice the yield further.

- Finally, KDP could go down over the next year, below $30.69. In that case, you’d own the stock from a better-than-market price, plus you’d still have the opportunity to sell more calls on the stock going forward.

To us, KDP seems rather stable but, ultimately, probably doesn’t have explosive upside in terms of capital appreciation. Thus, we think that a covered call trade like the one above is highly attractive. It trades some of this potential into cold hard cash in our accounts.

Ultimately, we’d be happy with any of the three outcomes listed above.

Risks

There are upsides, but there are some risks when it comes to engaging in a covered call trade as well.

For example, KDP could go down in value materially, such that selling another covered call wouldn’t produce much in the way of yield. This is why we’re happy with holding the stock given the stability and value anyway, but it’s good to be aware of if you’re going in expecting to attempt a long-term option selling campaign on the stock.

Additionally, selling calls comes with opportunity risk if KDP does quite well. Capital appreciation with this covered call trade is limited to 6.5%, and anything more than that is null and void, assuming you don’t adjust the trade, which we wouldn’t recommend. It’s a sacrifice, but it makes sense, in our view.

Finally, KDP, to us, doesn’t appear to be an expensive stock, but there’s always a chance that operational fumbles could cause the multiple to contract following a string of poor results. Given that this trade has a timeline of a year, to some degree, you can be ‘locked in’ unless you want to exit early, which can be more expensive given the higher transaction fees associated with closing option trades.

Summary

That said, despite the risks, we’d be happy with any of the outcomes mentioned above.

Whether KDP goes up, down, or sideways, selling premium on this stable, profitable, low-vol company seems to be a win-win, no matter how you look at it.

Thus, our ‘Buy’ rating.

Good luck out there!