LauriPatterson/E+ via Getty Images

Intro

We wrote about Lancaster Colony Corporation (NASDAQ:LANC) in September of last year when we reiterated our ‘Hold’ rating on the stock due to stagnating technicals and falling forward-looking EPS revisions. Consensus revisions began to turn up not long after our commentary with Lancaster Colony, with the company now expected to report $6.28 in earnings per share ($6.10 projected in September 2023) for this fiscal year (Ending June 2024). This trend aided shares in rallying just over 12% over the past nine months.

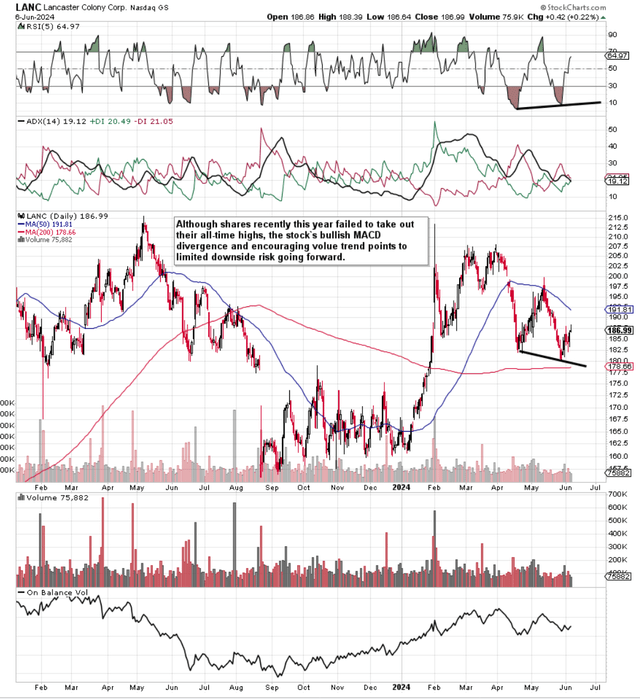

From a technical standpoint initially, we believe a ‘Hold’ rating remains the right call in the specialty food company. As the technical chart below shows, shares rallied well in early 2024 but couldn’t garner the necessary momentum in March of this year to take out their May & all-time highs of the previous year. Although the stock has been making lower lows for some months now, the fact that shares continue to trade above their 200-day moving average ($178.66) is encouraging especially given the bullish divergence in the MACD indicator. Therefore, let’s go to the trends & key metrics that make up Lancaster Colony’s profitability & valuation to see if they are aligned with what we are currently seeing on the technical chart (more consolidation).

Lancaster Colony Technical Chart (Stockcharts.com)

Excluding dividend payments, shares of LANC have risen by well over 30% over the past five years. However, as we learn below, some of the company’s key profitability metrics continue to lag behind corresponding 5-year average counterparts.

Gross Margin Continues To Trail Historic Average

In Lancaster Colony’s most recent third-quarter earnings report the company reported $107.1 million in gross profit on revenues of $471.4 million. Sales grew due to solid uptake from the newly launched Texas Roadhouse & Subway offerings in retail along with above-average demand in the Food segment. These reported numbers on the income statement were the best third-quarter numbers in the company’s history culminating in a Q3 gross margin of 22.72%.

Strong PNOC performance, ongoing cost-saving improvements, and increased sales (despite the discontinuation of Angelic Bakehouse & Flatout) led to the growth of gross profit ($104.5 million) in the quarter. Although this Q3 gross margin print was a sizable jump over the same period of 12 months prior (20.26%), it must be pointed out that it trailed the 12-month trailing average (22.97%) as well as the 5-year average number (24.13%).

Remember, this reduced profitability on average is against the backdrop of the stock rallying well over 30% over the past five years. This is key because a company’s gross margin trend tends to set the bar as to how bottom-line profitability will fare going forward. To this point, we see the ramifications of prolonged inflation in Lancaster retail & food businesses in recent times through the company’s trailing net profit margin of 7.1% which also trails the 5-year average counterpart of 8.48%.

We focus on the trailing 12-month number because of charges concerning the exit of the above-mentioned product lines (thus, skewing the Q3 GAAP earnings number somewhat) and corresponding inventory unloading. Management on the recent Q3 earnings call talked up the fact that reduced forward-looking derived expense in ‘Project Ascent’ as well as lower forward-looking capex spend (due to Horse Cave work now being finished) will free up more cash going forward. Whilst this may be so, it remains to be seen whether this cash can be put to fruitful use with respect to driving that key gross margin metric back above its historic norm over time.

Valuation OF LANC Through The Dividend Discount Model

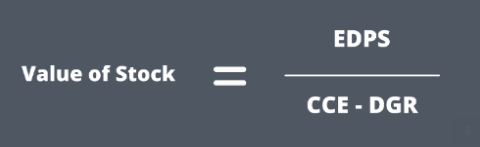

Given that Lancaster Colony has increased its dividend for the past 60+ years, we can use the popular dividend discount model illustrated below to stamp an approximate valuation on the stock.

Dividend Discount Model Formula (wallstreetmojo.com)

EDPS denotes expected dividend per share, CCE equates to cost of equity & DGR means dividend growth rate. With the company standing pat on its $0.90 per share quarterly payment last month, we can state that the forward annual payout amounts to $3.60 per share.

To calculate a sustained dividend growth rate, we multiply Lancaster Colony’s GAAP retention ratio by the trailing return on equity. This makes sense as the retention ratio denotes the amount of net profit that is essentially ‘retained’ to grow the business. In contrast, ROE demonstrates how effectively the company is using its capital. Multiplying the company’s GAAP retention ratio (26.35%) by trailing ROE (14.85%), we get a sustained DGR of 3.99%. Interestingly, this calculation also lags the 5-year annual dividend growth average (6.8%) so let’s continue with the valuation exercise.

A sustained dividend growth rate of 3.99% means our EDPS (Expected Dividend Per Share) comes in at $3.74 per share.

Cost Of Equity

Cost of equity refers to the rate of return investors are willing to earn to essentially invest in the stock. It is a very useful metric as it provides a baseline scenario or cut-off point concerning investor interest. To calculate the ‘cost of equity’, we use the following formula

Cost of equity = Risk-Free Rate + (Beta) x (Equity Risk Premium)

where we use the US 10-year US treasury bond (4.43%) as our risk-free rate, beta (0.38), is a measure of Lancaster Colony’s volatility & ‘Equity Risk Premium’ denotes the absolute minimum market return investors can expect on investment in Lancaster Colony. Here we use a third-party calculation (Damodaran) which currently comes in at 4.6% in the US. What is immediately evident here is the company’s very low beta which in investors’ eyes reduces risk in long exposure in LANC.

Plugging all of our values into the initial formula, we get the following result.

Valuation of LANC = $3.74 / [0.0443 + (0.38)(0.046) ] – 0.0399

= $170.93 per share

Conclusion

Therefore, to sum up, we are reiterating our ‘Hold’ rating in Lancaster Colony due to rangebound technicals, sustained below-average profitability trends & the fact that our valuation estimate comes in almost 9% below Lancaster Colony’s prevailing share price. Let’s see what the fourth quarter numbers bring. We look forward to continued coverage.