urbazon/E+ via Getty Images

Investment thesis

Dividend growth investing requires a certain degree of predictability. This will quickly take you to the consumer staples sector. Resilient business models, constant growth and a sector where stable dividend growth often occurs.

Despite the fact that there is always a lot of attention for American stocks in this sector, there are also great ones in Europe. And when we talk about high-quality companies, L’Oréal (OTCPK:LRLCF) comes into the picture. LRLCF is the world number 1 in the beauty industry and has an impressive track-record of growing its earnings at a rapid pace. I think this quote, which I read on psychology today, is a nice description of why consumers spend a lot of money on beauty products.

For most, physical appearance is an important thing, as studies show that feeling that one is attractive helps build confidence and self-esteem. The psychology of beauty thus has much to do with individual self-worth and simply feeling good about oneself.

The company in general really intrigues me and in my opinion LRLCF is a European business to be proud of. However, a quality company does not always have to be a good investment.

Today we’re going to do a business breakdown to determine if the company is a good investment at current levels.

Company overview

LRLCF is a French-based beauty giant with a market cap of €235 billion and is headquartered in Clichy. It all started in 1907 where Eugéne Schueller created one of the first hair dyes. From 1957, the company began to expand internationally and experienced rapid growth.

We can say that this has worked out well, since LRLCF has sold over 7 billion products worldwide in FY 2023. It is a European company, but LRLCF is clearly a global business. With over 37 global brands and activities in +150 countries.

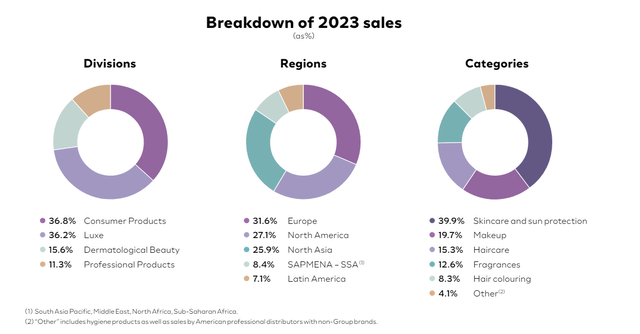

Revenue distribution (FY 2023 annual report)

Their revenue is well diversified across different continents and they divide their business into four divisions.

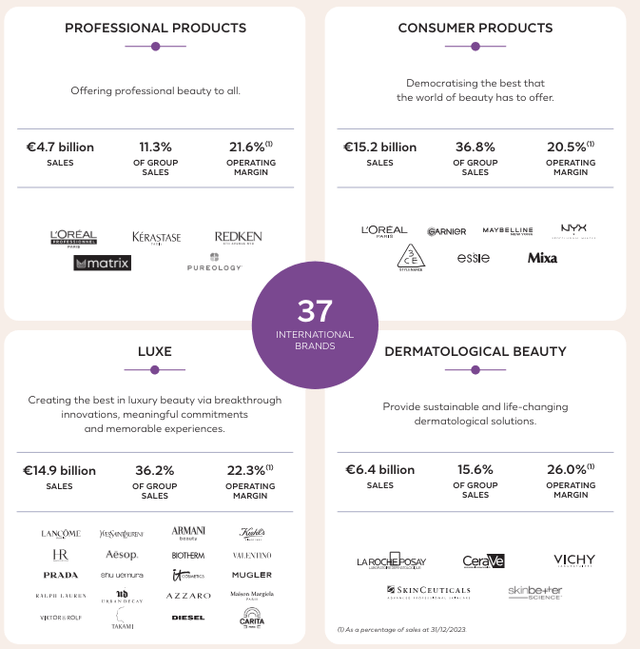

Brand portfolio (FY 2023 annual report)

LRLCF’s brand portfolio is simply impressive and includes a lot of billionaire brands such as: Lancôme, Yves Saint Laurent, Giorgio Armani, Kiehl’s, Helena Rubinstein , just to name a few.

Competitive advantage

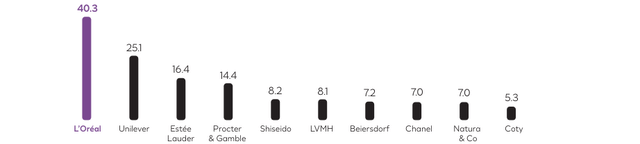

There are a lot of great businesses to mention that are also operating in the beauty segment, but LRLCF is by far the largest one.

Peers (LRLCF FY 2023 annual report)

I like the fact that LRLCF is a pure play. The cosmetics market in general is dominated by some big players, which all have really large distribution networks. In my opinion it would be really hard for potential newcomers to become serious competition. In my opinion LRLCF has a wide-moat, which can largely be found in its brand power. I am not an absolute beauty specialist myself. What I do know is that my wife regularly uses LRLCF products and I personally recognize many of the brands. Just look at the list of brands earlier on in the article and you will see most of them don’t need an introduction.

The company is doing a lot of investments to stay ahead of competition to maintain their moat. In 2023 alone LRLCF invested €1,489 billion, which is 3.6% of their total sales.

Market characteristics (Grand View Research)

As shown in the image, it is important to stay innovative. Think about collection expansion which helps in maintaining consumer interest. In my experience, LRLCF responds well to trends that I think are very relevant in the future. The company is leaning more and more towards “green initiatives”. This fits well with the needs of the current generation and to get rid of the petrochemical components in beauty products.

Beauty combined with technological innovation is also high on the agenda. For example, the company is busy with their own AI beauty assistant called Beauty Genius. Given the size of the company, LRLCF has an enormous amount of data that can be applied in this AI tool. This responds to the consumer’s experience and specific needs. This fits perfectly with the ambition to grow when it comes to digital sales.

Beauty Tech (Barclays Global Consumer Staples Conference 2023 presentation)

Talking about digital sales, LRLCF’s revenue by e-commerce is growing fast. In 2015 it represented about 5% of total sales and it grew to 27% in 2023. The long-term goal is to bring this percentage to 50%.

A steadily growing market

It is always nice to be able to invest in companies that are active in a growing market. Based on research the global cosmetics market size is about $295 billion is expected to grow at a CAGR of 6.1% from 2024 to 2030.

This study also shows that there is a clear trend among millennials to use cosmetic products in their daily routine and the introduction of cosmetics with organic ingredients is a big contributor to the growing market.

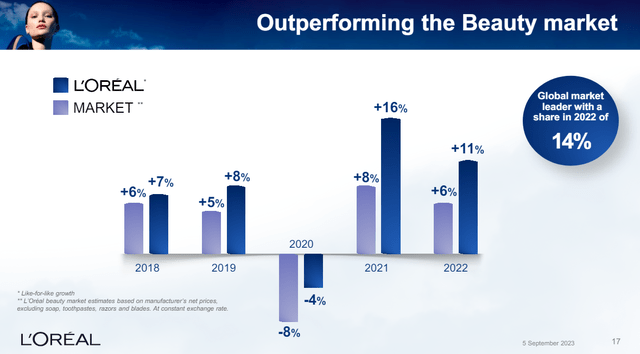

LRLCF seems to focus exactly on these points when it comes to their investments. They also shown in recent years that they are able to structurally outperform the market.

Market outperformance (Barclays Global Consumer Staples Conference 2023 investor presentation)

Financials

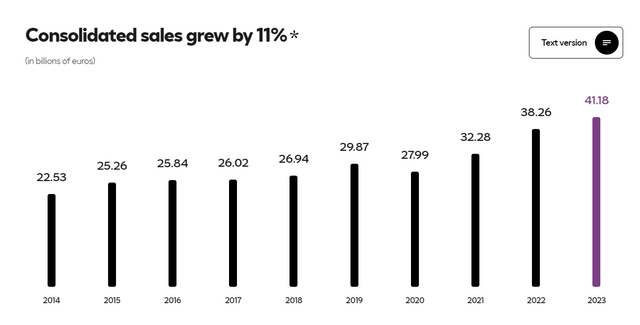

The company has managed to grow its revenue from €26.9 billion in FY 2018 to €41.2 billion in FY 2023. This comes down to a 5Y CAGR of 8.9%.

Revenue development (LRLCF investor relations)

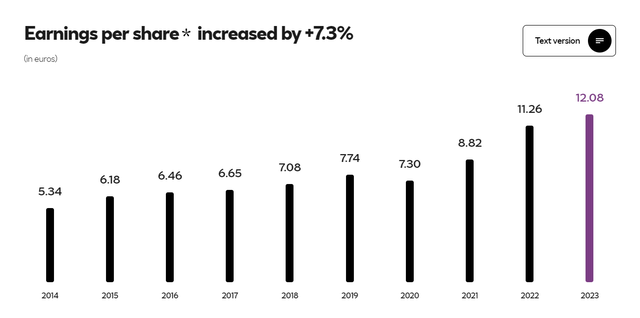

From an EPS point of view, these metrics are a bit better, with a 5Y EPS CAGR of 11.27%.

EPS development (LRLCF investor relations)

We can speak of very stable growth and the company is showing that it is a solid compounder.

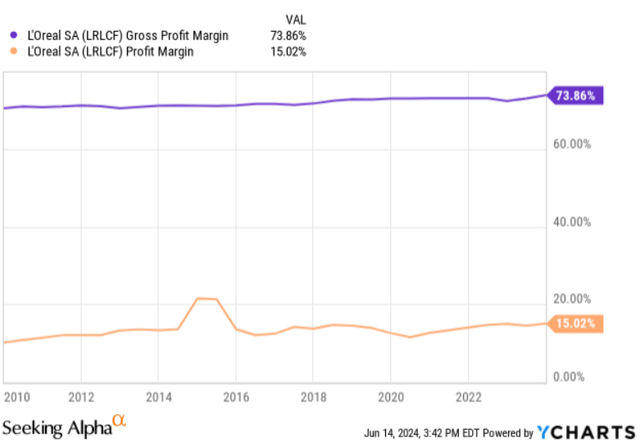

LRLCF’s margins are excellent and have been far above the market average for a very long time.

Margin development (Ycharts)

Their gross margin of 73.86% is in line with its own 5Y average and is significantly higher , compared to its sector median of 35.3%. The same can be said for their net income margin (15.02% vs 4.77% sector median).

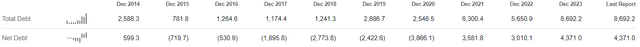

Balance sheet

The balance sheet of LRLCF is rock-solid.

Debt development in Euro (Seeking Alpha )

As can be seen in the table above the net debt is only €4.3 billion. Over a 10Y period, the balance sheet has always been good and there have been quite a few years in which there was more cash than debt. The long-term debt has increased in the past year, but far from worrying. Their Net debt to EBITDA is 0.49 (€4.371 billion/ €9,009 billion) and can be considered healthy.

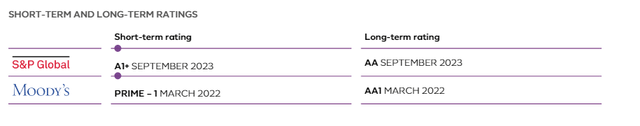

The credit rating agencies also assess the company as being financially healthy, with a high grade in both the short and long term. This is also very much in line with my own view.

Credit ratings (FY 2023 annual report)

Management

I have to say I am impressed by LRLCF’s management history. At the moment Nicolas Hieronimus is the CEO of LRLCF. He started in 2021 as the CEO and he is only the sixth one ever, which is in my view a good sign. He has a long history when it comes to working at LRLCF, since he joined in 1987 as a product manager. Given his short track record as a CEO, it remains to be seen whether he will do as well in terms of capital allocation as his predecessors, but his long work history at the company will be an advantage.

I like to invest in companies where my interests align with those of management. With these interests I mean long-term value creation and management with significant skin in the game is more likely to perform better.

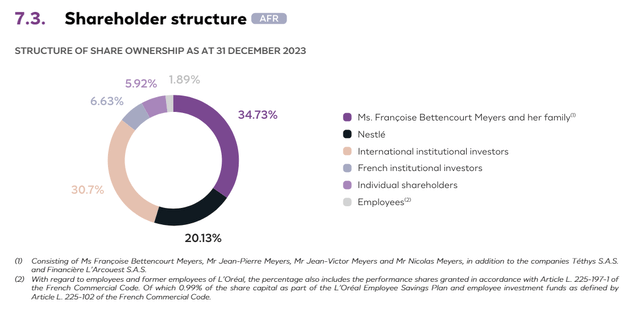

Looking at the structure of share ownership, current management has actually significant skin in the game.

Shareholder structure (FY 2023 annual report)

It is immediately noticeable that a large part of the shares are owned by Francoise Bettencourt Meyers and her family. Francoise is actually the granddaughter of the founder Eugéne Schueller and is currently the Vice-Chairwoman of the board of directors. There are also other family members on the board of directors. In companies where the founding family still has a lot of control, the focus is often even more on the long-term. As a long-term investor you can certainly benefit from this.

Capital allocation

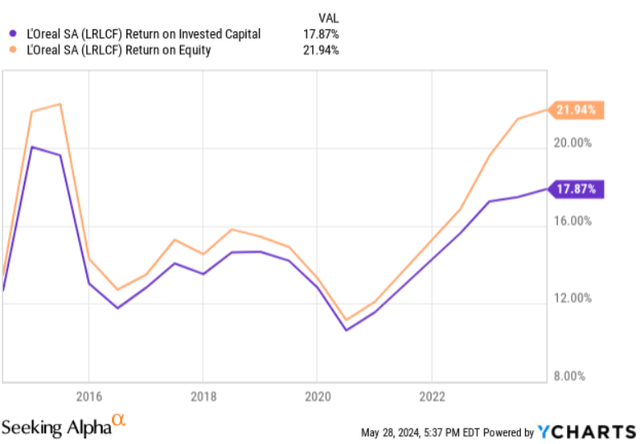

High-quality companies often have great capital allocation skills. LRLCF has demonstrated that it can achieve a healthy ROIC and ROE in the long-term.

ROIC and ROE (Y charts)

With regard to capital allocation, the emphasis is mainly on further growing their business. As previously indicated, LRLCF invests quite a lot in (technological) innovation to stay ahead of the competition.

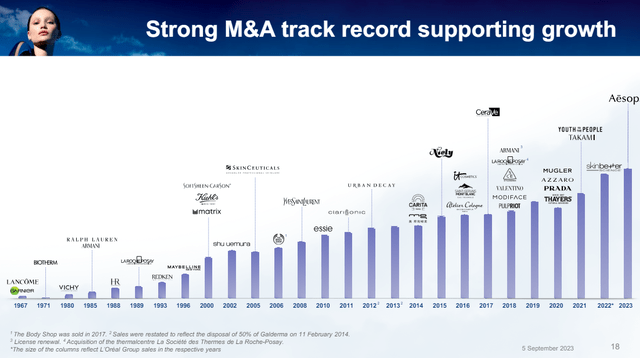

LRLCF has also a rich history of M&A. Normally I prefer companies that grow organically, plus it happens a lot that M&A destroys value rather than creating it. There are of course companies that are very good at this principle and LRLCF seems to be one of them.

M&A history (Barclays Global Consumer Staples Conference 2023 presentation)

As can be seen here, LRLCF has made quite a few acquisitions, many of which have proven to be a very successful addition.

On the 30th of August, LRLCF announced that they completed the acquisition of Aesop in a $2.5 billion deal. The company is known for its skin hair and body products and their use of plant-based ingredients and vegan formulations.

LRLCF stated that they see a lot of potential in this acquisition, especially in Asia. Aesop joins the L’Oréal Luxe division and this is what the president Cyril Chapuy said about it in the press release

We have great confidence that in time, Aesop will join the L’Oréal ‘Billionaire Brands’ club and play a significant role in the future growth of the Luxury Division

In December 2023, LRLCF acquired Lactobio. The Danish company is leading in probiotic and microbiome research. This could lead to new scientific opportunities to develop safe and effective new cosmetic solutions using live bacteria.

This acquisition fits perfectly with LRLCF’s scientific mindset. Various skin problems are associated with imbalances in the skin microbiome. Lactobio itself says it has the potential to drastically change the world of skin care.

Dividend

Since I am a dividend growth investor, this part deserves an exclusive section. The company pays a dividend once per year and is normally paid in April.

Yield and growth

With a current share price of €440.45 and an annual dividend payout of €6.60 you get a dividend yield of 1.50%. This is not that high, especially for the investor that is seeking income in short-term. However, it is almost impossible to buy LRLCF with a high starting yield. However, in recent years there were opportunities to buy shares at a more attractive yield.

Dividend yield development (Seeking Alpha)

Considering the 10Y average (from a dividend yield point of view), LRLCF currently seems on the expensive side. Fortunately for the shareholder, the low yield has everything to do with solid share price appreciation.

At LRLCF there is also something special regarding the dividend. There is a preferential dividend of +10% for shareholders who hold shares in registered form for at least two calendar years. So this means 7.26 in FY 2023 for registered shares. If this is interesting, this is the link for more information. Take a good look at what the options are and which options are most beneficial for you.

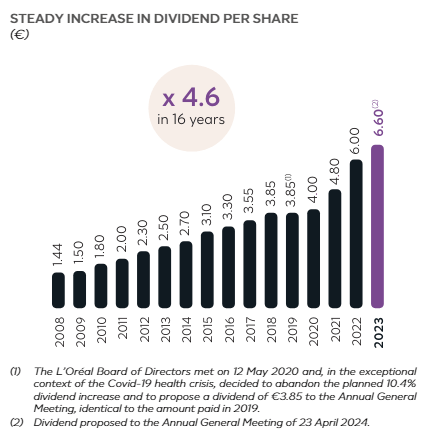

Dividend growth (Investor relations)

In terms of growth, the dividend has grown rapidly in recent years and has even accelerated. LRLCF has a 10Y dividend growth CAGR of 9.3%, a 5Y CAGR of 11.3% and a 3Y CAGR 18.1%. The dividend growth CAGR of 18% is not sustainable in the long-term and I think the 10Y dividend growth CAGR of 9.3% is more plausible, which is more in line with the earnings growth.

Safety and consistency

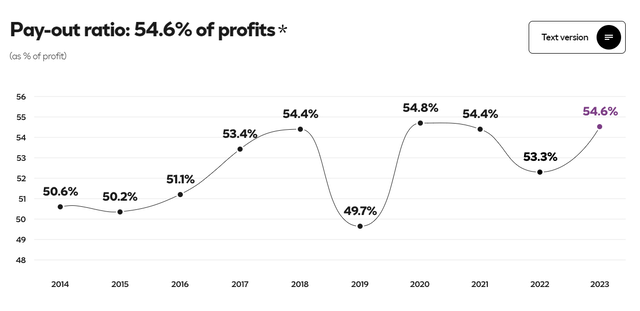

Dividend is my opinion very safe, with an annual dividend of €6.60 and an EPS of €12.08, LRLCF has a payout ratio of 54.6%. The company has been able to keep the payout ratio fairly stable over time.

Payout ratio development (Investor relations)

This what I like to see in a dividend growth investment, it indicates that the increases are mainly the result of being able to consistently grow earnings. A payout in the 50% range also has sufficient room to make further investments into growth.

When it comes to consistency, It is unclear how long LRLCF has been paying dividends or how long the dividend growth track record actually is. I think it’s a shame that the company hasn’t reported this better. I tried to contact investor relations, but unfortunately no response. I do expect the company to be a very stable dividend grower in the coming years.

Valuation

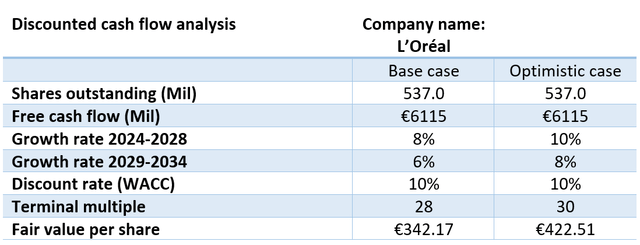

I used DCF analysis to give an indication of the fair value. I used the FY 2023 free cash flow of €6.115 billion (CFO €7.604,6 billion- CapEx €1.488,7 billion).

I created two scenarios, a more conservative baseline case and a more bullish case. As discussed earlier, LRLCF’s has outperformed the beauty market in recent years and I expect the company will continue to do that in the future.

Based on the estimated overall market growth of 6% and LRLCF’s 5Y FCF per share CAGR of 10.5%, I think a 5Y free cash flow growth of 8% is reasonable. I used 6% for the 5 years thereafter, because it is more difficult to make assumptions further into the future.

FCF per share development in Euro (Seeking Alpha)

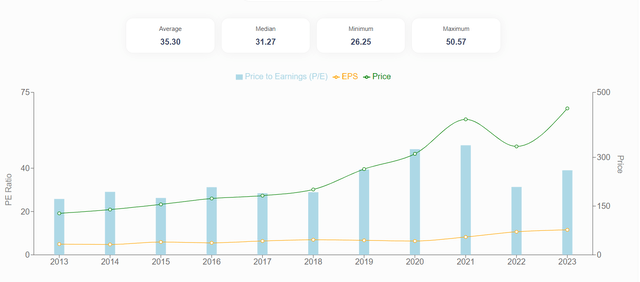

At the current share price , LRLCF has a PE of 36.8, which is just a bit higher than its 10Y average of 35.

Pe ratio (Wisesheets)

Of course, high-quality has its price and picking up LRLCF at a low PE has proven to be difficult over the past 10 years. I used a PE of 28 as a terminal multiple, because LRLCF is a high-quality and stable business where I think this multiple can be justified. If the company can keep producing impressive numbers, a PE of around 32 will not be out of place. The PE could possibly remain above my used multiples for a long time, but I don’t want to take the risk of paying too much.

DCF analysis (Google spreadsheet)

Finally, I used a discount rate of 10% as personal hurdle rate I demand for LRLCF. If we do the math, this comes to a fair value of per share €342 for the base case and a €422 per share for the more bullish case.

As most people know, discounted cash flow analysis is highly sensitive to the input given. What can be concluded is that even when using the more optimistic case, the current share price of €440 is still above the fair value for the more optimistic case.

Conclusion

LRLCF is without a doubt a quality business. The company ticks a lot of boxes:

- Steady top-line and bottom-line growth.

- Outstanding margins, reflecting its brand power.

- LRLCF is operating in a sector with a secular growth trend.

- Rock-solid balance sheet.

- Management with a long-term mindset and significant skin in the game.

Of course there are also investment risks involved. One of the most important on is in my opinion the current multiple. I know LRLCF has never been cheap, but it’s still possible to overpay, potentially making it a bad investment. And I think that the growth in combination with the current multiple is out of proportion.

Secondly, LRLCF has definitely pricing power. The company has been able to maintain high margins during times of high inflation. However, the consumer market appears to be weakening somewhat and this remains a risk for LRLCF. If there is a significant economic slowdown, there is a chance that consumers will switch to cheaper alternatives due to changing spending patterns.

For now I give LRLCF a “HOLD” rating. Do I think the company will be worth more in 10 years than it is worth today? Probably! However, I think it can be worthwhile to wait on the sidelines for a better buying opportunity.

Consider me a buyer in the €380-€400 range. From a dividend perspective, this would be a starting yield of 1.65%-1.73% which is historically an attractive entry point.

The company is definitely on my watch list and hopefully the market will give us a better buying opportunity in the future. I’m certainly willing to wait and am definitely considering buying LRLCF at a slightly more attractive valuation.

Happy investing everyone!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.