UncleDmytro/iStock via Getty Images

“We’re not fast food. We’re home meal replacement!”

So said Boston Market management to an audience of stock analysts (including me) back around the mid-1990s.

Back then, the restaurant chain was relatively new. And it was very popular.

Lines in my neighborhood often stretched outside the door. And typically, there wasn’t a seat to be had.

So many patrons had little choice but to order take-out. Management was fine with that. After all, it was home meal replacement, not really fast-food eateries.

Anyway, the stock was also hot.

It didn’t last.

Food quality slid. But prices remained high.

Meanwhile, the company took on lots of debt to expand rapidly. But operations weren’t too profitable. The company lived mainly from one-time fees it collected from “area developers.” They, like franchisees elsewhere, really ran the business.

The financially weak chain was eventually sold to McDonald’s (MCD). It later passed into private equity hands. And now, it’s barely a shell of its former self.

Boston Market didn’t succeed. But its rhetoric was on point.

The U.S., and perhaps other nations, badly need home meal replacement.

That exact terminology didn’t stick. But the need persists.

The Meal Prep Conundrum

For most of human history, the world knew how to deal with this.

In the early prehistoric hunter-gatherer era, men would hunt animals. Women minded children, gathered berries etc., and prepared meals.

The agriculture era modified that script. Men got the food, now from their farms. Women focused mainly on kids and cooking.

That more or less played out well into the urban-commercial-industrial ages. Men went outside to earn money, which long ago supplanted barter. Women ran the home. Again, that meant kids and cooking.

There were always situations in which individuals varied from this set of stereotypes. But for the most part the cave-wife or farm-wife or housewife handled family meal prep.

Those traditional roles have, however, been weakening in recent generations. Now, they’re gone or on life support.

Today, we have many single person households. Working allows little time for daily shopping and meal prep. It’s even harder if we’re dealing with a single parent.

Multi-adult households also struggle to find as much time as they really need. Often, all the adults have jobs or careers.

The Boston Market dream, effectively executed and prudently financed, may yet work. Takeout and delivery from established eateries remain a thing.

Companies like DoorDash (DASH) and the Eats unit of Uber Technologies (UBER) are planting stakes in this business. I’ll probably cover both on Seeking Alpha at some point.

But restaurants aren’t cheap. Delivery services add cost.

For today, I want to focus on the food.

There are various solutions in use today. Frozen meals have long been established in supermarkets. Some of us may remember the mid-20th century heat-and-eat “TV dinners.”

These haven’t vanished but they’ve been re-packaged in nicer ways. And variety has mushroomed including many supposedly gourmet, healthy and/or ethnic variations.

But these have so-so at best acceptance. Taste can be iffy. Ditto nutritional value. And portion sizes can be skimpy.

We don’t need to dive into details. All we need do is notice that if they were succeeding as home meal replacement, we wouldn’t be seeing the growth of newer alternatives.

Surely, you’ve heard of the Ready Meal craze … Factor Meals, Cook Unity and its cousin, easy prep (see, e.g., Blue Apron).

Ready Meals mean just that. You subscribe to a company that sends you a bunch of chilled meals, each in its own container and ready for you to refrigerate and eat before the next delivery arrives.

Opinions on these vary very widely. Personally, I tried Factor and found the quality weak. But you can see for yourself the full range of opinion in a Reddit group dedicated to such discussions.

Taste aside, most agree these can get very expensive.

The Blue Aprons of the world give you fresh ingredients. But they leave to you the burden of cooking.

Maybe these meal prep services will become better and more economical. Maybe not. Time will tell.

But today, I want to focus on another up-and-comer building a different approach to home meal replacement in the supermarket deli area.

The company is Mama’s Creations (NASDAQ:MAMA).

.I recently found this small (market cap: about $240 million) company in the “LATEST GROWTH IDEAS” module I added to my personalized Seeking Alpha home page.

The Company is Legit

Because MAMA is so small, I’ll bring the fundamentals, etc. up to this point in the article. I think it’s important to settle this before exploring MAMA’s business model and trends.

It wasn’t easy to come up with a peer group. The company’s rivals at deli counters are typically tiny privately owned firms.

That’s good in that it makes MAMA the big gorilla is this extremely fragmented market (more on this below). But it’s hard to come up with a bona fide public-company peer group.

I started with firms in the “Packaged Foods & Meats” Industry as defined by the Seeking Alpha screening universe. Looking at each, I selected only those that aimed at main courses. I dropped those that emphasized snacks, desserts, spices, etc.

As to the usual benchmark, the constituents of the SPDR S&P 500 ETF (SPY) … that group’s extreme exposure to monster-sized Magnificent 7 and similar firms makes it largely useless for comparison to a tiny micro-cap like MAMA. I include it only in deference to tradition.

I cure some SPY’s deficiencies by using median data. That eliminates big extremes. Even so, I feel more comfortable also benchmarking MAMA against the SPDR Portfolio S&P 600 Small Cap ETF (SPSM).

We can’t get perfect benchmarking. But we have enough for what we need, to see if this micro-firm is for real.

So, let’s get to it.

MAMA is an acquirer. And it’s had some operating issues in the recent past. So, it occasionally caught fundamentals-related flack from some Seeking Alpha analysts. But the past is the past. And top management is new (see below).

I care about where the company is now. And that looks pretty good.

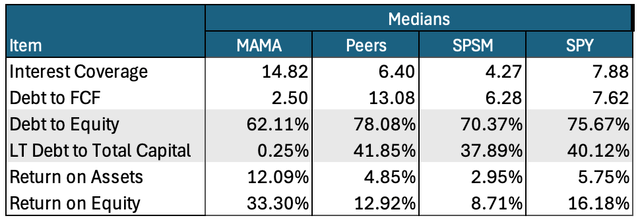

Author’s computations and summary from data displayed in Seeking Alpha Portfolios

Author’s computations and summary from data displayed in Seeking Alpha Portfolios

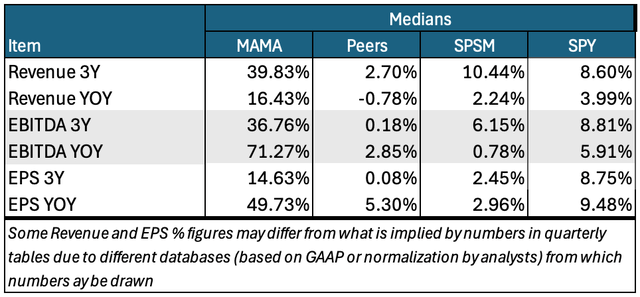

So, too, does its likely future path.

Author’s computations and summary from data displayed in Seeking Alpha Portfolios

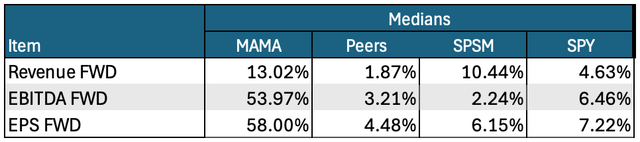

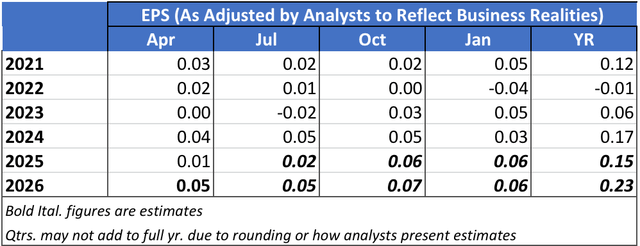

The following tables put Revenue and EPS estimates in the context of historical figures. These, too, show impressive growth trends and expectations.

Author’s compilation from Seeking Alpha Earnings Presentations

Author’s compilation from Seeking Alpha Earnings Presentations

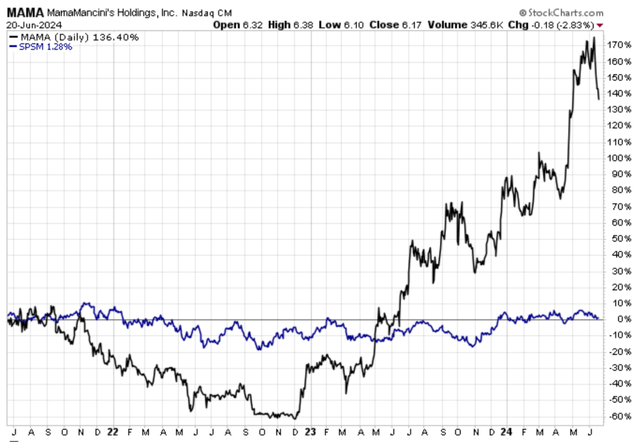

Wall Street is already starting to take MAMA seriously. Here’s the three-year record of MAMA stock versus that of the SPSM ETF.

StockCharts.com

Details will change as MAMA continues to evolve. But I’d say we’ve seen enough to establish that MAMA is for real, and not likely a here-today-gone-tomorrow thing.

Having established that base, let’s now look at what owning these shares would be getting us into…

MAMA Feeding Hungry Culinarily Challenged People

Historically, food quality hasn’t always led to business and stock-market success. Look no further than McDonald’s (MCD).

MCD sprang from the vision of Ray Kroc, who sold milkshake mixers. His visit to a small California burger joint suggested great efficiencies and sales of many mixers, and eventually, a bunch of replicable eateries.

Was Kroc a visionary genius? Was Kroc an exploiter (of Richard and Maurice McDonald, who owned the restaurant that initially impressed Kroc)? One person’s opinion is as good as any other. But I’ve never seen or hear anyone characterize him as a foodie.

Some companies are born of Excel spreadsheets calculating net present value, internal rate of return and whatnot. (I suspect Kroc would have used this had it been invented when he got his 1954 inspiration.)

MAMA founder Daniel Mancini is cut from a different cloth. He was inspired by memories of his grandmother’s meatballs.

MAMA IR

Does passion for product, in Mancini’s case, meatballs and sauce, make for eventual business and stock-market mega success? Kroc didn’t need it. Steve Jobs carried it a long way with Apple (AAPL). Countless more anecdotes on both sides of the coin remain out there. I’ll leave ultimate objective resolution to academia.

But we’re seeing now reasons to suspect it may matter in home meal replacement (HMR).

I get that Boston Market left a bad taste around this phrase and that it’s not used so much today. But it’s a good phrase and I wouldn’t mind seeing it revive.

Just look around.

Go to the Reddit r/readymeals subreddit. Those folks are discussing and arguing about food, not return on equity. Consider the popularity of the Food Network and the Cooking Channel. Few, if any, viewers can actually prepare those meals. But many love watching others do it.

Have you ever eaten a dish prepared by Chef Gordon Ramsey. Many who haven’t watch faithfully as he lambasts, and judges cooks and chefs on various television cooking competitions or televised restaurant rehab efforts.

According to an April 2024 Parrot Analytics proprietary measure, “audience demand for Top Chef (US) is 23.5 times the demand of the average TV series in the United States in the last 30 days.” It’s likely few viewers ever tasted contestant’s or judge’s food. But viewers have those they like and those they don’t.

Notice, too, how many crave health food, organic food, etc.

This is how far food culture has come. Today, we care deeply about taste, quality, presentation… even if we can only perceive it rather than experiencing it directly.

It’s a good thing businessman Kroc did his thing in the mid-1900s rather than today!

Mancini, on the other hand, seems an ideal sort of contemporary food business founder.

But it takes more than vision to succeed in today’s hyper-competitive markets. We also need the businesspeople. (Ray Kroc might not be a good 2020s era food business founder. But there’d still be a place for him somewhere in the C-suite.)

It took MAMA some time to get the business team right.

And kudos to Seeking Alpha Analyst Investing 501 for recognizing and explaining this with a bluntly titled Adults are Now in Charge January 23, 2023 article. It’s too late for us now to fully enjoy that article’s Strong Buy recommendation. (The stock was priced then at $1.88.) But we still get one important benefit…

We can now evaluate MAMA’s strategy and prospects with an expectation that the company can competently execute.

(Of course this is never assured, even for old-time mega-caps. But at least now, our assumption of competence is on par with those normally made by analysts… at Seeking Alpha and elsewhere.)

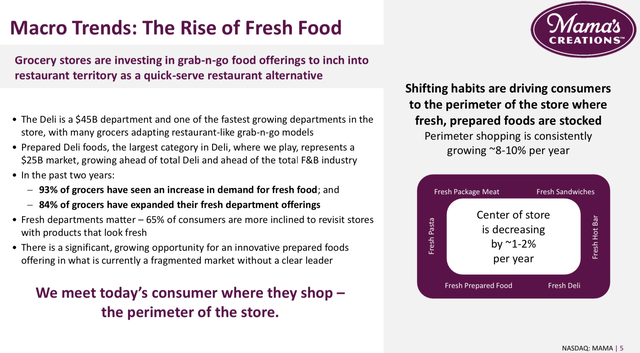

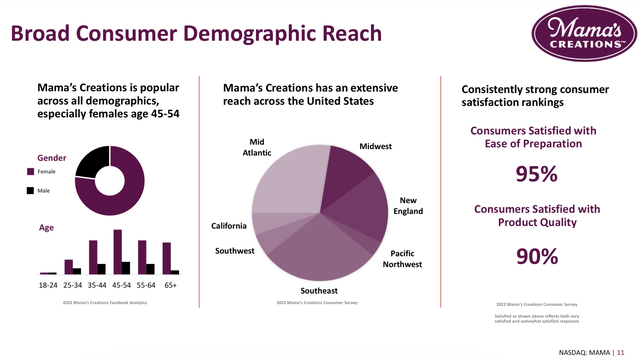

The MAMA strategy stands on the notion that deli-areas are becoming more important in the context of supermarkets.

Here’s how MAMA puts it.

MAMA IR

Speaking for myself, the data presented above feels right.

When I enter a supermarket, especially one at which I never before shopped, my eye immediately goes to an edge. I look toward the produce and deli. That tells me if I’m likely in a quality place, or a dive.

Do you react differently?

We see that these supermarket delis have lots of freshly cooked and prepared offerings. But who prepares them?

Obviously, supermarket employees can do it.

But these stores always operate under razor-thin margins. Devoting manpower to that often hurts the bottom line. That’s especially so as labor gets tighter and more expensive.

So, as in many industries, outsourcing is taking hold.

Also consistent with what we see elsewhere, outsourcers prefer where possible to do more business with fewer stronger vendors.

Low margin supermarkets depend heavily on fast turnover among many different SKUs (stocking units). That’s a lot of managerial work. So being able to more efficiently stock delis is, for them, a big deal.

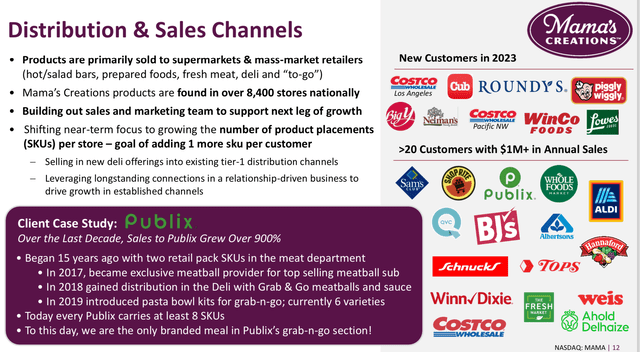

This is why MAMA’s reach has been growing.

MAMA IR

MAMA IR

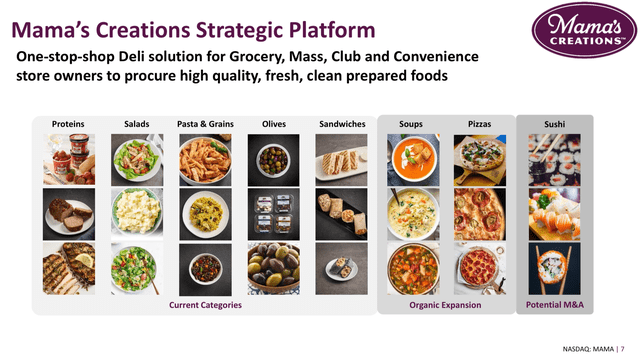

And the company wants to do even more, much more.

The next image shows components of MAMA’s current platform, and on the right, areas into which it may expand.

MAMA IR

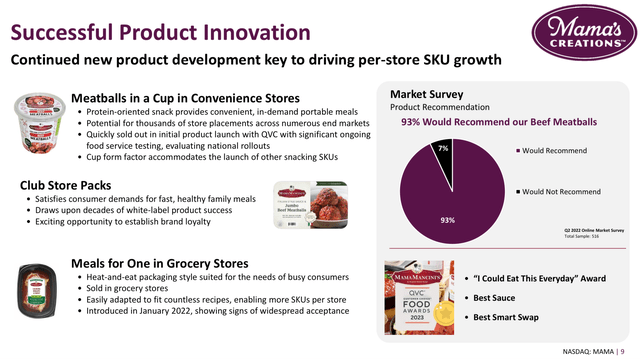

The next slide shows how MAMA has already gone, beyond the deli.

MAMA IR

And more is coming.

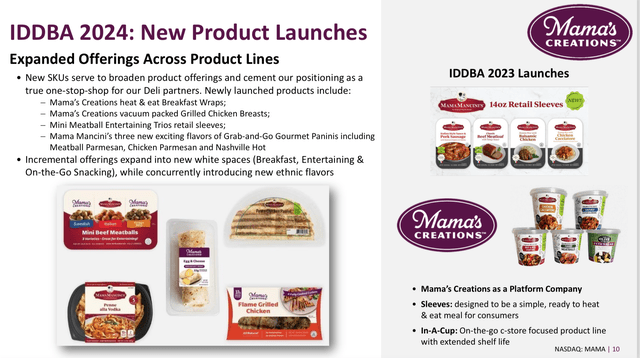

MAMA made a big push at the 2024 at the recent important IDDBA (International Dairy Deli Bakery Association) trade show in New Orleans. Here’s what it launched there…

MAMA IR

Recall above the portion of the platform that distinguished between organic expansion and “Potential M&A.”

The latter is a very serious aspiration. The company’s most recent earnings release expressed its belief that…

supported by our strong balance sheet, attractively priced M&A opportunities in the industry could enable us to become a consolidator in the fragmented prepared foods market and emerge as a leading one-stop-shop deli solution on a national level.

Page 6 of the latest 10-K expressed management’s belief that…

the Company has the potential to achieve $1 billion in sales through a combination of accretive acquisitions of complementary companies and organic growth, spurred by cross-selling and new product innovation.

Given its present financial situation and the nature of this industry, one could argue that MAMA already has enough scale and reach to pull this off.

This isn’t like Intel (INTC) trying to build a semiconductor foundry to compete with Taiwan Semiconductor (TSM). We’re dealing here with prepared food and grocery stores.

But there’s another angle to MAMA’s size.

On the one hand, it’s big enough to make its planned expansion push. Yet at the same time, it’s still small enough to attract a suitor.

I really think Home Meal Replacement is going to attract more and more attention over time. All players, as well as potential players, have a lot to do and consider.

Right now, MAMA is the only viable way for investors in the public equity markets to take a stake in new ways to feed the culinarily challenged.

So, if you don’t want to own the stock right now, you should at least click to “Follow” it.

Risks

I really wish FASB (the Financial Accounting Standards Board) would recognize the importance of distinguishing between a company’s fixed versus variable costs.

Companies know it and often account this way in private. You probably know this if you studied and remember cost or managerial accounting.

Shades of “contribution margin!” That addresses profit left over after covering fixed costs.

Sadly, investors don’t really examine this. That’s because it’s not part of what FASB requires firms to disclose per Generally Accepted Accounting Principles (GAAP).

But every investor should know about this. That’s especially so for those who invest in very small companies.

These present dis-economies of scale. In other words, fixed costs are more likely to consume much larger portions of small company’s total expense base.

When sales go down, fixed costs stay… well, fixed.

That puts much more pressure on the bottom line. So smaller company profit trends are apt to be much more volatile than are their larger brethren. (For the latter, bigger portions of the cost base are variable and hence can be managed during tough times.)

More volatile profit streams lead to more volatile stock prices.

You won’t always see this reflected in Beta. That just measures the extent to which a stock price’s movements coordinate (i.e., correlate) with S&P 500’s movements.

A volatile stock that charts a different course may wind up with a very low Beta. But when it happens with your stocks, you’re likely to be less blasé than statisticians.

Because MAMA is so small, be prepared for heavy share price volatility, even when the company is making progress. It’s simply inherent in small size.

Be prepared, too, for stock reactions to buyout news.

Shares of acquirers often get hit when investors fear near-term earnings dilution.

I don’t freak out so much over this. Acquisition costs tend to hit more rapidly than the financial benefits of the deals.

But Mr. Market often doesn’t think this way. That’s especially so since commentators don’t know the inside details of what the acquirer would do with its new business. They may be quick to say the acquirer overpaid.

So given MAMA’s expressed willingness to acquire, stay seated with your seat belts securely fastened.

Also with acquisitions, integration often doesn’t proceed nearly as smoothly as expected. At the end of the day, mergers deal with fallible humans, not with investment bankers’ typically perfect PowerPoint presentations.

And, of course, it’s hard to precisely forecast every quarterly result, especially in a newly emerging field. And we know how nutty the market can react to imperfect guidance.

Finally, with an issue this small, we need to consider trading liquidity. Will the market be active enough to properly absorb you buy or sell orders?

The good news, though, is that MAMA looks ok in this regard. It’s 3-day average dollars traded (number of shares times price) is a solid $2.5 million. Its 90-day average is $1.8 million.

What to do About MAMA Stock

Obviously, don’t own this stock if you can’t tolerate the above risks.

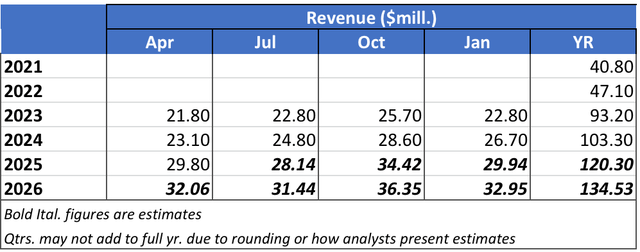

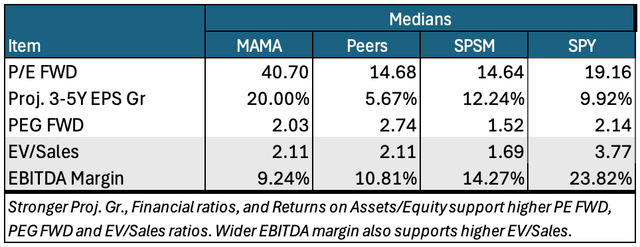

As to basic valuation, MAMA’s earnings-based assessment is rescued, so to speak, by the high projected earnings growth rate. That brings the PEG FWRD back toward earth.

Author’s computations and summary from data displayed in Seeking Alpha Portfolios

But the PEG is still higher than the SPSM median.

Meanwhile, MAMA’s sales-based valuation is not a bargain.

To accept MAMA’s valuation ratios, you can’t just call yourself a growth investor. You have to really mean it. In other words, you have to believe MAMA will grow into and above its current ratios.

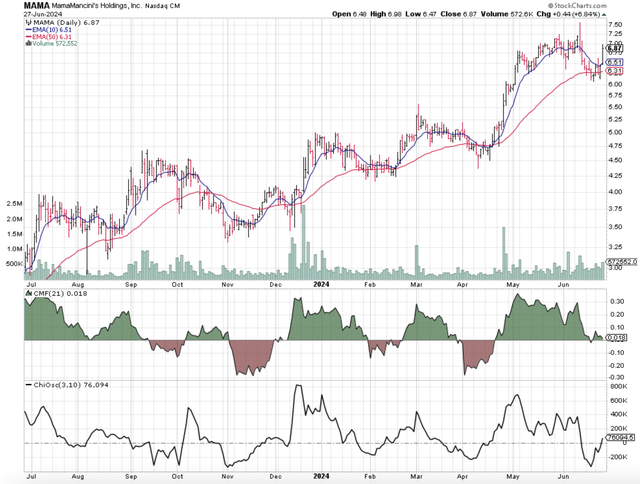

The price chart shows us how Mr. Market feels about MAMA right now.

StockCharts.com

The Chaikin Money Flow (CMF) and the Chaikin Oscillator (CO) measure which party to trades is more motivated. CMF does it for institutional investors. CO does it for the market in general.

At present, both groups of buyers and sellers both seem blasé.

Meanwhile, a serious technical analyst could call the 50-day exponential moving average a “support.” That means a level below which the price doesn’t really want to go or stay. And it’s bouncing off that support now.

Looking at this chart, I see nothing that tells me to buy now or else. But also, nothing is scaring me away.

I refer back to the nature of the investment case for this young and evolving company and business. Those that can handle the potential volatility may find it worthwhile to plant a flag in this newly developing business.

As I’ve said before, my investment stance depends mainly on whether I think a stock will be better than, in line with, or worse than market.

Here’s how I apply that to the Seeking Alpha rating system:

- “Strong Buy” means I see the stock as being better than the market and I’m bullish about the direction of the market.

- “Buy” means I see the stock as being better than the market but am not confident about the market’s near-term direction.

- “Hold” means I see the stock as moving in line with the market.

- “Sell” means I see the stock as being worse than the market but am not confident about the market’s near-term direction.

- “Strong Sell” means I see the stock as being worse than the market and I’m bearish about the direction of the market.

Based on this scale, I’m rating MAMA as a “Buy.”