monsitj

Introduction

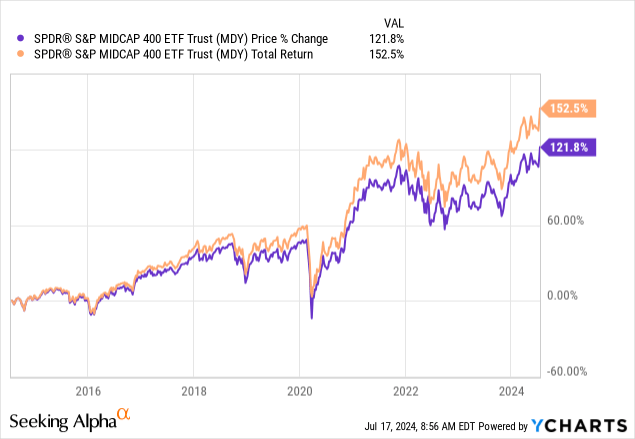

We covered SPDR S&P MidCap 400 ETF (NYSEARCA:MDY) back in April 2023. At that time, we suggested that investors should take advantage of the downward earnings revision of stocks in the S&P 400 index. We also noted that its valuation was quite attractive. It has been over a year since we last analyzed MDY, we think it is time for us to provide our updates and suggestions again.

ETF Overview

MDY owns a portfolio of U.S. mid-cap stocks. The fund basically tracks the S&P Mid-Cap 400 Index. MDY’s expense ratio of 0.24% is high among other funds that tracks the same index. For example, iShares Core S&P 400 Index ETF (IJH) and Vanguard S&P Mid-Cap 400 ETF (IVOO) have much lower ratios of 0.05% and 0.10%, respectively. MDY has underperformed the S&P 500 index, which consists of large-cap stocks. Fortunately, the Federal Reserve may soon cut the rates thanks to improving inflation data and MDY’s portfolio of mid-cap stocks will benefit. The S&P 400 index’s earnings growth forecasts are also expected to be better than the S&P 500 index in the next two years. Therefore, MDY has a good chance to outperform the broader market, namely the S&P 500 index. Hence, we have a buy rating on this fund and think investors should take advantage of any pullbacks.

YCharts

Fund Analysis

MDY has underperformed against the S&P 500 index in the past 3 years

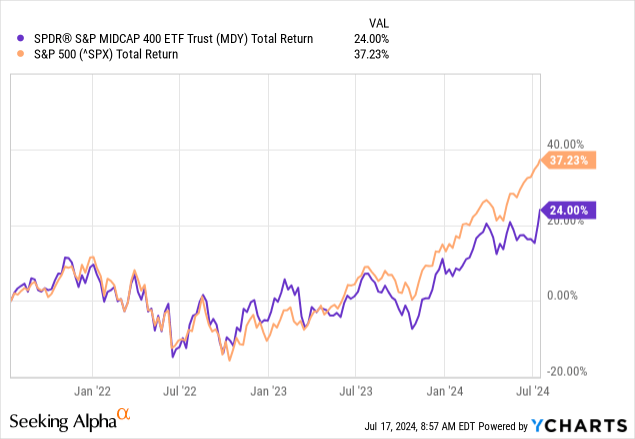

MDY has delivered positive performance in the past 3 years. As can be seen from the performance chart below, MDY delivered a total return of 24.0%. This return was good, but still not good enough relative to the S&P 500 index, which delivered a total return of 37.2% in the same period.

YCharts

MDY also has slightly higher volatility than the S&P 500 index, as it has a beta ratio of 1.04 than the S&P 500 index’s 1.0. MDY’s slightly higher volatility and underperformance to the S&P 500 index is not difficult to explain. The elevated rate environment in the past 2 years has caused more stress to mid-cap stocks than the large-cap stocks in the S&P 500 index. This is because mid-cap stocks typically have inferior balance sheets than large-cap stocks, and the cost of capital are typically higher for these mid-cap stocks than large-cap stocks. Therefore, mid-cap stocks in MDY’s portfolio have been under pressure in the past two years.

Possible rate cuts will result in MDY’s outperformance

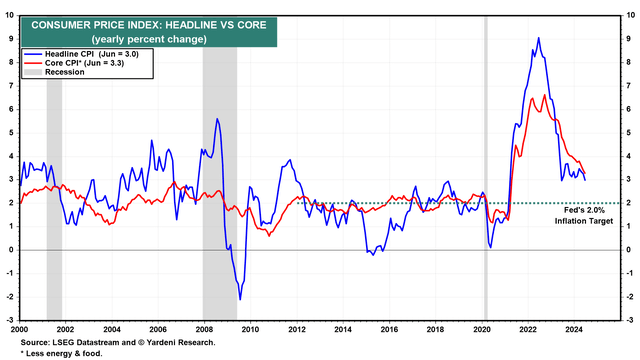

Fortunately, this high-rate environment will likely not be here forever. Inflation has come down substantially from the peak reached in mid-2022. As can be seen from the chart below, core CPI has dropped down to 3.3%. The Federal Reserve Chair Jerome Powell has recently also signaled that they will not wait until inflation reached 2% before lowering interest rates. Therefore, the odds of a rate cut is increasing, and this should be positive news to stocks in MDY’s portfolio.

Yardeni Research

Growth rates are expected to outperform the S&P 500 index

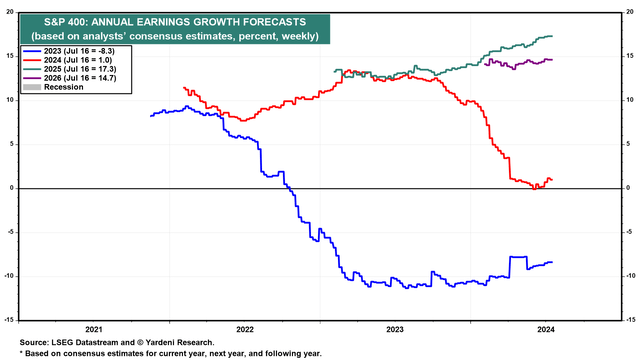

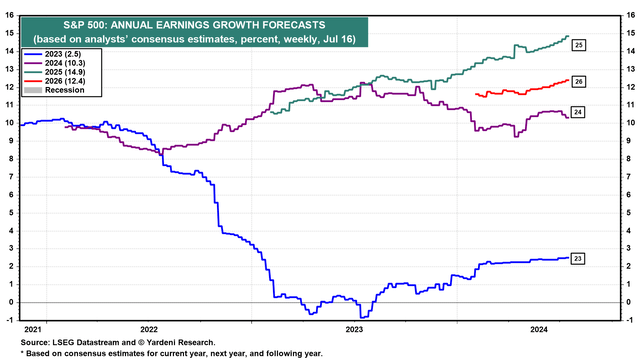

Below is a chart that shows the annual earnings growth forecasts for stocks in the S&P 400 index. As can be seen from the chart below, earnings growth rate is only expected to be around 1% this year. While this is low, it is still much better than 2023’s negative 8.3%. What is more important for investors to know is that the S&P 400 index is expected to deliver strong annual earnings growth of 17.3% and 14.7% in 2025 and 2026, respectively.

Yardeni Research

As can be seen from the chart below, annual earnings growth rates for stocks in the S&P 500 index are 14.9% and 12.4% in 2025 and 2026, respectively. These growth rates are inferior to the growth rates of the S&P 400 index, which are expected to be 17.3% and 14.7%, respectively. Therefore, MDY has a good chance to outperform the S&P 500 index.

Yardeni Research

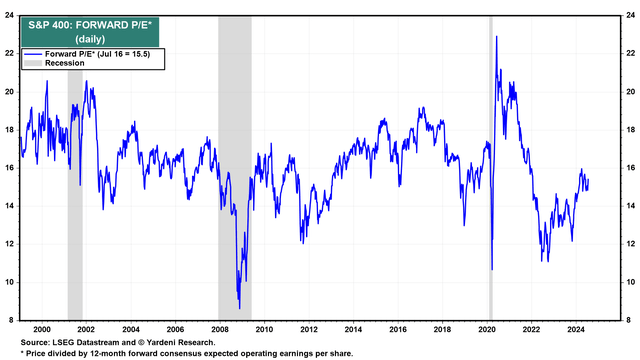

Attractive Valuation

Below is a chart that shows the forward P/E ratio of the S&P 400 index. As can be seen, the average forward P/E ratio is currently about 15.5x. In the past 25 years, the average forward P/E ratio has typically been in the range of 14x and 18x. Therefore, the current forward P/E ratio of 15.5x is slightly below the median of 16x. Therefore, we think MDY currently trades at an attractive valuation, especially given its solid earnings growth outlook in 2025 and 2026.

Yardeni Research

Investor Takeaway

MDY should benefit from the eventual rate cuts by the Federal Reserve. The fund should also outperform the S&P 500 index in the upcoming year. Its valuation is also quite attractive. Therefore, we continue to give the fund a buy rating and think investors should take advantage of any pullbacks.