Maskot/DigitalVision via Getty Images

Medifast, Inc. (NYSE:MED) is making significant efforts to offer GLP-1 medication in combination with the action of coaches and weight loss proprietary formulas. In my view, the recent agreement with LifeMD (LFMD) and the acquisition of LifeMD shares could enhance the demand for the stock. Moreover, the recent supply chain reorganization initiatives like the closure of the Maryland Distribution Center and further potential announcements may also bring FCF margin growth. Given previous equity growth, FCF growth in the last decade, and recent investments in marketing, I expect business growth to continue in the near future. I do not think that the current stock price represents the stock price potential in the stock valuation.

Source: Seeking Alpha

Medifast

Medifast reports more than 40 years of history in its sector, and claims to offer scientifically developed products and lifestyle plans reinforced by independent Coaches and a large community.

In my view, the most relevant about the company is its entrepreneurial spirit and the connections that MED builds with independent coaches. According to the company’s documents, MED is an expert in developing new relationships with customers and transforming previous customers into coaches. These ongoing connections seem to create a cycle of growth that is also reinforced by economic incentives. In my opinion, the company’s programs are successful because of the financial growth. The mention made by Financial Times about MED being one of The Americas’ Fastest Growing Companies is also quite impressive.

Medifast sells a number of weight loss proprietary formulas that include bards, cereal, drinks, shakes, soft bakes, and many other nutritional products. Some of these products are approved and regulated by the Federal Trade Commission, the Consumer Product Safety Commission, the United States Department of Agriculture, and the United States Environmental Protection Agency. In my view, the company’s accumulated know-how and the expertise in dealing with the existing regulatory framework serve as a competitive advantage over new entrants in the sector.

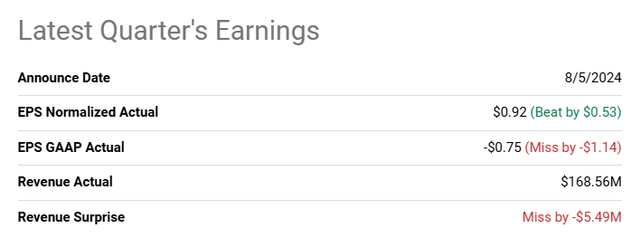

Lower EPS Than Expected, But Increase In The Book Value Per Share

In the last quarter, the company reported lower than expected EPS GAAP figures, and less quarterly revenue than expected. The financial figures expected for 2024, and 2025 are also not that beneficial.

Source: Seeking Alpha

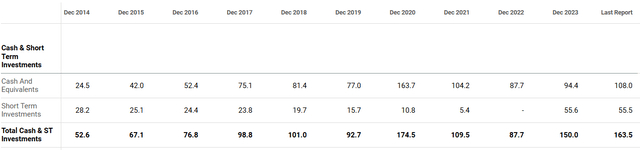

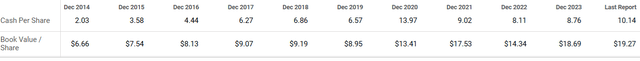

With that, about the company’s most recent financial statements, I took a look at the numbers delivered in the last ten years. In my view, the figures reported in the last decade are more representative and significantly better than those from the most recent business history.

In the last ten years, the company reported an impressive increase in the total amount of cash, increases in the amount of equity, and a significant increase in the book value per share. In my view, at some point, investors may take the time to look at these figures, and the stock price may trend higher.

Source: Seeking Alpha Source: Seeking Alpha

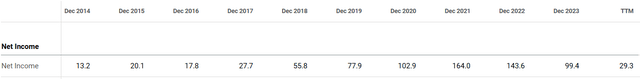

Net Income Growth, And FCF Growth

If we look at the company’s net income growth, MED does seem to be executing a proven business model. The company went from reporting negative net income to report positive net income in the most recent history. I do accept that the net income, recently, did not increase as in the past. However, I do not see why with the expertise accumulated in the industry and the cash in hand, MED may not successfully invest in new attractive business models in the long term.

Source: Seeking Alpha

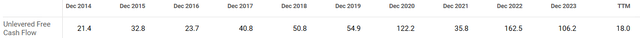

The increase in free cash flow reported in the last decade is also significant. In the last decade, free cash flow increased almost every year, and I did not see negative free cash flow in the last seven years.

Source: Seeking Alpha

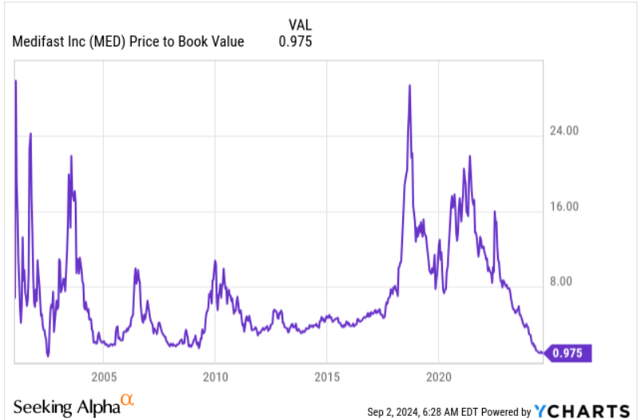

In sum, I do not really understand the skepticism about the company’s business growth. The stock price does not seem correlated to the book value per share, but MED seems to know what it does. I took into consideration previous free cash flows to design future free cash flow forecasts.

YCharts

The New Collaboration With LifeMD, And Competitors

The company signed a collaboration agreement with LifeMD, which could, in my view, bring new clients, who are currently taking only medical weight loss options.

The company’s coach-guided approach, in combination with LifeMD healthcare providing GLP-1 medications, appears to represent a significant advantage over other competitors not offering integrated offerings. Besides, in my view, the most important is the fact that MED brings a plan that could lower, under certain circumstances, the GLP-1 medication side effects like muscle loss.

In addition, thanks to LifeMD, MED’s new combined offers bring blood work as well as prescription and insurance support. In my financial model, I assumed that these new products will most likely accelerate future free cash flow growth.

In this regard, in my view, it is quite remarkable that MED recently noted the acquisition of shares from LFMD. In sum, if we buy MED shares today, we are also buying exposure to the business model of a virtual primary care provider. In my opinion, further acquisition of equity from LifeMD could have a beneficial effect on the stock. The valuation of health care operators appears to be significantly higher than that of MED.

During the fourth quarter of 2023, the Company entered into an agreement with LifeMD, Inc (Nasdaq: LFMD), a leading provider of virtual primary care, to purchase shares of common stock of LifeMD for $10 million. Source: 10-Q

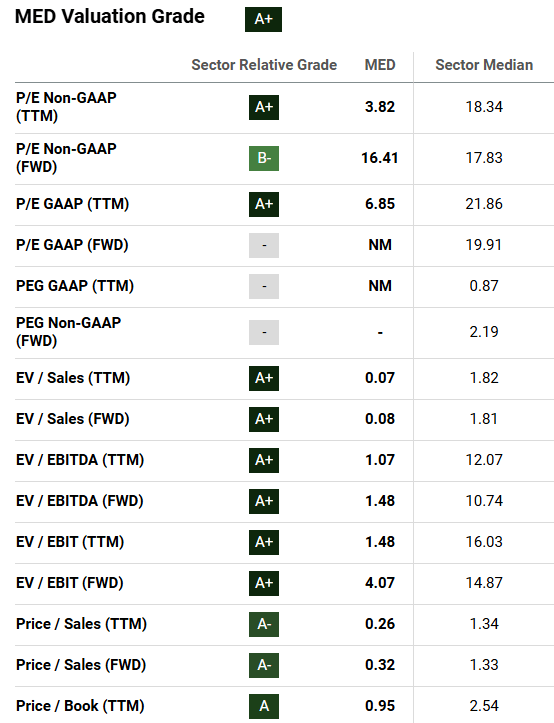

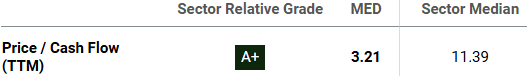

I do not think market participants did have a look at the numbers of other competitors. Peers report higher PE TTM GAAP, and EV/ TTM EBITDA figures than MED. Competitors trade at 21x TTM GAAP earnings. MED trades at 6x TTM GAAP earnings.

Source: Seeking Alpha

New Marketing Efforts And New Supply Chain Optimization Initiative Could Accelerate Net FCF Growth

In the last quarterly report, MED promised meaningful investments in marketing efforts to enhance brand visibility about its new holistic offers. In my opinion, brand awareness, enhancement of client conversion, the company’s expertise in launching omnichannel campaigns, and digital expertise will most likely accelerate FCF growth from 2025.

During the three months ended June 30, 2024, the company also noted a new supply chain optimization initiative, which could have a beneficial effect on future FCF margin growth. Among recent initiatives, there is the closure of the company’s Maryland Distribution Center. Besides, MED appears to be assessing options for the disposition of land and building. MED already located several supply chain assets that will not be used in the future, so we could expect new announcements soon. In my opinion, successful change in the company’s supply chain network could not only bring financial flexibility and cash, but we could also expect FCF growth.

My Free Cash Flow Expectations

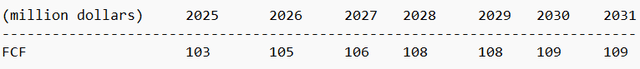

In order to design my free cash flow expectations, I took into account previous financial statements and my own assumptions about the agreement with LifeMD, successful investments in marketing, and the new supply chain optimization initiative. My financial model includes small free cash flow growth because I tried to be as conservative as possible. My numbers are not very different from the figures reported from 2014 to 2024.

Source: Seeking Alpha

I also revised the expectations that market participants expect for the GLP-1 market. According to UBS, from 2023 to 2029, we could be talking about sales CAGR of 30%. MED could benefit from the market growth.

GLP-1 growth has predominantly been driven by the latest products from key industry players in the pharmaceutical sector. UBS estimates global GLP-1 model forecasts 40m people on GLP-1s by 2029, with 44% in the US. This translates into $126bn sales by 2029, a 2023-2029 sales CAGR of 30%. Source: UBS Global

Besides, I used a WACC of 9% and a terminal EV/2031 FCF of about 1.5x. Given the valuation of competitors, and that of MED, I think that the trading multiple used is quite conservative.

Source: Seeking Alpha

My free cash flow forecasts, and the results obtained, are shown in the table below. I obtained a target price of $72 per share, implied equity valuation of $773 million, and total enterprise value of $628 million.

Source: My Expectations

- NPV of FCF @ 9%: $538.79 million

- NPV of TV @ 9% = $90.16 million

- Total EV $628.94

- Net Debt: -$144.4 million

- Equity: $773 million

- Shares: 10.7 million

- Target Price $72

The company repurchased shares in the past, and reported an authorization to acquire 1,323,568 shares. Given the current total share count, I think that potential acquisition of shares could bring demand for the stock. As a result, I think that we could see stock price increases in the coming years. Given the current valuation of the company and ongoing stock repurchases, in my view, new investors may be interested in the company.

As of June 30, 2024, there were 1,323,568 shares of the Company’s common stock eligible for repurchase under the Stock Repurchase Plan. Source: 10-Q

Risks From The Decline In The Total Number Of Coaches, Failed Marketing, Or Brand Deterioration

In my view, the largest risks come from a significant reduction in the number of coaches. In the last annual report, the company noted a decline in the number of coaches from 60k in 2022 to 41k in 2023. Further decline in this number could have quite a detrimental effect on the company’s net sales growth and free cash flow growth.

The company works with independent coaches, involving a number of risks. Misconduct of coaches or certain actions could damage the company’s brand, and destroy the company’s FCF growth. Failed introduction of new products and failed multi-level marketing strategies could also be quite detrimental for MED’s future net sales growth. The company discussed some of these risks in the last annual report.

The growth and sustainability of our network of OPTAVIA Coaches is also subject to risks which may be outside of our control. These include: potential misconduct or improper claims by OPTAVIA Coaches; negative public perceptions of multi-level marketing; general economic conditions; failure to develop innovative products to meet consumer demands; adverse opinions of our products, services, or industry; and regulatory actions against our Company, competitors in our industry, or other direct selling companies. Source: 10-k

Changes In The Regulatory Framework Or Actions By The FTC Could Lower Future Net Sales Growth

In the past, the FTC enacted actions against companies running multilevel marketing campaigns. I cannot say whether the company will not receive the attention of the FTC. In addition, coaches could launch lawsuits against the company, which could also trigger FTC investigations. Under certain circumstances, MED may not be fined by the FTC, however negative publicity about lawsuits or legal claims against MED could bring lower net sales growth. As per the last annual report, MED could also suffer from lawsuits from customers because of the company’s marketing techniques or matters related to consumer protection laws.

Lack Of Supply Of Ingredients Or Interruption Of Supplies Could Be Quite Detrimental

The company receives ingredients from the United States and other international markets. In my view, shortages in the supply of certain ingredients, supply chain issues, distribution problems, and changes in tariffs or international trade laws could bring a number of problems. As a result, if the company has to pay more for certain ingredients, MED may deliver lower net income growth than expected. Besides, under certain circumstances, the company could suffer from production decreases, which may also affect future net sales growth. In sum, lower financial performance could push the company’s stock valuation down.

Conclusion

Medifast’s most recent agreement with LifeMD and the acquisition of LifeMD shares will most likely have a beneficial effect on the company’s business growth. In my view, the combination of weight loss proprietary formulas, the action of coaches, and GLP-1 medication represent a holistic approach that could bring new FCF growth. Besides, I expect further growth coming from the company’s recently announced investments in brand awareness. In addition, MED’s recent supply chain optimization initiatives including the closure of the Maryland Distribution Center and other new initiatives that may be announced could bring further FCF margin increases. Overall, I think that the company is significantly undervalued. I did conduct a DCF model, which revealed an implied fair price of close to $72, and implied equity valuation of $773 million. In sum, the stock appears quite undervalued.