DNY59

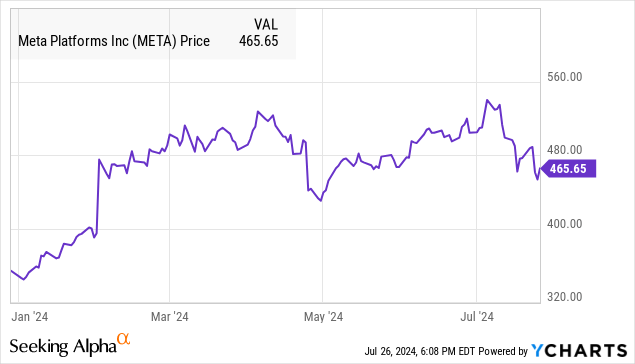

Anticipation is building for Meta Platform’s (NASDAQ:META) (NEOE:META:CA) second-quarter earnings report, set to be released on July 31 after the market close. Shares of the social media giant have surged over the past year, but are struggling to maintain momentum, down more than 14% from its 52-week high.

While a growth resurgence and improved profitability have been the big story since 2023, the challenge now for Meta is to deliver on a high bar of expectations. We highlighted this theme when we last covered the stock in May with a hold rating, suggesting investors should not count on a new all-time high anytime soon.

Our update today takes a more bearish tone, viewing META’s upcoming Q2 report as a high-risk event that could kickstart a deeper correction in the stock. Here’s what we expect.

META Q2 Earnings Preview

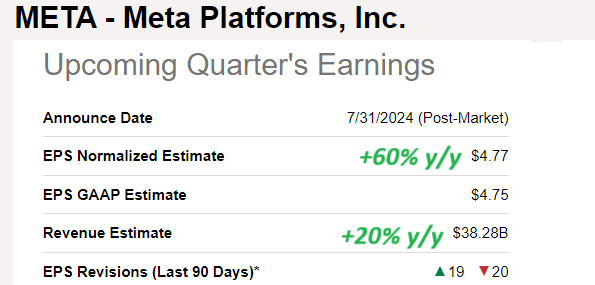

The consensus estimates for Meta Platforms this quarter are impressive between 20% year-over-year revenue growth and EPS of $4.77, a 60% increase from the period last year.

The results are expected to largely follow Q1 trends where the company managed to leverage a 7% increase in family-daily-active people (DAP) representing users across all apps like Facebook, Instagram, and WhatsApp with an 18% increase in average revenue per person (ARPP).

The company has benefited from improving ad rates and increasing the number of ad impressions in recent quarters, with some of that tailwind likely carrying over into Q2.

Separately, efforts implemented over the past to improve financial efficiency, including a sharply reduced headcount, have lifted margins as an earnings driver. For context, the Q1 operating expense as a percentage of revenue at 62% was down from as high as 80% in late 2022.

Seeking Alpha

By all accounts, Meta Platforms is doing fine operationally and maintains solid fundamentals. At the same time, the dynamics described above are hardly a secret and help explain why the stock is up 55% over the past year.

What the market is more interested in is where the company goes next. Platform active user growth and trends by region will be closely watched, with any indications of volatility in advertising conversions as a key monitoring point.

Ultimately, updated management guidance for Q3 and its outlook for the rest of the year will set the tone for how shares of META trade off the report.

META’s Massive Bet on AI

If META is up for a big miss this quarter, the Q2 EPS figure stands out as at risk of coming in below expectations based on several factors impacting margins into the second half of the year.

A major theme for Meta has been its big push into artificial intelligence, incorporating various features across the platform ecosystem. During the Q1 earnings conference call, management noted a plan to spend significantly to ramp up its AI initiatives for the foreseeable future, even revising its 2024 CAPEX guidance by an extra $4 billion at the midpoint.

We won’t be surprised if that estimate gets bumped up again this quarter as an earnings and cash flow headwind for the rest of the year.

Beyond AI’s ability to enhance advertising targeting and conversions, we haven’t seen any indication of a breakthrough AI product or incremental growth driver, certainly not at a level that begins justifying the billions in new spending.

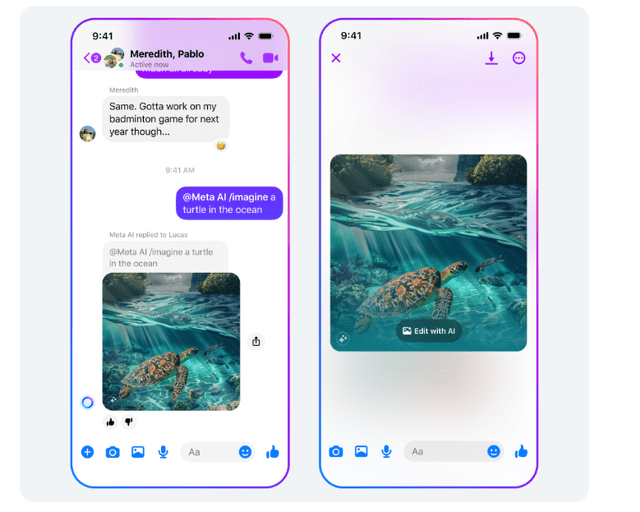

Meta AI has recently showcased its latest Llama 3.1 language learning model as an intelligent assistant within its family of apps. We’ve been unimpressed. In our view, Meta’s text and image-generative technology seems to only be playing catch up to AI tools that have been widely available on other platforms for the past year.

The ability to ask Meta AI on Facebook Messenger to “image a turtle in the ocean” may be a novelty to some, but it doesn’t appear to grow the top or bottom line of the business for shareholders.

source: company IR

What’s Next For Meta?

The challenge for Meta is to thread a fine line between its investing requirements and maintaining earnings momentum.

The concern is that Meta’s path with AI follows the same result the company has presented with its “Reality Labs” segment over the last several years, as essentially a money pit failing to live up to expectations.

Signs that Meta AI is more hype than anything and margins alongside free cash flow momentum have peaked could be a reason the stock faces a repricing lower.

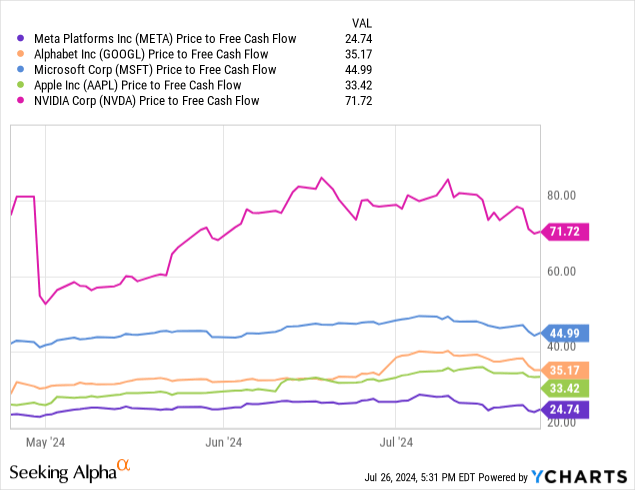

In terms of valuation, META trading at approximately 25 times its free cash flow over the past year is at a discount to mega-cap “tech” peers like Alphabet Inc. (GOOGL), Microsoft Corp. (MSFT), or even Apple Inc. (AAPL) trading at an average multiple closer to 35x. We believe this spread is justified and could even widen given Meta’s less diversified business profile and a sense the company remains a step behind in the AI arms race.

Our Bearish View On META Q2 Earnings

We rate shares of META as a strong sell with a price target of $375 implying a 20x price to free cash flow multiple, taking the shares back to a level they last traded at in early January. A disappointing Q2 report could be the catalyst for that move to materialize.

Upside Risks

On the upside, a big top and bottom line beat to estimates with positive guidance from management above expectations would help restore more positive sentiment words of the stock. While the recent high in shares represents a tough area of near-term technical resistance, a re-acceleration in performance indicators such as advertising impressions growth and the ARPP would be a favorable development for META bulls and force us to reassess our sell rating.