Imilian/iStock via Getty Images

By David Baskin

Lesson from the pandemic – Markets are complex

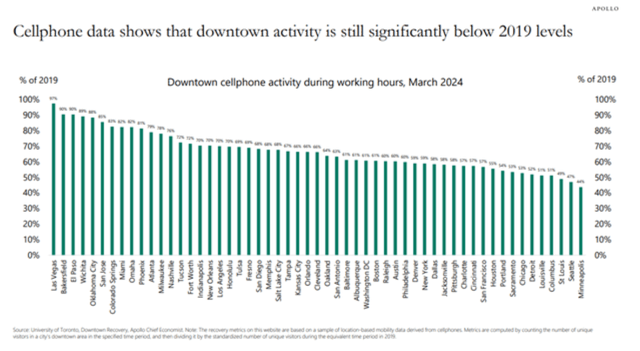

It is now just over 4 years since we all learned about COVID-19, and our lives were forever disrupted. Although most of us are no longer wearing masks in public, and the fear of air travel has disappeared (record travel in the US for Memorial Day last week), some changes look to be more permanent. Among these are the persistence of the “work from home” model, where many employees come to the office a few days a week, and some no days at all. This has, not surprisingly, caused havoc in the commercial real estate business, particularly in large city downtowns. A good and easy way of measuring how busy things are in city cores is to look at cellphone usage. That gives you a very good measure of how many people are there. The data is not reassuring.

Owners of large office buildings are in a bind, and the continuation of high interest rates makes it even worse. High vacancies, increasing taxes and utilities and heavy debt loads are causing some property owners to simply walk away from significant buildings. Here are some examples:

St. Louis downtown trapped in ‘doom loop’ – Fox News

Chicago Office Tower sells at a massive discount

Empty SF Tower sells at a 90% discount

How and when this real estate crash will resolve is unknown. Some office buildings are being repurposed as apartments or condominiums – we have an example immediately to the west of our office. Others are being redesigned for multiple small business users, the model WeWork unsuccessfully tried a few years ago.

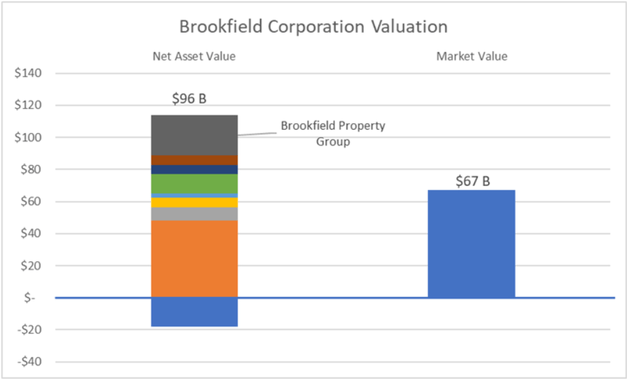

In our portfolio, we have very limited exposure to commercial real estate, and that is mostly through our shares of Brookfield Corporation (BN). Brookfield is a conglomerate that has operations in asset management, insurance, infrastructure and energy, as well as commercial real estate. Right now, on a “sum of the parts” basis, the market is giving minimal value to Brookfield’s property holdings. We expect that this will turn out to be overly pessimistic, but it is comforting to know that our exposure has already been “marked to market”.

A final comment on COVID. During the early days of the pandemic, a few stocks became must-owns for stock pickers who use momentum as a means to find value. When we started using Zoom for our annual client meetings, many clients were impressed by the technology and asked if we should buy the stock. We demurred. Zoom stock (ZM) peaked at $559 in October 2020 and is currently trading at $61, has zoomed down 89%. Another COVID darling was Peloton (PTON), the exercise bike company. Since people couldn’t or wouldn’t go to the gym, this seemed like a natural. Peloton rode up all the way to $167 in December 2020 and is now running on flat tires at $3.64, down 97%. Finally, the two vaccine companies that, through heroic effort, developed novel and effective new medicines to fight the disease became, briefly, market heroes. Pfizer (PFE) rose to $61 in December 2020 shortly after its vaccine came to market; it now looks decidedly ill at $29. Much smaller Moderna (MRNA) rocketed to $465 in September 2021 and is now in the sick bay at $142, down 69%.

Markets are complex, and stock pricing is even more so. Picking winners and losers by reading the headlines seldom works for long, and we simply don’t do it. We continue to look for high quality companies that make money in good times and bad, in sickness and in health, and over long periods.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.