We Are

Main Thesis & Background

The purpose of this article is to evaluate the Nuveen AMT-Free Quality Municipal Income Fund (NYSE:NEA) as an investment option at its current market price. This is a multi-state, closed-end fund with an objective “to provide current income exempt from regular federal income tax and the alternative minimum tax applicable to individuals by investing in an actively managed portfolio of tax-exempt municipal securities”.

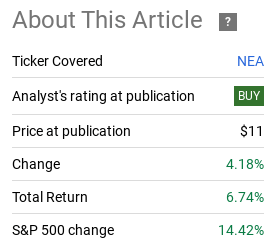

I wrote positively about NEA back in January to kick the year off. While I was generally cautious about highly leveraged CEFs more broadly, I still saw some value in this particular option. Looking back, this turned out to be a pretty good call as NEA has seen a nice move higher along with tax-exempt distributions to shareholders:

Fund Performance (Seeking Alpha)

As we are about to begin the second half of the year, I thought it was timely to take another look at NEA and see if a “buy” rating still makes sense. After review, I believe it does, and I will use this article to justify why I see continued gains ahead for the municipal bond CEF.

Income Keeps Getting Boosted

A key reason for I remain bullish on this fund has to do with a continued trend from Nuveen to raise distribution payouts for a number of its CEFs. This has been an effort to narrow discounts to NAV in many cases and also to bring in renewed interest to its funds. While I prefer to see more income generation to amplify distribution payouts, these are generally positive reasons too.

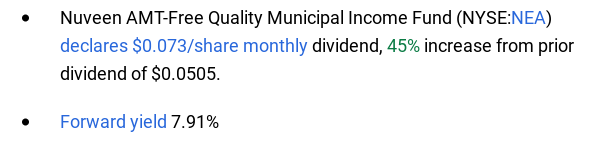

Fortunately, NEA has been a part of this program and what I find particularly attractive is that there have been multiple increases – not just one. For instance, back in January I talked about how NEA’s income boost was a nice sign but not a cure-all for some of the other challenges facing the fund. I would not have guessed at the time that that was simply the beginning of a continued effort by Nuveen to aggressively raise this fund’s payout. It has been raised multiple times since then, including earlier this month:

NEA’s Income Boost (Seeking Alpha)

I bring this up because I gave a warning in my January review – even though I was bullish on the fund – that the distribution increase may not be sustainable long-term. Well, I was wrong about that, as NEA has actually raised it a few more times since that initial bump:

Income Boosts (NEA) (Nuveen)

What this suggests is that NEA’s current yield is safer than I realized earlier this year. The asset manager (Nuveen) clearly has intentions to use this metric to draw buyers into the fund and this was not a “one and done” development. The current level of income – which may see a decline at some point in the future – is not at risk in the short-term as multiple cuts amplify the messaging that a higher payout is a strategy Nuveen is committed to. I view this as a strong rationale to remain long this fund and keep my buy rating in place.

Discount Has Narrowed, But Still Is Attractive

My next thought is one that is short and sweet. This concerns the fund’s valuation, a metric I viewed very positively when 2024 got underway. At that time, NEA was sporting a 14% discount to NAV, and that was simply too good a value for me to pass up. Given how the fund has performed since that time, it was indeed a strong value in hindsight.

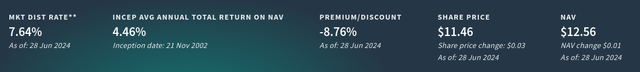

The challenge here is that this discount has narrowed considerably since January. This supports the distribution policy by Nuveen since one of the primary goals of that program was to narrow outstanding market price discounts. For NEA, that seems to have worked. What that means though is for new positions in the fund, investors are paying a more expensive price in terms of discount to net asset value. The good news is that while shares are more expensive, they are still well below the underlying value:

NEA: Fast Facts (Nuveen)

What this shows is new positions in the fund are still almost 9% below NAV and in isolation that looks pretty sweet. Yes, they were cheaper months ago, but this is still a pretty good value. This supports my continued “buy” rating because it demonstrates success in Nuveen’s management policy regarding the distribution and still presents a good deal for value-oriented investors.

Opportunity Is In Long-Dated Issues

Continuing to dive deeper into NEA, another reason I like this fund is because of the individual holdings. While the portfolio is fairly diversified across sectors, jurisdictions, and maturities, it tends to favor long-dated issues. In fact, the bulk of the underlying securities have maturities ranging from 10-30 years:

Maturity Breakdown (NEA) (Nuveen)

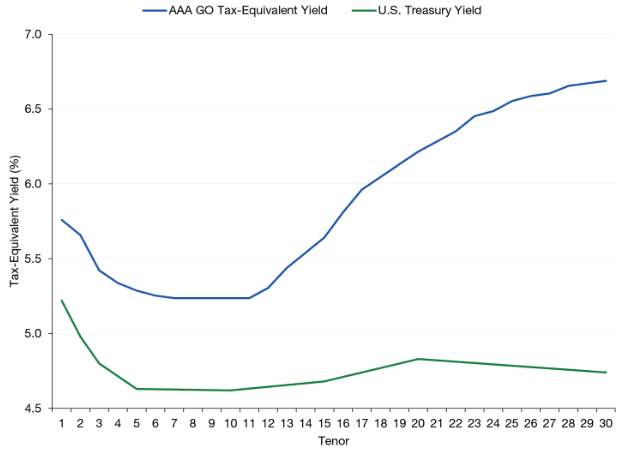

Now, this isn’t always what I prefer, but it is at the present moment. The reason why has to do with the yield curve. For the municipal bond sector the curve remains upward sloping – which it should be in normal times. But if we compare it to the treasury yield curve, we don’t see that same pattern emerge:

Muni and Treasury Yield Curves (Lord Abbett)

What this means is that investors are getting compensated with a higher yield for the greater risk they are taking by locking up their money for longer in long-dated issues in the municipal bond sector. By contrast, investors are earning the same (or in some cases less) the further out they go in the treasury market.

All things being equal, this makes the muni sector a lot more attractive for long-dated securities and those are precisely what NEA holds for the most part. This is a key element for why I favor NEA over many of the other muni CEFs that are available to retail investors today.

Equity Concentration Supports Hedges

My final point is to look at the market more broadly and consider why one would want to buy municipal bonds (whether through NEA or another vehicle) at the present time. As my followers know, I have been a large-cap US stock bull for a while, and I remain so today. This is not to suggest that I believe markets are about to fall and to exit those positions. But just because I believe in the story of large-cap US stocks does not mean that is the only place I would put my cash. Diversification is always important, in my view, and that message remains top of mind today.

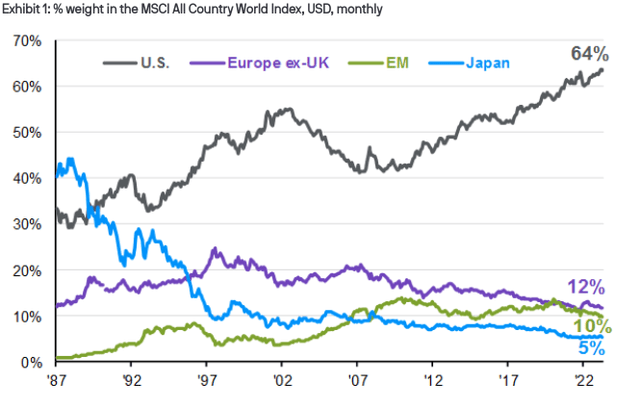

One of the reasons why I feel this way has to do with the growing concentration of just a handful of names in broader market indices. For example, we all know about the “Magnificent 7” here at home and how they are dominating large-cap US funds – especially those that track the NASDAQ or S&P 500 indices. But the story goes beyond that. Domestic (US) names have been performing so well, they have been dominating even global funds as well. What this means is that when one buys an “equity” fund – with a primary US focus or not – they are getting exposure to an increasingly higher level of US exposure, as illustrated in the graphic below:

US Stocks Out-Sized Impact (JPMorgan Asset Management)

I bring this up because it may not be obvious on the surface what one is owning without digging into individual funds themselves. A “global” equity fund may or may not have fairly identical exposure to domestic funds – it all depends on their individual make-up. So relying on the targeted objective or the name of the fund may just be an illusion of diversity. You may wind up amplifying your portfolio concentration in US names without realizing it.

This is central to why I see a supportive environment for buying hedges, like muni bonds. I also see this graphic as a valid reason to buy individual country ETFs – of which I own (and write about) several. This removes the drawback that a lot of overlap with a US-centric holding will exist.

The conclusion I draw here is that readers should remain tactical and diverse in their position because a handful of US names are dominating equity funds not just across our country but the globe. Keep this in mind when evaluating whether a muni fund like NEA (or other bond or equity fund) is needed in your portfolio.

Bottom-line

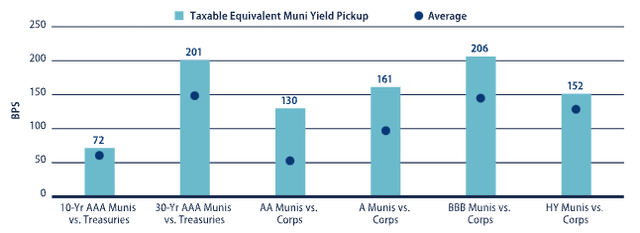

NEA has been having a good year in 2024, and I believe more gains are set to come. I have an overall positive view of the municipal bond sector, and I would urge my followers to consider this arena over other fixed-income alternatives. The reason being that after-tax yields for munis are besting other sectors across the spectrum at current levels:

Comparable Yields (Bloomberg)

This helps to make the case for munis overall. In addition, I like NEA for its recent (and third) income boost in less than a year, strong credit quality of the underlying securities, and large discount to NAV. All things considered, there are a lot of positive attributes for this fund and I still see value despite the 7% gain since my last article. The net result is I see merit to maintaining the “buy” rating on this fund, and I would suggest to my followers they give the idea some thought going forward.