zhongguo/E+ via Getty Images

NET Power Inc. (NYSE:NPWR) is basically a development stage company that now has enough information available to be able to get some actual models working for potential customers while also working to improve what is already available. There is highly unlikely to be any revenue until at least 2025. However, the company has an impressive list of industry partners along with a cash balance that should get it to the point where the company has some cash flow. These two things help to mitigate the very high risk of a pioneering company that currently has no revenue.

Management

My last article mentioned that the Rice brothers have consistently made shareholders money. Currently, the other company that shareholders know, that has Rice brothers management, would be Enterprise Products Partners (EPD).

This is yet another way in which a potential investor can reduce the usually high risk of a company that claims to have the latest technology and is going to change how things are done.

The Rice family is involved and has invested money in the venture as well. The family has a long history in projects involving natural gas.

Finances

Probably the most important part of the NET Power balance sheet is the liquid assets and how fast those liquids assets are disappearing. Many companies go broke simply by not planning for adequate cash sources to get their product to market.

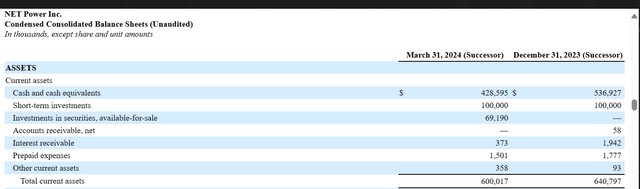

Net Power Liquid Assets First Quarter 2024 (Net Power First Quarter 2024, 10-Q)

The total current assets declined roughly $40 million in the first quarter. That would imply about 6 years of cash at the current rate of spend. Expenditures are likely to accelerate in the future as the company actually sells working units to customers or potentially builds some self-operated units.

As discussed in the last article, there are a number of ways for this company to make a profit. However, that pathway to profitability can shift as the company moves along the path to a going concern.

One thing that is always unknown with a company like this is the future and what the final going concern will look like. All management can do is project a future and then wait to see the market reception. Whenever a company is the pioneer of a new idea, the original model as to what the going concern will be like is really just an educated idea that needs to be tried out in the marketplace. Management has to be flexible enough to adjust as the company moves along. Investors can put that down as an additional risk for a startup.

Partners

Probably the most obvious partnership is with Baker Hughes (BKR). However, the member’s equity statement also shows shares going to Occidental Petroleum (OXY). Establishing relationships with major industry players is yet another way to reduce the risk of a startup.

These partnerships in no way ensure success. But they do indicate that the company has reached a point where there is a reasonable chance that the company has a product that will enable a significant profitable opportunity (potentially) in the future. As the last article mentioned briefly, this company has attracted the interest of some big names, both on the consumer and on the supplier side. That alone is quite an accomplishment.

Intangibles

The assets have significant value attached to both Goodwill and Intangible assets. At this stage in the company’s history, both of these assets are unlikely to have much value unless the company becomes a going concern. Therefore, any investor considering this investment needs to consider that there is a possibility of a total loss of the investment principal. This vehicle is definitely not for conservative or income investors.

The Business

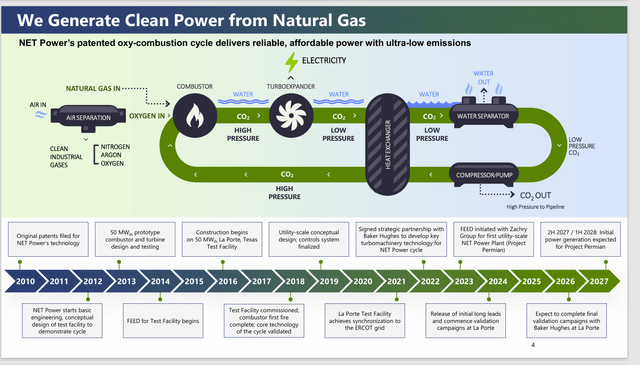

NET Power aims to generate electricity without adding carbon dioxide to the air.

Net Power Description Of Business (Net Power First Quarter 2024, Earnings Conference Call Slides)

One of the reasons for the interest in this project by Occidental Petroleum (for example) is that the CEO mentioned previously that carbon dioxide produced in this process can be used to maintain pressure in oil wells to enhance oil recovery while permanently storing the carbon dioxide.

I follow companies that purchase carbon dioxide for secondary recovery efforts for oil and related products. This idea has considerable potential to expand the supply of carbon dioxide available for the industry to pursue secondary recovery. That, in turn, makes a lot more oil available to recover from areas known to have oil still in the ground that we currently cannot produce profitably.

This is on top of the fact that the oil and gas industry, like many other industries, is looking for a source of clean power. Now there is a way to generate power while producing the needed carbon dioxide to enhance oil recovery literally “on the spot.” Before this, the industry often had power generators on the leases that generated power while polluting the air in the process. There are probably a lot of other potential applications besides what would obviously benefit the oil and gas industry.

Electric Demand

It is no secret that the utility industry is building a lot more natural gas plants. While those plants reduce pollution compared to previous sources for electric energy. The new design shown above has the potential to reduce pollution more while allowing the use of natural gas (as a source of electricity) to grow. This company follows several others like Kinder Morgan (KMI) and Antero Resources (AR) that have long predicted more use of natural gas as the green revolution proceeds using current technology.

The La Porte project is in the process of testing various stages and equipment for the actual viability of a full-scale plan. There is another project, the Project Permian, that is doing the same thing (in terms of testing).

There is always a risk that new technology will not work when fully scaled up, or that the technology will need to be modified in ways not seen when the small-scale proposal was developed.

Summary

Probably the biggest part of the whole plan is the risk reduction undertaken by management that obviously has some experience in starting and building companies. The biggest risk reduction is a combination of “name” industry suppliers and potential customers with a financial interest in the company, as well as doing project partnerships to get this company to an operating entity. One or more of these “partners” may well be interested in acquiring the company if it succeeds.

The cash balance appears to be more than enough to get the company to the point where some positive cash flow begins to happen. That could be as long as five years from now. The uncertainty in this area is the biggest risk, as companies like this can run out of liquidity before they get the product to market. Unexpected delays can be very costly to shareholders in terms of dilution, or much worse.

Currently, the stock remains a very speculative strong buy based upon the measures management has taken to reduce the early business risk for this relatively new idea. How the stock performs until the actual day it becomes a going concern is definitely up for discussion because these types of stocks can soar if they become a market favorite. On the other hand, a significant setback can result in significant loss of principal, shareholder dilution or worse.

Overall, I like the idea, and I like management’s chances. This one has the potential to be a big long-term winner.

Risks

The company’s sources of liquidity have to be watched for the “burn rate” as this type of company can run out of money before the product is viable as a going concern.

Any new technology is subject to both testing and a final scalable project for actual viability. Some things that look great on a small scale just do not scale up.

The fact that this company has various relationships with “name” industry partners is a great risk reduction strategy. But it also does not guarantee success.

Management experience is crucial to a company like this. The loss of key personnel could prove fatal.