Pgiam/iStock via Getty Images

Investment Thesis

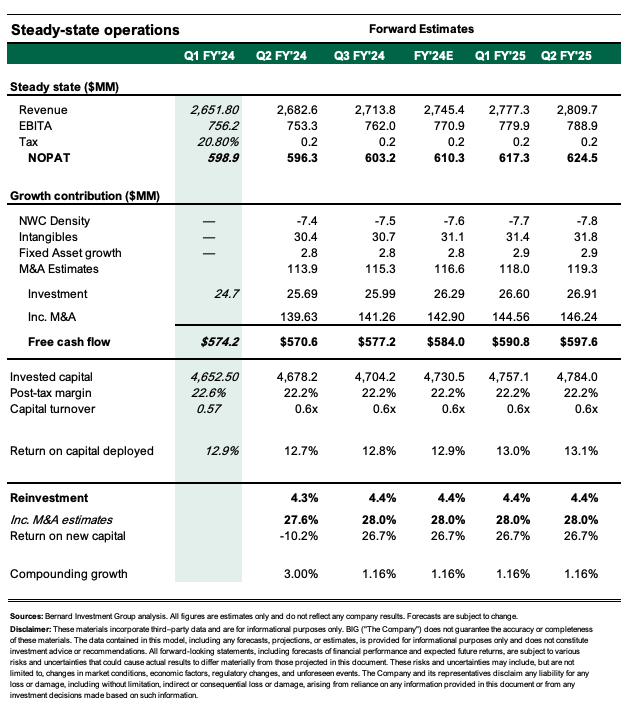

Nordson Corporation (NASDAQ:NDSN) is a precision technology company that’s popped onto our screens after a 10% pullback this YTD. Established in 1954 and headquartered in Ohio, the company manufactures products for adhesives, coatings, polymers, sealants, and so forth. It also manufactures for the medical industry in its medical devices business (products such as catheters and tubing). The company operates in >35 countries with a headcount of 7,700 employees.

I am hold on NDSN due to 1) declining competitive advantage in its business returns and 2) valuations that look fully priced and implied ~$235 per share as the intrinsic worth of the business, ~3x EV/IC.

NDSN 12-month price evolution

Tradingview

Business characteristics

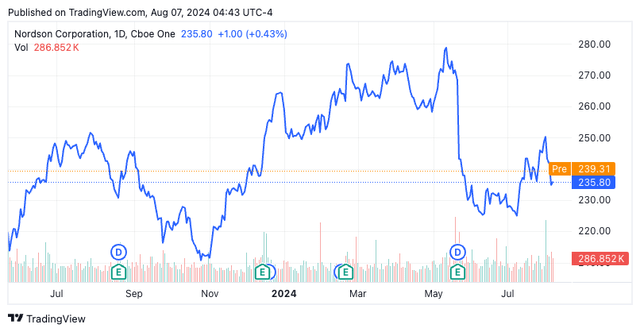

NDSN is a high-quality business in an industry with commodity economics (industrial machinery + supplies). In my view, it enjoys consumer advantages as its products are highly differentiated and attract higher operating + post-tax margins vs. peers (Figure 1).

- It enjoys somewhat profit margin advantages (with higher gross margins vs. the median industry peer) – but operating costs are far lower as a percentage of sales given the fact its offerings are, in many instances, the preferred customer choice. NDSN therefore operates on far higher operating margins vs. peers due to differentiated offerings which have consumer advantages (~13% pre-tax margin vs. 5.4% industry avg.). It thus earns nearly double the rate of return on investor capital that’s been employed into the business to maintain its competitive position and grow the enterprise.

Figure 1.

Seeking Alpha

- NDSN put up $651mm of sales in Q2 FY’24, underscored by +500bps upsides from its recently completed ARAG Group acquisition in 2023 and +200bps organic business growth. The divisional contribution was mixed, with industrial precision +9% to %367mm [mainly due to ARAG’s integration], medical and fluid solutions were $170mm (+2%) and the advanced technology segment did $115mm of business during the quarter (-22% YoY). This segment continues to be a drag on growth due to 1) headwinds in the electronics markets, driven by 2) excess capacity and destocking of end markets.

- It left the quarter with $700mm in backlog and management revised guidance to ~0-2% growth in FY’24, calling for ~$2.7Bn at the upper end of range [~350bps are expected from ARAG]. One of the appealing factors in NSDNs case is its ex-US sales exposure – ~2/3 of sales are international, providing a tactical, liquid diversifier to a US slowdown.

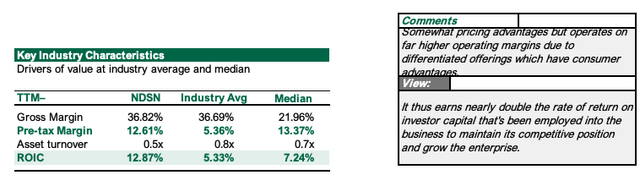

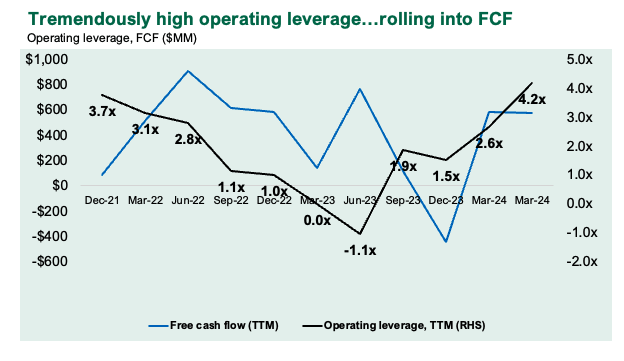

- Meanwhile operating leverage is high given the business’s relatively fixed cost base where each $1 of sales growth produced ~$4.20 EBIT in the last 12mo (Figure 2). This falls within FY’21–’22 range (Figure 3). Critically, the business methodically rotates most of this into FCFs thus providing confidence it will reinvest cash flows + grow earnings with each $1 of sales growth.

Figure 2.

Company filings, author

Figure 3.

Company filings, author

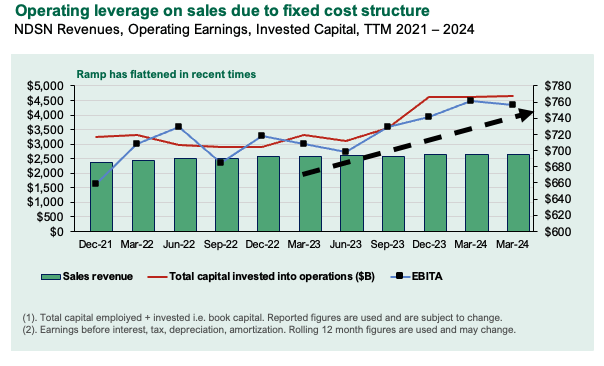

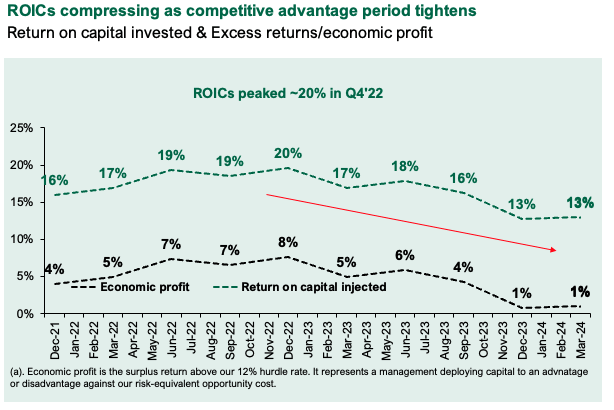

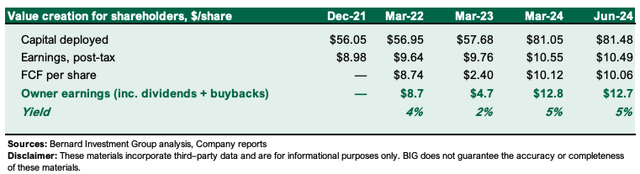

- The value drivers are margin-driven where post-tax margins are >22% routinely on <1x capital turns – as such it produces ~13% on all capital deployed into the business assets. The issue I have is there’s not an extensive runway for management to reinvest high sums back into the enterprise to compound its intrinsic business worth. Growth in earnings power is therefore limited as 1) the capital base produces ~13%, 2) often <10% of this is reinvested to maintain its competitive position + grow [using data from FY’21–’24 on a rolling TTM basis], meaning 3) it only has $0.10 on the dollar to work with to grow post-tax earnings. The business routinely throws off ~$500mm in freely available cash after all capital obligations are met. Yet, the lack of viable projects to redeploy this cash saw management reinvest ~$25/share into the business to produce ~$1.50/share incremental NOPAT, ~6% marginal return. It only recycled ~23% of total NOPAT produced since FY’21, so the intrinsic worth of the business has only expanded by ~1.4% in my view (6% x 23% = 1.4%).

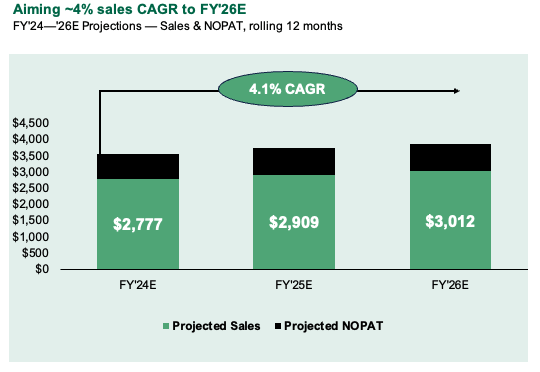

- This tells me there is absent a reinvestment runway to compound the business – my forward estimates [see: Appendix 1] project ~4% CAGR in sales to~$3Bn by FY’26E. I see it producing ~$500–$600mm in surplus cash flows on this, reinvesting up to 28% of earnings into existing operations + mining the acquisition pipeline. My view is to produce an additional $1 in sales over the next 2-3 years will require an investment of ~$0.83 given this is a relatively slow-turnover business. As such, my opinion is the competitive advantage period (that length of time it can earn ROICs >12%, our hurdle rate) has dwindled, and my view is its ROICs will fade to ~12-13% from here. This is fine, but difficult to see it compounding on these economics, as mentioned earlier.

Figure 4.

Company filings

Figure 5.

Company filings, Author

Figure 6.

Author’s estimates

Valuations priced fairly

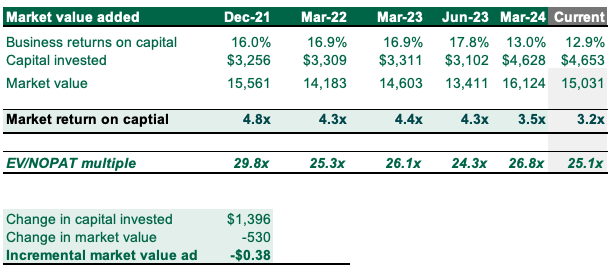

The issue in the debate here is the high starting multiples relative to earnings and assets of the business against the fundamentals of the company. Valuations have come down sharply vs. FY’21/’22 (Figure 7) and now rest ~3.2x EV/IC. My view is this is fair and ~3x is fair given 1) <5% of NOPAT will be redeployed into the firm to position it forward, 2) ROICs are compressing and 3.2x is even an ask [if we take EV/IC = ROIC/WACC, then I get to ~1.25x with avg. ROIC of 15% since Q1 FY’23], and 3) the only way it will likely compound its corporate value is through further operating efficiencies [higher capital turns] which are neither sustainable or worth 25x NOPAT in my view.

Valuation insights

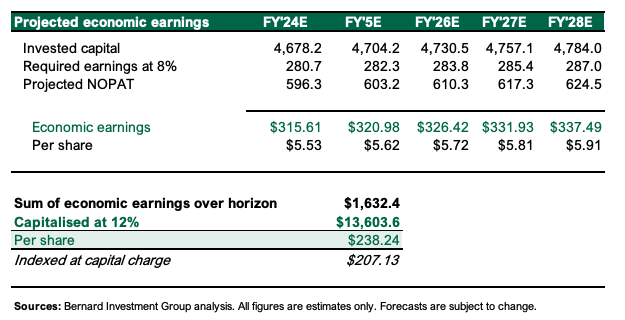

- Expectations were so high but growth + ROICs came in behind the embedded set of viewpoints, therefore resulting in a compression to ~3.2x where it trades today. The market expects it to produce ~$10.4Bn in economic profit ($15Bn EV – $4.6Bn capital = $10.4Bn market implied return on capital) in what I’m estimating is ~5 years and to me this is fair. The sum of discounted cash produced for a private owner or NSDN amounts to ~$238/share on my estimates [see: Appendix 1], where we only accept cash flows produced above a 12% ROIC to reflect the appropriate opportunity cost (Figure 8).

Figure 7.

Company filings, author

Figure 8.

Author’s estimates

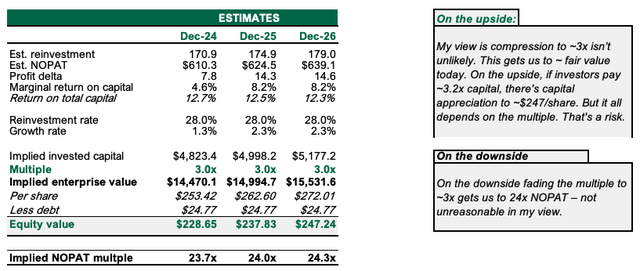

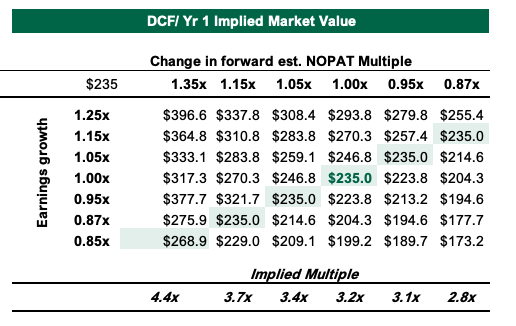

- On the downside, my view is compression to ~3x isn’t unlikely – due to 1) the reduced competitive advantage period, 2) slow turnover on capital, 3) compressing ROICs, and 4) lack of viable compounding opportunities. This gets us to the market value of ~$235 as I write today. On the upside, if investors pay ~3.2x capital, there’s scope for capital appreciation to ~$247/share. But it all depends on the multiple. That’s a risk. Fading the multiple to ~3x gets us to 24x NOPAT – not unreasonable in my view. In any sense, the valuation calculus appears biased to the downside – 5% contraction in multiple is balanced with ~5% earnings growth (Figure 10).

- Issue is, my numbers back in <5% – thus any contraction to the downside in multiple falters our investment return. This supports a neutral view on valuation. I can’t advocate a buy rating on a business where 1) the market has fully captured its prospects, and 2) the propensity for multiples expansion is low, but 3) the change for contractions are high given where they rest on the spectrum vs. fundamentals. If NDSN continues earning ~12% on capital, and investors can reasonably achieve this elsewhere, I see the stock trading closer to 1-2x EV/IC in the future.

Figure 9.

Author

Figure 10.

Author

Risks to thesis

Upside risks to the thesis include 1) NDSN growing ROICs above 15% as this justifies a higher multiple, 2) sales growth +5% which increases capital turnover and suggests more growth, and 3) management reinvesting >20% NOPAT each period at these valuations.

On the downside, risks are further degradation in business returns <10%, investors paying <3x EV/IC, and the broader set of macro risks that must be factored into all equity evaluations at this point in time. This includes geopolitical risks.

Investors must recognise these risks in full before proceeding any further.

In short

NDSN is a hold in my view due to 1) deteriorating competitive advantage period where surplus ROICs above our hurdle rate are reducing [now <1yr in my view], 2) ex-acquisitions management is recycling <10% of NOPAT on avg. towards expanding the business meaning 3) high EV/IC multiples are susceptible for contracting [investors won’t pay high multiples on capital with no capital and/or earnings growth]. Embedded expectations are currently high but NDSN meets the high bar set for itself to trade fairly at today’s market range of ~$235/share. Net-net, rate hold.

Appendix 1.

Author